Cross-Border Investing: The Most Active US-Based VCs in Africa

by WT ResearchAfrica’s evolution to cross-border investing has been interesting, but more so, challenging for Venture Capitalists. Traditionally, VCs pump money into businesses and geographies they understand, while tending to be skeptical about businesses in emerging markets.

Concerns around regulatory risks, regional stability, market size, distance from their headquarters which increase oversight costs, all have at one point made it difficult to get U.S-based VCs on board.

A decade back, only a few for-profit early-stage investors were attracted to Africa, with citations of “a slim picking away from social investing.” The playing field was therefore left to non-profits and social-focused investors.

However, the arrival of specialized funds led by development finance institutions such as the International Finance Organization (IFC), Acumen, and Overseas Private Investment Corporation (OPIC), has slowly transformed early-stage company financing across the continent to include top-tier VC investors from the U.S.

Similarly, the tech revolution in the continent continues to redefine the approach to venture capital, with startups raising a total USD 1.34 Bn in 2019, and USD 725.6 Mn in 2018.

To put into perspective the role and engagement of U.S-based VC firms in the African startup ecosystem, WeeTracker Research analyzed startup funding data over an approximate 30 months, over which at least 51 transactions were identified to be led by U.S VC firms.

Activity From 2018-2020

Majority of the deals in the last two years have been co-investments between VC firms and other investment houses. 21 U.S-based VC firms have participated in at least 42 co-investments worth over USD 243 Mn between 2018 and 2020.

Solo investments form a small portion of the total disclosed investments at 2.7% of USD 250.7 Mn. Major players include Deciens Capital, Ben Franklin Technology Partners, AHL Ventures, and AC Ventures.

Over the period, North Africa recorded the largest deal number with 24 investment rounds led by 2 US VC firms—500 Startups, and Endure Capital. East and West Africa recorded 13 and 10 deals respectively, reporting the highest number of unique lead U.S VC investors and deal amounts raised.

Southern Africa recorded the lowest number of funding deals led by U.S venture capitalists and also reported the lowest funding amount led by these investors.

In industry focus, Fintech recorded the highest number of deals, attracting 11 U.S-backed VCs, and a total USD 77 Bn worth of Investments. Logistics & Supply Chain came in second at 9 deals with USD 51.9 Mn raised. Closing at the top four was Healthtech and eCommerce, with 7 deals worth USD 51.9 Mn and USD 15.7 Mn, respectively.

Other industries that have raised funds include Analytics & Big Data and Agritech, which have raised USD 19.1 Mn and USD 15. 6 Mn, from 4 and 3 U.S VC-led deals respectively.

By investment stage, the seed-level received the most interest by deal number, attracting 25 transactions, led by 13 VCs, representing 17% of the total amount raised.

