OPKO Health: A Hero Against The COVID-19 Villain But Has To Control Those Expenses Going Forward

by Chetan WoodunSummary

- The company has been able to rapidly ramp up testing for COVID-19.

- Its revenue figures are down as sales of its other products have been affected by confinement measures.

- There are longer-term balance sheet risks in case the company is not able to increase revenues faster than expenses.

- However, COVID-19 windfall gains, CARES Act funds, the shareholding structure, diversification, and partnership with one of the world's largest drug maker are strong positives.

- Valuations are currently on the low side.

Since the second week of March, BioReference Laboratories, a subsidiary of OPKO Health (OPK), has been running at full speed carrying out PCR tests to detect people who may have been in contact with SARS-CoV-2, the coronavirus causing the COVID-19 pandemic. This is crucial in limiting the spread of infection. Additionally, as of April 27, 2020, OPKO Health started offering COVID-19 antibody testing.

It is easy for investors to be influenced by the positive news, but it is also important to look at the financial side too as COVID-19 has not been just a boon for OPKO Health as some may be tempted to think.

Also, OPKO Health is not only about diagnostic but has a pharmaceutical segment that includes commercial drugs, some developed with Pfizer (PFE).

In this thesis, I first look at the company's product revenues, customer base, and expenses. I also analyze the finances and provide a valuation through comparison with competitors, not forgetting a profound look at the challenges.

Revenue figures

Revenues have fallen in the quarter ending March 2020 as expected because of COVID-19 with the associated social distancing and stay-at-home orders resulting in significant reductions in physician office visits and medical procedures. However, these could have fallen more steeply had COVID-19 stroke earlier on.

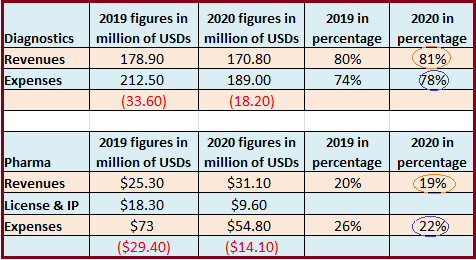

Figure 1: OPKO Health first quarter 2020 vs. 2019 results

Source: Tables compiled from data obtained from Q1-2020 Earnings

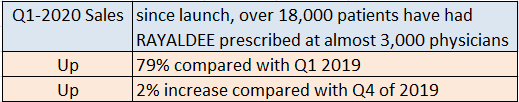

Also, the revenues from the pharma segment, while still low (at 20%) compared to diagnostic has potential to increase considerably as soon as lockdown measures are lifted. The revenues from this product segment have actually increased as opposed to the diagnostic segment and it includes a key drug Rayaldee. The latter is seeing considerable success.

What I like about pharma is that it is synonymous with higher profit margins which means relatively fewer expenses required to generate sales figures. The numbers are here to prove this: while revenues from the pharma segment have risen from $25 million to $31 million, the expenses have actually fallen (26 to 22%).

Rayaldee is used for adults with stage 4 chronic kidney disease and vitamin D insufficiency. Moreover, the advantage of Rayaldee over the leading therapies, as per the management, is that it does not have the usual safety concerns. There is also the possibility of a European approval for Rayaldee and first commercial launch later this year.

Figure 2: Rayaldee sales

Source: Table compiled from Earnings Transcript

In addition, the company is considering extending the indication of Rayaldee for stage 5, which is an advanced stage of kidney disease.

Now, after lockdown, will customers have the capacity to pay? To answer this question, I look at the company's customer base.

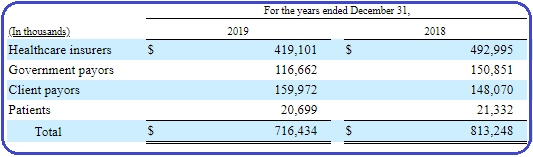

Figure 3: The composition of revenue from services

Source: SEC filings

With less than 25% of payment coming from individual clients including patients, the company has less exposure to economic downturn impacting people directly.

Moreover, getting insurance (Medicare) coverage for its products is essential for a medical company. In this respect, OPKO Health has been able to secure Medicare reimbursement for customers going for 4Kscore tests (also called routine tests). 4Kscore is a test that assesses a patient's risk for aggressive prostate cancer.

