Shopify Is Taking The E-Commerce World By Storm

by Vincenzo FurcilloSummary

- Lately, Shopify (SHOP) is firing on all cylinders. The company announced a series of new features on its May 20 Reunite event, together with a new partnership with Facebook.

- The e-commerce sector is growing, and Covid-19 accelerated this trend in an exponential way.

- Shopify has a unique opportunity to position themselves as a leader for the future of commerce.

Introduction

“Pessimists sound smart. Optimists make money.” Nat Friedman

Lately, Shopify (NYSE:SHOP) is firing on all cylinders. The Company announced a series of new features for businesses on its May 20th Reunite event, a new partnership with Facebook (FB), and a new strategic partnership with CoinPayments. The stock price skyrocketed in response, reaching an intraday all-time high of $809 per share. If you look at the current state of the business, a $92 billion valuation may seem expensive. However, I believe that the following catalysts could set Shopify as the biggest winner in the post-pandemic e-commerce world.

Unpacking the news

On May 20th Shopify announced a series of new features to help small businesses grow. These new and upcoming features are:

Shopify Local Delivery app: Businesses have now the possibility to offer local delivery at checkout for customers nearby. This feature rides the Covid-19 trend, in which people need to spend locally to comply with restriction orders.

Shop Pay: An App in which customers can track orders, access return policies, and find their receipts. An accelerated checkout lets customers save their email address, credit card, and shipping and billing information so they can complete their transaction faster the next time they are directed to the Shopify checkout. Shopify claims a 4x faster checkout and an 18% higher conversion rate for returning customers.

Shopify Email: Free integration of an email direct extension of the online store. Includes smart templates that automatically use the store’s logo, colours, and products.

Shopify Balance: Businesses get their own card, account, and other money-management tools.

The key takeaway from these new and improved features is that the company is getting stickier, and this is happening both for businesses and for customers. Emails, card and account are fundamental features that a small business cannot live without. Ensuring that the pillars of the business are all within Shopify ecosystem will make it hard and inconvenient for businesses to switch to the competition. For customers, the Shop app will give better customer experience through an easy to use interface and faster checkouts, increasing the chances that they will stick around for subsequent purchases.

Crypto payments probably deserve a whole article, but in short, Shopify completed the beta trial of CoinPayments, the world’s largest cryptocurrency payments processor. The two parties consequently renewed their partnership. Using this payment option offers a reduction in transaction fees and faster payments. Analysing the deal, this partnership is unlikely to move the needle for Shopify’s revenue. Transaction fees do not apply for Shopify payments users, manual payments or POS orders. Increased payment volumes due to this integration will be very low, and the positive relies mostly upon the expanded choice of payment options for cryptocurrency users.

Lastly, the renewed partnership with Facebook created a bit of confusion. To make it clear, it is a great deal for Shopify and here is why. All the transactions happening on Facebook and Instagram will be handled by Shopify. Facebook will not receive any transaction fee or store management fee, and it is not competition for Shopify’s business. Facebook's business model will rely on ads, as businesses will increase their ad spending to push their product in the Facebook feed or Instagram’s soon-to-be-launched Shop tab. The success of this deal goes hand in hand with Facebook’s success, but it surely offers an extended reach for Shopify businesses and a big potential in transactions volume. As a reminder, Facebook monthly active users (MAUs) were 2.60 billion as of March 31, 2020, and increased by 10% year-over-year.

Shopify competition will remain their current competition, or other back end stores management providers such as BigCommerce, WooCommerce, and Channel Advisor (NYSE:ECOM).

The Path is Clear – More Growth

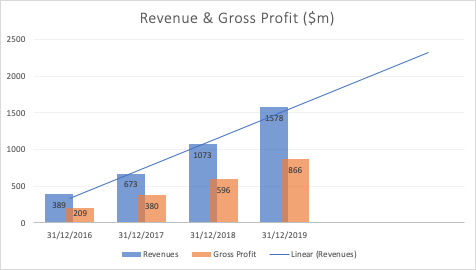

Total revenue in the first quarter was $470 million, a 47% increase from the same quarter last year. Figure 1 shows the evolution of revenue and gross profit over the last 3 years.

