Arista Networks: Free Cash Flow To Drive The Stock Back To $300

by Nikolaos SismanisSummary

- Arista Networks displays a stellar balance sheet and juicy net profit margins.

- Discounted cash flow model points towards a return to $300/share, with prudent growth assumptions.

- Despite numerous risks, the stock is a great buy at its current valuation.

Arista Networks (ANET) sells advanced network-operating systems, enabling third-party developments to scale and achieve speeds from 10 to 400 Gbit/s. The company has been making significant progress in capturing a larger pie of the network hardware space, but shares have lagged behind, currently trading at their late 2017 levels. In the meantime, the company has grown both its top and bottom line, where it enjoys juicy margins. Moreover, the balance sheet is stellar, with $2.6B in cash and no debt. I see Arista as a great buy in this market environment. With high valuations and indices near all-time highs, Arista is a free cash flow generator, at a reasonable price.

In this article, I will discuss:

- What makes Arista's financial profile great

- Why the stock should return towards $300 based on my DCF valuation model

- The company's future prospects and risks.

Source: Arista.com

AAA financials

Balance Sheet

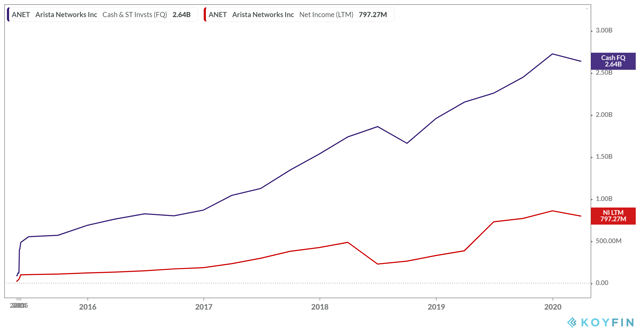

In uncertain economic environments like the one we are currently undergoing, companies must have robust financials to withstand potential adverse outcomes. Arista has impressed me with its balance sheet, which reassures me that the company is built to last. Since its IPO, Arista's cash position has been consistently growing. Because the company has not issued any long-term debt, its cash pile has been accumulating entirely through its net income generation, which has totaled to nearly $800M over the past twelve months. With a cash position worth ~15% of the company's market cap and no outstanding interest payments, Arista should have enough ammo to both withstand short-term adversities and return sufficient capital to shareholders.

Income Statement

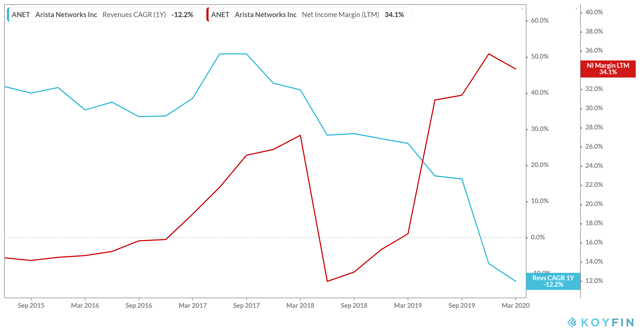

My greatest concern with Arista, and what has probably caused the market to be trading the stock sideways, is its revenue growth deceleration. The same company that was growing at nearly 50% YoY around three years ago, increased its sales by only 2.8% on a trailing twelve months (TTM) basis. In fact, in the most recent Q1, sales declined by 12.2% YoY. This is in the nature of the hardware business, which tends to be cyclical. I expect the company's revenues to continue rising in the long term, as I will discuss later on.

Despite the slowdown in sales, Arista has managed to boost its profitability, achieving spectacular margins. Net income margins are hovering around 35%, increasing Arista's bottom line, as shown in the earlier graph.

Here's where my thesis with Arista is starting to take form. Sure, "growth," the word that makes investors exciting and interested, has not been impressive lately. Profitability, however, has. Hardware companies are subject to revenue fluctuations based on business cycles being deprived of the recurring revenue model many SaaS businesses enjoy on the software side of things. The important point, in my view, is for cyclical businesses to have juicy margins in order to maintain or even grow in this case, their profitability. Arista does exactly that. If the company can grow its profitability, while its revenue growth declines, the bottom line should increase even more rapidly once revenue growth resumes.

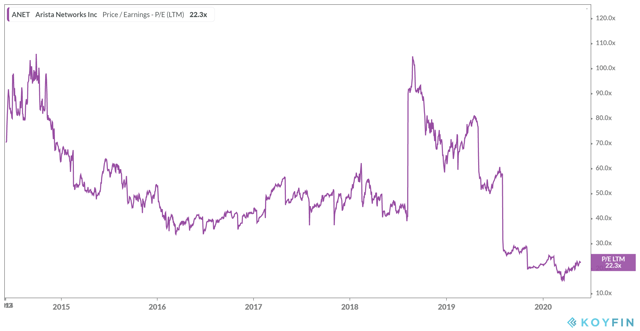

Such cases, in which cyclicality can cause stocks to drop or move sideways, allow for investors to grab unique opportunities. I believe that Arista is one of those, currently trading near its all-time low P/E ratio, around 22 times.