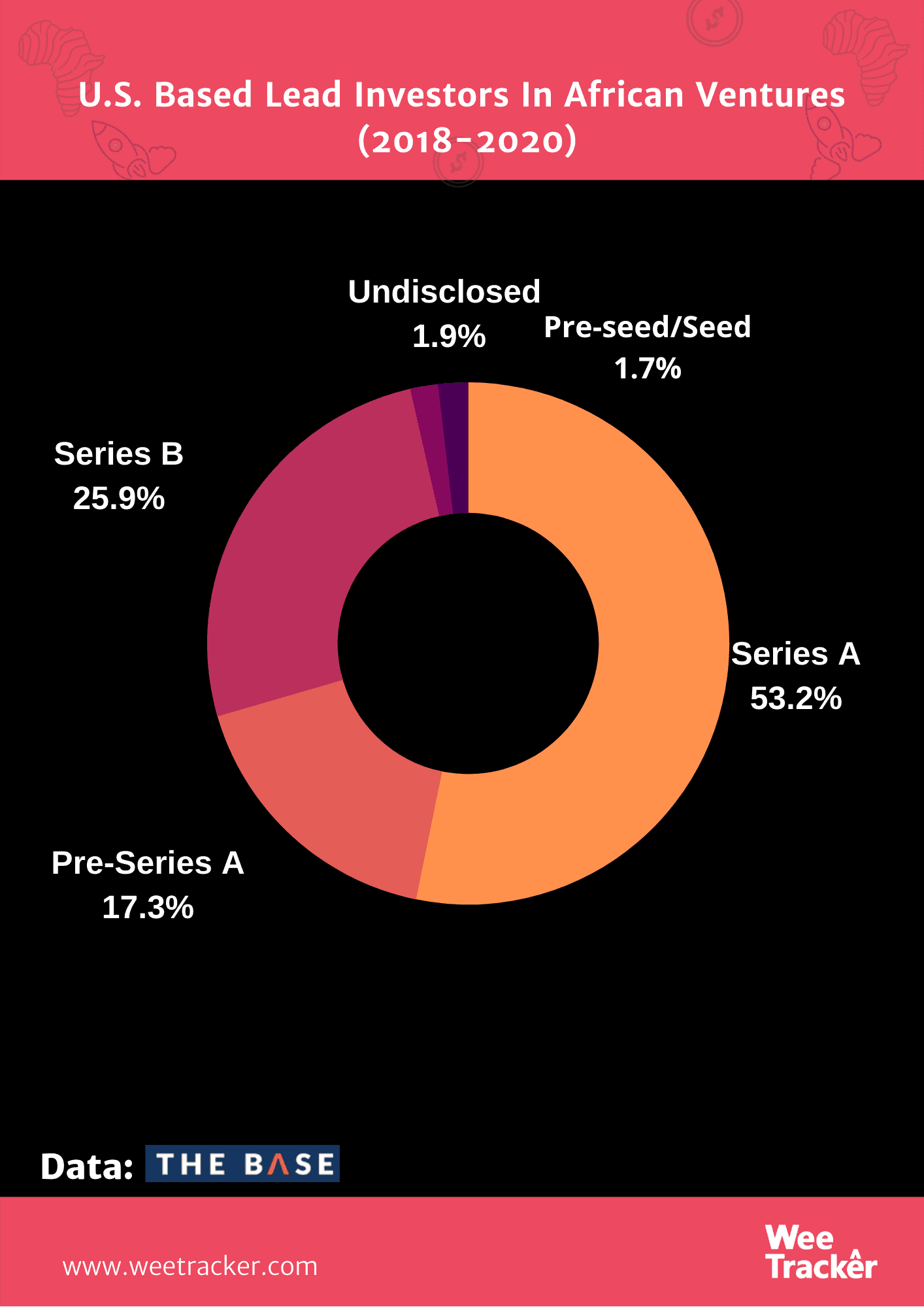

53% of the total disclosed amount was invested in the form of Series A, attracting 14 transactions, with 13 VCs. Third in place was Series B, attracting 3 U.S VC led funding rounds, with a total of USD 65 Mn raised. Pre-seed and Pre-Series A rounds attracted 3 and 2 U.S VC lead transactions, surmounting to USD 4.3 Mn.

Operational Strategies

United States-based VCs have adopted different operation models for their investments in Africa. While a number have opted to set up local offices with local teams—Vertex Ventures by Vertex Global for instance—a good number operate from their headquarter offices with partner heads in African cities.

To control the risk exposure associated with most African markets, VCs such as Colorado-headquartered Unreasonable Capital will invest only when a local investor agrees to co-invest in the same startup. However, a majority co-invest with other cross-border investors.

Most investment offerings range from USD 100 K to USD 500 K, and up to USD 5 Mn depending on the VC’s target stage and capacity. VCs such as San Francisco-based 500 Startups offers USD 150 K for 6% equity ownership, while the likes of Village Global offer up to USD 500 K for 7% equity ownership. Larger VC firms offer a range of equity and debt capital, including Lateral Capital and Finca Ventures.

To a large extent, US-based VC firms investing in Africa are backed by specialized funds, normally with a social focus in addition to a financial goal. For instance, Village Global, another San Francisco-based VC, is backed by some of the world’s most successful entrepreneurs and philanthropists, including Diana Greene, and Bill Gates.

Pennsylvania-based Ben Franklin Technology Partners, is funded by its parent company, the Ben Franklin Technology Development Authority. Similarly, Washington, DC-based Quona Capital is funded by Massachusetts-headquartered Accion, a global non-profit committed to improving financial inclusion in developing markets.

Quona also manages Accion Frontier Inclusion Fund, with Accion as the Anchor investor. AHL Ventures, one of the largest solo US VC investors reported, invests through AHCLF Stock Rating & Data, a tax-exempt Charitable Foundation making equity quasi-equity, and debt investments in early-stage social enterprises in Africa. Other social-driven investors include Social Capital and Elma Investments.

Conclusion

The entrepreneurial space in Africa is young but promising. With a growing change in reforms, business environment, and a more enabling startup ecosystem, cross-border ventures capital injections are expected to grow.

| Name | Logo | Industry Focus | Investment by Deal Number |

|---|---|---|---|

| 500 Starups | eCommerce, HealthTech, Media& Entertainment, FoodTech | 17 | |

| Accion Venture Lab | FinTech | 1 | |

| AHL Venture Partners | FinTech, HR Tech, Renewable Energy, Agriculture | 1 | |

| Atlantica Investors | Logistics | ||

| Ben Franklin Technology Partners | Manufacturing | 1 | |

| Breyer Labs | FinTech, Media & Entertainment, Analytics | 1 | |

| Deciens Capital | FinTech | 1 | |

| Endure Capital | eCommerce, FinTech, HealthTech, HR Tech, Transportation, Marketplace, Renewable Energy, SAAS | 6 | |

| Finca Ventures | Renewable Energy, Education, Agriculture, HealthCare | ||

| GreatPoint Ventures | eCommerce, HealthTech, Analytics, Agriculture | 1 | |

| Khosla Ventures | Internet of Things (IOT) | 1 | |

| Lateral Capital | CleanTech, HealthTech, HR Tech, Transportation, Renewable Energy, SAAS, Analytics, Social Impact, Marketplace | 1 | |

| Lynett Capital | Logistics, Internet Of Things (IOT) | 3 | |

| Quona Capital | FinTech | 1 | |

| Rise Capital | Internet Of Things (IOT) | 1 | |

| Social Capital | HealthCare, Education, FinTech | 2 | |

| Tekton Ventures | eCommerce, FinTech, Social | 1 | |

| True Ventures | HealthTech, Analytics, Blockchains, SAAS | 1 | |

| Unreasonable Capital | CleanTech, Agriculture, FinTech | 1 | |

| Vertex Ventures ( US) | Logistics | ||

| Village Global | FinTech, SAAS, HealthTech, IOT | 1 | |

| Hack Vc | SAAS, Marketplace | 1 | |

| ELMA Philanthropies | Social Impact | 1 | |

| Ac Ventures | Space Industry | 1 | |

| GreyCroft | FinTech, Analytics, Marketplace, SAAS, HealthTech |