Last Chance To Board The Microsoft Train

by The Value TrendSummary

- Microsoft trades near all-time highs and this may have investors wondering if the stock is still a good buy.

- Through our DCF valuation, we propose two scenarios as to how the stock price/return could evolve.

- We believe that at today's price Microsoft still offers above-average returns with very little downside potential.

Thesis Summary

Upon reevaluating Microsoft Corporation (MSFT) we believe the company could still be fairly undervalued given the potential of cloud growth. Using our DCF valuation we propose two different scenarios depending on how strongly investors value the growth prospects of Microsoft and more specifically Azure. At best, the company will be a cloud pioneer and market leader. At worst, Microsoft is a tech giant with steady and predictable cash-flow.

Source: Zdnet.com

The little tech company that could (and still can)

Not many people could have predicted the transformation that Microsoft underwent in the last decade. What once looked like a declining and antiquated technological company become a cutting edge provider in one of the fastest-growing and most lucrative sectors in tech.

But Microsoft’s cloud success didn’t just fall out of the sky. There are many things that the company and its management have done very well in recent years to get to where it is right now. Microsoft CEO Satya Nadella stepped up in 2014 and completely shifted the direction and perception of Microsoft. Amongst other things, the company has managed to increase revenue thanks to the switch to Office and Word’s subscription-based systems. It was around this time too that Azure was rebranded as Microsoft Azure and revenues started to pick up.

The strength of revenues has stemmed from both the continuing success of Office, which has yet to find any real competition and the success of Azure. Microsoft is the second-largest cloud player in the cloud space, behind Amazon.com (AMZN), but it has been taking market share from the commerce giant year after year.

The latest quarterly results continue to support the strong strength of Microsoft’s cloud segment, which was up 27% compared to the first quarter of 2019. Microsoft not only continues to thrive in a space that is expected to grow at 12.5% CAGR in the next decade but also threatens to dominate it. The simple explanation; Microsoft Azure is a superior product.

Firstly, because Microsoft is responsible for creating the most successful OS in the world, Windows, which is now integrated with Azure. Secondly, Azure is crushing it in the corporate space, with 90% of fortune 500 companies using it. And finally, Azure is much better positioned to capture government contracts as evidenced by the fact that they won over the $10 billion Jedi contract.

But growth is just one part of the equation. With Microsoft’s stock trading at near-all time highs many investors may be wondering; Have I missed my chance? The valuations below provide some insight into this question.

Valuation

We have made the valuation below using our new DCF model (the same we used in our latest The Boeing Company (BA) article. Our updated valuation system makes a summary of the income statements and balance sheets available, and generates a forecast through regression analysis, using the effect of aggregates on one another, their evolution over time, and some restrictions based on economic sense.

Case 1

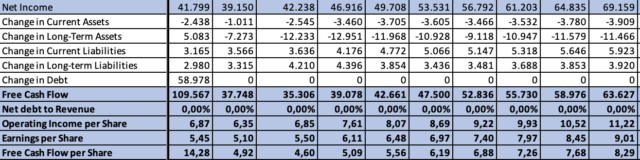

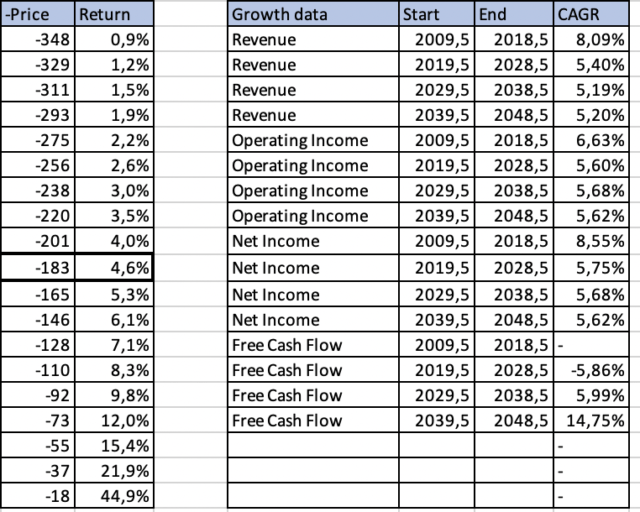

For case 1, we simply plugged in the numbers for the last 10 years, and here’s what we got.

Source: Author’s Work

As we can see, our regression analysis forecasts that from 2020 to 2030 Microsoft will grow revenues at a modest CAGR of 5.4%. This would give us a return of 4.6% given today’s market price of $183 per share. This is a very poor return when compared to most other companies and what one would expect the general market return to be.

But this analysis is incomplete since the company has fundamentally changed how it operates and its revenue streams. This does not take into account the potential that Microsoft has.

Case 2

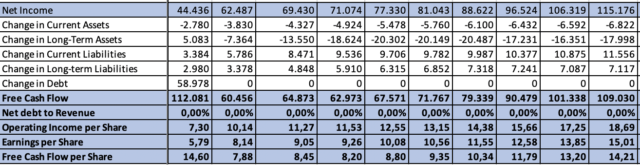

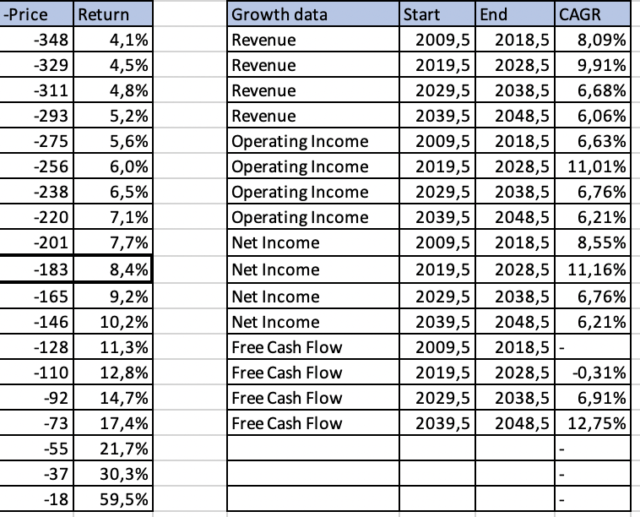

In case 2, we have adjusted growth to better reflect our expectations of Microsoft’s potential. We could say that we have given more weighting to the recent performance, as this more closely reflects what we would expect to see in the future, which is continued double-digit growth coming from Cloud.

Source: Author’s Work

This scenario gives us a CAGR for the next decade of almost 10%, which seems more than achievable, and it slowly tapers off towards 2050, which is where our DCF valuation forecast ends. With this in mind, at today’s price of $183 Microsoft offers by our calculations a much more attractive and likely 8.4% return.

Takeaway

The valuation above shows that, while Microsoft’s growth is certainly priced in, the current price still offers good potential returns for investors. It is understandable that at a P/E of over 30 investors might be put off, but the cold hard truth is that Microsoft will continue to deliver cold hard cash. Microsoft offers the best of both worlds, value and growth, and potential upside with very little downside. It is perhaps one of, if not the best, company out there to hold for the long-run if you like to sleep soundly at night.

Disclosure: I am/we are long MSFT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.