Nearly 16,000 tests were performed during the first quarter of 2020 but less tests have been performed due to confinement. Therefore, the company has some key products addressing critical medical needs and sales should pickup after confinement.

Now, I check the less rosy part of the income statement.

Relatively high expense level

The problem for OPKO Health is that COVID-19 stopped it short on its heels as the company was expanding its sales force to aggressively promote its Rayaldee drug and 4Kscore test. Moreover, the company seems not to have been able to get a control of costs.

Now, revenues being negatively impacted is something investors can understand as a force majeure but the ability to manage costs, especially in a time of economic downturn also has its significance.

There has indeed been costs reduction from $212.5 million to $189.0 million for SG&D this quarter but these appear too timid when compared to the revenue shortfall. Also, the research and development expenses have been lowered but are attributed more to the pediatric phase 3 study for Somatrogon being completed, not some process optimization.

Moreover, the company has 6,000 employees for an enterprise value of only $2 billion. This gives an enterprise value per employee metric of $0.34 million (figure 5), which is the lowest when compared to the competition. While I do not have a problem with the number of employees itself, I firmly believe that the enterprise value per employee should be more or in other words, there should be more productivity.

To address the high expenses, the company has outlined a cost-reduction initiative in its annual report for the year ending Dec 31, 2019. According to the management, some progress has been made in terms of "efficiency gains" at its testing labs.

These efficiency gains may have helped OPKO Health beef up capacity for COVID-19 PCR testing to the astronomical figure of 700,000 in such a short period of time.

Taking into consideration the company's expansion from COVID-19 PCR testing to antibodies testing, I anticipate that the associated revenues should compensate for revenue shortfall resulting from a decline in routine tests (4kscore) in Q2-2020 revenues for the diagnostic segment.

As for the pharma segment, the sales team are having problem increasing sales, despite working online as doctors are not actively seeing patients. Things should improve after lockdown as doctors resume routine treatment.

Because of this uncertainty as to revenues from the pharma segment, I go deeper into the financial position to assess OPKO Health's capacity to pay debts.

Balance sheet and Cash

OPKO Health had liabilities of $245.1 million due within a year as of March 31, 2020. Now, total receivables were $146.7 million and cash was $34.5 million. In addition, the Company has a non-utilized amount of $100 million credit facility. Therefore, the company has adequate liquidity and there is no fear of any further share dilution this year.

Moreover, in April 2020, OPKO Health also availed additional capital under the CARES Act which provided the company with approximately $30 million of short-term liquidity. This amount included a grant of $6 million.

However, the company had liabilities of $438.8 million falling due after one year as of March 31. Hence, longer-term investors may have doubts as to its solvency. I address these doubts by analyzing the challenges.

Challenges and mitigation

First, this is a company with a negative operating income and there are questions as to the balance sheet after one year. Moreover, its revenue has dropped and expenses have increased. It would have been easy for me to draw conclusions. However, this would be against the very strategy of value investing.

Therefore, I look under the hood. For a company involved in large volume COVID-19 testing, there may be factors that are likely to mitigate longer term financial risks.

First, in an environment with the COVID-19 virus unleashed and with no date as to the availability of the vaccine, the only proven in the fight against this deadly disease is testing, testing, and more testing. Now, OPKO Health has become a star against the COVID-19 villain especially in the New York area where it is providing tests to residents and state employees.

Its laboratories are not only carrying out tests but have also benefited financially from the CARES Act and should benefit more as an essential medical services provider.

Secondly, there is intellectual property. As a drug developer, the company has acquired (some of these through M&A activities) significant knowledge capital and it has already started to benefit as a result, through its commercial partnership with Pfizer (NYSE:PFE) for the Rayaldee drug generating as much as $66 million in 2019.

More is to come with the development of Somatrogon for the treatment of GHD (Growth Hormone Deficiency). In fact, there has been a delay in presenting the clinical stage 3 results to the Endocrine Society due to confinement measures, but the company has already signed a commercialization agreement with Pfizer for this one too.

To give investors an idea of the value, just the deal OPKO signed with Pfizer in December 2014 for GHD was worth $570 million. Moreover, those commercial partnerships with Pfizer act as an element of risk reduction especially in case the company faces severe liquidity shortage and has to borrow money urgently.

Finally, there is the ownership. OPKO Health has an institutional ownership of about 25.37%. This list includes some reputable investors. Also, the presence of management, through the CEO, Dr. Frost in the capital is also reassuring, as this is an instance of "skin in the game" or being involved in achieving the goal.

