Walmart: Don't Chase The Rally

by Opal Investment ResearchSummary

- Walmart US posts a record Q1, but the margin outlook is cause for concern.

- The International segment is set to come under pressure amid forced closures and macro weakness.

- The stock trades at premium valuations and could come under pressure as consumer demand slows and margin pressures become more apparent.

As its Q1 results highlighted, Walmart (WMT) has a lot going for it at present. Yet, there are also plenty of risks to the story as COVID-19 accelerates the shift online amid a weaker consumer backdrop. With Walmart also set for a multi-year investment cycle, its margins are set to come under pressure as a result. Yet, at current levels, Walmart’s valuation seems full as shares now trade significantly above historical levels in-line with the recent ramp in sales. However, I do not view these trends as sustainable and, as such, would caution against extrapolating the sales ramp going forward. An inevitable slowdown as consumer demand comes under stress, alongside margin pressures from a multi-year investment cycle, limits the upside potential of Walmart shares.

Walmart US Posts Record Comps in Q1

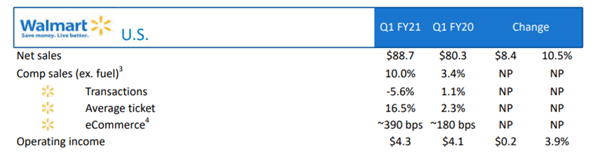

In a testament to its underlying momentum, Walmart posted record comps in its US business (+10% Y/Y) on the back of strength across average ticket and an increased e-commerce contribution. More specifically, the rise in Walmart US comparable sales came in conjunction with a 74% Y/Y e-commerce growth (grocery pickup and delivery services, walmart.com, as well as marketplace), while EBIT growth stood at 3.9% Y/Y for Walmart US.

Source: Walmart Press Release

Impressively, Walmart's US comps have been accelerating at a rapid pace, moving from +3.8% Y/Y in Feb, +15.0% Y/Y in March, and +9.5% Y/Y in April. April saw a slowdown in the first part of the month, but saw a subsequent acceleration toward month-end, as demand picked up due to stimulus checks. By category, the April strength was concentrated in discretionary, with apparel also turning positive (vs. down 14% for the quarter).

To understand how demand will trend in the upcoming quarters, it helps to understand the underlying drivers of Q1. The quarter began with a stock-up phase, which saw a heavy mix shift to consumables, followed by a pick-up in demand for entertainment and education at home, and finally, relief spending (likely stimulus-driven), which saw more discretionary categories such as apparel and sporting goods trend upward.

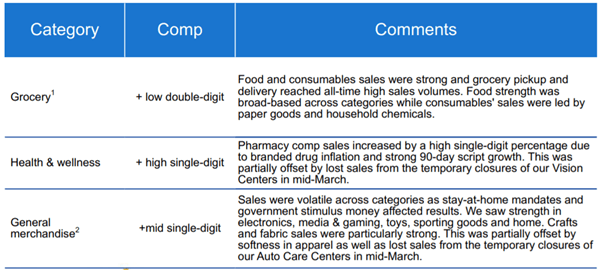

As of Q1, Grocery and Health & Wellness were the outperformers with low double-digit and high-single-digit comps, respectively, while General Merchandise was surprisingly resilient in the mid-single digits on strength in consumer electronics, gaming, and sporting goods, among others.

Source: Walmart Press Release

Q2 sales should see some signs of deceleration following the initial stock-up period, but Walmart US comps is nonetheless set for mid to high single-digit range in Q2. The ramp will likely slow as stimulus benefits fade, and the grim economic realities of high unemployment levels take hold, with the full slowdown likely to become apparent in the second half of the year.

Signs of Margin Pressure Emerging

Beyond the impressive top-line performance, Walmart's overall gross margin appears to be under pressure, contracting by c. 66 bps in Q1. In the US, gross margins declined c. 113 bps, primarily on price investments, unfavorable product mix shifts to lower-margin categories such as consumables, along with increased e-commerce penetration (now c. 9% of US sales). Lower fuel costs provided some offset, but not enough to stem the gross margin decline. As a result, profits rose by c. 3.9% Y/Y to $4.3bn for the quarter, which equates to a c. 4.8% margin (-31bps Y/Y).

| Walmart US | |||||

| 1Q19 | 2Q19 | 3Q19 | 4Q19 | 1Q20 | |

| Operating Income | $4,142 | $4,659 | $4,176 | $4,853 | $4,302 |

| Y/Y Change | 5.5% | 4.0% | 6.1% | (3.8%) | 3.9% |

| EBIT Margin | 5.2% | 5.5% | 5.0% | 5.3% | 4.8% |

| Y/Y bp Change | 10 bps | 6 bps | 13 bps | -31 bps | -31 bps |

Source: Company Data

By comparison, Sam's Club and International profits were up 9.5% Y/Y and 15.6% Y/Y, respectively. While, like the US, Sam's Club saw its margins (ex-fuel) decline, Walmart's international margins have remained resilient in Q1 (relative to consecutive quarterly declines since early-2017).

