IPG Photonics: Buy On Weakness

by Paul FrankeSummary

- IPG owns one of the safest and strongest balance sheets in corporate America.

- The long-term trend of rising demand for lasers of all types puts the wind at your back as a shareholder.

- A technical picture reversal higher during April-May may have marked a bottom in the stock, and opened an area for accumulation.

IPG Photonics (IPGP) owns a stellar balance sheet, with a high level of cash against little debt. The stock’s technical picture has improved dramatically in May, as its price approaches a 52-week high. While the growth in laser products has been steady for decades, I do not expect a major bump higher in company sales until 2021. Instead the safety and relative value characteristics of it shares against an economy in decline are attracting long-term investment demand. My goal is to acquire shares on a 5-10% drop in coming months. Buying on weakness, especially if it tracks another drop in the S&P 500, should prove an intelligent decision as the economy and laser sales expand again later in 2021-22.

Image Source: Company Website

IPG Photonics manufactures and sells all types of fiber lasers and amplifiers, plus diode lasers for uses from fiber optic communications to medical surgeries to the cutting of metal parts and other precise specialized applications for businesses. The company markets its products to original equipment manufacturers, system integrators, and health care providers. It is grouped as a semiconductor supplier in the stock indices, while its operating business is quite unique.

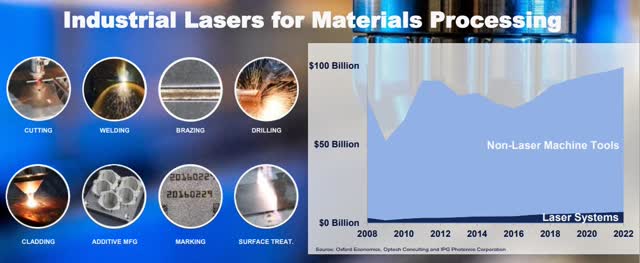

IPG’s main product lines are used to cut, clean and weld items in industrial applications. Below is a breakdown of sales, with a graph illustrating the still huge potential market for its best-in-class laser offerings. Considering 90% of the materials processing market has yet to convert to new age technologies, the company may be able to double and triple revenues in the next economic cycle as laser costs and advantages continue to improve over time.

Image Source: Company Presentation

Fundamental Valuation

IPG has been a leading growth stock for decades since the company was founded in 1990. The stock quote has risen from $7 a share at the last recession low in early 2009 to $157 today. Over the last eleven years, annual sales have risen from $230 million to $1.3 billion, and income from $36 million to a $180 million in 2019. You can review below the terrific price gains made by investors in the stock at the last recession low vs. the S&P 500, had you invested $10,000 in each.

At the end of March, the company held $1.2 billion in cash and $2.5 billion in tangible assets, against just $42 million in debt and $324 million in total liabilities. Overall, IPG Photonics possessed one of the most liquid and conservative balance sheets of ANY business in America going into the coronavirus economic shutdown. When you buy IPG at $157 a share, you are getting $23 in cash and a tangible book value of $43 per unit, plus direct ownership of future earnings and business growth. Unlike other American businesses fully leveraged with debts and IOUs, IPG stockholders are a relatively unique breed, not beholden to banking interests or debt holders.

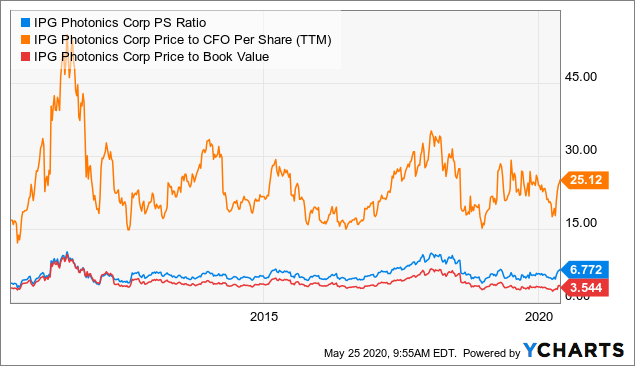

On price to trailing sales, cash flow and book value, IPG is trading slightly below its 10-year normal valuation. Not a screaming buy on financial ratio valuations, but a far better setup than the typical S&P 500 stock still trading at, or near, all-time record highs using 10-year equivalent valuation comparisons.

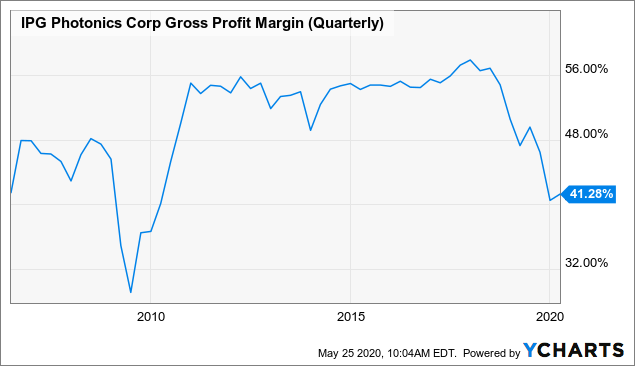

The stock price sell-off during 2018-20 in IPG Photonics resembles the 2007-09 Great Recession situation. Sluggish industrial demand from the appearance of an economic recession again in 2019-20 has rebalanced the stock price lower. However, new buyers today have a stronger long-term valuation story vs. the high price of $264 in January 2018. Below is a graph of the company’s gross operating margin performance since 2007. Notice the recession dips.

