Filling Up At Ultrapar To Get Exposure To Energy Sector

by James CherrySummary

- Over the past ten years, Ultragaz has maintained its market share and its number one position in the Brazilian market.

- Ipiranga, Ultrapar's subsidiary, is the second-largest fuel distributor in Brazil, with a 19.3% market share in 2019.

- Ultrapar has five subsidiaries that are the top in their respective sector.

Since 2011, I have only used gasoline from Ipiranga (a subsidiary of Ultrapar (UGP)) and occasional from Shell. I moved to Brazil in 2009, and between 2009 and 2011, I had a couple of bad experiences (poor quality gas) with certain service station brands. And once I discovered that Ipiranga had a loyalty program, I began to use them almost exclusively. In 2017, the company launched its cellphone app "Abastece Ai," which translates to fill'er up there. This app made it easier for their clients to use the loyalty program points on products at their service stations and made it easier for the clients to pay.

Disclaimer, I do not believe that my consumer habits are equal to the consumer habits of most Brazilians, nor will I imply this throughout my analysis.

This article has two parts, and the first section is essential for those who do not know much about UGP and its operations. If I were to describe their operations as short as possible, I would say that their operations are focused on adding value to the oil and gas industry. The second part is to provide the reader with my estimates of the second quarter and its fundamentals.

Ultrapar Participações Principal Operations

Ultragaz is UGP's distribution arm of bottled and bulk LPG. Ultragaz has been the Brazilian market leader (24% market share on that date) in LGP since it acquired Royal Dutch Shell's (NYSE:RDS.A) (NYSE:RDS.B) Brazilian LPG operations in 2003.

In 2011, Ultragaz acquired Repsol's (OTCQX:REPYF) LPG Brazilian Distribution business. Before this acquisition, 2010 to be exact, Ultragaz had 23.14% of the LPG market share, and Repsol had 0.29%. The company's 2011 total market share after the acquisition of Repsol was 23.46%.

According to Sindigas, in 2019, Ultragaz had 23.38% of the total LPG market share. Until March of this year, Ultragaz's current market share is 23.67%.

Top five LPG distributors by market share in 2019 and 2020 (until March):

- Ultragaz - 23.38% and 23.67%

- Liquigas (Petrobras (PBR)) - 21.14% and 21.15%

- Supergasbras - 19.97% and 19.96%

- Nacional Gas - 18.92% and 18.09%

- Copagaz - 8.72% and 8.88%

Over the past ten years, Ultragaz has maintained its market share and its number one position in the market. This year, it seems that Ultragaz is gaining a little extra market share (0.29%), which should translate into an increase in sales volume.

The source for the above information is Sindigas, the statistics are based upon sales volume, and it is only in Portuguese.

The company's current strategy for Ultragaz is to increase its share in bulk distribution by focusing its marketing strategy on small and medium businesses. They want to expand their presence in the North and Northeast of Brazil. They also want to take advantage of Ipiranga's network and use it to expand their sales volume.

Oxiteno is UGP's petrochemical division, and it was created in 1970, making it one of the first players in the petrochemical industry. It expanded its operations internationally in 2003 with the acquisition of Canamex (Mexican specialty chemicals company).

The company's operations are located in Brazil, Mexico, Uruguay, USA, and Venezuela. They have commercial offices in Argentina, Belgium, China, and Colombia. The chemicals that they produce have end uses that range from soft drink bottles to home cleaning supplies to paint products to vehicle parts. According to their 2017 Annual Report, Oxiteno had approximately 70% of the specialty chemical market share.

Oxiteno's strategy is to increase market share through innovation. It also wants to protect its leadership in Latin America and to improve its international sales through expansion in the United States.

Ultracargo was founded in the '60s with the purpose of safe transportation of chemicals, petrochemicals, and LPG in Brazil. Later, Ultracargo acquired Tequimar, which facilitated its growth in becoming Brazil's largest liquid bulk storage provider.

Ultracargo has acquired many targets throughout the years, which allowed them to increase their footprint in Brazil. The result of these acquisitions and its construction projects, they now have storage terminals in the ports of Aratu, Santos, Rio de Janeiro, Paranagua, Suape, and Itaqui.

They hope to leverage their presence in the main ports of Brazil and expand into new locations. I would like to point out that two of their ports have access to the railroad system.

Ipiranga is my favorite subsidiary of this company because I believe it and Extrafarma (the pharmacy segment of the company) are the segments that can offer them the most growth over the next five years.

Ipiranga is the second-largest fuel distributor in Brazil, with a 19.3% market share in 2019. It has a network of 7,090 services stations as of the end of 2019. Besides the services stations, it has 2,377 am/pm convenience stores and 1,492 Jet Oil franchises. In 2019, Ipiranga sold 23.5 million cubic meters of fuel.

| DISTRIBUTOR | 2019 | 2018 | 2017 |

| BR DISTRIBUIDORA | 24.8% | 26.3% | 26.8% |

| IPIRANGA | 19.3% | 20.2% | 20.3% |

| RAIZEN | 21.0% | 20.6% | 20.6% |

| OTHERS | 34.9% | 32.9% | 32.3% |

Source: Company's 2019 Annual Report

The conversion of unbranded service stations (service stations without affiliations) to Ipiranga resellers is the company's primary strategy to grow its operation. According to my research, more than 80% of 34.9% labeled "OTHERS" are unaffiliated service stations. Ipiranga is adding value to their stations by adding convenience stores (am/pm), oil change stations (Jet Oil), and ConectCar (automated payment systems for toll booths).

Petrobras controls BR Distribuidora, which is Ipiranga's most significant competitor. BR has over 7,703 service stations in Brazil. In 2015, BR Distribuidora had a 31.3% market share and now they have only 24.8%. In my opinion, this loss in market share was a result of negative press caused by the Operation Carwash investigation in Brazil. In 2015, Ipiranga had a 21.6% market share, and now it has 19.3%, a loss of almost 2% while BR Distribuidora lost nearly 7%.

Extrafarma is the only subsidiary of the company that, at first glance, might seem like it does not have any synergies with the rest of the organization. Brazilian law prevents any organization but a pharmacy from selling medicine of any type. Yes, you cannot go into a convenience store and by over the counter medication. Extrafarma is one of the top pharmacy chains in North and Northeast Brazil.

The strategic plan for Extrafarma is to grow its amount of locations by being close to Ipiranga's service stations and Ultragaz's resellers. By doing so, they will be able to give their service station customers more convenience by being able to provide medicine.

Forecasts For Ultrapar's Subsidiaries

Ipiranga

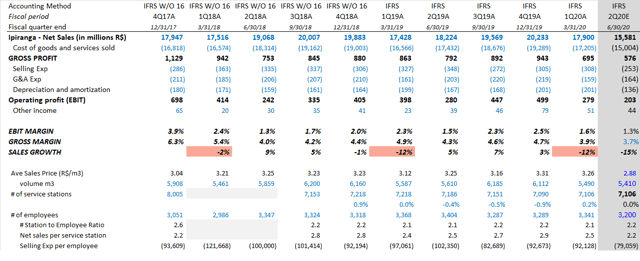

Source: Company's Financials and own estimates

Ipiranga's 1Q20 net sales were higher than I had estimated. Ipiranga's first quarter of the year typically suffers from seasonality, and in 1Q19, the sales dropped by 12% q-o-q. Imagine my surprise when this year's first quarter also dropped by 12% q-o-q even though this quarter's oil price volatility was high and demand for gas dropped in the last half of March. With this information, we can assume that before the stay-at-home order, Ipiranga's sales were up compared to the same period the previous year. Net sales per store increased by 0.1 million, meaning that the increase in sales was not total the result of the 2% increase in stores. My estimates for 2Q20 are that q-o-q net sales will decrease by 15%, mainly due to a decrease in the average unit price by 12% and a decrease in volume by 1.5%.

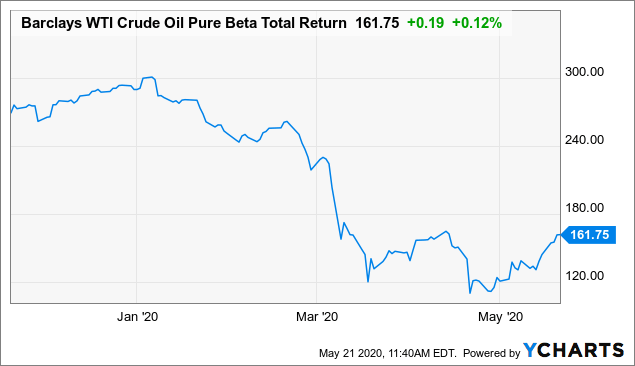

There are two statements from UGP's 1Q20 results that help to estimate their gross margin. Increase in sales by "+3% due mainly to the increase in average unit costs and increase in COGS by +4%, mainly due to the increase in Ipiranga's average unit cost." The report goes on to say that the increase in unit costs was due to the depreciation of the Brazilian real. The point being is that I estimate that during periods of high volatility in the real or petroleum, Ipiranga can only pass about 75% of the change in unit price to its customers. According to this Brazilian website, diesel and gasoline prices dropped rapidly in April, but volatility has since decreased though prices are low. In my opinion, the 2Q20 gross margin will be 3.7%, which is 20 basis points lower than their worst gross margin over the past two years. The decrease in gross margin is a result of the extremely volatile falling oil prices, as seen in the chart below.

