Sberbank: The Downside Is Limited

by Aleksey RazdolginSummary

- As Russia’s flagship bank, Sberbank already felt the pain of the virus, as its Q1 earnings results showed a staggering decline in its profits.

- Nevertheless, Sberbank will survive this pandemic, but the recovery will take time.

- I continue to hold Sberbank’s shares in my portfolio, as I believe that the downside is already priced in, and its stock offers enough margin of safety.

As COVID-19 continues to ravage the planet, Russia slowly becomes the new epicenter of the virus in Eurasia. Currently, it's the second most infected country in the world with more than 300,000 cases. As Russia's flagship bank, Sberbank (OTCPK:SBRCY) already felt the pain of the virus. Its Q1 earnings results showed a staggering decline in its profits. It seems that Russia is far away from its peak of COVID-19 cases, and as a result, Sberbank will be underperforming for the rest of the year. Nevertheless, I'm still optimistic about the bank's long-term future, and I continue to hold its stock in my portfolio.

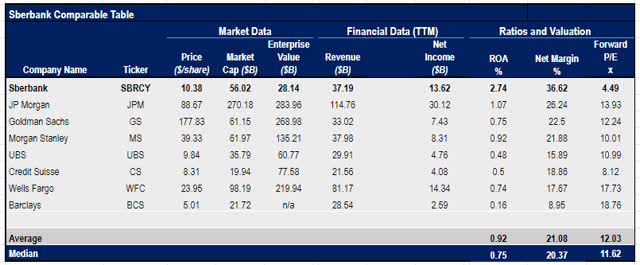

Right now, Sberbank has one of the best margins and returns on assets among its banking peers, and by being owned by the country's Ministry of Finance, the risk of becoming insolvent is non-existent. While 2019 dividends will be slashed, the ability to pay them in the first place is a sign that things are not as bad as they look. With the political backing, Sberbank will stay afloat for years to come no matter how the pandemic ends. By trading at a P/E of 4.49x, the downside is already priced in, and its stock offers enough margin of safety for investors with a long investment horizon.

A Long Recovery Ahead

Since the publication of my latest article on Sberbank in January, the bank's stock depreciated by nearly 40% due to the spread of COVID-19 in Russia. As a result, Sberbank's net profit of ₽120.5 billion (~$1.68 billion) in Q1 was down 48.8% Y/Y, while its return on equity declined to 10.6%. Currently, Sberbank's stock slightly recovered from its bottom, and it currently trades at the same levels as stocks of its peers from the banking industry.

Source: Bloomberg

Despite such a bad performance, Sberbank continues to be one of the best banks to own in the current environment. Its net margin of 36.62% is above the industry's median net margin of 20.37%, while its Forward P/E ratio of 4.49x is way below the industry's median Forward P/E ratio of 11.62x.

Source: Yahoo Finance. The table was created by the author

At this stage, I believe that the downside of owning the bank's stock is now limited. In April, Sberbank changed its ownership structure, and Russia's Ministry of Finance became the majority owner of the bank. The Russian government wanted its Central Bank to be responsible solely for the monetary policy inside the country and didn't want it to have a commercial bank under its wing. Up until April, the Central Bank was the major shareholder of Sberbank. With political backing from the government, Sberbank can weather the current storm quite well, as it will not go under even in the worst-case scenario.

While it's very likely that the bank's 2020 dividends will be slashed due to a bad performance, there's still a high chance that Sberbank will be able to pay 50% of its net income to its shareholders later this year. Earlier this week, Sberbank's CEO Herman Gref said that, despite the pandemic, the bank didn't rule out the possibility of giving away 50% of its 2019 net income to its shareholders later on. The Annual Shareholder meeting is scheduled for September 25, and the latest possible date to buy the stock and receive the upcoming dividend is July 14. At the same time, once the pandemic is over, Sberbank will once again be targeting a 50% payout ratio, and soon, the Ministry of Finance will require all government companies to pay half of their IFRS profits to its shareholders in dividends.

The biggest hurdle that Russia and all of its companies will now face is a slow and painful recovery. The Central Bank already cut its interest rates to 5.5%, and it could cut it even more at its meeting in June to encourage consumer spending. Q2 GDP is expected to be down 8%, but then, we should see a recovery in Q3 and Q4. It's too soon to tell how well the economy will perform at the end of the year, but what's now certain is that Russia decided to end the lockdown policy and will be pursuing a herd immunity strategy to end the pandemic faster. This will result in more pain in the short term, but the country will be able to start the recovery process much sooner. This is good news for Sberbank, as it'll be able to absorb as many losses as possible in the short term and start its recovery much faster. By having the Russian government as an equity partner, the bank will be able to weather this storm quite well and return to profitability once this is all over. At the same time, by having the lowest Forward P/E and the highest net margin among its international peers, Sberbank seems to me like the safest investment from the banking sector at this time.

Disclosure: I am/we are long SBRCY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.