JetBlue Airways: Beware The Pending Capital Raise

by Aaron ButlerSummary

- JetBlue's 1Q commentary points to an April trough.

- I am less confident about JetBlue leading a recovery given its exposure to the Northeast.

- The ~$750 million capital raise in the pipeline keeps me on hold.

JetBlue (JBLU) stock has caught a bid lately as modest load factor improvements in May, particularly in the Northeast and Florida, have sparked hopes of a recovery. If JBLU management is right that leisure will lead a rebound, then its outsized focus on leisure (~80% of passengers carried) should drive upside near term. However, I would be cautious about buying into JBLU at this juncture as the company is still looking to build its cash position, with an additional ~$750 million capital raise in the pipeline. Thus, I think investors in JBLU equity should allow for a larger-than-forecast EV in the event JetBlue has to take on more capital (likely debt) to bolster its near-term liquidity.

1Q Commentary Points Toward an April Trough

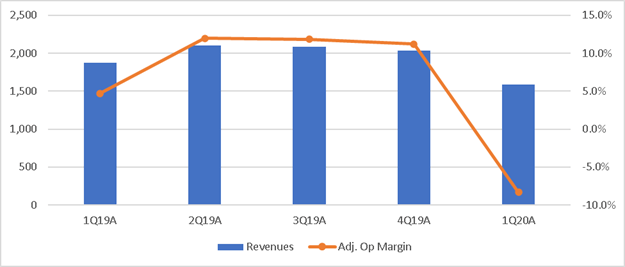

During 1Q20, JetBlue lost $0.42 per share (ex-specials), though passenger revenue was better than expected. Total revenue declined 15% YoY, with operating expenses also declining by 3.5% YoY, leading to an adj operating margin (ex-one-offs) of -8.3% (vs. 4.7% in 1Q19) and a pre-tax margin of -9.6% (vs. 3.7% in 1Q19).

Source: Company Filings

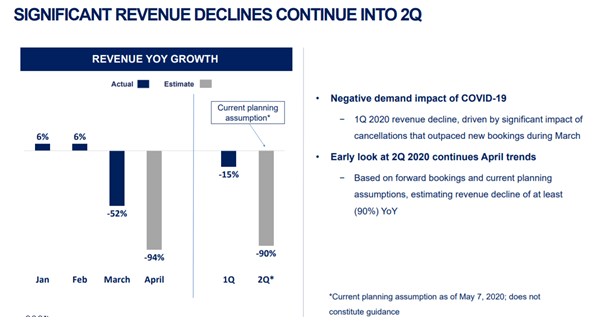

The outlook was quite positive, though, as management pointed toward a demand trough in mid-April, with revenue expected to decline 94% on 85% lower capacity. 2Q revenue is also set to decline at least 90% YoY, with operating expenses also down 44% YoY on capacity declines of >80%. Fuel price per gallon was guided to land at $0.76 in 2Q.

Source: Investor Presentation

Management still factors London into its long-term plans but will likely push back the London launch to late-FY21, as it still sees slot opportunities opening up. For now, JBLU's international operation will remain focused around visiting friends and relatives (VFR) traffic to/from the Caribbean and Latin America. Another key insight on the call was that JBLU's current demographic skews 80/20 leisure to business, and thus, a VFR-led rebound should see the stock higher.

As we think about the network, international versus domestic, we obviously believe domestic will recover sooner than leisure. And as Robin pointed out, given that our network is predominantly leisure 80/20 and largely domestic and the fact that we have a meaningful cost advantage to the legacy carriers, we feel that JetBlue is the -- is best set up for recovery when recovery happens."- 1Q20 Transcript

Recovery Could Lag Given JetBlue's Northeast Exposure

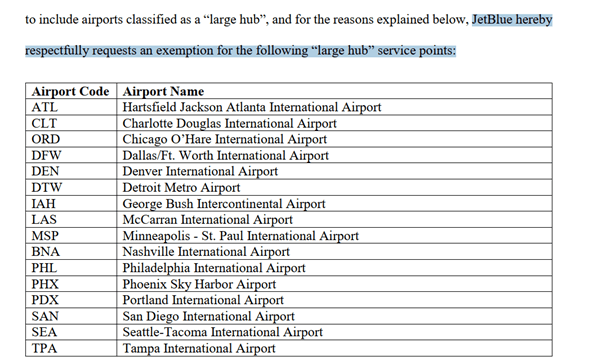

I would, however, push back on the notion that JBLU will lead a recovery - given its network is transitioning around the Northeast (e.g., New York and Boston), JBLU has increased exposure to states hit particularly hard by COVID-19. Per a recent filing, JBLU has requested a service suspension to large airports in Chicago, Atlanta, and Denver, among others.