Data by YCharts

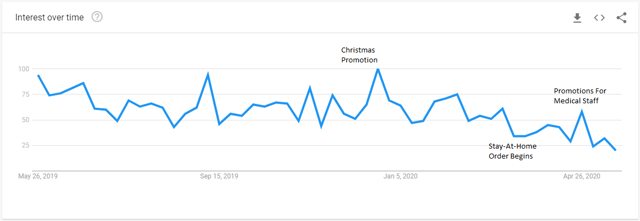

This semester will probably be Ipiranga's worse semester in years due to the coronavirus. My preliminary research has led me to believe that the company should be able to recoup its losses in the second semester for two reasons. UGP has been conducting strong marketing campaigns throughout the year. As seen in the graph below, Brazilians increased their search for Ipiranga's app. The Abastece Ai app provides consumers with quick access to their loyalty points, and these points give discounts between three to five reais per 100 reais spent on fuel. The discount should be enough for the consumer to provide preference to Ipiranga, which should attract other non-affiliated stations (over 30% of Brazil's gas stations) to become affiliated with Ipiranga.

The Abastece Ai app continues to grow exponentially and reached more than R$ 4.0 billion annualized payment transactions, while the Km de Vantagens, Brazil's leading loyalty program, continues to add new users and surpassed the mark of 32 million participants.

Source: Google Trends

I believe that once the stay-at-home order is lifted in Brazil, Brazilians will be less likely to use crowded public transportation and air travel in the short term. The preference to use less public transportation should increase the demand for automotive fuels, just like what is happening in China, according to this Financial Times article.

Oxiteno

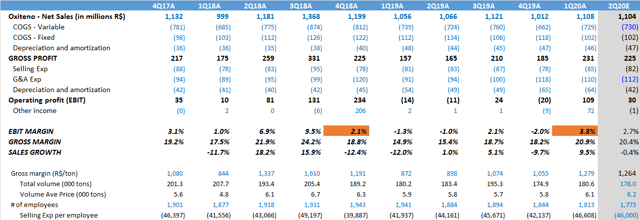

Source: Company's Financials and own estimates

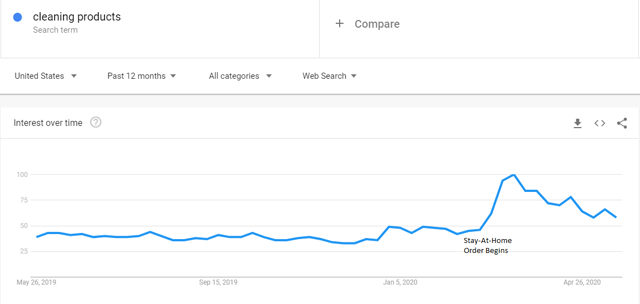

I estimate that Oxiteno's net sales for 2Q20 will decrease by 0.4% q-o-q. I believe that the company's volume will reduce by 1.4% as the Asian market's demand will continue to be as low as it was during the 1Q20. Domestic demand should be able to prevent too large of a drop in volume as consumers are taking advantage of their free time to clean more.

Source: Google Trends

The unit price should decrease by about 2.2% principally due to the appreciation of the Brazilian real during the period.

Although the first wave of rapid ethylene production capacity expansions is coming to a close, supply is likely to lengthen during Q2. Cracker operators, seeking return on their new investments, will be reluctant to reduce rates even in light of muted global demand.

Variable COGS for Oxiteno should remain stable according to the Independent Commodity Intelligence Services above comment. The company's fixed COGS should remain close to the same as their 1Q20.

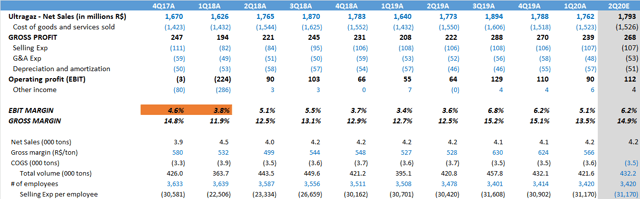

Ultragaz

Source: Company's Financials and own estimates

During my per subsidiary analysis, I discovered that Ultragaz's market share had increased by 0.29% this year (until March 2020). Taking into consideration a slight increase in market share and the average volume sold during the second quarter of the past couple of years, I estimate that Ultragaz will sell 432.2 tons ('000) in 2Q20. The average price of LGP during April was R$69.89 for a 13kg bottle, and the average in the first quarter was R$69.86. In May and June, the average price tends to decrease, so I adjusted my average price for the second quarter to R$69.39, or a 0.7% decrease. Estimates for Ultragaz's net sales for 2Q20 is 1,793 or a q-o-q increase of 1.8%.

