SolarWinds: The Winds Will Change To Lower Revenue Growth For The Next Several Quarters

by The Software Side of LifeSummary

- SolarWinds reported a strong Q1 with revenue growing 15% to $248.5 million, well above expectations for $240 million.

- Management provided Q2 guidance which only calls for 4-8% revenue growth, a big deceleration from Q1.

- Economic headwinds from the global pandemic combined with a new subscription pricing model aimed at reducing license revenue could be a several quarter growth impediment.

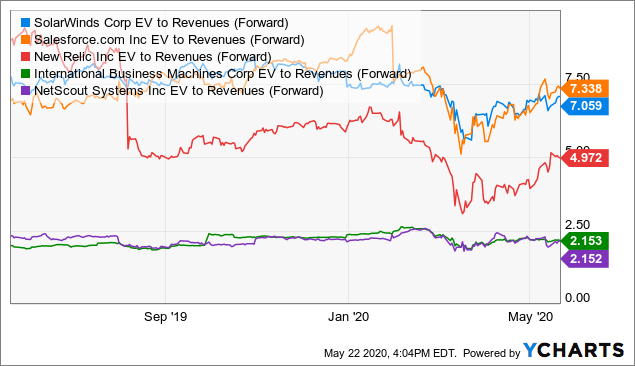

- Valuation seems about right a ~7.4x forward revenue for a company who will see revenue decelerate for the next several quarters.

SolarWinds Corporation (SWI) reported a strong quarter with revenue growing ~15% to $248.5 million, well above expectations for ~$240 million. However, the company’s Q2 guidance only implies 4-8% growth as they company battles the many uncertainties in today’s marketplace. In addition, the company introduced a new subscription pricing model which over the long-term is a benefit, but in the near-term, this could cause license revenue to decline in favor of more subscription revenue.

Since license revenue is a larger upfront payment, the move to more recurring, smaller monthly payments will cause a big revenue growth headwind for the next several quarters. Given this and the market uncertainty surrounding the global pandemic, the company’s 2020 revenue guidance is simply some level of growth.

The stock is up less than 5% since the company reported earnings a few weeks ago, however, valuation does not seem overly compelling at ~7.4x forward revenue. The company is likely to experience some revenue growth challenges over the next several quarters which optically does not look good and could cause some investors to worry more about the more normalized level of revenue growth. With 2020 revenue growth remaining minimal, it might not be until this time in 2021 where investors start to see the benefits of having less license revenue in favor of more subscription revenue.

While I am a long-term bull on this name, I have become a little more hesitant to put new money to work given the low revenue growth profile and not appealing valuation. Long-term investors should continue to hold onto the name and benefit from the highly recurring revenue model.

SolarWinds offers IT management software that helps manage and monitor an enterprise's IT infrastructure, capable of operating in a cloud, on-premise, or hybrid environment. The company offers a suite of software for network management that operates in real-time, giving the users increased visibility for decision-making. The software has the ability to identify, diagnose, and solve network performance issues. SolarWinds offers products on a standalone basis including software such as archiving and email protection against malware and phishing.

SolarWinds competes with a variety of other competitors offering IT infrastructure management solutions. Some of their primary competitors are larger IT vendors and network management service providers such as IBM (IBM), NetScout (NTCT), CA Technologies, and many more. There are dozens of other smaller, more localized service providers that the company also competes with.

Q1 Earnings and Guidance

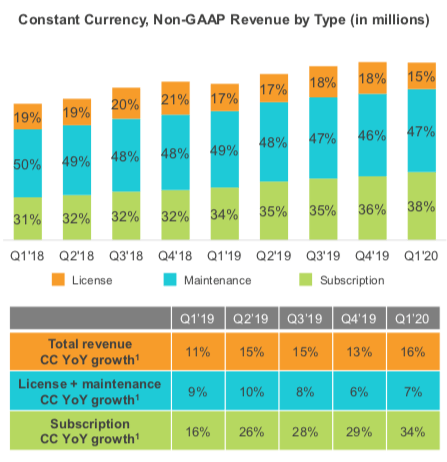

During the quarter, non-GAAP revenue grew ~15% to $248.5 million, or ~16% on a constant currency basis. Revenue during the quarter was well above expectations for ~$240 million or only ~12% growth. The company continues to have ~35% of their revenue coming from outside North America and international expansion remains a forefront opportunity for additional growth. The company also benefits from recurring revenue, which grew 19% during the quarter to $211.5 million and represented ~85% of total revenue.

Source: Company Presentation

Subscription revenue of $95.1 million remained impressive and grew ~33% during the quarter, coming in well above expectations and drove the revenue beat during the quarter. Maintenance revenue grew ~10% during the quarter to $116.3 million, resulting in total recurring revenue of $211.5 million growing ~19%. Despite the challenging economic environment given the global pandemic, the company was able to sustain their recurring revenue stream, which should give investors more confidence as global economies continue to slow down and struggle to achieve growth. By having a strong, recurring revenue base, the company should be able to continue their strength over the long-term.

