DBB: Reopening Economies Could Lead To More Upside For Base Metals

by Orchid ResearchSummary

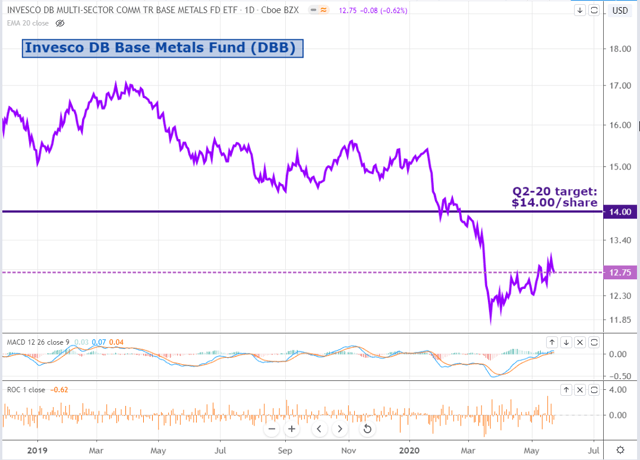

- DBB has recovered rather slowly since it reached its lowest since February 2016 on March 23. In contrast with equities, base metals have not enjoyed a fast rebound.

- Our analysis of the fundamental indicators suggests that fundamental dynamics have improved only slightly in recent weeks.

- For the rebound in DBB to be stronger, fundamental indicators need to improve more tangibly.

- Given the re-opening of most economies in the world, we think that a more noticeable improvement is likely in the coming weeks, which could naturally lead to a firmer rebound in DBB.

- Having said that, we acknowledge that the relations between the US and China remain a big and dark cloud to our constructive near-term outlook.

Thesis

In this regular note, we provide a discussion on fundamental dynamics across the industrial metals, with a special focus on copper, zinc, and aluminium, in order to formulate a clear view on the Invesco DB Base Metals Fund (DBB).

By tracking many real-time micro indicators across the base metals space, we help readers to better assess the real-time changes in refined market balances.

DBB has recovered rather slowly since it reached its lowest since February 2016 on March 23. In contrast with equities, base metals have not enjoyed a fast rebound.

Our analysis of the fundamental indicators suggests that fundamental dynamics have improved only slightly in recent weeks, as evident in the stabilization in physical premiums and the halt of exchange inventory inflow.

For the rebound in DBB to be stronger, fundamental indicators need to improve more tangibly. In other words, exchange inventories need to fall at a stronger pace and physical premiums need to move more connivingly higher.

Given the re-opening of most economies in the world, we think that a more noticeable improvement is likely in the coming weeks, which could naturally lead to a firmer rebound in DBB.

Having said that, we acknowledge that the relations between the US and China remain a big and dark cloud to our constructive near-term outlook.

We set a max target for DBB at $14 per share for Q2-20.

Source: Trading View, Orchid Research

About Invesco DB Base Metals Fund (DBB)

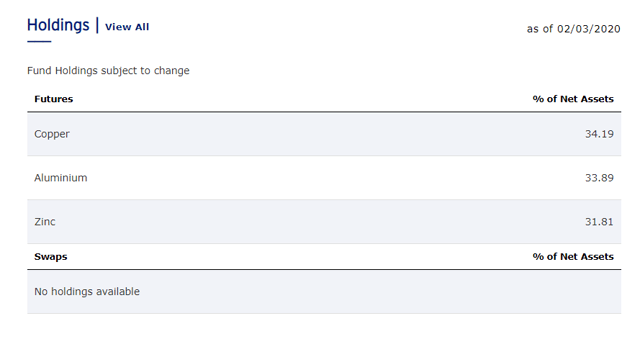

Invesco DB Base Metals Fund allows investors to assert exposure to some of the LME base metals.

The composition of the Fund is as follows:

Source: DBB, Orchid Research

DBB's assets under management total $115 million, with an average daily volume of $1.77 million and average spread (over the past 60 days) of 0.18%.

Its expense ratio is 0.80%, which makes it a relatively cheap ETF to get an exposure to the industrial metals complex.

Price trends

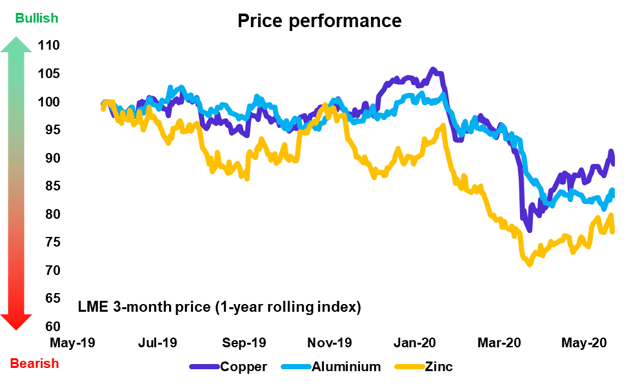

Source: Bloomberg, Orchid Research

All base metals composing DBB are up since the start of May, with zinc the best performer (+3% MTD), followed by copper (+2.5% MTD), and aluminium (+0.5% MTD).

The base metals space performed strongly last week, driven by expectations for more policy stimulus in China ahead of National People’s Congress (NPC) on Friday, May 22.

The NPC did not disappoint in this regard. The Chinese government expects to raise the fiscal deficit to more than 3.6% of GDP, compared with 2.6% last year, and very close to levels seen in the aftermath of the Great Financial Crisis (GFC).

However, base metals came all under pressure on Friday, May 22, after the NPC announced on Thursday night that it would impose national security legislation on Hong Kong. This has elicited growing fears that US-China relations deteriorate even further.

Open interest trends

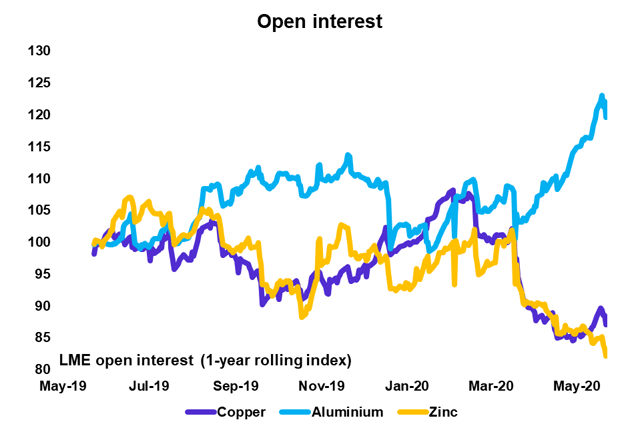

Source: Bloomberg, Orchid Research

Open interest in copper, aluminium, and zinc has fallen over the past week, suggesting that the recent appreciation in prices has been predominantly driven by short-covering.

This suggests a still cautious sentiment among traders. Traders are reluctant to add new longs to the market, probably due to the heightened level of uncertainty in the global economic outlook.

This chart tells us that there is a lot of room for short-covering in the aluminium market because the sell-off in Q1 was largely driven by fresh selling. A positive shift in sentiment could trigger a large wave of short-covering, pushing aluminium prices strongly higher.

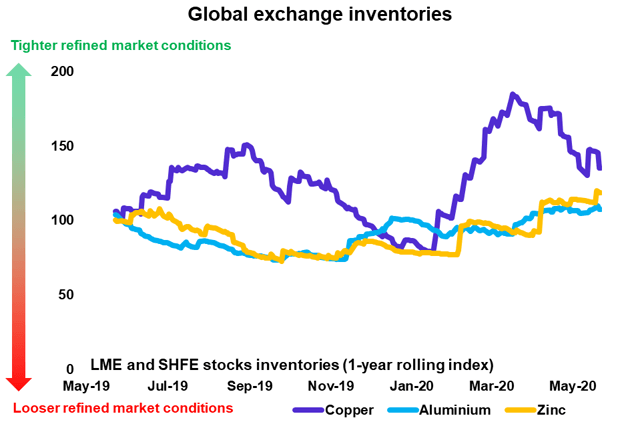

Exchange inventory trends

Source: Bloomberg, Orchid Research

Global exchange inventories are all at a higher level than a year ago, reflecting a relatively weaker fundamental backdrop, which is not surprising considering the global economic downturn.

We are not seeing yet a tangible decline in global visible inventories across copper, aluminium, and zinc. This suggests that even though Chinese demand conditions have likely improved since the start of Q2, the weakness in the world ex-China balances the global market out.

Given our view that demand conditions in the world ex-China should pick up due to the gradual easing of lockdown measures, we think that global inventories should trend lower in the months ahead.

In this case, we could expect a stronger rebound in DBB.

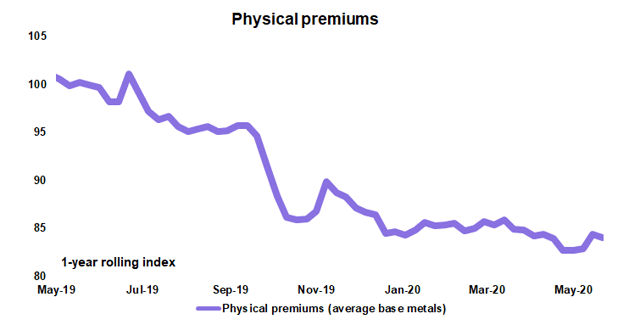

Physical premiums

Source: Bloomberg, Orchid Research

Physical premiums have picked up slightly since the start of May, which could signal improvement on the physical front.

Our discussions with traders suggest that demand conditions have improved in recent weeks, reflecting a recovery in end-user demand. However, it will take time before demand recovers to pre-COVID-19 levels.

This is moderately positive for DBB.

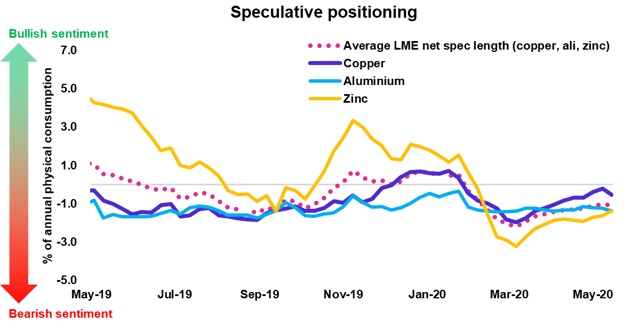

Positioning among the speculative community

Source: Bloomberg, Orchid Research

Spec positionings in LME copper, aluminium, and zinc remain net short, despite the recent improvement since the start of Q2.

Although there is room for speculative buying, the macro environment and the fundamental dynamics need to improve more tangibly to elicit buying activity in the speculative community.

While financial conditions have eased noticeably, there are dark clouds on the horizon, especially the relations between the US and China.

Closing thoughts

We expect a further appreciation in DBB into the quarter-end, driven by an improvement in fundamental indicators due to a pick-up in demand conditions in the world ex-China.

Should exchange inventories fall at a more tangible pace, this could prompt the speculative community to assert more upside exposure to the base metals space.

In turn, an appreciation in base metals prices could lead to some restocking activity, resulting in firmer demand for base metals.

Having said that, we acknowledge that the relations between the US and China remain a big and dark cloud, which could undermine our near-term bullish thesis and therefore, run the party.

We see a max upside of $14 per share for DBB in Q2.

Did you like this?

Please click the "Follow" button at the top of the article to receive notifications.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Our research has not been prepared in accordance with the legal requirements designed to promote the independence of investment research. Therefore, this material cannot be considered as investment research, a research recommendation, nor a personal recommendation or advice, for regulatory purposes.