I believe that the gross margin for 2Q20 will be 14.9%, as costs to produce or import LPG in Brazil has decreased considerably. SG&A for the company should remain around the same as the first quarter as the company focuses on meeting the demand for its products.

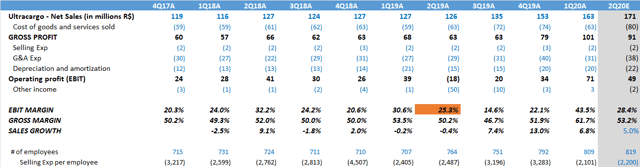

Ultracargo

Forecasting Ultracargo's net sales require a crystal ball, which I do not have. The company's net sales only show a slight variation each quarter when I remove the effects of changes in its capacity due to non-sales issues. Examples of non-sales problems are when the government closes down one of their facilities, a closed facility reopens, or the company purchases a new storage facility. To account for this risk, I will adjust the company's market risk instead of trying to forecast an unexpected decrease or increase in capacity.

I estimate that Ultracarga's net sales will grow by 5% as the company increases the usage of its excess storage capacity.

Ultracargo's average storage in the quarter grows 12% compared with the fourth quarter of 2018 with the start of operations and the capacity expansions in Santos and Itaqui. This reflected an increase in fuels handling in the period. Source: 4Q19 Financial Results

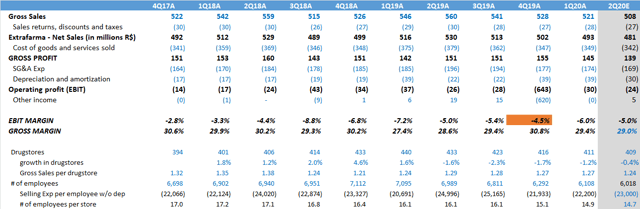

Extrafarma

Before I go into my 2Q20 forecast, I want to cover some things about Extrafarma that I noticed. During 2017 and 2018, the company began expanding its network by over 2% per quarter. In my opinion, the company was careless about picking its locations as their gross sales per drugstore were reduced from R$ 1.32 million to 1.21 million. In 2019, the company perceived this error and began closing down underperforming locations to improve its efficiency, and an example is in their quote below. Another thing I notice is that from 4Q17 until 2Q18, the company had an average of 17.1 employees per store. In the past two quarters, an average of 15 employees per store. I believe the company is trying to reduce its operating expenses, but the increase in depreciation has distorted the results of these improvements.

Fourteen underperforming stores were closed, and seven were opened in regions with better profitability. Source: 1Q20 Financial Results

Source: Company's Financial and own estimates

Gross sales forecast for Extrafarma is projected to be 2.6% less than 1Q20, a result of a slight decrease in stores and a 2.2% decrease in total sales per store. During the pandemic, people will still need medicine, but drugstores sell more than just medicine. Extrafarma's stores also sell beauty products and some snacks, which is where a majority of the drop in sales should occur. Gross margin should be around 29%, a little lower than 1Q20 due to the decrease in sales of value-added products (non-medicine items)

Conclusion

I estimate that UGP's net sales will R$ 19,099 million in the 2Q20, 11% less than 1Q20. The operation most responsible for this decrease in net sales is Ipiranga. For the quarter, the EBITDA margin should be around 3.1% or R$312 million. In my opinion, once the stay-at-home order is lifted, UGP will be able to recover their loss in sales if demand in automotive fuels increases according to my projects.

Due to the complexity of the Ultrapar organization, I will have to conduct a sum-of-the-parts (SOTP) DCF valuation. This type of valuation takes time, as I will do a valuation on each segment. That being said, I am neutral on the company at this time. The only operations that will be able to provide an increase in sales for UGP are Ipiranga and Extrafarma, in my opinion. There is a large number of unaffiliated service stations that could become Ipiranga, am/pm, Jet Oil and Extrafarma resellers. I am neutral on UGP because it should have been able to take some of BR Distribuidoras' market share (it lost 7%) when the Operation Carwash scandal occurred, and instead, Ipiranga lost 2% of its market share during that time.

Please follow me via Seeking Alpha for analysis of Brazilian and Food Industry Stocks.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.