Qualys: Revenue Guidance Appears Choppy But Valuation Reasonable

by The Software Side of LifeSummary

- Qualys reported Q1 revenue growth of ~15% which was slightly ahead of expectations with operating margins showing strong expansion.

- Management provided 2020 revenue guidance of 10-12% growth, which implies some deceleration throughout the year.

- Valuation remains somewhat attractive at ~10x a conservative 2021 revenue trajectory despite the global pandemic uncertainties and potentially conservative guidance.

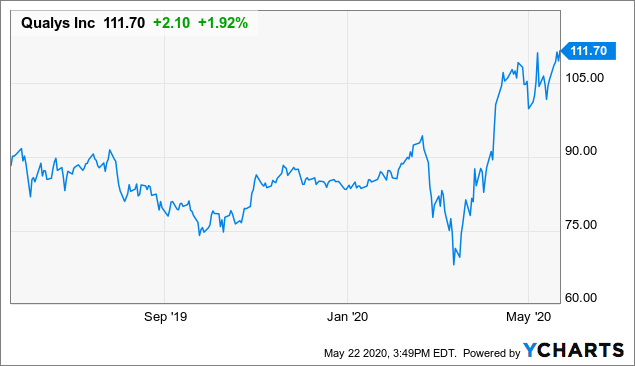

Qualys (QLYS) reported a better than expected earnings a few weeks ago with revenue growing ~15%, though the stock has traded pretty flat since then. I believe part of this is due to the stock remaining near all-time highs during a rather uncertain time period in the market.

Management provided Q2 guidance which included revenue growth of 11-12% as well as 2020 revenue guidance of 10-12%, meaning they expect to see continued deceleration of growth throughout the year. While part of this is likely due to the global pandemic causing uncertainties around business expenditures, part of this may also be from the company electing to provide conservative guidance amidst the uncertainty.

QLYS competes more in the field of vulnerability management, competing with Tenable (TENB). Their job is to detect which applications may be at risk and how much of a risk they pose. This functionality resembles to a greater extent what many SaaS defined companies do.

Investors continue to battle with valuation as the company has seen their revenue growth naturally decelerate, though margins remain very strong. It is very easy for investors to put a 10x multiple on a software company growing revenue 25%+ with minimal margins, but the challenging part is how to value a strong, 15% revenue growth company with leading operating margins.

Valuation is a very important part to any investment, however, QLYS is a strong company with a large TAM opportunity ahead of them and these factors should excite investors enough to maintain a premium valuation. With the stock trading near all-time highs and valuation now ~10x when looking at a somewhat conservative 2021 revenue trajectory, I believe long-term investors will continue to be rewarded. I don’t think now is the greatest time to put new money to work, but investors should look to build a position and buy on the dips.

Q1 Earnings and Guidance

During the quarter, revenue grew ~15% to $86.3 million, which was slightly better than expectations for ~$85.5 million. While revenue is not growing as fast as their closest competitor, Tenable, the company has demonstrated consistency with the revenue growth given the highly recurring business model.

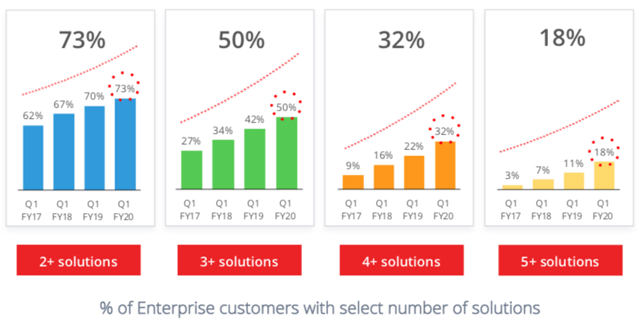

QLYS continues to do a good job introducing new products to the market, which has helped them cross-sell their solutions to customers. For example, during the quarter, 73% of their customers used 2 or more products and 18% of customers used 5 or more solutions. These are both up from 70% and 11%, respectively, in the year ago period. Over time, as the company continues to further penetrate their customers, they will be able to generate highly recurring revenue streams.

Source: Company Presentation

What remains very impressive about this company is their consistently strong margins. Even during challenging economic conditions given the global pandemic, the company has been able to expand their margins. Gross margins during the quarter came in at 81%, expanding from 79% in the year ago period. The gross margin expansion in addition to the company continuing to leverage their operating expense base as they gain scale led to operating margins of 37% during the quarter, up from 32% in the year ago period.

