Waste Management Is On Sale Due To COVID-19

by Jesse CashSummary

- The company's stable balance sheet will enable it to weather the recession while maintaining its dividend.

- Income stream diversity will help provide stability, and aggressive cost containment will help management counteract the Covid recession decline in revenue.

- Management is seeking rate increases for residential collection to offset higher costs of increased volume.

- Waste services are largely recession proof as municipalities, companies, and residents will always have a need for waste disposal.

Waste Management (WM) is North America's largest provider of waste management environmental services. The company has excellent financials, and is well-poised to weather the temporary declines to revenue and earnings that will result from the Covid-19 economic shutdown and resulting recession. Because they have a diversified income streams, in both types of income, and customers serviced, management should be in a good place to overcome the temporary setbacks that will follow in the next few months. Upon an end to the nationwide lock downs, and a resumption of a more normal business climate, Waste Management should emerge even stronger than before, and ready to resume both price and business growth.

(Source: Waste Management)

I first wrote about Waste Management corporation in September of 2017 when the company was trading at $78.32. In the years since, the price of the stock continued to climb reaching an eventual peak of $126.79 on February 19, of this year. At that level it had a PE (NYSE:TTM) of 28.6 and seemed overpriced as it was far above the five year average PE of 22.12. However, in the era of Covid-19 the price of the stock has fallen dramatically, and again represents an attractive buying opportunity.

Covid-19 Challenges

Falling from $126.79 to a March low of $85.34 was definitely an overreaction as the stock was pulled down with the falling tide of the overall market. In the time since the low, the stock has recovered to $98.92 (as of this writing), but it still represents an attractive buy at that level. While the company will certainly have to deal with the challenges of the Covid recession they should be well-positioned to make it through the difficult time.

During the company's May 6th quarterly earnings call, they laid out some of the challenges and expenses related to Covid.

A reduction in landfill and industrial collection volumes. While volume-driven revenue in the commercial collection business held up relatively well in March, service decreases accelerated late in the month and into the second quarter. An increase in container weights in the residential line of business, which increased our cost to service these customers. A negative revenue impact of approximately $40 million [first quarter] A $6 million increase in SG&A expenses, driven by technology costs incurred to accelerate work-from-home capabilities. A decline in operating EBITDA margin of approximately 40 basis points, which the Company attributes to volume declines in our higher-margin lines of business and cost pressures in the residential line of business.

The company is responding to this pressure on revenue and the bottom line in numerous ways. First and foremost, the social distancing society of late has resulted in far higher collection volumes from residential customers. Even though these servicing rates are set in multi-year contracts with municipalities, management is seeking rate increases to adjust for the increased volume.

The company's CFO, Devina Rankin said,

We need to have conversations about the level of service we are required to provide because it is different than what we signed up for,” the Waste Management Inc. finance chief said. The weight of residential waste has increased 15% to 25% since the beginning of widespread lockdown orders in the U.S.

There is precedent for this. The company was able to successfully renegotiate contracts with many municipalities after China stopped importing recyclable goods from other countries, and thus costs changed. In states like California, new laws requiring a large reduction in organic matter being diverted to landfills, add ammunition to renegotiate contracts, to allow for increased costs of collection.

Management is not content to ask for rate increases and hope. They are proactively engaged in other cost containment and cash preservation measures. Technology is being used to optimize route design and thus reduce collection costs. Overtime is being cut and hiring is being limited. Rather management is working to optimize employee effectiveness, maximize employee retention and reduce employee turnover (thus reducing hiring and training costs). They are moving and adjusting capital expenditures to account for reduced collection volume, and eliminating all non-essential expenses. In addition, stock buybacks have been suspended "for the foreseeable future" to preserve cash on hand.

As of March 2020, the company had over 3 billion dollars in cash on hand, and another $3 billion dollars available in credit if needed. This should be more than enough to manage the downturn of the Covid-19 recession.

