JOYY Inc.: Be Patient

by WY CapitalSummary

- Management revealed that Bigo Live had far more potential than we originally believed, with potential revenue.

- YY Live saw a revenue and profit decline due to COVID-19, but we don't believe this permanently impairs the business.

- Management seems to be optimizing Hago for ROI, not growth, leading us to lower our valuation of this app substantially.

- Likee continues its strong growth momentum, and management has started to focus more on monetization.

- We believe a strong focus on profitability should be a large catalyst to shareholder value creation in the future.

JOYY (NASDAQ:YY) found a pretty terrible time to report earnings. Following fraudulent activity at LK, the US has passed a bill to potentially delist Chinese companies that are state-owned and don't meet certain standards. This has led to JOYY falling despite reporting decent results and giving an extremely bullish conference call even though JOYY uses a US auditor - PwC. We believe the company remains heavily undervalued and has great long-term potential.

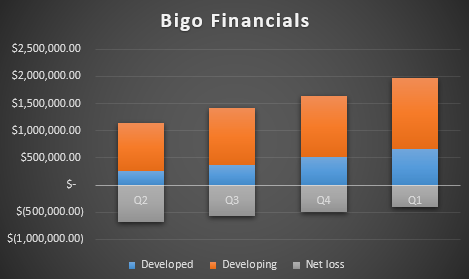

Bigo Live

Bigo Live is an absolutely amazing business. Users are growing, monetization is improving, and profitability is strong. Originally, I had expected this business to be like YY Live - a slow-growing, profitable live streaming business, but it seems I'm wrong. Live streaming revenues, most of which come from Bigo Live, have grown over 90% YOY, fueled by the developed markets business growing nearly 3x. Management believes the growth potential for Bigo Live is enormous, as you can see from the conference call:

Going forward, we plan to further expand BIGO Live's presence through our four key areas: North America, Europe, The Middle East, Japan, South Korea, Australia and New Zealand. Taking into account of each market's user base and spending power, we think that every one of those markets has the potential of exceeding the revenue scale currently generated from our domestic live streaming business in China. Source: Q1 2020 call

Note that this is Bigo Live alone - No Likee, no IMO, just Bigo Live alone has the potential to be multiple times YY's size in terms of revenue. The profitability is also quite impressive, with Bigo Live generating a 25% non-GAAP net margin, which management believes can be further increased.

In terms of the probability, as you can see BIGO Live's profit is well above 25%. I think in the next few quarters we expect that probability to continue or even to further optimize. Source: Q1 2020 call

Source: WY Capital, Press releases

Likee

Likee's results are definitely not as impressive as Bigo Live's, but it has done well nonetheless, growing its MAUs to 130mil despite management reducing UA spend substantially. With the reduced spending, management now expects Likee's losses to be reduced faster than expected, leading to the overall Bigo segment reaching breakeven ahead of target.

For Likee, it's still burning money, but as David surely mentioned that we focused on ROI, we focused on self-sustained growth, so we are expecting the breakeven for the total BIGO segment will come sooner than we previously guide. So which means the operating margin, the net margin profile for the total BIGO will be better than expected this quarter. Source: Q1 2020 call

Currently, management is focusing on adding users in developed markets as they tend to spend more money on online entertainment. By doing this, they believe Likee will be able to more effectively monetize users through advertisements and live streaming.

Notably, we also accelerated Likee's user acquisition from developed markets, including North America, Europe and Japan, because the average user spending on online entertainment in those developed markets is greater than in emerging markets. Likee's expanding footprints in developed markets is paving a clear path towards enhancing monetization going forward. Source: Q1 2020 call

Overall, we believe management's focus on increasing monetization and reducing cash burn will be a massive catalyst for improving shareholder returns. If you look at the stock chart for YY, you can see that the early 2017 to mid-2018 timeframe was the best period for YY shareholders. When you look back at that period, YY was generating both strong revenue growth and profitability. When Bigo hits breakeven, we believe YY's profitability will be boosted by over $0.40 per share per quarter if you include the offsetting effect from HUYA's (NYSE:HUYA) consolidation. This should make YY more attractive on a PE basis to value investors, which should hopefully lead to stock price improvement.