| Walmart International | |||||

| 1Q19 | 2Q19 | 3Q19 | 4Q19 | 1Q20 | |

| Operating Income (Constant Currency) | $790 | $922 | $698 | $1,175 | $853 |

| Y/Y Change | (37.5%) | (27.3%) | (40.8%) | 0.4% | 15.6% |

| EBIT Margin | 2.6% | 3.0% | 2.3% | 3.6% | 2.7% |

| Y/Y bp Change | -160 bps | -128 bps | -178 bps | -6 bps | 19 bps |

| Sam's Club | |||||

| 1Q19 | 2Q19 | 3Q19 | 4Q19 | 1Q20 | |

| Operating Income (ex-Fuel) | 443 | $424 | $274 | $356 | 398 |

| Y/Y Change | 41.5% | 14.9% | (20.6%) | (216.0%) | (10.2%) |

| EBIT Margin (ex-Fuel) | 3.6% | 3.2% | 2.1% | 2.6% | 2.8% |

| Y/Y bp Change | 103 bps | 38 bps | -56 bps | 476 bps | -73 bps |

Source: Company Data

Nonetheless, Walmart's demand strength buoyed its adjusted EPS for the quarter to $1.18 (above the $1.12 consensus estimate). Looking ahead, however, there is an element of uncertainty around the EPS path as the company has withdrawn its full-year outlook at a time when major retailers are increasingly re-investing in their people and infrastructure.

In Walmart's case, the scale of its investments has been sizable at c. $900m in incremental bonuses and wages incurred in relation to COVID-19 (including one-time bonuses for employees hired up to May). This comes in addition to the wage costs associated with hiring an additional c. 200k workers. While some might be tempted to dismiss these pay bumps as one-offs, this is certainly not a given. Should Walmart come under pressure to extend the recent hourly pay raises for employees at the store and distribution centers or make permanent some portion of recent benefits, I anticipate increased margin pressure as stimulus benefits also fade.

Challenging Times Ahead for International

Walmart International has been a bright spot in Q1, with the top-line rising +7.8% Y/Y and EBIT growth at 15.6% Y/Y (constant currency). This does, however, reflect a disproportionate benefit from pantry stock-up for the quarter, with trends set to become more challenging going forward. As March and April progressed, for example, International has come under increased economic pressure, leading to significant April sales declines in certain regions. Note that Walmart’s international markets benefit from no (or less) stimulus, while forced closures in markets such as South Africa have also weighed on the outlook.

As a result of the crisis, toward the end of the quarter, we had pretty extensive store and operational closures in markets like South Africa, India, and in the Central American countries. For example, 25% of stores in Africa were closed, and our Flipkart operations were impacted by restrictions on non-essential deliveries.

Trends in China have been positive, however, as operations have gradually stabilized. All stores are open, and customers are starting to purchase more discretionary categories, though spending has not returned to pre-crisis levels. On a net basis, International is still set for a challenging few quarters ahead, with management guiding toward "significant" EBIT pressures ahead. The likely considerable currency headwind at over $2 billion (c. $0.03 EPS using current rates) should also weigh on earnings for Q2.

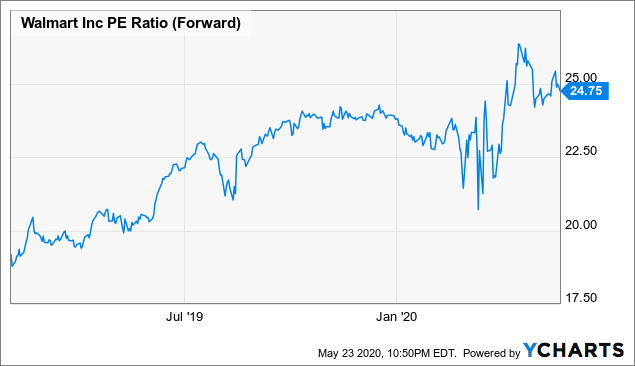

Premium Valuation Keeps Me on Hold

Admittedly, Walmart did deliver record Q1 results on the back of the recent surge in discretionary demand. Though we are in a unique period, with consumers sheltered in place and ironically, flush with cash from the stimulus, the recent demand ramp will inevitably slow at some point as these benefits wane. On that basis, I do not believe the current sales trend can be extrapolated forward while rising investment needs could pressure EPS toward the second half of the year.

With Walmart shares already trading at a premium to its historical PE range, I think much of the upside is already priced into its shares. While bulls may argue Walmart's defensiveness warrants a premium in this environment, a lower EBIT growth outlook is cause for concern, and as such, I think shares should instead, command a slightly lower premium to the market than it has historically. I would also note additional risks on the horizon, such as a deeper slowdown in economic activity, more intense price competition, and earnings dilution from Flipkart (FPKT) following recent government selling restrictions in India.

Data by YCharts

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.