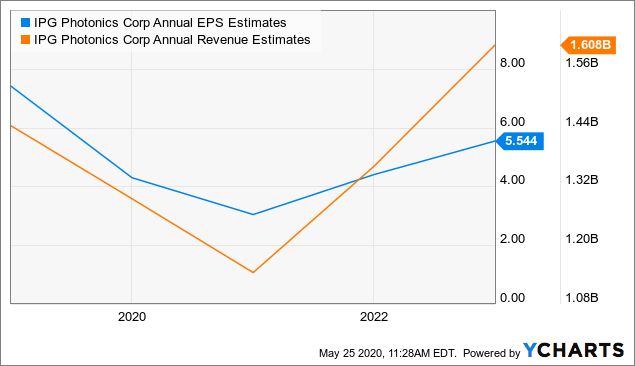

Current Wall Street estimates are calling for a significant rebound in revenues and profits after 2020. You can review analyst consensus numbers below. I am personally modeling sharply stronger numbers by 2022, in the $7-8 a share range for income, with the help of higher than expected inflation.

Technical Momentum Reversal

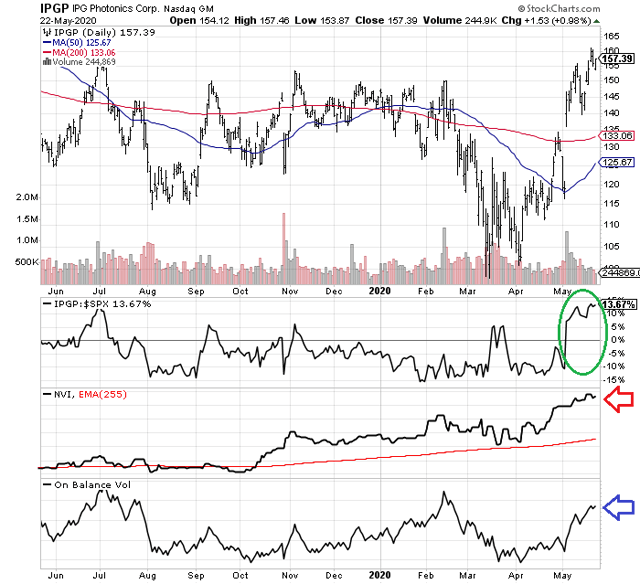

It is possible the recent downturn in the industrial economy was substantially discounted into the stock quote bottom of $99 a share in March. On the 12-month creation below, I am charting the strong relative price performance of the stock against the S&P 500 during May, circled in green. The Negative Volume Index (NVI) has been quite positive the last nine months, and confirms a regular buy on weakness trend by smart investors. The red arrow marks a decent trend of up days on falling volume in the NVI, even during the March price plunge. In addition, the On Balance Volume (OBV) line has improved nicely in May on the robust price upmove. Basically, buyers are willing to pay a higher price to get into shares, each well back by cash and high margin earnings into the future.

Over the past five years of trading, you can review the same data points. Interestingly, even including a weak 2018-20 period of price decline, an investor in IPG Photonics during 2015 would have earned greater profits than holding the S&P 500 index.

Trading Plan

If you are searching for a strong balance sheet company, with high profit margins and above average growth prospects in the next economic recovery, IPG Photonics deserves your research attention. A leading technology company with new patents and inventions coming out all the time, marketing customer productivity and cost improvements as selling points is almost always worth a look for your capital.

My battle plan is to purchase shares on minor weakness into June. A stock quote in the $145-150 range seems reasonable for long-term investors. If the U.S. stock market dives during the early summer, a gap filling drop back to $135-$140 would be an even smarter area to accumulate shares, supported by the simple 200-day moving average.

While a prolonged and deep recession could weigh on the stock price the rest of 2020, I don’t foresee IPG weakness lasting past the autumn months. We can debate the odds of $120 as a retest of the lows in March, but a price closer to $200 by late 2021 appears to be the next important destination. Remember a lingering recession would likely clean out a number of competitors in the industrial cutting space and other markets served by IPG. Less competition a year or two down the road, coupled with a rise in demand, means improved pricing power and profitability for the company will be the end game when our economy finally recovers.

It's entirely possible, the company will use its $1.2 billion in cash to acquire smaller peers and competitors in 2020-21 to gain scale and increase sales. Opportunistic and accretive asset buys would help the stock rise faster, in my opinion, when the economic cycle turns higher. A second way to increase shareholder value would be a stock buyback program. IPG could spend its cash on reducing share counts to the tune of 10% initially and 20% over a few years of income reinvestment, without adding any debt.

Using IPG Photonics in a diversified long/short portfolio design is a good angle for ownership. My personal portfolios are run this way, where a period of "outperformance" of the S&P 500 generates gains against my short position in other, weaker selections. In essence, if IPG rises faster or falls less than the market, I would consider the position a winner.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Want to read more? Click the "Follow" button at the top of this article to receive future author posts.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in IPGP over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only. All opinions expressed herein are not investment recommendations, and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication, and are subject to change without notice. Past performance is no guarantee of future returns.