Insider Weekends: Moderna Executives Go On A Selling Spree

by Asif SuriaSummary

- Insider buying decreased significantly last week.

- Notable Insider Buys: Mercury General Corporation, Cortexyme, Inc., New Mountain Finance Corporation, Berkshire Hathaway Inc., The Greenbrier Companies, Inc.

- Notable Insider Sells: Paycom Software, Inc., Activision Blizzard, Inc., Monster Beverage Corporation, IDEXX Laboratories, Inc., PayPal Holdings, Inc.

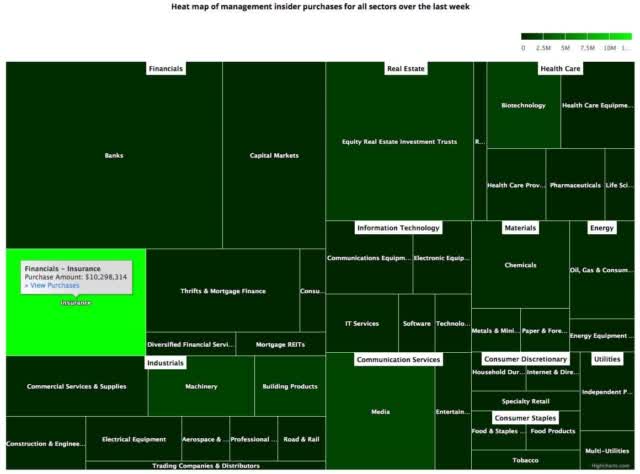

Insider buying decreased significantly last week, with insiders purchasing $107.94 million of stock compared to $305.64 million in the week prior. Selling also decreased, with insiders selling $1.33 billion of stock last week compared to $2.89 billion in the week prior. Most of the management insider buying appears to be concentrated in the financial sector as you can see from the sector heat map below. A large part of this was driven by the Chairman of the insurance company Mercury General buying in size for a second week in a row.

While there were some interesting transactions on the buy side, what caught my eye was the selling by the insiders of Moderna (NASDAQ:MRNA). Moderna kicked off a powerful broad-based rally last Monday when it reported promising results for a COVID-19 vaccine it was testing. The stock shot up nearly 30% to $86.14 at the open on Monday based on this pre-market news but settled down during the day to close at $80 with a gain of "just" 20%. I was perplexed by such a huge reaction to phase 1 trial results that were positive for, get this, just 8 participants.

By the end of that day, Moderna had announced it was going to raise $1.25 billion in a secondary stock offering and priced it at $76 per share. The icing on the cake was that Moderna executives were selling their stock on the open market on Monday, Tuesday, and Wednesday, as you can see here. While some of these were options-related sales and others were part of an established 10b5-1 selling plan, these transactions and the secondary offering don't pass the smell test. As folks who are familiar with the 10b5-1 plan will tell you, it can be gamed, and the reason we have the 10b5-1 plan is because its predecessor, the 10b-5, was also gamed by some insiders. Matt Egan and Chris Isidore wrote an excellent article discussing these sales in more detail. By the end of the week, Moderna had given back most of its Monday gains, but the S&P 500 continued to hold on to its gains.

Sell/Buy Ratio: The insider Sell/Buy ratio is calculated by dividing the total insider sales in a given week by total insider purchases that week. The adjusted ratio for last week went up to 12.31. In other words, insiders sold more than 12 times as much stock as they purchased. The Sell/Buy ratio this week compares unfavorably with the prior week when the ratio stood at 9.48.

(Source: InsideArbitrage.com database)

Note: As mentioned in the first post in this series, certain industries have their preferred metrics such as same-store sales for retailers, funds from operations (FFO) for REITs, and revenue per available room (RevPAR) for hotels that provide a better basis for comparison than simple valuation metrics. However, metrics like Price/Earnings, Price/Sales and Enterprise Value/EBITDA included below should provide a good starting point for analyzing the majority of stocks.

Notable Insider Buys:

1. Mercury General Corporation (NYSE:MCY): $39.24

Chairman of the Board George Joseph acquired 248,692 shares of this insurance company, paying $37.21 per share for a total amount of $9.25 million. Mr. Joseph increased his stake by 1.29% to 19,549,434 shares with this purchase.

Mercury General also made our list last week, and we wrote the following about the company.

Mercury General is mostly focused on automobile insurance and in this period when their customers are driving less, their risk of claims has also gone down. This is why other companies like All State and Geico have voluntarily reduced their insurance premiums. When I called Geico they told me that they will be reducing my premium by 15% and then reduced it an additional 10% after hearing I was not driving one of my cars very much. The current environment is favorable for Mercury General on the risk side of the equation but they will take a hit on their assets, which are likely to yield less in this market. The company earned $1.07 per share in Q1 2020, beating estimates by 23 cents and growing its revenue by 4.12% to $954.22 million. The stock is trading near its 52 week low and also a multi-year low. The dividend yield is 6.64% with a 32 year history of growing its dividends. A payout ratio of over 88% is too rich for my liking.

| P/E: 48.27 | Forward P/E: 11.37 | Industry P/E: 9.97 |

| P/S: 0.59 | Price/Book: 1.34 | EV/EBITDA: 16.94 |

| Market Cap: $2.17B | Avg. Daily Volume: 412,235 | 52 Week Range: $33.45 - $65.22 |

2. Cortexyme, Inc. (NASDAQ:CRTX): $55.08

Director David Lamond acquired 44,648 shares of this biotech company, paying $55.35 per share for a total amount of $2,471,251. These shares were purchased indirectly through a trust.

| P/E: N/A | Forward P/E: -27.13 | Industry P/E: 2,231.20 |

| P/S: N/A | Price/Book: 7.43 | EV/EBITDA: -23.52 |

| Market Cap: $1.62B | Avg. Daily Volume: 129,979 | 52 Week Range: $19.35 - $73.84 |

3. New Mountain Finance Corporation (NYSE:NMFC): $9.11

Director Steven B. Klinsky acquired 300,000 shares of this business development company (BDC), paying $7.96 per share for a total amount of $2,388,430. Mr. Klinsky increased his stake by 4.45% to 7,040,751 shares with this purchase. These shares were purchased indirectly through a trust.

BDCs have been particularly hard hit during their downturn because they primarily lend to small and medium size businesses, and those are the ones that will bear the disproportionate brunt of the COVID-19-related drop in business. The ones that survive will often be able to tap into the stimulus related loans at very low rates and may not turn to the BDCs. While the insiders appear to be optimistic, the optimism could be misguided at this stage of the cycle.

| P/E: N/A | Forward P/E: 7.29 | Industry P/E: 17.17 |

| P/S: 3.08 | Price/Book: 0.82 | EV/EBITDA: N/A |

| Market Cap: $882.1M | Avg. Daily Volume: 1,550,759 | 52 Week Range: $4.62 - $14.45 |

4. Berkshire Hathaway Inc.

Director Meryl B. Witmer acquired 1,000 class B shares of Berkshire Hathaway, paying $173.30 per share for a total amount of $173,300 and 8 class A shares, paying $261,002.63 for a total amount of $2.09 million.

Berkshire Hathaway Inc. (NYSE:BRK.A): $236,094

| P/E: 44.27 | Forward P/E: 93.46 | Industry P/E: 24.03 |

| P/S: 1.81 | Price/Book: 1.15 | EV/EBITDA: N/A |

| Market Cap: $427.78B | Avg. Daily Volume: 662 | 52 Week Range: $239,440 - $347,400 |

Berkshire Hathaway Inc. (NYSE:BRK.B): $174.93

| P/E: 44.26 | Forward P/E: 94.34 | Industry P/E: 24.03 |

| P/S: 1.81 | Price/Book: 1.15 | EV/EBITDA: N/A |

| Market Cap: $427.78B | Avg. Daily Volume: 9,219,751 | 52 Week Range: $159.50 - $231.61 |

5. The Greenbrier Companies, Inc. (NYSE:GBX): $21.35

Chairman & CEO William A. Furman acquired 100,000 shares of this Oregon-based railroad freight car equipment company, paying $16.52 per share for a total amount of $1.65 million.

| P/E: 9.94 | Forward P/E: 21.79 | Industry P/E: 16.54 |

| P/S: 0.22 | Price/Book: 0.54 | EV/EBITDA: 5.09 |

| Market Cap: $697.46M | Avg. Daily Volume: 624,496 | 52 Week Range: $12.89 - $34.3 |

You can view the full list of purchases from this Insider Buying page.

