McBride: A European COVID-19 Winner, But Basic Challenges Remain

by Retirement PotSummary

- COVID-19 has actually helped Europe's largest private label household products company, McBride.

- The company has struggled to sustain a decent profit margin for years, leading to a new CEO.

- The company is a price-taker in a mature, low-margin industry.

- Until the company has a strategy to tackle that, its share price won't outperform even with the COVID-19 tailwind.

One European company which has benefited from COVID-19 is private label and contract manufacturing household goods maker McBride (OTC:MCBRF) (OTC:MCBDY). Despite a sales fillip, the business' underlying structural challenges remain. A new CEO is in place but it is too early to feel confident that he will effect a winning strategy after the COVID-19 sales bump.

Company Overview

McBride is a British-based private label and contract manufacturer of household goods such as personal care and cleaning products. The U.K. is approximately a quarter of its business. It has a continental European business as well and in fact is Europe's largest private label manufacturer of such goods. It also has a small Asian business. It has been around in one form or another since the 1920s. Its current corporate incarnation dates from a 1995 listing on the London stock exchange.

A Good Business Platform, But Poorly Run

The story of McBride has been the same for many years. In short they have an excellent business platform. Private label has grown in developed markets in Europe as in North America. McBride is the go-to manufacturer, with modern, efficient facilities and good customer relationships in many European markets. Indeed, they supply 49 of Europe's 50 top grocery retailers. Private label and contract manufacturing is basically a price-taking market, but McBride's leading position should at least give it negotiating power. Also, its focus on private label rather than mixing it with a significant proprietary brand portfolio as some other manufacturers do (McBride's own label portfolio focuses on only four brands) make it a more focused organization retailers and brands see as a supplier not as a potential competitor.

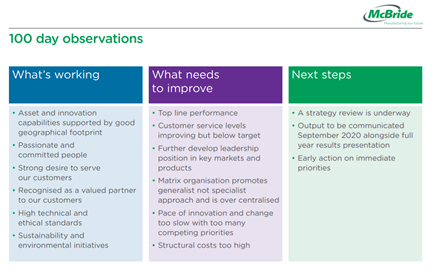

Despite that, McBride has consistently underperformed. I think that it has had poor management and a constantly shifting strategy which have negated some of its advantages. This is echoed by the initial impressions of the current CEO shared in recent results. Summarized, these point to high reputational value but low commercial performance:

Source: company's 2019 interim results

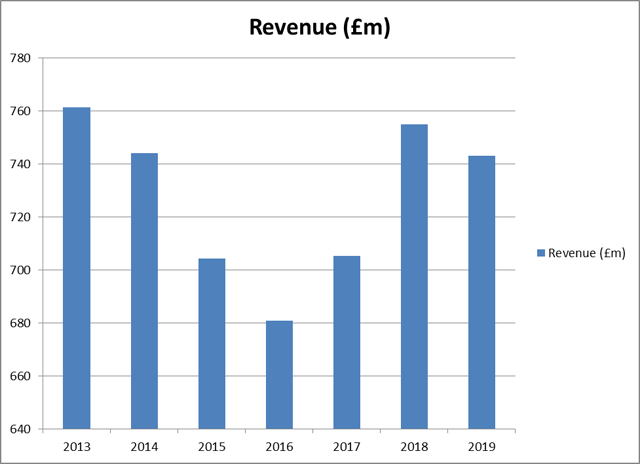

Revenue has jumped about:

Source: company annual reports 2019 and 2014

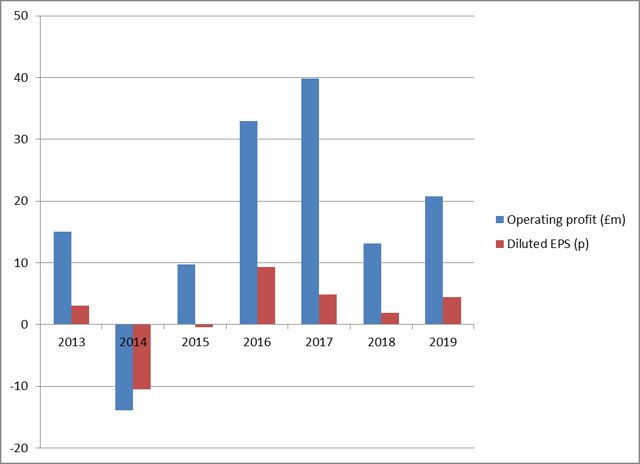

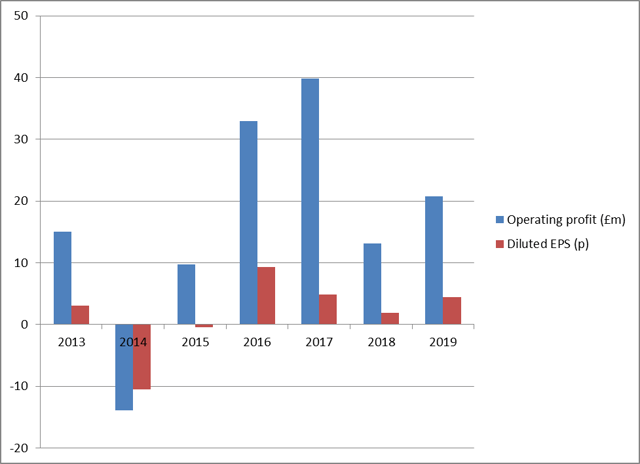

While revenue has been uneven, the picture on earnings has yoyo-ed even more dramatically. This is much more concerning, reflecting as it does McBride's sustained challenges in getting a roughly similar return on its sales year to year:

Source: company annual reports 2019 and 2014

Revealingly, operating profit does best when revenue is weakest, suggesting that revenue growth in some years comes from lower margin businesses. But even in its best year recently (2017) the £39.8m of operating profit equates to a profit margin of only 5.6%, which is weak.

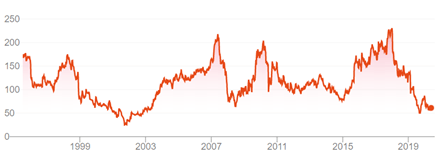

The price chart of McBride stock since its 1995 listing tells its own story. There are a series of run-ups for the stock, only to fall down substantially again when the next round of disappointments sets in.

(Source: Google Finance)

However, some succor for shareholders is that the company has consistently paid a dividend. However, in Mach it suspended its interim dividend. This was due to "prudence" despite improved demand due to COVID-19. I find this rather a rum decision by management. Financial prudence is a virtue, but McBride's decision to cancel a dividend when its business is performing well seems unreasonable. In its results published the month before that decision, it reported undrawn debt facility of £52.8 million - the interim dividend of 0.8p per share would have cost slightly less than £1.5 million. This is a red flag that current management is not considering shareholder payouts as a priority of any sort.

Source: company annual reports 2019 and 2014

McBride Faced Headwinds Going Into COVID

McBride has long been a business I felt had strong promise but never quite delivered, seeming to go from the fat into the fire. This has happened again in the past couple of years, as this sequence of events shows.

- July 2018 - profit warning, based on weaker sales in some markets

- February 2019 - profit warning, blamed on costs

- May 2019 - profit warning, based on weakness in some western European markets. After this its CEO quit.

- Jan 2020 - profit warning, based on weakness in the U.K.

The COVID-19 Pandemic has Played to McBride's Strengths

A stream of British companies have used COVID-19 as a justification for weaker results. McBride however announced a profit upgrade in its trading update this week based on higher demand, related to COVID-19. It saw an initial surge in demand for household products when countries went into lockdown in March. After that, demand moderated but remained higher than the run rate seen before the COVID-19 period. It stated that adjusted pre-tax profit will be 15% higher than market expectations and net debt will be lower.

The company said "higher demand levels are evident in most of our major markets and apply mostly to surface cleaning and dishwashing products, with more limited impact in laundry products." My hypothesis on that is that people are cleaning more due to COVID-19, but they aren't doing more laundry because of it and in fact may be doing less as they change clothes less often if not going out to work. That is consistent with previous comments by Unilever's CEO on consumers lowering personal grooming standards during lockdown.

New hand sanitizer products were stated to be helping the group's aerosols business. The company also called out lower input pricing, which is surprising as some manufacturers had cited higher input prices due to demand squeezes.

But the COVID-19 Pandemic Has Also Underlined McBride's Weaknesses

So far, so good. But McBride historically has managed to underwhelm in capitalizing on opportunities, while tripping up on the basics of its business.

