Lundin: Superb Asset Base Means A Tenable Dividend

by Mare Evidence LabSummary

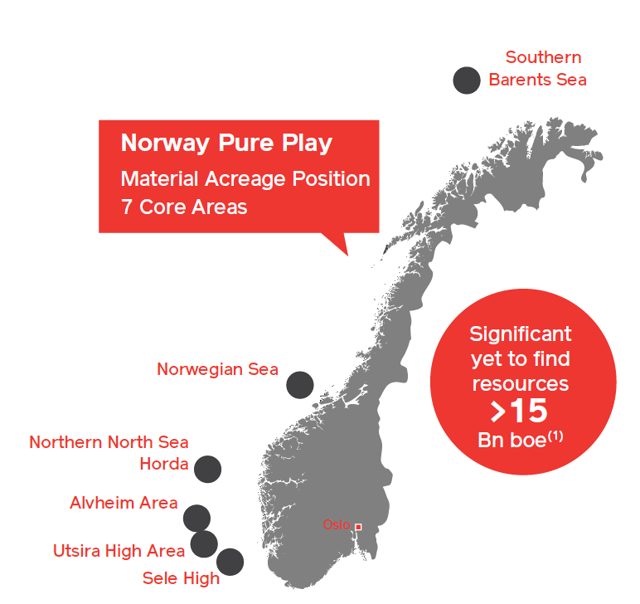

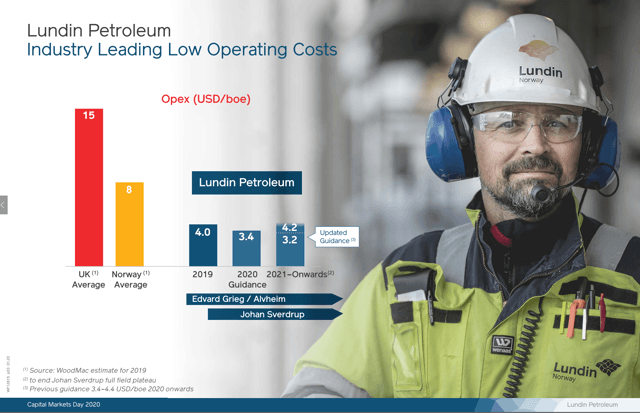

- Lundin has an excellent asset base with stakes in massive Norwegian oil fields, sporting some of the lowest operating costs, and thresholds for cash flow neutrality in the industry.

- Assets are going to be able to generate ample cash flow for a while due to ample reserves.

- The highly invested Lundin family shareholder base also means that dividend continues to be a remuneration priority.

- For investors even only somewhat confident in the oil rebound, Lundin makes a lot of sense if looking for an income proposition.

With the oil crash revealing the weakness of high breakeven price businesses with the near collapse of shale oil production, the key question for investors in upstream oil is which companies can sustain a commodity downturn, whether politically spurred or otherwise. With compressed prices in oil stocks still allowing for strong dividend yields in the sector, we searched and, eventually, found a potentially interesting Swedish company focused almost entirely on the Norwegian Continental Shelf (NCS) called Lundin Energy (OTCPK:LNDNF). Although small, we think that it is a robust company that investors might consider in as an oil & gas exposure due to dividend support from a low-cost asset base and strong shareholder support due to substantial Lundin family ownership. We think that there is a margin of safety for Lundin's payout, and in many of the potential outcomes in the oil sector, the income proposition looks strong.

(Source: CMD Jan 2020)

Strong Asset Base and Still Ample Dividend

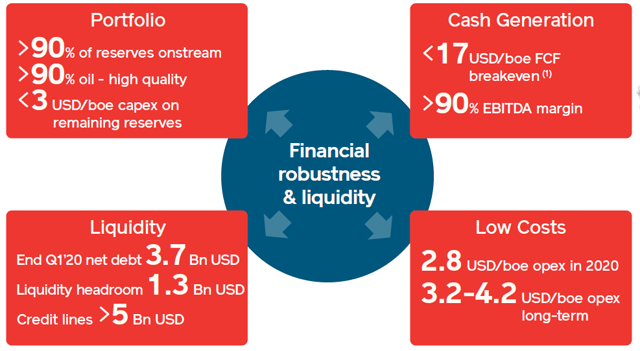

Our analysis started with a breakeven price screen, and we are pretty confident, despite the small market cap, this company is very well positioned to navigate this extraordinarily challenging times. For cash flow neutrality and, therefore, for deleveraging to be the main mode of equity growth, only a $17 per barrel price is necessary. This exceptionally low threshold for cash flow neutrality is made possible by the quality NCS asset base, which sports very low operating costs on a per barrel basis.

(Source: CMD Jan 2020)

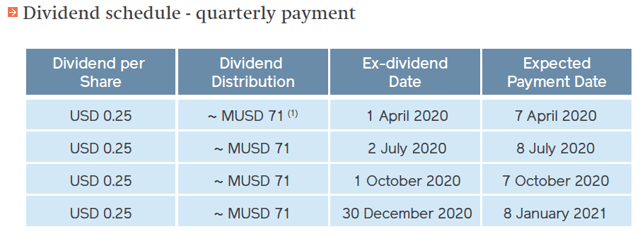

Although Lundin has a low BEP and is in good health with a rather robust balance sheet, the Company has made the decision to amend its dividend proposal. This has been done in order to maintain financial robustness and provide further liquidity flexibility in this challenging market. During the AGM, the Board decided to scale down a proposed dividend from $1.8 to $1 per share with quarterly payment of $0.25. Despite the cut, they are still offering a solid 5.02% dividend yield.

(Source: Operations & Financial Update Q1 2020)

Some Considerations on Oil

The oil situation improved markedly in the past months, first with some supply cuts being agreed to by critical OPEC+ nations, and now with lockdowns easing and industry tentatively resuming. For now, the main driver of oil will be the state of industry and mobility, the chief drags on oil price in March and April. Of course, air travel will not make a sharp rebound and will be a highly depressed oil end-market. However, due to the relative fuel inefficiency of light-vehicle based travel, overall mobility does not have to recover entirely for those end-markets to recover. Essentially, we have to see where the equilibrium sets in this new environment. The IEA's latest oil demand growth forecast for 2020 is expected to contract for the first time since the global recession of 2009, but lending itself to the Lundin thesis, it is expected to sharply rebound in 2021 to over +2 million barrels per day.

Risks and Concluding Remarks

Although one cannot be certain what oil demand will look like in the near term, and indeed things could go bad in both the political arena and on the demand side with potential second-wave lockdowns, we are comfortable with an income proposition like Lundin's. With a substantial margin now between the Brent at $33 and Lundin's BEP for cash flow neutrality at $17, they are not in dire straits.

Moreover, with Leverage ratios going into this crisis only a little bit above 2x Net Debt/EBITDA, the liquidity situation and balance sheet are in a reasonable state, fully financed for the next 12-24 months even with upcoming financing commitments. With reserves that will last Lundin more than 10 years, they also have time to continue to execute on exploration projects, which recently they've struggled with.

(Source: Operations & Financial Update Q1 2020)

Finally, with high ownership of the Lundin family, we can expect that the remuneration policies and orientation around real shareholder gains will remain a priority, as seen with the recent dividend cut still leaving yields at attractive levels. As such, for income-oriented investors, Lundin appears to be a solid option.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.