Figure 1 – Source: Shopify Financials – Figure created by Author

In percentage terms, revenue growth has been decreasing YoY, from 73% from 2016 to 2017 to 59% in 2017-2018 and ultimately 47% from 2018 to 2019. In fact, this growth rate is unsustainable and I expect it to decrease to the low 30s within a couple of years. That being said, this 30% growth rate could be sustained for much longer than expected. Here’s why.

1) E-commerce growth

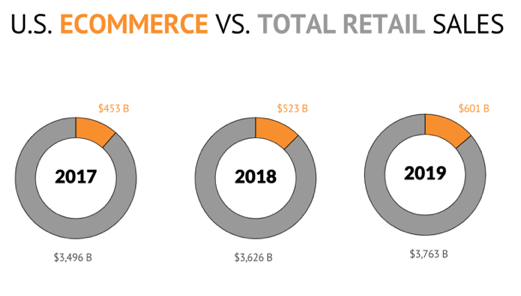

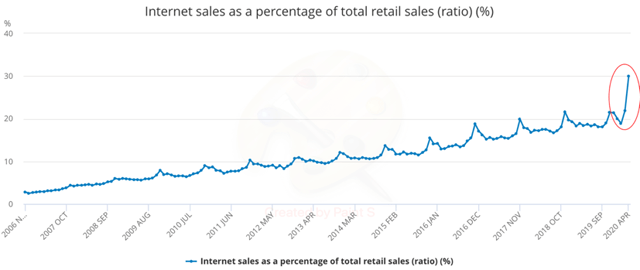

E-commerce still represents a fraction of total retail sales (Figure 2), and this trend will only increase.

Figure 2 – Source: Internet Retailer

Sales statistics help understand the infancy and growth potential of this market. In 2007, e-commerce represented 5.6% of total retail purchases. Since 2007, e-commerce has tripled its share of retail sales. E-commerce penetration jumped from 13.2% in 2017 to 14.4% in 2018, and to 16% in 2019. In the US, consumers spent $602 billion online in 2019, a 14.9% increase from 2018.

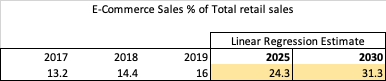

Figure 3 - Source: Digital Commerce 360, U.S. Commerce Dept.- Author calculations

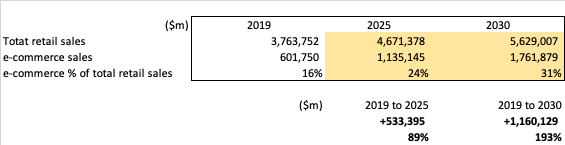

A linear regression of this data would take the % of internet sales to around 30% by 2030. To put this in perspective, this amounts to an estimate of $533 billion increase in e-commerce sales by 2025, and $1.2 trillion by 2030, or a 193% increase from 2019 sales data (Figure 4).

Figure 4 – Digital Commerce 360, U.S. Commerce Dept. - Author calculations

2) Covid-19 as a catalyst

The coronavirus pandemic in the last few months has changed customers behaviour, and online shopping is certainly part of the newly accelerated trends. In the UK (Figure 5) in April, already 30% of retail sales occurred online. The pandemic seems, therefore, to have shifted consumers behaviour 10 years ahead. While this 30% will probably be only temporary, it is also probable that these newly established behaviours will significantly raise the baseline percentage of online sales versus total retail sales.

Figure 5 - Source: UK Office for National Statistics (ONS)

3) Shopify’s Is Ready To Collect

Being at the centre of e-commerce, Shopify is expected to reap the fruits of this shift. The last available data show that this may as well be the case:

- Between March 13 and April 24, the number of new stores created on the platform grew 62% compared to the prior six weeks

- The number of new customers completing purchases from any merchant on the platform increased by 8%.