Business

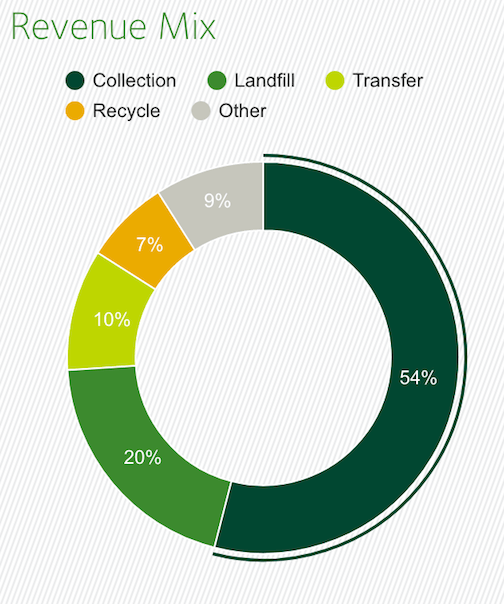

Waste Management is actually a rather diverse company. They generate revenue in several business segments including: collection, landfill, transfer, recycling and other smaller streams including specialized business services, and energy generation and sale. Their primary business is waste collection, but that is also diverse in that they service several different types of customers.

(Source:Waste Management)

While the majority of Waste Management's revenue (54%) does come from collection activities. What is surprising is that 46% comes from other business segments. The company makes 20% of their revenue in landfill fees, 10% from transfer fees (from their 302 transfer stations), 7% from recycling, and the final 9% from the other business services.

While they do anticipate,

a significant decrease in 2020 revenue from planned levels as a result of COVID-19, driven by volume declines in our landfill and industrial and commercial collection businesses.

The fact that they are so diverse, should help them to effectively manage this downturn. Several of their units are continuing to do well. Recycling, energy generation, transfer stations and business industry specific services all continue to do well. Their size also allows for business synergies that will help in this time. For example: a good deal of their landfill to CNG generation is used to power their fleet of collection trucks. This turns what would otherwise be an environmental liability and cost (methane mitigation) into a benefit, as it allows them to run their fleet significantly cheaper than they otherwise could. The balance of the energy is sold off to utility providers.

Another business positive of late is their recycling revenue has increased by $3 million over the same quarter in 2019, in spite of a 30% decline in recycled commodity prices. They have also seen an increase in domestic demand for recycled materials.

There is now greater U.S. demand for recycled paper and cardboard to produce things such as toilet paper and packaging...Waste Management is selling 80% to 85% of its recycled materials domestically, compared with about 70% before the Coronavirus pandemic.

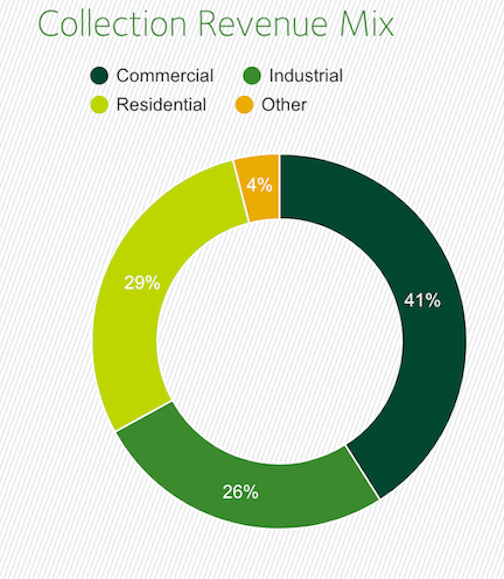

In addition to having a variety of revenue streams in different business lines, because their collection business is also diversified among client types, the business is better-positioned to ride out the downturn.

(Source: Waste Management)

While it is true that Commercial and Industrial collection (67% of the overall collection business) is being heavily affected by the downturn (first quarter volumes were down 16% in those segments), the wound is by no means fatal. Assuming a further decline in May of 16% (equal to that in the second half of march until the end of the first quarter), that would mean that their largest sources of collection revenue are would be down by about a third over pre-Covid levels. This would leave two-thirds of their largest collection revenue streams intact. I do not believe the May numbers will be that bad, as most of the country is currently in some stage of reopening. However, even assuming the worst, it is survivable. Because the company generates the other third of their collection revenue from residential and "other" types of collection, this provides further stability. While residential costs have increased, cost containment steps, combined with likely residential rate increases in numerous markets, should help the company to maintain a revenue stream that is negatively impacted by Covid, but solid.