There have been some "debates" concerning Dr. Frost but he has been at the helm of OPKO Health since 2007 and is a successful biotech investor. The reason for this is that he has been able to make some judicious acquisitions and displayed ability for unlocking value.

Therefore, there are challenges, but the company not only has solutions that mitigate the impact of the coronavirus (through testing) but is also getting financial help from the government through the CARES Act. Also, it has a CEO who is fully committed to the company. In fact, OPKO Health is already benefiting as a result of COVID-19 and should benefit more going forward because of that element of goodwill created as a test center for COVID-19.

Moreover, this is a stock which is far from its 2015's highs and this downside must have been painful for investors holding the stock. This is one strong reason to be prudent and avoid over-optimism as to the pricing. In summary, it is important to get it right on the valuations for those willing to position themselves.

Valuations

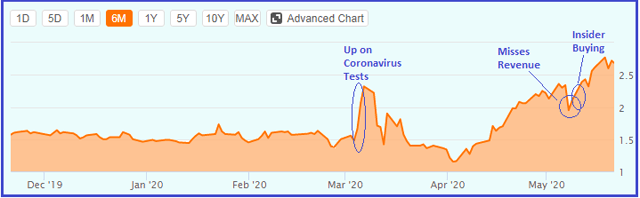

First, the upside (extended spike) which resulted from positive COVID-19-related testing had already subsided by April and the company's stock was in a steady progression till that revenue miss. The downside was somewhat dampened by some aggressive investor buying immediately afterward. However, the net uptrend indicates real investor's interest in the stock.

Figure 4: Stock price evolution

Source: Marbetbeat for Insider Trading

Now, in order to have an idea of the valuation, I compare the stock with competitors in the healthcare sector.

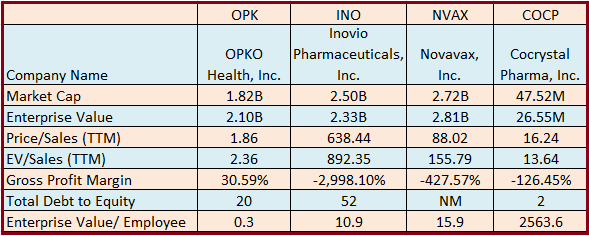

Figure 5: Comparing OPKO Health with competitors Inovio Pharma (INO), Novavax (NVAX) and Cocrystal Pharma (COCP)

Source: Seeking Alpha

All these companies are either at phase 1, phase 2, or phase 3 clinical trials except for OPKO Health, which is at phase 4 (commercial stage) and considering a phase 5 for Rayaldee. In addition, with Somatrogon, it has completed a phase 3 pediatric trial.

Second, since earnings are currently on the negative side, a comparison of P/E makes no sense and hence I use the EV/Sales metric. The latter, instead of the Price/Sales metric, also takes into consideration the debt and cash position.

Based on EV/Sales, the company is undervalued by a factor of 4 when compared to Cocrystal Pharma. Recent insiders buying may also be an indication that the stock is currently undervalued at these levels.

After additional research and taking into consideration the need for cost-reduction initiatives to continue, I come with a conservative target price range of $3.5 to $4.

I expect some volatility in the stock price going into June 8 when there will be a presentation for Somatrogon at the ENDO Online 2020, a virtual meeting for endocrine researchers and clinicians.

Key takeaways

Investing in a pharma involves risks, hoping that after a long and complex process, the company will market a product that will bring in millions. However, OPKO Health is already past this stage and has already started commercialization of its products.

In addition, OPKO Health is also a diversified company and also includes a stable income-generating diagnostic segment.

COVID-19 has created headwinds that have stopped the company's sales team in their tracks selling novelty drugs and lab tests but, in response, OPKO Health has been able to deliver COVID-19 tests, which has propelled it in the exclusive league of national commercial laboratories fighting COVID-19.

Also, the CARES Act funding even if financially not significant at this stage is just the beginning, and the company has drugs in its portfolio and a partnership with Pfizer.

Finally, OPKO Health has idle growth engines idle in the garage, ready to fire as soon as confinement ends, and these will be crucial in bringing in the much-needed revenue for the longer term.

I will be just watching from the sidelines for continuation in the cost-reduction initiative after the COVID-19 testing episode.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in OPK over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing.