Why Entravision Communications Stock Could Be A Solid Play For Your Deep Value Portfolio

by Thomas NielSummary

- Entravision Communications is a major owner/operator of Spanish-language TV and radio stations.

- COVID-19 may mean an ugly Q2, and headwinds could persist through 2020.

- Like other TV/radio plays, the company has moved into the digital domain. But again, this may be too little, too late.

- However, the deep value may trump high risk as shares remain beaten down after March's pandemic sell-off.

- Yes, lack of catalysts is a problem. So is the risk shares tank further. But, consider this an opportunity for a diversified deep value portfolio.

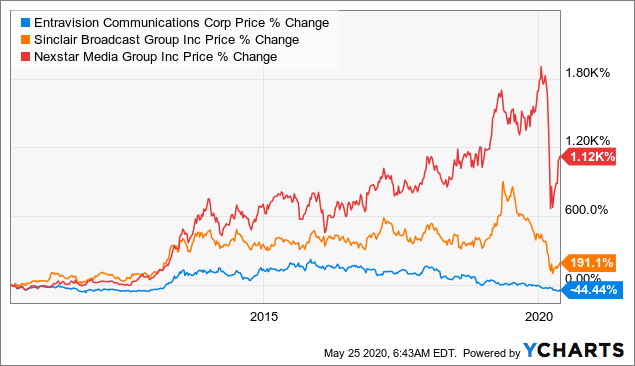

Entravision Communications (EVC) could have been Hispanic broadcasting's version of a Sinclair (SBGI) or Nexstar (NXST). But, the company failed to seize this opportunity. Instead of becoming a station consolidation play like its larger rivals, Entravision stock has gone nowhere in the past ten years.

EVC Logo | Source: Entravision

On the other hand, SBGI and NXST have compounded as they gobbled up stations and maximized profits:

Data by YCharts

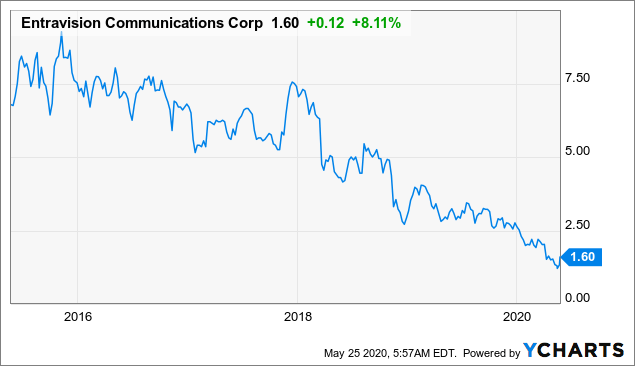

Entravision investors did see some bright spots, such as windfall from broadcast spectrum sales in 2017.

But, after that, shares tumbled, falling from prices above $7.50 per share to around $2.25 per share at the start of 2020.

Data by YCharts

Then came COVID-19. With the pandemic-driven sell-off, shares tumbled to as low as $1.10 per share. Shares have since moved up a bit and trade around $1.60 per share.

Granted, EVC missed the mark in delivering shareholder value in years past. But now, with shares selling at a sharp discount to underlying value, there may be opportunity at today's prices.

Yes, there's plenty of reason to be bearish on EVC. Firstly, the pandemic could decimate cash flow. Even beyond what's going to be an ugly Q2.

Secondly, where's the upside with this stock? As a controlled company, activism is out of the question. Until controlling shareholder Walter Ulloa wants to cash out, we won't see a takeout anytime soon.

On top of that, who would buy Entravision? Univision? Entravision owns/operates many Univision stations. But, given their lingering issues, they're probably not looking to buy more assets.

Other buyers? With most of its stations already duopolies, this wouldn't be a simple bolt-on for another broadcasting company.

So, why do I see EVC stock as a buy? Deep value may exceed high risk. I'm not a big fan of "value is its own catalyst." Yet, today's pricing of EVC stock may make it an asymmetric wager.

This isn't a name worthy of a 10% portfolio allocation. But, as part of a basket of statistically-cheap stocks, it may be a worthwhile opportunity.

Overview

Background

- Founded by 1996 by Walter Ulloa, the company owns/operates largely Univision and Unimas affiliates in major markets like Washington DC, Boston, Tampa, among others.

- Along with its 56 TV stations, the company owns 49 Spanish-language radio stations. Major clusters in Los Angeles, Phoenix, as well as in predominantly-Hispanic Texas metros like El Paso and McAllen.

- On top of the legacy media assets, the company has a substantial digital advertising business built via recent acquisitions.

- The company saw a big windfall from the broadcast spectrum sales in 2017. While debt load remains high, company still has substantial cash cushion from this transaction.

Recent Developments

Per the Q1 earnings call on May 7, COVID-19 could mean materially worse results in the second quarter.

The company concedes "low visibility" for Q2, but noted the TV and Digital units could both see Q2 sales declines above 30%, and the Radio unit could see sales fall about 50% this quarter.

