Adyen: A Leading International Payment Platform

by Tech and GrowthSummary

- Adyen is a global-first payment platform with €240 billion ($261 billion) of the transaction value (TPV) processed as of 2019.

- The fast-growing business is already twice the size of Square and over a third of PayPal by TPV.

- Given the scale, international exposure, and strong balance sheet, there are many upside opportunities Adyen can tap into going forward.

- Adyen is a cash-rich business that generates +€200 million of cash annually. It consistently converts over 90% of its EBITDA into cash.

- The valuation is also attractive. The P/TPV of ~0.13x is almost half as much as PayPal's.

Overview

Adyen (OTCPK:ADYYF) (OTCPK:ADYEY) (AMS: ADYEN) is an interesting growth investment opportunity in the global payment processing space. Founded in 2006, the Amsterdam-based company is not as well known as PayPal (PYPL) or Stripe (STRIP). However, Adyen's strong global-first payment platform business has allowed it to acquire clients with massive international operations such as Uber (UBER), Netflix (NFLX), and Airbnb (AIRB).

Catalyst

Adyen is a smaller company than PayPal, twice the size of Square (SQ), and, potentially, larger than Stripe in terms of Total Payment Value (TPV). Though Stripe has never disclosed its annual TPV, it is unlikely that the figure surpasses Adyen's ~€240 billion ($261 billion) and PayPal's $712 billion of TPV as of 2019. Since the IPO in 2018, Adyen's shares have been outperforming. In the last twelve months alone, the shares price has almost doubled to ~$25 per share today.

In our view, some long-term catalysts will drive sustainable outperformance further. Adyen differentiates itself from the rest by having a cross-border focused payment platform, payment method agnostic platform, and a merchant-focused business. For instance, Adyen adopts a mix of volume-based, method-based, and flat fee pricing model that will benefit any merchants with large payment volume and international operations. Therefore, the business is indeed solving the biggest pain points in payment for the likes of Uber, Netflix, and Airbnb. Eventually, it has allowed the business to have a deep moat in the industry and rock-solid fundamentals.

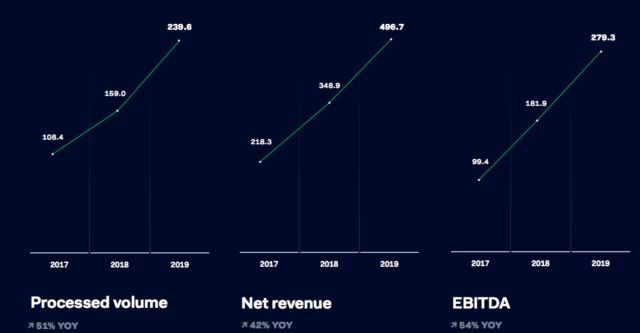

(source: company's 2019 annual report)

Over the last two years alone, TPV more than doubled to €240 billion in 2019. Even during the COVID-19 situation, which affected its large customers like Uber and Airbnb in Q1 2020, TPV still grew by 38% YoY. This was partly driven by the decreasing dependency on its top-10 merchants, whose contributions to net revenue has dropped from over 30% in 2018 to 27% in 2019.

(source: company's 2019 annual report)

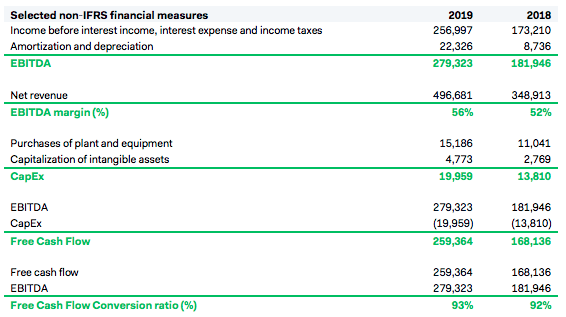

There are so many upside opportunities Adyen can tap into to grow the business given the exceptional scale at which it operates and its strong balance sheet. As EBITDA margin expanded and exceeded the 55% target in 2019, the company has also consistently converted over 90% of the EBITDA to FCF (Free Cash Flow). More recently, it launched a card-issuing feature, which will allow merchants to issue their virtual or physical cards. This makes fund reconciliation easier, especially when it comes to disbursements to the merchants' suppliers or partners. The move is also strategic, considering the similarity of the use cases to those of Apple Pay (AAPL), which will open up future opportunities to tap into the fast-growing mobile wallet market.

Risk

Apart from the impact of COVID-19 to its large international customers such as Airbnb, Booking Holdings (BKNG), or Uber, the reliance on the top-10 customers to drive the massive TPV required to maintain its competitive pricing is a potential risk factor. Furthermore, two individual customers were making up at least 10% of revenue in 2018. As a global payment gateway, there is also a geographic risk. At present, Europe and North America, the two regions hit hardest by the pandemic, made up over half of the revenue in 2019.

Valuation

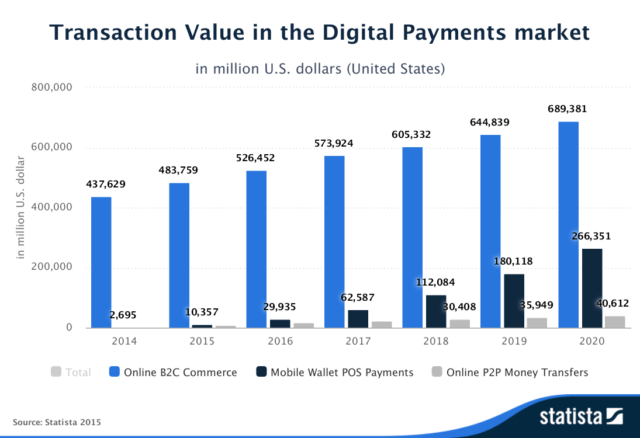

The digital payment sector is one of the most attractive segments in the technology industry. It has a massive TAM, interesting growth opportunities across many niches, and a high entry barrier. When understanding the valuation of the payment gateway players, we primarily also look at their TPVs as a proxy of their market shares. Except for PayPal, which still grows decently at ~14%, many of the emerging niche leaders such as Stripe, Square, and also Adyen are still growing at ~40% YoY.

(source: Statista)

While we do not have the data on Stripe, Adyen is a far more interesting business than Square in our view and is also a faster-growing one. Square and Adyen both have a similar level of market cap at ~$35 billion, though Adyen's 2019 TPV was at least twice as much as Square's $106.2 billion.

Taking the leading international presence and also the fact that it has a similar POS business like Square as well into account, we think that Adyen's 12x P/S is justified. Square, currently, trades at ~6.8x P/S. The launch of the card-issuing business will also put Adyen in the mobile/online wallet market map. Within the space, PayPal is the market leader in terms of volume with $712 billion of TPV. While PayPal's 9.5x P/S potentially reflects its market leadership, PayPal is also slightly more expensive than Adyen in terms of the P/TPV ratio. Given the $177 billion market cap, PayPal's P/TPV of 0.24x is almost twice that of Adyen. Considering all these factors, we feel that Adyen is fairly priced and, as such, presents an attractive buying opportunity today.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.