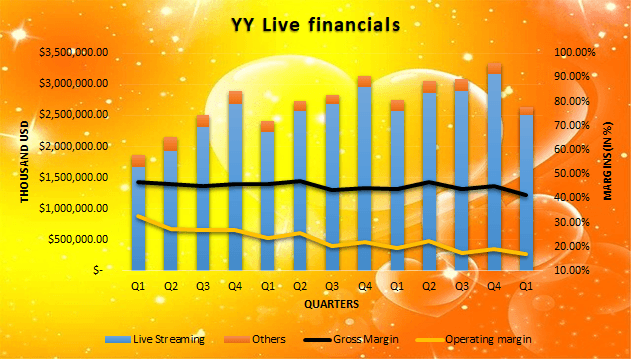

YY Live

In Q1, YY Live saw its first revenue decline in many years due to the effects of COVID-19. Even though usage increased substantially, with mobile MAUs increasing 20% YOY, paying users declined 0.1mil YOY as the COVID-19 outbreak wreaked havoc in the Chinese economy.

Oddly enough, live streaming revenues were relatively unaffected, down just 2.2%, while the "others" revenue stream declined 35% (we suspect advertising makes up a large portion of this revenue stream). We believe this demonstrates the resilience of the donation model and shows that even in a severe economic crisis, people will want to donate to their favorite creators.

Source: WY Capital, Press releases

The 4.5% decline in revenue, combined with a massive influx of users, led to a far more severe drop in operating income, which declined 17%. Despite the magnitude of the decline, we believe there is minimal long-term impairment to YY Live's value as life has mostly returned to normal.

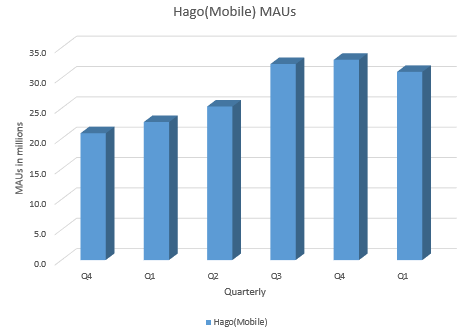

Hago

Hago has been quite disappointing, in my opinion. Having used the app, I had thought its uniqueness would allow it to scale up more, but users seem to have hit a ceiling for now.

Source: WY Capital, Press releases

According to management, they are now cutting UA spend in order to improve ROI, which is the main reason for the recent decline in users.

During the first quarter, we assessed our operations and made the decision to take the long-term view, prioritizing both user acquisition efforts that would deliver a high quality ROI. As such, HAGO's MAU's decreased to 31 million in the period from 33 million in the previous quarter. Notably, by reducing our marketing initiative and investment in India, we were able to generate more effective user traffic and refine the quality of HAGO's user base. Source: Q1 2020 call

Despite the decline in users, all other metrics seem to be quite strong. Growing user retention and user time spent are driving up the willingness to pay, which is slowly helping to improve monetization. With management focused on growing the LTV of each user, it seems like Hago is going the way of YY Live - a cash generative but slow-growing business.

Updated Valuation

Our target valuation for JOYY has increased substantially due to the bullish remarks regarding Bigo and the continued strong growth of Likee. Now, we believe JOYY should be worth over $25bil, or 6x its current valuation. We believe our valuation is conservative too, as this is all based on valuations of other companies.

| Valuation | Reasoning | |

| YY Live | $3.2bil | Despite lowered operating profit due to COVID-19, we believe the intrinsic value of the YY Live remains the same |

| Bigo Live | $8bil | Considering Bigo Live's fast growth, large TAM, and high profitability, we decided to increase its valuation substantially, giving it a revenue multiple in line with HUYA in its early days |

| HUYA stake | $1.1bil | Based on the market value of HUYA stock, sale to Tencent is accounted for |

| Hago | $0.5bil | Considering management has decided to focus on a low growth, ROI maximization strategy, we have decided to lower our valuation substantially in line with mature social media companies |

| Net cash | $1.6bil | From balance sheet |

| Likee | $9.1bil | After the recent updated valuation of ByteDance (BDNCE), we decided to increase the valuation of Likee to $70 per MAU |

| IMO | $1bil | We have lowered our valuation of IMO as management has barely talked about this segment in the last few earnings calls |

| Total | $25.5bil |

Takeaway

Overall, we continue to believe that JOYY has incredible potential, and the Q1 results just validate our view. Bigo Live and Likee have the potential to become major players in the live streaming and short-form video world, and we believe it is just a matter of time before this happens.

Disclosure: I am/we are long YY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.