Five9: Stock At All Time-Highs But Still Remains Attractive

by The Software Side of LifeSummary

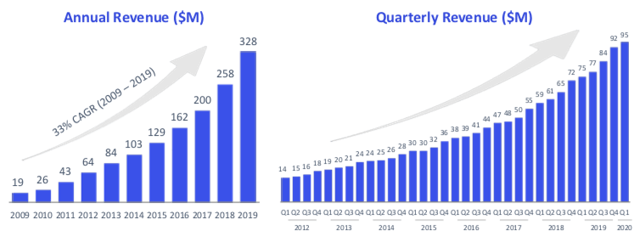

- Five9 reported a good Q1 with revenue growing 28% to ~$95 million, around $5 million above expectations.

- Management reiterated their 2020 revenue guidance of ~16% growth, which now seems somewhat conservative given the Q1 revenue beat.

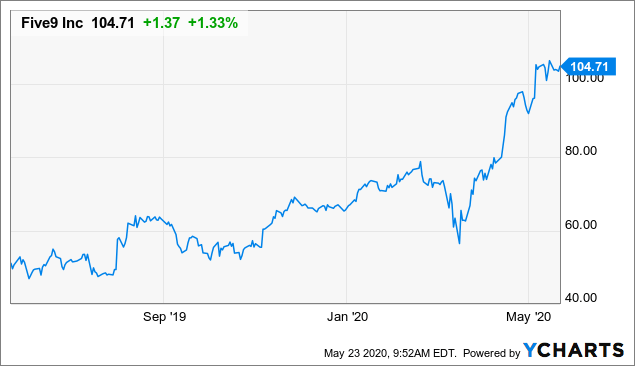

- The stock has traded up ~10% since earnings and is now near all-time highs, though valuation ~16.4x does not appear overly expensive.

Even amidst all of the volatility in the market, Five9 (NASDAQ:FIVN) has continued to push higher as companies now more than ever embrace cloud-based technology. FIVN is one of the leaders in a market currently disrupting the cloud software for contact centers. Enterprises have trended towards updating legacy software and investing more into cloud-based solutions. FIVN is the only pure-play company at scale looking to further disrupt this market.

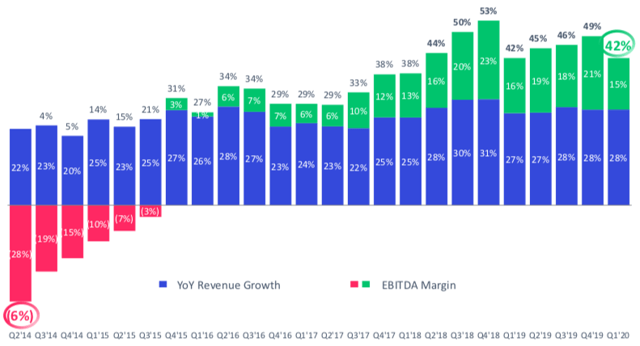

The company reported strong Q1 earnings with revenue growing 28% and their Rule of 40 score coming in at 42, marking the 8th consecutive quarter of achieving this level. In addition, management reiterated their 2020 revenue guidance despite Q1 coming in ~$5 million above expectations, thus making the full year guidance appear somewhat more conservative.

Data by YCharts

Even as global economies remain in an uncertain condition, given the global pandemic, companies still need to have their call centers available for customers at all times. More companies are encouraging employees to work from home, and the rise of cloud-based solutions has been at the forefront of investment discussions.

Since reporting earnings a few weeks ago, FIVN has seen their stock go up ~10% and is now trading near all-time highs. This has caused valuation to also ramp, with the stock now trading at ~16.4x 2020 revenue and ~14.5x a somewhat conservative 2021 revenue figure. There are many software players in the market that trade at 15x forward revenue or higher, and I believe FIVN has solidified their spot as a company well deserving of a premium valuation.

