L3Harris Technologies: Steady Growth Yet Insulated From COVID-19 And The Economy

by Chuck WalstonSummary

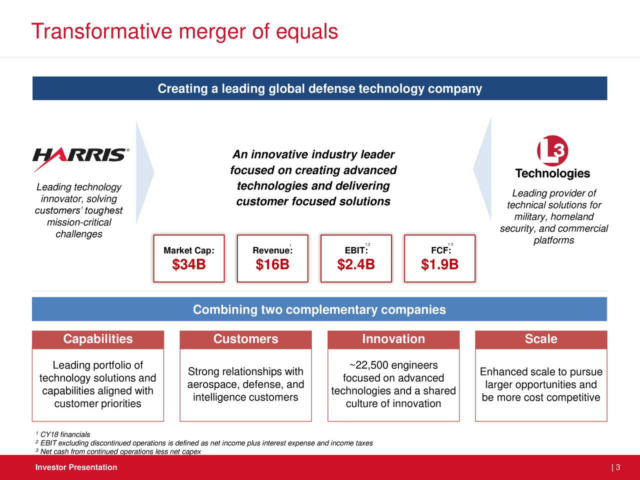

- The recent merger of L3 Technologies and Harris Corporation created synergies that are driving cost savings and increasing margins.

- As a defense contractor, the company's business is deemed essential.

- Although the company is experiencing COVID headwinds, those are ameliorated by merger synergies.

The SA community is a great source for investment ideas. As a contributor, you find there are some very savvy readers that provide outstanding investment advice. I learned of L3Harris Technologies (LHX), hereafter to be referred to as L3, by perusing readers' comments.

L3 is the result of a merger, consummated roughly a year ago, between L3 Technologies and the Harris Corporation. Most of L3’s businesses are in the Aerospace and Defense industry, which are somewhat insulated from the COVID crisis and swings in the economy. Remember that as a defense contractor, L3’s business is deemed essential to national security. During the last earnings call, management stated all of the company’s facilities were operating with limited disruptions reported.

Source: Merger presentation

One problem with an investigation into the new firm is you are essentially researching three companies: the two original businesses as well as the new company. To do so, at times you must use pro forma business metrics. In other words, you are perusing results or forecasts as they would be if the two companies had always been one entity.

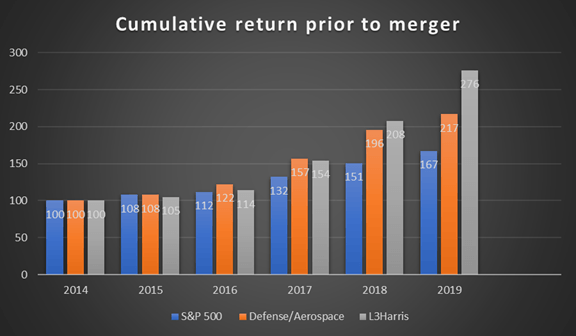

The following chart combines the two companies' metrics in a pro forma fashion and illustrates how L3stock performed in relation to the market and the defense/aerospace industry over the last half decade.

Source: Company 10K / Chart by Author

The marriage has gone well. Management states, in no uncertain terms, that synergies and savings stemming from the merger are advancing ahead of schedule.

Prior to the deal, L3 Technologies sold three businesses (Vertex, Crestview and TCS) for $540 million in cash. To win approval for the merger, Harris sold the company's night vision business for $350 million.

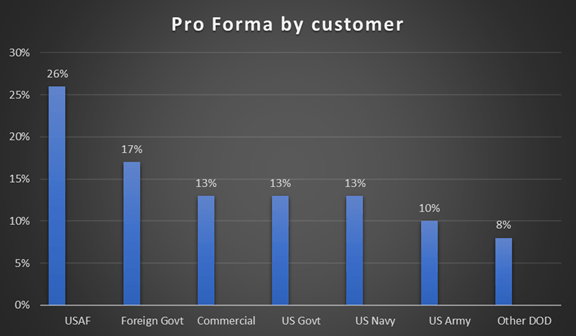

The combination of the two companies created a stock that is underfollowed despite its being the 6th largest defense contractor in the US. As defense contractors go, L3’s business is reasonably diversified. The following chart, provides the percentage of revenues from differing sources.

Source: Metrics merger presentation/ chart by author

After The Merger

Early this year, L3 sold the company’s Security & Detection Systems and MacDonald Humfrey Automation solutions businesses to Leidos Holdings (LDOS) for $1 billion. A bit over a month ago, L3 entered into a deal to sell its EOTech business to American Holoptic for $24 million. The combined annual revenues of the two totaled $560 million.