Notable Insider Sales:

1. Paycom Software, Inc. (NYSE:PAYC): $269.35

Shares of this software application company were sold by 2 insiders:

- President and CEO Chad R. Richison sold 650,000 shares for $268.00, generating $174.2 million from the sale. 229,135 of these shares were purchased indirectly by The Ruby Group.

- Chief Financial Officer Craig E. Boelte sold 10,000 shares for $285.49, generating $2.85 million from the sale.

| P/E: 80.14 | Forward P/E: 59.59 | Industry P/E: 45.78 |

| P/S: 20.22 | Price/Book: 25.88 | EV/EBITDA: 55.53 |

| Market Cap: $15.77B | Avg. Daily Volume: 1,100,740 | 52 Week Range: $163.42 - $342 |

2. Activision Blizzard, Inc. (NASDAQ:ATVI): $73.08

Director Brian G. Kelly sold 375,000 shares of this video game company for $72.72, generating $27.27 million from the sale. These shares were sold indirectly by ASAC TJKS LLC.

| P/E: 36.16 | Forward P/E: 25.82 | Industry P/E: 67.16 |

| P/S: 8.73 | Price/Book: 4.32 | EV/EBITDA: 25.81 |

| Market Cap: $56.31B | Avg. Daily Volume: 9,462,746 | 52 Week Range: $42.1 - $75.97 |

3. Monster Beverage Corporation (NASDAQ:MNST): $68.71

Shares of this beverage company were sold by 2 insiders:

- Director Mark J. Hall sold 188,826 shares for $66.76, generating $12.61 million from the sale. These shares were sold indirectly through a trust.

- President of EMEA Guy Carling sold 27,000 shares for $67.24, generating $1.82 million from the sale. These shares were sold as a result of exercising options immediately prior to the sale.

| P/E: 33.19 | Forward P/E: 28.04 | Industry P/E: 24.37 |

| P/S: 8.38 | Price/Book: 9.35 | EV/EBITDA: 22.1 |

| Market Cap: $36.18B | Avg. Daily Volume: 3,969,020 | 52 Week Range: $50.06 - $70.52 |

4. IDEXX Laboratories, Inc. (NASDAQ:IDXX): $294.72

Shares of this diagnostics and research company were sold by 3 insiders:

- Director Jonathan W. Ayers sold 38,000 shares for $296.67, generating $11.27 million from the sale. These shares were sold indirectly through a trust.

- Director Daniel M. Junius sold 4,000 shares for $295.61, generating $1.18 million from the sale. These shares were sold as a result of exercising options immediately prior to the sale.

- Corporate Vice President Kathy V. Turner sold 2,690 shares for $301.00, generating $809,690 from the sale.

| P/E: 58.83 | Forward P/E: 50.12 | Industry P/E: 44.36 |

| P/S: 10.19 | Price/Book: 232.43 | EV/EBITDA: 38.42 |

| Market Cap: $25.03B | Avg. Daily Volume: 743,020 | 52 Week Range: $168.65 - $302.99 |

5. PayPal Holdings, Inc. (NASDAQ:PYPL): $150.86

Shares of this digital payments company were sold by 2 insiders:

- EVP, Chief Strategy & Growth Officer Jonathan Auerbach sold 64,621 shares for $147.91, generating $9.56 million from the sale.

- President and CEO Daniel H. Schulman sold 25,000 shares for $144.15, generating $3.6 million from the sale.

| P/E: 95.42 | Forward P/E: 37.81 | Industry P/E: N/A |

| P/S: 9.7 | Price/Book: 11.08 | EV/EBITDA: 51.16 |

| Market Cap: $177.11B | Avg. Daily Volume: 11,162,034 | 52-Week Range: $82.07 - $151.08 |

You can view the full list of sales from this Insider Sales page.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: Please do your own due diligence before buying or selling any securities mentioned in this article. We do not warrant the completeness or accuracy of the content or data provided in this article.