A couple of points mitigate against any continued business uplift from COVID-19:

- While consumers have loaded up on cleaning products, that has not necessarily translated into use. So there will be some consumer loading which will depress demand in future quarters; and

- The rush of new entrants into hand sanitizers and heightened awareness of the benefits of local supplies means that contract manufacturing may get more crowded, depressing prices. In line with other markets, the U.K. has already gone from shortages of hand sanitizer to a glut and some of the new manufacturing capacity is likely to stay online having been put into use.

Against that, however, if there is a prolonged economic downturn, belt-tightening shoppers are more likely to switch from branded products to private label, which boosts McBride's prospects. On balance, though, it seems that the fact that COVID-19 provided an upturn not downturn for McBride is welcome but not likely to last as a structural improvement.

McBride Needs a Path to Growth

McBride's challenge is that it is in a fairly mature category, mostly in mature markets, and it is already the market leader. Top line growth is hard to find. Historically it has not demonstrated success in delivering sustainable bottom-line growth either.

The new CEO is conducting a full strategic review and will announce the results alongside full-year financial results in September. That will present a good opportunity to assess future prospects for the business. His background is packaging and extractive industries so I have doubts over whether he is well-equipped for the role: someone with a background dealing with grocery retailers would perhaps have better understood how to extract value in pricing, which seems to be McBride's perennial key challenge.

Meanwhile, the company's net debt of £121.7m (at end of 2019, per the interim earnings report) is larger than its current market cap of £111.5m. The company did reduce it between June and December, and has reduced it since according to their last announcement, but it is still a sizable debt load.

If the new leadership can put the company on a stable footing with less earnings volatility, there could be a strong path forward. But that will likely only become clear once the review results are announced in September. Until then, in the absence of any takeover offer there is no reason to believe the stock will outperform the broad market.

The Asian business seems like an unhelpful distraction despite the company describing it positively as a "growing and expandable platform". At £12.1 million, the continuing revenue in the first half of the current financial year represents just 3.4% of the company total. The company's last full-year report said it proposes to triple its manufacturing capacity in Asia. However, Asia is a competitive manufacturing landscape a long way away and financial irregularities at factories in Asia are hard to monitor from afar, so in my view management time would be much better focused exclusively on the bigger and more important task of getting the core British and continental European businesses to sustainable health. If Asia is emphasized rather than de-emphasized in the strategic review, I will take this as a leading indicator that the new management is not focused on the core challenges.

Longer term, McBride with its unpredictable earnings, strong market position and opportunities for further consolidation feels to me like a business better suited to private than public ownership. Before listing it was owned by private equity. If the new CEO can improve results and gussy it up for sale to private equity the share price could rise pretty sharply. But that will likely not be until the last quarter of this calendar year at the earliest, after the future strategy is shared and some initial results come in.

Insider Buying

One positive sign is that several directors including the chairman have been buying the shares at recent depressed levels.

| Date | Director name | Director's position | Deal type | Number of shares dealt | Price | Value of trade | Director's shares remaining |

| 27 Apr 2020 | Harrington, Neil Simon | Independent Director | Regular purchase transaction | 16,932 | £0.59 | £9,938.58 | 64,395 |

| 24 Apr 2020 | Nodland, Jeffrey Mark (Jeff) | Chairman of the Board | Regular purchase transaction | 70,000 | £0.59 | £41,548.60 | 290,600 |

| 25-Feb 2020 | Nodland, Jeffrey Mark (Jeff) | Chairman of the Board | Regular purchase transaction | 90,600 | £0.68 | £61,526.46 | 220,600 |

Source: Hargreaves Lansdown, table by author

That said, the company has not reported any share purchases by the new CEO.

Conclusion

McBride has a solid position in an unexciting but solid industry. It is well-positioned to cope with COVID-19 and even to benefit from it. But although past management largely managed to turn a profit, they have struggled to provide consistent profits at the right level. The "new brush" management have started by suspending the interim dividend even while signaling higher earnings, which is not an shareholder-friendly move. The onus is on the new CEO to provide a strong plan in September to fix the underlying profitability issues. Absent any move by a bidder, McBride's COVID-19 uplift doesn't make it any more attractive and there is no reason it will outperform the market between now and September when the strategic review is shared with investors.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.