Even with the stock trading near all-time highs, I believe long-term investors will continue to be rewarded as enterprises are constantly looking to shift more of their workload to the cloud. Legacy contact centers which host thousands of representatives in a building could eventually become a thing of the past, given the global pandemic has altered companies' thoughts around their work-from-home policy. For now, I believe FIVN will continue their upward trend as companies will likely increase their cloud usage when it comes to contact centers.

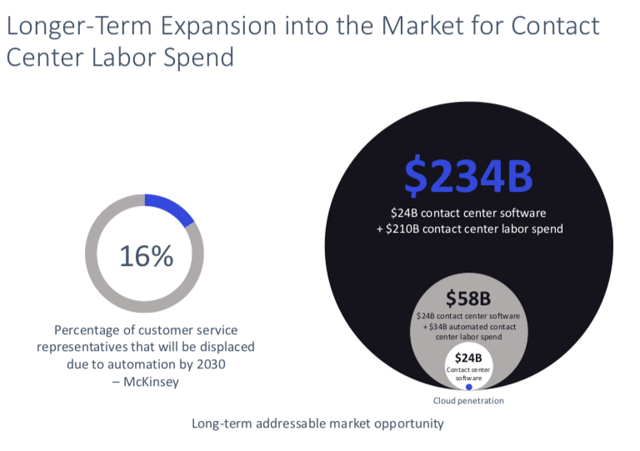

Management has previously talked about the market remaining only 10-15% cloud penetrated, and with ~$24 billion of the total global addressable market, there is plenty of room left for FIVN to grow and expand. FIVN competes in the cloud software contact center market, focusing mostly on large enterprises. This market, known as the Contact Center as a Service, or CCaaS, is an estimated $24 billion industry that remains highly underpenetrated.

Source: Company Presentation

Legacy vendors have historically focused on building out large call centers. This legacy model invested in people to work the phones and provide customer service. I am sure many readers have an experience calling customer service and speaking with agents. Not all of these experiences are necessarily negative; however, the use of technology has advanced the customer service experience. Another factor of legacy contact center operations is its use of offshore or nearshore operations. Largely held in India and the Philippines, these contact centers play host to hundreds or even thousands of workers.

While this offshore work is generally cheaper for the company compared to domestic employees, technology has changed the way contact centers operate. As companies increasingly transition to a work-from-home model, having a cloud-based solution is essential to ensuring a smooth transition.

Q1 Results And Guidance

During the quarter, revenue grew an impressive 28% to $95.1 million, which was nicely above expectations for ~$90 million and was consistent with the 28% growth seen last quarter. In addition, 91% of their revenue was recurring, which remains an important aspect for investors especially during a time when global economies are slowing down. The company continues to demonstrate strength within their Enterprise customers, with 81% of LTM revenue coming from Enterprise customers. As contact centers continue to move towards cloud-based operations, Enterprises are more willing to make investments in these areas, ultimately using FIVN's services.

Source: Company Presentation

Gross margin during the quarter came in at 64.1%, which expanded slightly from 63.4% in the year ago period. Over time, I believe gross margins could approach 70% as the company gains scale, and more of their revenue comes from software subscription streams. Given the company continues to invest in their operations, including S&M and R&D, adjusted EBITDA margin during the quarter came in at 14.9%, which was down ~100 basis points from the 15.9% in the year-ago period.

Source: Company Presentation

One of the biggest gauges software companies focus on is the Rule of 40, that is the company's revenue growth percentage plus their adjusted EBITDA margin percentage. During Q1, FIVN reported 28% revenue growth and ~15% adjusted EBITDA margin, which led to a Rule of 40 score of 42, marking the 8th consecutive quarter achieving this feat. On top of this, the company continues to increase their internal investments, which has weighed down margins for the past few quarters.

The better than expected revenue, combined with continued strong margins, led to EPS of $0.17 during the quarter, which was slightly above expectations for ~$0.15.