- The number of customers purchasing from merchants they had never shopped with online before climbed 45%.

- Adjusted net income tripled, as the increase in both merchants and transactions helped shift more profit to the bottom line.

4) And it is building the necessary infrastructure to expand

Shopify is building the most advanced, robotics-driven warehouses to help businesses fulfil fast and affordably. They claim 99.5% order accuracy across the network with collaborative robotic support. As a result:

- More new merchants signed on to Shopify Fulfillment Network in the first quarter of 2020 compared to any previous quarter since its launch in June 2019.

Since one of the requirement to join the fulfilment network is a minimum of 10 and a maximum of 10,000 orders a day, volumes for the fulfilment network are expected the rise quickly, contributing to the growth in revenue.

Challenges To Consider

Shopify pointed out that it is not clear how many of the new online stores would generate sustainable sales. A good number of these new subscriptions were created by established merchants, but during these uncertain times, a good number of them could be forced to close. On the other hand, for those who survive, it is hard to imagine that the newly opened online store will be instantly closed.

Moreover, Shopify is not playing alone. A big chunk of online sales will be collected by big players such as Amazon (NASDAQ:AMZN) and eBay (NASDAQ:EBAY), which currently collect about 50% and 7% of the whole US e-commerce market respectively. Another professional online store creator like Weebly by Square (NYSE:SQ) could certainly compete with Shopify for market share and also benefit from the shift in trends. However, Amazon and eBay do not offer the same level of support as Shopify to small businesses and their brands. In the same way, although Square’s online store business is now growing fast, this segment remains a secondary part of the company’s business.

On the other hand, Shopify’s whole business is focused on providing support for the small-medium sized online businesses. The Company extensive set of features are being constantly improved and in 2019 alone, the company has spent $355 million in Research and Development to make sure they stay at the forefront of the race.

Valuation & Price analysis

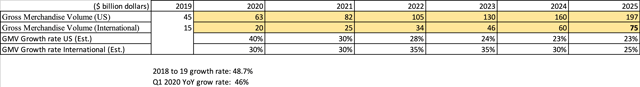

Considered that small businesses generate 44% of the US economy, Shopify has room to grow. In 2019, Shopify facilitated Gross Merchandise Volume ("GMV") of $61.1 billion, an increase of 48.7% from 2018. Excluding international merchant (29% at the end of 2019) we can estimate a GMV for the US market of about $45 billion, or 0.08% of the total US e-commerce market. Projecting Shopify’s annual GMV growth, decreasing accordingly over time until 2025, we get $197 billion in sales in the US and $75 billion internationally.

Figure 6 – Source: Shopify financials - Author estimates and calculations

In comparison, Amazon at the end of 2018 processed $233 billion in revenue. At the end of 2018, with a stock price of $1500, Amazon had a market cap of around $750 billion.

Figure 7 – Amazon Stock Price – Source: Yahoo Finance

Figure 8 - Source: Finviz

This is the level Shopify could get at in 5 years. Considered that Shopify issues around 10M shares a year, a market cap of 750 billion in 2025 would result in a stock price of $ 4412.

Conclusion

Given the recent acceleration in the shift of retail spending toward e-commerce, together with a newly-established partnership with Facebook and a growing fulfilment network, Shopify has a unique opportunity to position themselves as a leader for the future of commerce. The Company is growing fast in a sector that is growing even faster, and I believe that with the same level of execution as in the past Shopify has a very bright future ahead. I believe this company should be valued on its future potential, and therefore I rate Shopify a BUY with 1Y target price of $1000.

If you found this article of value, please follow (near the title) and/or press "Like this article" just below.

Disclosure: I am/we are long FB, SHOP, SQ. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not a financial advisor. All articles are my opinion - they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before investing or trading.