Returning to $300/share

I am now going to illustrate why Arista could soon return to its $300/share price point. I am going to use a discounted cash flow model to do so. As I mentioned, revenue growth decline has overshadowed Arista's massive free cash flow generation, which is what drives value in stocks in the long term. As always, I am going to take a prudent approach.

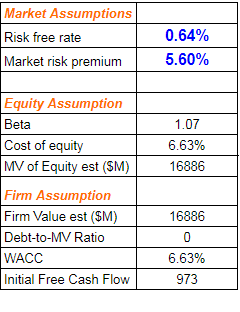

I have set the risk free rate at 0.64% to reflect the 10-year U.S. Treasury bill. I have set the market risk premium at 5.6% to reflect the average risk-premium of the S&P 500. We come out with a WACC of 6.63%. Remember, Arista has no long-term debt.

Source: Author

I have then set our projected free cash flow. Over the past twelve months, Arista has generated $973M in free cash flow (cash flow from operations - CAPEX). While the company has grown its cash flow generation in line with its earnings, as shown earlier, I will take a more prudent approach. Thus, my growth rate starts at 5%, despite Arista's FCF CAGR of 58.35% over the past five years. In the short term, the growth rate fluctuates between 1% and 5% to reflect some cyclicality, until it settles at a reasonable terminal rate of 2%.

| Year | Gr. Rate | FCF($M) | Term Val | Total | PV | |

| 2020 | 0 | 5.00% | 973 | 973 | ||

| 2021 | 1 | 3.00% | 1021.65 | 1021.65 | 958.1082602 | |

| 2022 | 2 | 1.00% | 1052.2995 | 1052.2995 | 925.4740678 | |

| 2023 | 3 | 3.00% | 1062.822495 | 1062.822495 | 876.5931507 | |

| 2024 | 4 | 5.00% | 1094.70717 | 1094.70717 | 846.7354502 | |

| 2025 | 5 | 1.00% | 1149.442528 | 1149.442528 | 833.7761861 | |

| 2026 | 6 | 2% | 1160.936954 | 25564.67385 | 26725.6108 | 18180.35293 |

Source: Author

Using then these cash flows, along with our discount rate of 6.63%, we come to a fair value of nearly $300/share, representing an upside of ~35% from the stock's current price of $220.

Source: Author

I believe that the upside is considerable, especially since I assume FCF growth never goes beyond 5%. This is rather unlikely as the demand for data-centers and networks is rapidly increasing.

The future and potential risks

Arista's future in the high-speed data-center network should continue to grow. Not only is the demand for data centers and network solutions is increasing, but the company is proving product superiority, stealing from Cisco's (CSCO) existing market share. Over the past six years, Cisco's market share in the space has been nearly halved, while Arista's presence gradually grows larger.

Moreover, the company announced an optical line system for 400G. The coronavirus has caused massive casualties for many businesses. At the same time, it has forced many of them to embrace and take advantage of the power of the cloud. Businesses have been moving the majority of their activities online. Consumers are demanding unprecedented levels of data transmission for their streaming and in-home entertainment services. Data centers that previously utilized 100G switches will inevitably have to upgrade to 400G, to keep up with the demand.

Projections show that the 400G+ market will account for the majority of data-center Ethernet switch revenue, and Arista is ready to claim its piece of the pie.

However, despite the many opportunities that Arista can tap into as the network market spreads, there are potential risks, including massive competition. The cloud networking market swiftly evolves. Should Arista fail to innovate and fall behind its competitors, the company will lose immense credibility and market share. Companies like Cisco and Juniper Networks (JNPR) may start recouping Arista's piece of the pie.

Further, the company highlights its issues when it comes to having limited customers in its 10-K. Arista's revenue accounted for 23% and 17% by Microsoft (NASDAQ:MSFT) and Facebook (NASDAQ:FB), respectively. The company suffers from not having a diversified customer base. With 40% of its sales coming from two single companies, the concentrated nature of its customers may have its future sales fluctuate. In fact, the company mentioned that certain sales to both Microsoft and Facebook benefited from one-off factors that are not expected to be repeated in 2020 or the years after.

Finally, the nature of its market is massively cyclical and could easily be affected by budget-cutting and adverse macroeconomic conditions. The increasing demand for data-centers should help Arista withstand COVID-19. However, future network infrastructure spending reductions could materialize, should the macro environment worsen.

Conclusion

I believe that Arista is a great buy. Despite the risks mentioned, the company is a free cash flow monster. With great net income margins, its cash position keeps on growing, stacking ammo for future acquisitions, and a cushion for adverse times. Besides, having no debt makes for a clean, impressive balance sheet. As the discounted cash flow model suggests, the stock offers significant upside, even with little growth. The competition is indeed harsh, but so far, Arista has shown resilience and skills in capturing and increasing its market share.

Finally, while the stock has traded sideways for numerous months, demand for shares should now start increasing. The company has been executing its buyback program, retiring $494M worth of shares over the past four quarters. This should leave around half a billion worth of shares to be repurchased under its current program. Since the company has built a massive cash position, it can use some of the money to return capital back to investors. The remaining buyback program should account for around 3% of the company's current market cap, whose buying pressure should boost the stock higher.

As always, thank you for reading. If you liked this article, please consider following me here on Seeking Alpha. Have a great day.

Disclosure: I am/we are long ANET. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.