Source: Company Presentation

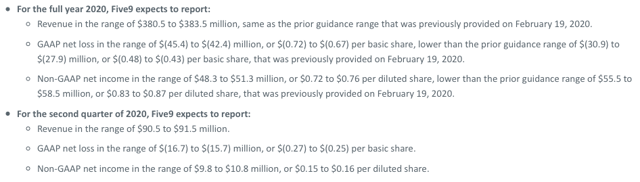

For Q2, the company is expecting revenue of $90.5-91.5 million and non-GAAP EPS of $0.15-0.16.

For the full year, the company is now expecting revenue of $380.5-383.5 million, which represents ~16% growth compared to 2019. In addition, the revenue guidance was similar to management's previous guidance range, which now makes it seem somewhat conservative. While there could be some pressure in Q2 and Q3, given the global pandemic, Q1 revenue came in ~$5 million ahead of expectations, which gives the company more flexibility for the remainder of the year.

In addition, the company reiterated their long-term model during the quarter, which includes gross margin reaching 70%+ and adjusted EBITDA margin expanding to 27%+. As the company scales and gains efficiencies, they should start to see R&D and G&A expenses start to decline, which will benefit margin expansion.

Valuation

Since reporting earnings, FIVN has been up ~10% over the past few weeks and continues to trade near all-time highs. Given the cloud-based nature of their operations, 90%+ recurring revenue, and companies likely to invest more in cloud-based solutions given the global pandemic, investors have rightfully placed a premium revenue multiple on this name. The cloud-based contact center market remains underpenetrated as there is a lot of growth runway remaining.

In addition, FIVN could end up being a potential acquisition target for a larger software or cloud-based player looking to gain more exposure into contact centers. FIVN is the leading pure-play competitor in the cloud-based contact center market, and legacy software players could see FIVN as a good opportunity to diversify their portfolio. With a market cap of ~$6.4 billion, there are several larger legacy players that could add FIVN to their portfolio.

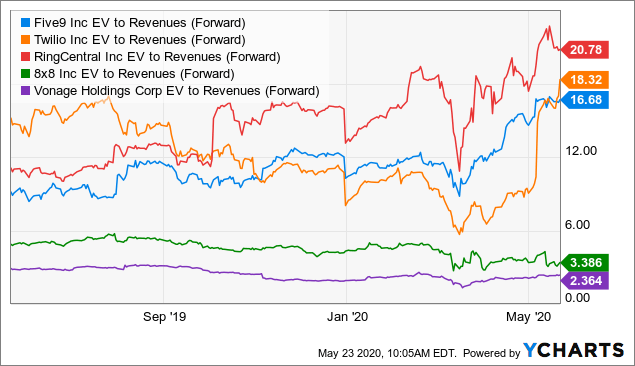

FIVN is the largest pure-play competitor in the CCaaS market and continues to be valued on similar metrics as leading software communication companies such as Twilio (TWLO), RingCentral (RNG), 8x8 (EGHT), Bandwidth (BAND), and Vonage (VG).

Data by YCharts

With a current market cap of ~$6.4 billion, cash/investments of ~$325 million, and debt of ~$215 million, the company has a current enterprise value of ~$6.3 billion. Management reiterated their 2020 revenue guidance of $380.5-383.5 million, Which represents only ~16% revenue growth. Using the midpoint of their guidance range, this results in a 2020 revenue multiple of ~16.4x.

Assuming the company comes in at the midpoint of revenue guidance and then grows ~13% in 2021, we could see 2021 revenue of ~$435 million, which would imply a 2021 revenue multiple of ~14.5x. Given the rapid change in companies' preferences to cloud-based technology solutions amid the global pandemic, I believe the above growth rates could end up being conservative and revenue could grow 15-20% over the next few years.

While valuation currently remains at a premium, there are many other cloud-based stocks that trade at 15x or higher forward revenue multiples given their consistency and recurring revenue base. FIVN could experience a significant increase in demand over the coming quarters and years and enterprises transition to cloud-based models amidst employees working from home more often. The company remains the leading pure-play competitor in the cloud-based contact center market and is poised to capture additional market share in an underpenetrated market.

Risks to FIVN include increased competition from other software communication players. In addition, if the market takes longer to invest in cloud-based contact center solutions, FIVN's growth may be limited.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.