Wile recurring revenue growth remains strong and healthy, license revenue of $37.0 million declined ~3% compared to the year ago period. One part of this weakness is due to the global pandemic resulting in less capital spending from companies. However, companies have started to transition more of their license spend to monthly recurring payments. License revenue tends to be lumpy and uncertain, whereas when a company selects a recurring payment stream, their monthly payments are much lower than the upfront license fee.

Source: Company Presentation

Given the largely subscription-based software revenue gross margins continue to impress investors, coming in at ~91% during the quarter, similar to the ~92% in the year ago period. Even though margins are not likely to expand from here, the very high gross margins give the company a lot of flexibility in their operating expenses as they look for growth opportunities.

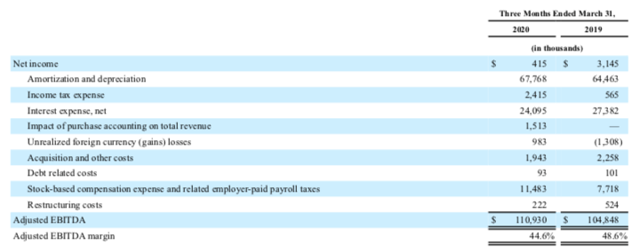

Adjusted EBITDA margin during the quarter was 44.6% and contracted from the 48.6% in the year ago period. Again, the high gross margins gives the company a lot of flexibility with their operating expenses, which saw S&M, R&D, and G&A expenses all increase compared to the year ago period. The company remains in a great position where they can invest heavily into their operations for continued growth and expansion without needing to give up too much of the margin optionality. This optionality is favorable for investors because over time as operating expenses slow down, the company will start to expand margins, which is favorable from a valuation standpoint.

The big revenue beat combined with another quarter of margin contraction led to non-GAAP EPS during the quarter of $0.20, which was similar to what expectations were calling for.

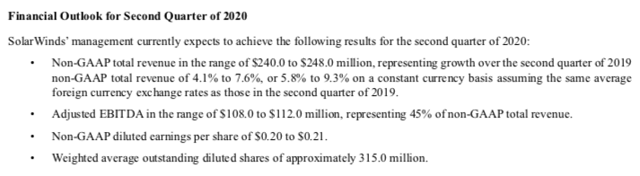

Source: Company Presentation

For Q2, the company provided revenue guidance of $240-248 million, which represents growth of only 4-8% compared to the year ago period, a significant deceleration from the ~15% growth this past quarter. On the earnings call, management discussed two main factors for the lower revenue growth. First, the uncertainty in the market remains high and companies are struggling to determine appropriate guidance ranges. Second, the guidance takes into account the new subscription pricing options which could shift revenue from license to subscription. Since license revenue is more dollars upfront compared to subscription, the company could see lower revenue growth in the company quarters. However, subscription revenue is viewed as healthy given the recurring long-term nature of the contracts.

While the company did not give full year guidance, given the uncertainty in the market and new subscription pricing, management did note they expected to deliver revenue growth in 2020 and they expected adjusted EBITDA margins to expand throughout the year. The move from license revenue to subscription revenue can take a big hit on the company’s overall revenue growth rates, but investors will surely be looking at subscription revenue growth.

Valuation

Since reporting earnings a few weeks ago, the stock is only trading up less than 5%. While Q1 was a strong quarter in terms of revenue growth, the uncertainty regarding full year guidance in addition to the new subscription pricing model may cause much lower revenue growth over the next several quarters. This transition looks bad optically as investors will see very minimal revenue growth, though over the long-term, the more subscription-based revenue stream will be a positive.

Below is a chart of a few SaaS companies with similar growth rates and path to continued profitability. I also included both IBM and NTCT, competitors more in line with SolarWinds in terms of the markets they compete in (not so much on their financial profile).

SolarWinds has a current market cap of ~$5.5 billion and with cash of ~$240 million and total debt of ~$1.9 billion at the end of the quarter, the company has an enterprise value of ~$7.15 billion.

Even thought the company did not provide a concrete number for their 2020 revenue guidance, they did not they expect to deliver growth in 2020. Using the $938.5 million of revenue in 2019 and assuming on ~5% growth during the year, we could see 2020 revenue end up ~$985 million. This would imply a 2020 revenue multiple of ~7.3x. While this revenue multiple does not seem overly aggressive considering the company’s historical growth of ~20% in addition to adjusted EBITDA margins of 45-50%, the company will have a challenging 2020.

Revenue growth will be impacted by the current uncertainties in the marketplace given the global pandemic has shut down a lot of business expenditures. In addition, the company changed their subscription pricing in order to encourage less license revenue and more subscription revenue. Subscription revenue is viewed as better given the visibility and highly-recurring in nature. However, license revenue is lumpy and comes in the form of one large payment rather than many smaller payments seen in subscription revenue. Thus, revenue growth will be negatively impacted as license revenue goes away.

Even though 2020 growth will be impacted, it may take the company several quarters in order to return to their normalized growth level. Margins will likely hold up over time as the company has high gross margins that can help retain operating margin expansion.

Nevertheless, given the change in their revenue growth profile for at least the next several quarters, the ~7.3x forward revenue seems about right. For now, I remain on the sidelines given valuation but an optimist about the longer-term growth potential. Investors should look to pick up shares on any weakness as the longer-term growth profile is likely to return once the company gets through their subscription-revenue transition.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.