To combat this, the company has tightened its belt, reducing expenses, suspending buybacks, and halving the dividend. But, that may not be enough to counter short-term cash burn.

In short, Q2 isn't going to be pretty. But Texas, where many of EVC's media properties are located, is starting to open up. However, the company's presence in California (which has been slow to reopen) may counter this.

With sudden drops in revenue and high leverage, Entravision stock is by no means a safe value play. It's a high-risk, high-return proposition. But, with underlying assets worth considerably more than today's valuation, upside may trump further downside risk.

Valuing Entravision Stock

Given EVC consists of three discrete business (TV, Radio, Digital), I'll use "sum-of-the-parts" to determine underlying value.

Caveat: like other "coronavirus valuations," this assumes "return to normal" no later than 2021.

Television Assets

Based on the 2019 10-K, the television segment generated $55.2 million in segment operating profit. This metric is before Entravision's corporate expenses (around $28.1 million in 2019).

Add back in about $10 million in depreciation/amortization, and this unit generated around $65 million in EBITDA last year.

Yet, it may not be appropriate to back out EVC's corporate G&A. An acquirer would probably spend less on overhead if they were to buy these stations. But, there's still a cost.

The right number is probably a fraction of $28 million. But, to be conservative, let's use 50%. $14 million in overhead, backed out $65 million, gives us around $51 million in EBITDA for the TV assets.

So, what's an appropriate multiple? I'm cautious to go ahead and use the multiples of Sinclair, Nexstar, et al to assign a valuation. A potential buyer would want an accretive deal.

So, let's use recent multi-station sales comps:

Take, for example, Tegna's (TGNA) 2019 purchase of several stations from Dispatch Broadcast Group. In that deal, the EBITDA multiple was 7.9.

Another major deal from 2019, E.W. Scripps' (SSP) purchase of stations from Nexstar in relation to Nexstar's purchase of Tribune, had a deal multiple of around 9.

Granted, these two deals were for high-profile stations. The Dispatch deal was for major network affiliates. The Scripps deal was for a mix of major affiliates, along with major CW network affiliates like WPIX (New York).

Yet, even assigning a discounted valuation to Entravision's TV stations implies a valuation much higher than Mr. Market currently assigns.

Right now, EVC as-a-whole trades at an EV/EBITDA ratio of 6.3.

But, let's say a strategic buyer comes in and offers to buy the stations for 7x 2019 EBITDA. At 7 times $51 million, that's $357 million. That figure alone exceeds the company's current enterprise value of $270 million.

Radio Assets

At $39 million in sales for 2019, radio is Entravision's second-largest business. But, radio has been a money-loser as of late. Last year, the Radio segment lost $3.5m on a segment operating business. Even adding back in depreciation and amortization, EBITDA was still a negative $1.68 million.

A few years back, Radio was profitable. 2018 segment EBITDA was around $4.6 million. But, it's debatable whether radio revenues could retrace prior levels. Especially post-coronavirus.

So, what's an appropriate value for these stations? And who exactly would come out and buy them?

Putting on rose-colored glasses, let's take the 2018 EBITDA, and apply a fair multiple for radio assets (7x). That gives us $32.2 million.

Yet, that amount may be aggressive. To be conservative, let's cut that in half. $16 million may be spitballing it but maybe a reasonable ballpark for our purposes.

Digital Assets

This segment is more a hedge against the digitalization of media. Made up of recent acquisitions, this segment posted $18.4 million in sales in 2019. But, like radio, lost money on a segment operating basis. Adding back D&A, it's breaking even.

But, valuing the business using EV/Sales, we may get an idea of what this unit could command in today's market. Publicly-traded digital agency stocks like Fluent (FLNT), currently, sports EV/Sales multiples of around 0.64.

Using that comp, this unit could be worth as little as $11.8m.

Yet, that may be a fire sale valuation. Tallying up the acquisition cost of these digital agency assets, Entravision spends many times more building this business.

But, for purposes of our valuation, we'll use this low ball figure.

Putting it All Together

- TV Stations: $357 million

- Radio Stations: $16 million

- Digital: $11.8 million

That's $384.8m in gross value for the company's operating assets. Deducting $215.4 million in short- and long-term debt (per the latest 10-Q) and adding back in around $128.2 million in cash and marketable securities, we get about $297.6 million net value or about $3.54/share

In other words, the company could be worth more than double what it trades for now. However, there's much to keep in mind.

Why EVC's Paper Value May Not Translate Into IRL Dollars

Shares look very cheap at today's prices. Yet, you could've said the same thing when it was trading between $2 and $3 per share!

Like with most deep-value microcap situations, there's a lot to bear in mind.

Between being a controlled company, the coronavirus materially impacting the ad market, and the limited salability of the company's assets, today's sharp discount is perfectly reasonable.

Controlled Company Status May Limit Upside

CEO/Founder Walter Ulloa controls Entravision. The potential for activism is out of the question.

Of course, controlled company status is not unique in the media sphere. Plenty of TV, and especially radio, companies remain in the hands of their founders.

