Autoliv: Aftermarket Sales Exposure Could Recover Quickly

by Mare Evidence LabSummary

- Automotive is a rough industry in the COVID-19 environment due to its cyclical nature and ability for customers to defer auto purchases.

- However, aftermarket sales might do fine, if autos will be used even if not newly purchased with people avoiding public transport and air travel.

- Autoliv is an interesting play in this market, with the majority of its product turnover related to car crashes.

- Use of cars and persistent crashing might be enough to help Autoliv sales make a sharp recovery ahead of the rest of automotive.

- However, this thesis still relies on cars crashing at similar rates as before, which may not be a tenable assumption, therefore making this exposure speculative.

Autoliv (NYSE:ALV) is an automotive play we think might be interesting. The plurality of its revenues come from Asia, where the dramatic consequences of a lockdown environment are increasingly in the rear-view mirror. Moreover, its revenues come primarily from the aftermarket in airbags, a product that sees turnover due to factors that should not be impacted too much by the behavioural changes spurred by COVID-19. We think that, based on historical precedent, and with greater car travel to commence as people shy away from public transport and air travel, airbag sales should make a V-shaped recovery together with Autoliv's stock price if crashes still occur at similar rates to before. Because of a recovery that we speculate could be ahead of the rest of automotive, we think Autoliv is an attractive exposure.

Aftermarket Products

More than a third of Autoliv's revenue comes from airbags, which need to be replaced every time a vehicle gets into a car crash. In seatbelts, pretensioners, which account for around 20% of Autoliv products sold, also need to be replaced every time a car crash occurs. Moreover, when a car crash is sufficiently severe, the car is totaled, and all the parts will see turnover as the car is replaced. As people see more need for light vehicles, these products should see resilient end-markets, as they are mandated for the vehicle to be operated safely, and there shouldn't be any clear reason for car crashes to be reduced in frequency (if not increased) as people employ light vehicles as the main mode of travel this summer.

Unlike cars themselves, Autoliv's products cannot be deferred in purchase, and in previous economic crises, we saw these effects in action as sales related to aftermarket products recovered rapidly to pre-crisis levels.

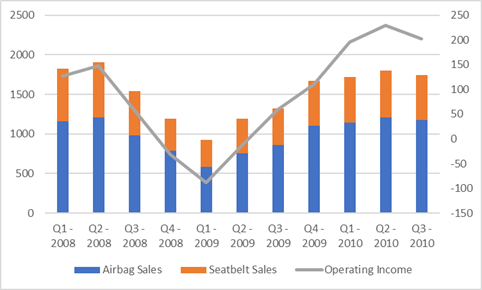

(Source: ALV 10-Qs 2008-2010)

As seen in the 2008-2009 crisis, where Autoliv's sales were highly concentrated in the geographically affected areas of Europe and the US, the trend in income and sales was V-shaped, with sales in seatbelts recovering most but not all of their pre-crisis highs, while airbags, capable of relying on crash turnover, managed to recover all that it had lost at the crisis lows.

| Q1 - 2008 | Q2 - 2008 | Q3 - 2008 | Q4 - 2008 | Q1 - 2009 | Q2 - 2009 | Q3 - 2009 | Q4 -2009 | Q1 - 2010 | Q2 - 2010 | Q3 - 2010 | |

| Airbag Sales | 1159.4 | 1207.4 | 979.1 | 784.1 | 586.5 | 755.1 | 858 | 1099.4 | 1146 | 1206.5 | 1173.4 |

| Seat-belt Sales | 668.3 | 700.3 | 565.6 | 408.8 | 340.2 | 439.3 | 467.9 | 574.6 | 574.8 | 595 | 567.5 |

| Operating Income | 127.3 | 148.2 | 58.3 | -31.8 | -88.7 | -12.5 | 60 | 110.2 | 195.4 | 229.1 | 202.1 |

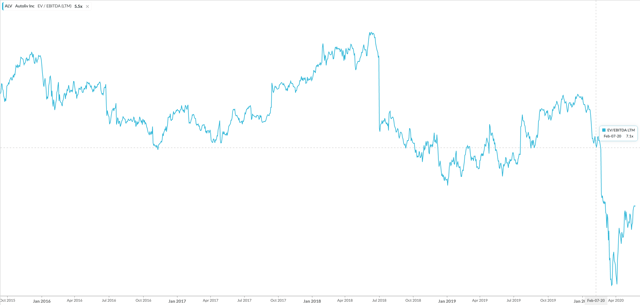

(Source: Mare E-Lab Research Database)

Financial Consequences

If we assume a similar trajectory of recovery for this crisis, with something like 6 quarters of a V-shaped recovery with a maximum drawdown of around $200 million on a 21% cash tax rate, this amounts to about $474 million of lost NOPAT compared to normalised levels.

(Source: koyfin.com)

If we assume the recovery as we have, only a little below 33% of the drop in stock price can be justified by current economics (33% of the 25% discount). Indeed, the terminal value of the business should remain intact. Therefore, this $1.5 billion drop in EV is likely the consequence of lessened risk appetite, which, although a valid reason for prices to move, is not a reason for investor price targets to move, as it relates to erroneous adjustments of equity risk-premiums under COVID-19. With financial stress on the business rather minimal due to excellent access to capital markets proven by a $1.5 billion liquidity situation as of today, we think that most of the discount is a result of the spurious use of financial modelling. A re-appreciation of 20% to justifiable levels seems possible on the speculative condition that auto use at least normalises.

Risks and Concluding Remarks

This investment relies on some speculative factors, as we need to presume a sustained return to car use post lockdown. With greater remote working, despite less public transport use, this normalisation is subject to opposed vectors with ambiguous outcomes. The biggest risk to this thesis is that most car crashes occur during rush hour, which could become substantially less hectic depending on the degree of remote working going on in metropolitan areas. Indeed, the divergent levels of unemployment from 2008 to now also confound comparability to an unknown degree, as unemployment likely impacts mobility.

Nonetheless, within automotive an aftermarket exposure makes more sense than directly investing in auto, which, although more optimistic in the medium term, is not at all resilient for the moment. Moreover, Autoliv management is already managing the current dramatic downturn well with substantial cost and CAPEX reductions achieving impressive income and cash preservation. Given the potential upside on the position, we think that it could be attractive for risk-tolerant investors.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.