ECB Facing Testy Stimulus Debate After Call to Scrap Limits

by William Horobin, Piotr Skolimowski, Paul Gordon- French governor says capital key not needed on pandemic buying

- ECB’s vice president says topic hasn’t been discussed

The European Central Bank looks set for another testy debate after one policy maker floated the prospect of removing what many see as an important limit on its powers.

Bank of France Governor Francois Villeroy de Galhau said the capital key, which forces the ECB to buy 19 nations’ government bonds in proportion to the size of their economies, is an “uncalled-for constraint” for its emergency asset purchase program.

ECB Vice President Luis de Guindos seemed to play down the importance of such a move in an interview with Bloomberg Television, highlighting a relaxation of tensions in sovereign bond markets and arguing “we have flexibility in the short term.”

Abolishing the capital key “is something that we have not discussed in the Governing Council,” he said.

Source: Bloomberg)

The topic has arisen little more than a week before a meeting where the Governing Council is seen as increasingly likely to increase the size of its 750 billion-euro ($817 billion) emergency purchase program, the key plank of its pandemic response.

Any move to loosen the constraint could spark resistance from some officials who see it as a key bulwark against the risk of the ECB directly financing governments, which is forbidden by European law.

At the same time it would give the institution more flexibility to allocate purchases where they are most needed without necessarily increasing the total size of the program.

According to Villeroy, it could mean that some national central banks could purchase “significantly more” and others “significantly less.” Due to its size, Germany purchases the biggest proportion of bonds.

“I think this is a quite astonishing comment actually,” said Piet Christiansen, chief strategist at Danske Bank in Copenhagen. “Scrapping the cap key is a major move -- and something I never thought they would do.”

