Atlassian: Recent Rise And Premium Valuation Put Me On Sidelines For Now

by The Software Side of LifeSummary

- Atlassian reported a strong Q3 earnings with revenue growing 33%, well above expectations for only ~28% growth.

- However, management provided Q4 revenue guidance of 20-24%, implying significant deceleration and was below expectations.

- After the stock’s recent 20% run, valuation is now ~22x FY21 revenue, which seems to be a bit too expensive for the current market conditions.

Atlassian (TEAM) is a software vendor that specializes in workflow and collaboration tools. The company reported a very strong Q3 earnings with revenue growth of 33% compared to expectations for only ~28% growth. Even though margins did not show much expansion compared to the year ago period, the stronger than expected revenue growth propelled EPS higher than consensus.

However, one of the weak spots to the quarter was Q4 revenue guidance implying revenue growth of only 20-24%, which would be a significant deceleration from the 33% growth in Q3. Management does have a history of guiding conservatively and there could be some headwinds from the global pandemic, but nevertheless, it is unsettling to see guidance imply a large deceleration and come in below expectations.

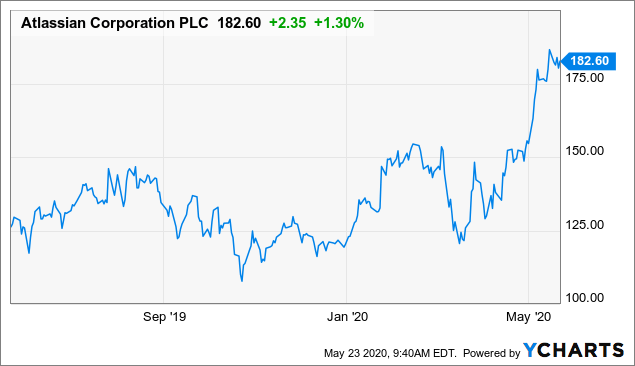

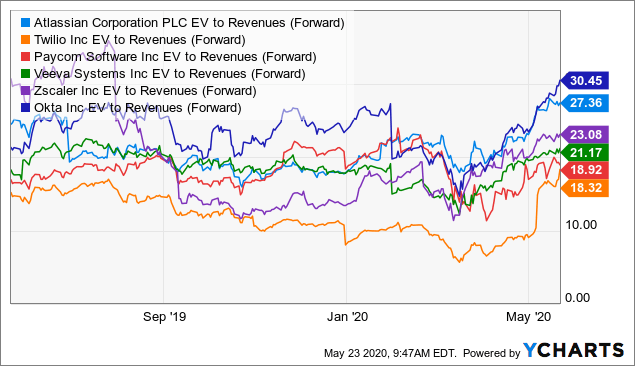

Data by YCharts

Over the past few weeks since reporting Q3 earnings, the stock has popped over 20%. While the company did have a great quarter, Q4 revenue guidance of 20-24% implies significant deceleration from the 33% growth in the past quarter. Management does have a history of conservative guidance and they could be a little more conservative than usual given the global pandemic impacts on the global economy. Nevertheless, guiding to deceleration and revenue below expectations does not typically result in the stock popping 20%.

In addition, valuation has become a bit expensive for my likings, now at ~22x forward revenue, which assumes revenue growth decelerates to only 25% growth in FY21. Even if revenue continues to grow at 30%+, valuation remains above 20x forward revenue, which seems a little too expensive given the many uncertainties in the market today.

I believe the company will remain at a premium valuation for many years to come, but history has shown software companies with 20x+ revenue multiples tend to contract if there is a soft spot in the market.

Q3 Earnings and Guidance

Revenue during the quarter grew an impressive 33% to $411.6 million, which was well above expectations for ~$395 million. However, even though growth did impress during the quarter, revenue did decelerate from the 37% growth last quarter as the company continues to see revenue growth decelerate. In this case, deceleration comes as a natural evolution for the company given the law of large numbers.

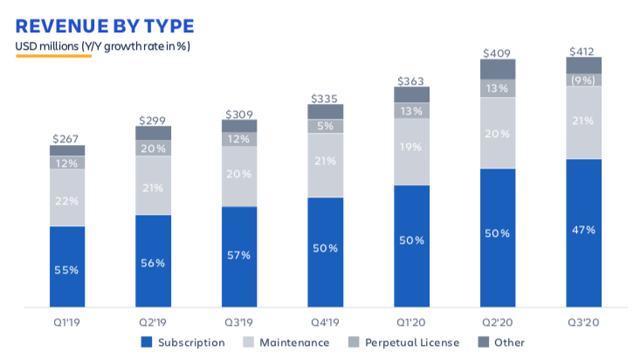

Source: Company Presentation

While subscription revenue growth continues to drive the overall growth, this revenue type only grew 47% during the quarter, decelerating from 50% last quarter and well below the 57% growth in the year ago period. Investors love to see consistently strong subscription revenue growth given the high visibility; and as a result investors tend to place a higher valuation multiple on companies that generate a majority of their revenue via subscriptions.