Source: Regulations.gov

Given the major Northeast states are coordinating a reopening via a regional council with a focus on flattening the curve, airlines with disproportionate exposure to the Northeast could lag in a recovery scenario relative to other regions. For context, half of JetBlue's flights in FY19 had the New York metropolitan area as their origin or destination, according to Forbes.

Favorable Liquidity Outlook

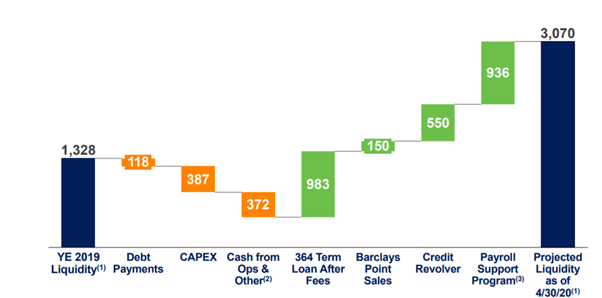

JBLU's projected liquidity stands at $3.1bn (inclusive of CARES Act funds), which compares to $1.3bn at end-FY19, reflecting management's efforts to drive cost savings and reduce discretionary spending, while boosting liquidity. ~$1.3bn in capex has also been pushed from FY20, with further spending cuts expected should demand fail to recover. Thus far, JBLU has raised ~$150m from a forward mileage sale to Barclays (NYSE:BCS), which among other sources, should drive end-2Q20 liquidity of $3.1bn (up from $1.6bn at end-1Q20), with net-adjusted debt standing at ~$2.2bn.

Source: Investor Presentation

Heading into the back half of FY20, liquidity needs should also decline as management targets ~$10m cash burn per day in May (vs. ~$12m in April), with a $7-9m target for 3Q. The moderation in the cash burn rate is set to be driven by lower cash opex, though I'd also point out that management has factored in some improvement in the revenue environment as well. This compares favorably to cash burn rates across the airlines, with Alaska Air (ALK) at ~$10m/day and Southwest (LUV) at $30-35m/day, for instance.

Beware the Pending Capital Raise

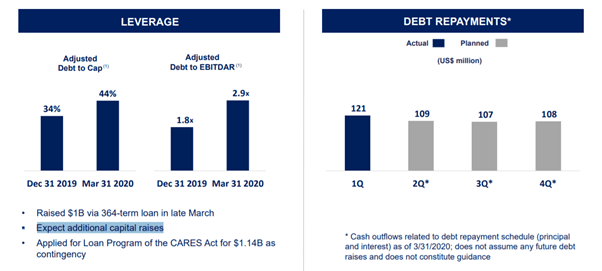

One of my key concerns around JBLU is the prospect of a capital raise near term. JBLU has already been actively raising capital amid the COVID-19-driven downturn, for instance, raising ~$1bn in March via a 364-term loan facility (LIBOR +175bps, with amortization payments amounting to 25bps of the outstanding principal), which entails an ~$2.5m quarterly payment. The loan also sets a $550m structural minimum to the cash balance and unused commitments.

Later in April, JetBlue also borrowed ~$550m from its previously unused revolver. In addition, JBLU will receive ~$936m in government aid (~$685m as a direct grant; $251m as a low-interest loan), which will result in the issuance of 2.7m warrants at $9.24/share (implying ~1$ dilution).

Though the current government loan should see limited dilution to the equity, JBLU has also applied for a second loan from the government, though loan acceptance will depend on the company's aircraft deferral plans. In the meantime, JBLU has been explicit in its intention to raise ~$750m via secured debt and sale-leaseback transactions, which should limit the need for an additional government loan.

Excluding the CARES Act loan, our goal is to raise up to $750 million over the next couple of months, which would take our total liquidity to approximately $3.25 billion by the end of the second quarter." - 1Q20 Transcript

Source: Investor Presentation

Though JBLU is pushing a liquidity raise through equity or convertible notes "much lower down the list" for now, I would hold off on going long JBLU, pending further clarity into its planned capital raise.

To be clear, this isn't a call on solvency - JBLU's range of liquidity-raising initiatives at their disposal positions it well to emerge strongly from the pandemic. However, with management targeting more fundraising ahead and given my belief that a Northeast recovery will prove relatively muted, investors might have to contend with a larger-than-forecast EV should JBLU take on additional debt to bolster its liquidity needs going forward. Fuel price volatility is also a key downside risk as well as the spread of COVID-19.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.