Teladoc Health: The Growth Is Here To Stay

by WG Investment ResearchSummary

- Teladoc Health recently reported impressive Q1 2020 results and management provided strong full-year 2020 guidance.

- This "new" market darling has a strong bull case and the company's growth profile keeps getting stronger.

- We are long Teladoc Health, and we plan to stay long the stock.

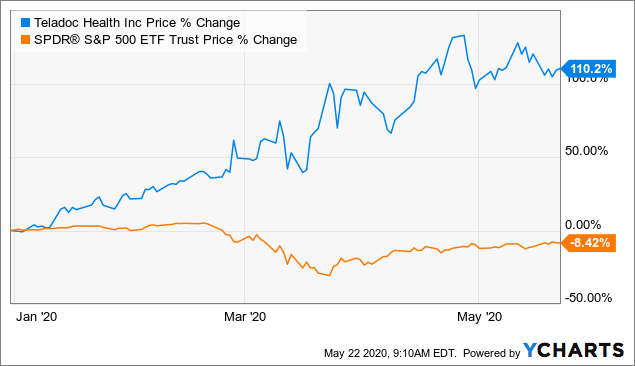

Teladoc Health's (TDOC) stock has significantly outperformed the broader market on a year-to-date basis.

Data by YCharts

Teladoc is currently being viewed as one of the few companies that have actually benefited from the current health crisis, and rightfully so, but I believe that some pundits are still downplaying just how promising this telehealth company's long-term business prospects are. Yes, Teladoc's business has seen increased demand as a result of the spread of COVID-19 but let's also remember that the impressive growth profile was already in place well before the outbreak (although not as impressive as today).

I believe that the stock still has room to run, especially if you are willing (and able) to hold on to shares for the next few years. This current market darling has a bullish long-term story to tell - and Teladoc's recently reported results (and management commentary) prove it.

The Latest, The Numbers Tell The Story

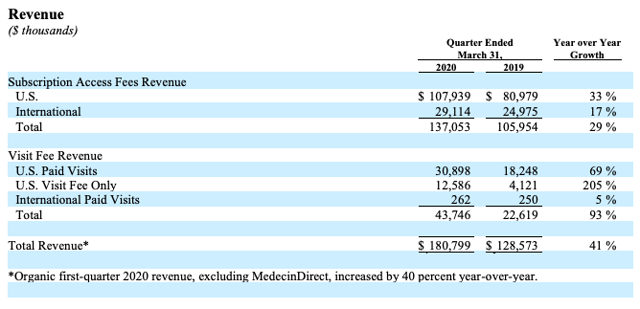

On April 29, 2020, Teladoc reported Q1 2020 results that missed on the bottom-line but were in line with analyst's top-line estimates. The company reported an adjusted loss per share of $0.40 (missed by $0.04) on revenue of $180.8mm.

Source: Q1 2020 Earnings Slides

The strong revenue growth was impressive, but it was the operating metrics that stood out the most.

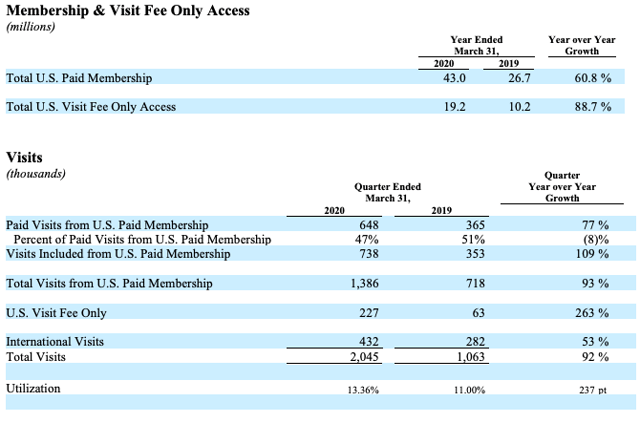

Source: Q1 2020 Earnings Slides

As shown, Teladoc exceeded over 2mm total visits over the first 3 months of 2020, which was a new milestone for the company. Additionally, management mentioned during the conference call that the company onboarded over 6mm new paid members in the U.S. and they anticipate having other 6mm-7mm members in Q2 2020. Moreover, new registrations increased 125% YoY and outpaced member growth for the quarter, which is meaningful from a long-term growth/engagement perspective.

It also helps the bull case that management provided strong guidance for the remainder of 2020:

- Total revenue to be in the range of $800mm-$825mm (up from $553mm in fiscal 2019)

- Adjusted EBITDA to be in the range of $70mm-$80mm (up from $31.8mm in fiscal 2019)

- Total visits to be between 8mm and 9mm (4.1mm was reported in the prior year)

- Total U.S. paid membership to be at least 50mm and visit-fee-only access to be available to ~19-20mm people

Simply put, there is a lot to like about these figures, and I believe that the story is just beginning because, in my opinion, telehealth is quickly becoming the new normal. As such, I believe that growth is here to stay.