One area of revenue that investors should continue to focus on is perpetual licenses, which declined by 9% during the quarter and represented ~5% of total revenue. Especially during the current economic challenges, companies are less inclined to spend a lot on upfront licenses and may delay some of their capital expenditures if possible. That being said, TEAM could continue to see increased headwinds from their license revenue, which could impact overall revenue growth.

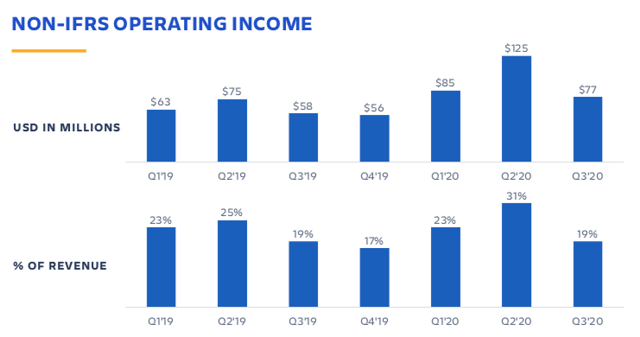

Source: Company Presentation

While revenue deceleration is natural for faster-growth companies as they reach the law of large numbers, the lower revenue growth is expected to come at the benefit of better margins. During the quarter, TEAM’s gross margins were 86%, which were strong and consistent with the year ago period. Operating margins also remained consistent at 19%, which was the same as the year ago period and could be somewhat disappointing given the lack of expansion.

Over time, I believe the company should drive margin expansion via gaining more scale and better leveraging its expense base. In addition, the company's ability to expand margins gives it more flexibility in terms of investing into growth opportunities, such as international markets. Nevertheless, the better than expected revenue led to EPS of $0.25 during the quarter, better than expectations for $0.21.

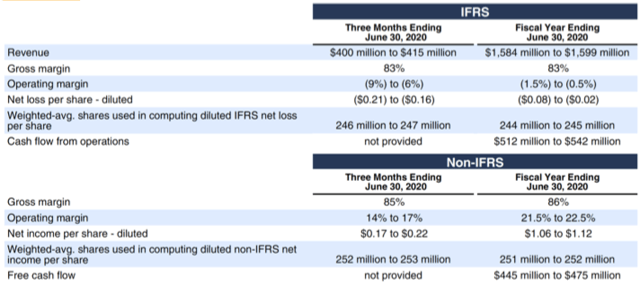

Source: Company Presentation

During Q4, the company expects revenue to be $400-415 million, which would represent only 20-24% growth, a rather significant deceleration from the 33% growth recorded last quarter. While the company has a history of being conservative (original Q3 revenue guidance was ~28% at the midpoint and actual growth was ~33%), the Q4 guidance range does seem a bit low. Consensus expectations for Q4 were closer to $420 million, although investors likely believe Q4 will ultimately come in ahead of guidance.

Profitability wise, gross margins are expected to be ~85% during the quarter with operating margins ~14-17%, near the 17% operating margin seen in the year ago period. I believe management’s guidance does remain a little conservative, though the metrics show Q4 decelerating in revenue growth and not having much margin expansion.

Valuation

While the stock was flat the day after reporting earnings, investors have propelled the stock nearly 20% higher over the past few weeks. Yes, revenue growth was much stronger than expected during Q3, but with Q4 guidance coming in below expectations, I believe these two factors should offset each other. Guidance could prove to be conservative for Q4, but there seems to be minimal margins expansion for now, something which could ultimately be conservative as well.

Nevertheless, the recent 20% rise in the stock has pushed valuation up even higher. The stock continues to trade near all-time highs in a market which continues to experience volatility. TEAM’s subscription-based revenue is encouraging in addition to license revenue now representing less than 5% of total revenue.

Data by YCharts

Given the current economic conditions are somewhat unstable and investors are still figuring out which stocks will be the next long-term winners, valuations has become somewhat sensitive. Higher-valued stocks may be placed under increased scrutiny in case the market goes through another abrupt correction phase.

The company has a current market cap of $45.4 billion, and with ~$2.1 billion of cash/investments and ~$0.9 billion of debt, the company has a current enterprise value of ~$44.2 billion. Management provided FY20 revenue guidance of $1,584-1,599 million, and considering we are almost one month away from the end of their fiscal year, we should start to look out another year.

Q4 guidance calls for revenue growth of 20-24%, which I believe is a rather conservative guidance. Even if we were to assume FY21 revenue growth is only 25%, which would be a big deceleration compared to FY20, and FY20 revenue is within the current guidance range, we could see FY21 revenue of ~$2 billion. Using this as our FY21 revenue base, this implies a FY21 revenue multiple of ~22.1x, which seems to be somewhat expensive even after considering next year’s growth is above the implied Q4 revenue growth.

While the actual revenue could end up coming in above my estimates, thus resulting in a lower forward revenue valuation, the stock remains expensive above 20x forward revenue. Revenue growth appears to be decelerating, which makes sense given the near $2 billion in revenue and the law of large numbers. However, investors may start to pay more attention to longer-term profitability expectations.

Although I am a long-term fan of the stock, I believe valuation has gotten slightly too high, especially after the recent run-up in the stock’s price after Q3 earnings. For now, I am waiting for a better entry point, but note that investors should not be quick to sell out of their positions.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.