Management targets additional divestitures representting 8% to 10% of L3’s revenues.

The lion’s share of funds from those deals were ploughed into the company's stock buyback program. Management projects $2.5 billion in share repurchases by June of 2020. With a market cap of $39 billion, that represents a significant percentage of the current float.

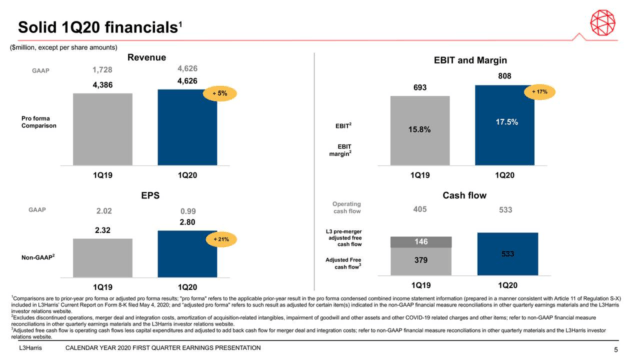

In Q1 2020, L3 reported revenue gains in all four segments. Overall revenues increased by 5% and EPS grew by 21%. Adjusted free cash flow was $533 million.

Source: Q120 Earnings Presentation

Management revised FY2020 guidance due to COVID headwinds, forecasting organic revenue growth of 3% to 5% (down from 5% to 7%) and EPS of $11.15 to $11.55 (prior forecast of $11.35 to $11.75).

The primary reason for altering the outlook was weakness in commercial aerospace and the company’s public safety radio business, as well as reduced revenues from the aforementioned divestitures.

Despite the revisions, guidance for adjusted FCF remained at $2.6 billion to $2.7 billion for 2020, and management reiterated the expectation of achieving $3 billion in FCF by 2022. This is in part due to the expectation that expanding margins will offset weakness in other areas.

Management sees prospective headwinds in reduced demand from state and local governments in North America facing budget and operational issues due to the COVID-19 crisis. Consequently, management anticipated a low single digit growth rate for the public safety radio operations but now projects a 10% revenue decline in that business going forward.

Prior to COVID-19, sales were expected to grow in the international business by low to mid-single digits. Now the company models flat revenues in that arena. I should add, however, that no single foreign country accounted for more than 5% of the company’s international revenues.

Dividend, Debt and Valuation

The current yield is at 1.85%. The current payout ratio is at 45% and the dividend coverage ratio is 225%. The company raised the dividend by 10% last July and by 13% in February. The dividend is safe and will likely grow in the future, albeit not at the pace recently witnessed. Management is quite vocal in advertising their intent to be a shareholder friendly company via stock buybacks and dividend increases.

L3 held cash and equivalents of $663 million at the end of Q1 2020. The company’s debt stood at $6.3 billion. The firm has nearly $2 billion remaining in its credit revolver. With the upcoming divestitures, management anticipates liquidity of more than $3.5 billion by the end of Q2 2020.

As I write these words, the stock trades for $180.45 a share. The 21 analysts covering the company have an average 12 month price target of $242.46. The average target for the 5 analysts that rated the stock over the last 30 days is $234.

The current PE is 26.56 and the forward PE is 14.39. The PEG is 2.01.

My Perspective

I believe L3Harris Technologies is the definition of “greater than the sum of the parts.”

The company is lowering costs and raising margins at a pace far greater than management’s forecasts due to merger synergies. The fact that L3 executed over a billion in divestitures, yet the company’s revenues are accelerating, also speaks to positives created by the merger. These factors, in part,explain why the company sticks to long range forecasts despite the COVID crisis..

The robust share repurchase program, largely funded by divestitures, as well as the two dividend hikes in eight months, testifies to the shareholder friendly culture of the company. The company also possesses a strong financial foundation.

Considering all of this, and the fact that the shares have fallen to a level that provides a reasonable margin of safety, means I’m comfortable with L3 as an investment. While conducting research for this article I invested in the stock.

I rate L3 Harris Technologies a buy.

One Last Word

I hope to continue providing articles to SA readers. If you found this article of value, I would greatly appreciate your following me (above near the title) and/or pressing “Like this article” just below. This will aid me greatly in continuing to write for SA. Best of luck in your investing endeavors.

Disclosure: I am/we are long LHX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I have no formal training in investing. All articles are my personal perspective on a given prospective investment and should not be considered as investment advice. Due diligence should be exercised, and readers should engage in additional research and analysis before making their own investment decisions. All relevant risks are not covered in this article. Readers should consider their own unique investment profile and contemplate seeking advice from an investment professional before making an investment decision.