Flexible Purchases

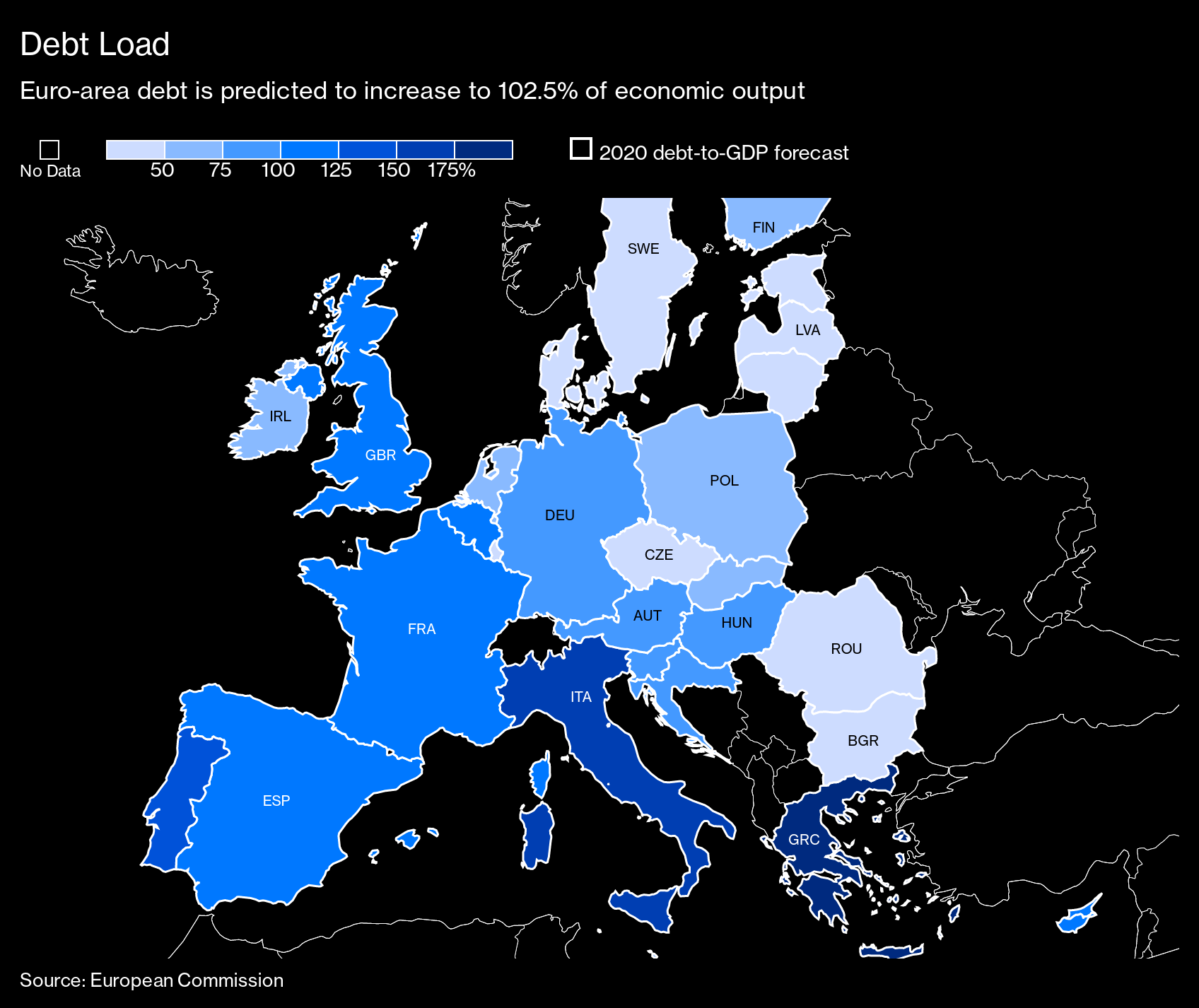

The ECB has already skewed its buying toward Italy, where debt sustainability is a recurring concern, now exacerbated by the recession brought on by the coronavirus. With inflation low, there is room to innovate and act “rapidly and powerfully,” Villeroy told a conference in Paris on Monday.

Chief Economist Philip Lane has argued the flexibility of the emergency program allows the institution to act to ensure its stimulus can reach all corners of the region by preventing an “unwarranted” increase in borrowing costs.

Speaking on Tuesday, he called the capital key “the benchmark” of the pandemic plan. The institution can depart from it if needed to improve the efficiency of monetary policy, according to Lane.

“If the proposal is to change the language on the capital key for the PEPP, then I am assuming that the more hawkish officials won’t support that part of the package,” said Nick Kounis, an economist at ABN Amro in Amsterdam. “However, it may well be pushed through by majority.”

The ECB already removed the one-third limit on purchases from a single country when the pandemic program was launched in March. But going further could reopen divisions within the Governing Council that festered under the previous president, Mario Draghi.

The ECB’s next policy meeting is June 4 and economists are increasingly forecasting that the central bank will use that session -- when it’ll also produce updated economic scenarios -- to add more stimulus.

The account of their meeting last month already showed officials gave up on the idea of a swift economic rebound from the pandemic. Lane said last week that the ECB is monitoring market developments closely and is fully prepared to expand its emergency bond-buying if needed.

What Bloomberg’s Economists Say

“We already know the scale of stimulus is falling short of what is needed. The ECB has significantly downgraded its forecasts for GDP growth in 2020 since the last time an expansion of asset purchases was announced on March 18.”

-David Powell. Read more.

Villeroy signaled he expected the package to be boosted next week. He also indicated that the ECB isn’t about to follow the U.S. Federal Reserve’s Main Street Lending Program by buying bank loans to businesses, though it shouldn’t be excluded for the future.

“It is in the name of our mandate that we will very probably need to go even further,” Villeroy said in a speech delivered by web link to France’s Societe d’Economie Politique. “It is its very flexibility that should make the pandemic emergency purchase program our preferred marginal instrument for dealing with the consequences of the crisis.”

— With assistance by Carolynn Look

(Update with comment by Guindos from third paragraph.)