With 49 states currently in some stage of reopening, it seems likely that the commercial and industrial volumes (and thus revenues) should increase rapidly in the coming months. As that happens, the business efficiencies and cost control steps will continue to spin of increased profits going forward as the economy stabilizes in the months and years to come.

Financials

Waste Management has solid financials over time. Since 2010, revenue per share has increased from $26.06 to $36.40 as of December 2019. That marks an increase of 36.6% over 2010 levels. In that same time, earnings per share have increased from $1.98 in 2010 to $3.93 in 2019, and increase of 98.4%.

During those intervening 9 years management has returned cash to investors with steadily increasing dividends and frequent share repurchase programs. Climbing from $1.28 per share in 2010 to $2.05 in 2019 the dividend has increased 60 percent with dividend raises each and every year. Shares outstanding have been brought down from 475.05 million in 2010 to 424.33 in 2019.

As of December 2019 the board has raised the annual dividend to $2.18 per share for the 2020 year. This represents an increase of over 6% over the prior year. According to the investor relations press release this represents the 17th consecutive year of dividend increases. Due to the large amount of cash on hand, in addition to the 3 billion in available credit (should a further downturn occur) it seems extremely likely that management will be able to maintain the dividend comfortably. According to their statements in the May earnings call, " The Company expects to generate strong free cash flow and remains committed to its dividend program."

Long-term debt remains manageable at 12.957 billion. While this represents a significant year over year increase from the 9.127 billion in 2018, a large amount of that increase is being used to finance the acquisition of Advanced Disposal (the fourth largest solid waste company in the US at the time of the announced acquisition).

This acquisition is still on track to close, and management expects the deal to be immediately accretive to earnings.

Possible Risks

The Covid-19 shutdown and resulting recession are full of unknowns. It is possible, that the country will be forced to deal with repeating lock downs and economic stoppages over years rather than months. This would cause a long-term impact to Waste Managements revenue and earnings. However, I do not believe this is a likely scenario. While sections of the country may repeat the events of the last several months, at different and unique times driven by local circumstances, it seems unlikely that the entire nation would shut down as it has since March. The public will is likely no longer there, and the economic realities will push business to resume work, in some way or another. A more likely scenario is that a partially functioning economy would be forced to limp on for a longer than currently expected period of time. While that would not be ideal, it is not fatal.

It seems more likely that the large reduction in commercial and industrial collection volumes and revenues, will begin to improve as the country begins to reopen. While hiccups and setbacks are likely, they probably will not be as severe as what the nation and the business world has just experienced.

The other major risk that I can see, would be a market selloff that returned us to the March lows. This is more possible than the above scenario. However again, I do not believe it is likely. A selloff in the coming months is certainly a possibility, maybe even an likelihood. It does not seem likely that such a selloff would revisit the March lows. Even if it did, Waste Management is fairly well positioned. The low of the March sell off was $85.34. That is roughly 14% below today's levels, and not catastrophic. With strategic purchases, such a pullback could be an excellent opportunity to increase one's holdings.

Plan of Action

As I've laid out, I believe Waste Management continues to be an excellent company, and a good long-term investment. They have excellent management that consistently produces Returns on Equity of over 20%, a solid balance sheet, and a workable plan for surviving the economic downturn. The recent Covid-induced selloff represents a fantastic opportunity to initiate a position in this company or to increase an existing position.

As the market is still somewhat unstable, I would recommend breaking up a total desired position into smaller purchases. This will allow buyers to take advantage of lower prices should they present themselves, and thus remove some of the risk of a market downturn (discussed above). My recommendation would be to break up your total desired position into no less than 5 steps. In addition, I would leave the final fifth available in case of a major pullback. It is thus possible that the final 20% may never be invested, should no major pullback happen. Waste Management is likely to have some tough months ahead, and they will likely face setbacks unforeseen at this moment. However, these will present opportunities to grow your investment in this fine company. With a current dividend yield of 2.2%, the you will earn solid and increasing income while you wait. Today's PE of 22.4 (TTM) is extremely close to the 5 year average of 22.12, and so it seems a good place to add shares. Should a pullback happen, more shares can and should be purchased at an even better price.

Good luck, and good investing.

Price Targets

12 Month Price Target: $105-$115

24-36 Month Price Target: $125-$135

Disclosure: I am/we are long WM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.