The Growth Is Here To Stay

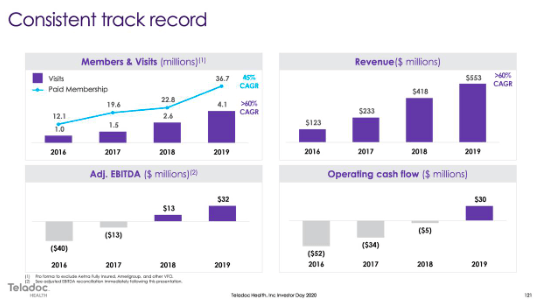

In a previous article, I described Teladoc's massive potential market opportunity and touched on the fact that the company already had a proven track record before the COVID-19 pandemic flipped the world upside down.

Source: Investor Presentation, 3/11/2020

The biggest pushback that I get in regards to Teladoc's promising long-term business prospects is the tough competitive landscape and the company's lack of having a competitive advantage (i.e., a moat). I, however, believe that telehealth will be the new-norm, so there will be room for many players - but it should be noted that Teladoc is already a clear leader in the space, which is extremely bullish.

To this point, the telemedicine market is projected to reach $185B by 2026 according to a recent report by Fortune Business Insights. The estimate factors in the surge in adoption of telehealth services as a direct result of the COVID-19 outbreak.

I believed that telehealth was the future long before the current pandemic (see this article from early-2018) and I completely agree with the current thought that COVID-19 is pushing more people to adopt this form of healthcare (with adoption meaning that people's future consumption will change for good). Simply put, Teladoc is a disruptive company that has a business that will likely continue to catch steam as we move through 2020 and beyond. Telemedicine is the future, in my opinion, and Teladoc may be one of the best bets in this growth industry. The growth is here to stay, in my opinion.

Valuation

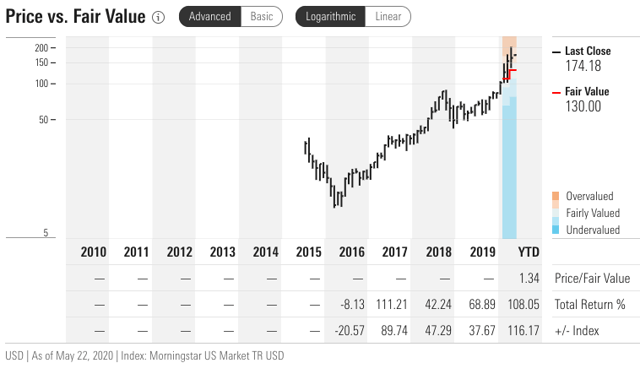

Teladoc Health's stock is overvalued according to estimates at Morningstar.

Source: Morningstar

There is no denying the fact that Teladoc is richly valued at current levels. However, I still do not believe that all of the company's growth potential is not factored into the stock. In my opinion, TDOC shares will more than grow into its current valuation through 2020/2021.

Risks

Investing in small-cap companies comes with many risks, but the major risk for Teladoc is related to the company being outspent by larger competitors. Additionally, the company relies heavily on its partnerships to expand its business, so deteriorating relationships in the industry could have a material impact on Teladoc's business.

In addition, integration risk needs to be considered given the numerous acquisitions that have been made over the last few years. And most importantly, regulatory changes have the potential to greatly impact Teladoc's business. Please also refer to Teladoc's 2019 10-K for additional risk factors that should be considered before investing in the company.

Bottom Line

There is a lot to like about Teladoc Health, and I believe that the company's Q1 2020 results (and guidance) show that the long-term story remains intact. Long-term investors will be richly rewarded if the company's story plays out like I believe that it will. Teladoc has consistently reported strong growth metrics, which makes me believe that this company still has promising long-term business prospects. It helps the bull case that the market also seems to be on the same page (notice the impressive YTD performance of the stock).

Additionally, the company recently pricing its $850mm convertible notes should be viewed as a positive development. Teladoc, like other companies, is taking advantage of the market to raise capital in this tough environment. I believe that this additional near-term liquidity will provide management with some flexibility and could eventually be used to add promising assets to an already impressive portfolio of businesses. Remember, it was not long ago that Teladoc was touted for its impressive track record of making small tuck-in acquisitions.

In my mind, Teladoc will either grow into a significant disruptive company in the healthcare industry or it will get acquired by a larger player. Either way, it is a win-win situation for investors. In my opinion, the risk for Teladoc's stock is to the upside if you are in it for the long haul.

Disclosure: I am/we are long TDOC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclosure: I am/we are long TDOC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.