But, with shares trading for a fraction of where they were years ago, what are the chances Ulloa cashes out? Even at a substantial premium to today's prices ($3 to $3.50 per share)?

Deterioration of Business Due to COVID-19

Wall Street may think the pandemic is behind us. But, corporate America is still reeling from the outbreak's effects on operating performance.

As Entravision's earnings call indicated, Q2 is going to be brutal. And while major markets like Texas are opening, what's to say weak sales won't continue through 2020?

A sharp decline in operating performance, even for a few quarters, challenges my back-of-the-envelope valuation.

Shallow Buyer Pool

Entravision's TV, Radio, and Digital assets look like takeover targets on paper. But, realistically, who are likely buyers?

It could make sense for Univision to acquire its largest non-O&O station group. But, as I mentioned above, Univision may not be in a position to do M&A right now.

Most of the company's TV stations are duopolies. That is to say, the company owns and/or operates two stations in a single media market. In some of these markets, EVC owns both stations. In others, they own one station but manage a second station owned by Univision (example: Washington, DC market).

As of now, a station owner can't own more than two stations outright. This means it may be tough for a larger station to buy EVC outright, and integrate the stations into their portfolio.

Sure, there are ways around the FCC's regulations. Perhaps a buyer could do what Sinclair does, use "shared services agreements" and third-party license-holders to make deals work. But, this dependence on loopholes makes a TV station deal less of a slam-dunk "bolt-on" opportunity.

Radio assets may also be tough to sell. Even at my extremely low valuation. Like with TV, EVC largely owns multiple stations in a given market (known as "clusters" in the radio business).

In short, larger competitors probably couldn't buy these assets without triggering market ownership limits.

Digital is another question mark. This business may make Entravision look less tied to "old media." But, it may not be an attractive asset on its own for an outside buyer.

How EVC Stock Could Head Higher

Presence in Battleground States Bodes Well for Political Ad Revenue

With COVID-19 dominating the headlines, it's hard to remember there's a U.S. Presidential election this year. But, while 2020's campaign season seems "dull" compared to that of 2016, expect campaign dollars to flood the airwaves.

On the recent earnings call, Ulloa discussed how the 2020 presidential race could benefit EVC's 2020 ad revenue.

Presumptive Democratic candidate Joe Biden's campaign plans to spend $55 million targeting Latino voters in 5 battleground states. With EVC owning stations in 4 of these 5 states, the 2020 election may help shore up ad sales this year.

Sale of Individual Assets

The company may never be sold outright, But, they could realize underlying value, and reduce debt, via selling individual assets.

Yet, with just a handful of their TV stations not being duopolies, I don't see individual TV station sales on the table. But, given the valuation of the radio assets relative to the TV assets, this may do little to move the needle.

Future Spectrum Sales

Consider this a long-shot catalyst. In 2019, SA contributor Edgar Torres broke down potential future spectrum sales. It's tough to see if and when they can sell additional spectrum. But, news a second auction would likely send shares substantially higher.

I wouldn't buy Entravision on the spectrum play alone. Nevertheless, these long-shot catalysts show there's more value than meets the eye with EVC stock.

Ways EVC Stock Could Head Lower

COVID-19 Continues to Decimate Cash Flow

We may soon see an end to "shelter-in-place." But, what's to say economic maelstrom won't continue through 2020?

Especially for the kinds of local businesses that buy ad time on EVC's stations. If key ad segments like automotive continue to be weak, it may be a while before revenues bounce back to prior levels.

Also, continued depressed sales/cash flow may mean breached debt covenants. Even if the cash cushion minimizes the impact, shares could fall substantially further on the news.

Secular Decline in Legacy Media Assets

As assimilation trends continue, Spanish-language media may see a secular decline long-term.

This is on top of secular decline of legacy media in general. Granted, I'd prefer to buy EVC at its low valuation than pay top dollar for Sinclair or Nexstar shares. But, it's highly likely Entravision's assets will continue to decline in value over time.

Company Fails to Build A Profitable Digital Ad Business

Does EVC have an edge building an ad business targeting America's growing Latino demographic? Or are they an "also-ran," ripe to be muscled out by larger, more focused digital ad companies?

Only time will tell. But, I'm skeptical Entravision can turn its budding digital business into a cash cow as seen with their television assets.

Bottom Line

EVC is no "diamond in the rough." Many challenges continue. If COVID-19 impacts cash flow, there could be issues down the road due to the company's high leverage.

Even post-pandemic, there's plenty of reason why shares could remain "dead money." Or even tumble to lower prices.

As a controlled company, there's no chance of activism. The company's assets may be worth more than what the stock price implies. But, as their flagship legacy media assets erode in value, realizing said value is going to be difficult.

So, why buy Entravision stock? This isn't a name worthy of a "high conviction" position. But, as a high-risk, high-return proposition, shares may be a worthwhile buy for a diversified portfolio of statistically-cheap stocks.

Disclosure: I am/we are long EVC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.