Typically as companies experience a stabilization in revenue growth as they reach a certain level of scale, they focus more on operating margin and profitability. QLYS has followed this plan perfectly and despite having lower revenue growth compared to peers, they remain one of the highest margin companies in the industry.

Given the slightly better than expected revenue in addition to operating margins showing some strength in expansion, the company reported EPS of $0.65 during the quarter, better than expectations for $0.60.

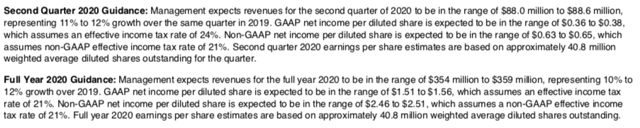

Source: Company Presentation

For Q2, management is expecting revenue of $88-88.6 million, which represents 11-12% growth compared to the year ago period. While this would represent some level of deceleration, the company is likely being a little conservative given the uncertainties regarding the global pandemic. EPS for the quarter is expected to be $0.63-0.65.

For the full year, the company is now expecting revenue to be $354-359 million, which represents 10-12% growth. Considering the company just reported ~15% growth during Q1 and guided Q2 to 11-12% growth, this would imply continued deceleration for the remainder of the year. While it is possible the rest of the year continues to decelerate given the economic uncertainties, I believe the company is being a little conservative with their guidance and we could see upside throughout the remainder of the year. EPS for the year is expected to be $2.46-2.51.

Valuation

QLYS' 100% SaaS-based model has been very successful as their revenue stream is highly visible and recurring, leading to greater investor confidence in both the current year revenue stream as well as the longer-term growth potential. Despite revenue continuing on its decelerating path, operating margins remain very healthy and expanding.

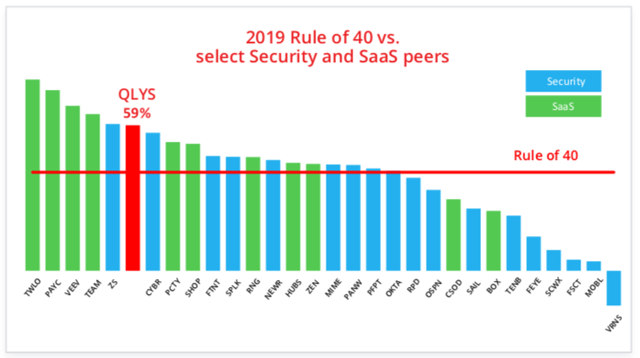

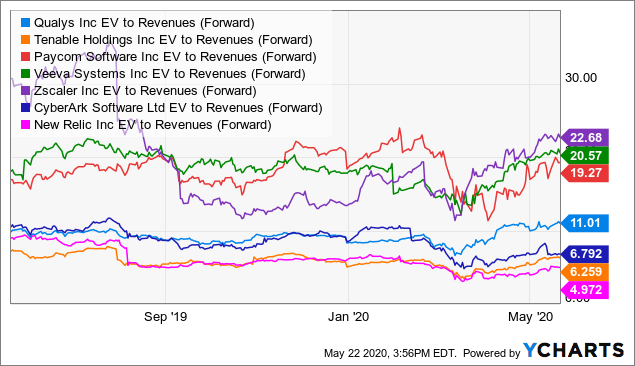

The company provides a very good chart in their presentation slides, which shows the coveted Rule of 40 across many security and SaaS competitors. As the chart demonstrates below, QLYS remains among the leading companies given their high level of profitability. If one were to only look at this chart, we would assume QLYS should be trading at the higher end of this peer group in terms of forward revenue.

Source: Company Presentation

With a current market cap of ~$4.35 billion, cash/investments of $325 million and no debt, the company has a current enterprise value of ~$4.0 billion. Using management’s 2020 revenue guidance of $354-359 million, which represents 10-12% growth, this implies a 2020 revenue multiple of ~11.2x.

To extrapolate this a little further, assuming revenue for 2020 comes in at the midpoint of management’s guidance and grows only 10% in 2021, we could see 2021 revenue of ~$400 million, which would imply a 2021 revenue multiple of only ~10x, which does not seem overly aggressive considering the company’s history of consistent revenue growth, conservative guidance, and strong margins.

Since reporting earnings a few weeks ago, the stock has not moved too much, likely resulting from strong Q1 results being offset by guiding to decelerating growth for the remainder of the year. QLYS continues to demonstrate consistency and strong profitability through margin expansion. While revenue growth may remain under pressure in the near term given the uncertainty in the market resulting from the global pandemic, I believe long-term investors will continue to be rewarded.

Risks to QLYS include greater competition from new market players, such as TENB. In addition, QLYS could see a quicker deceleration in revenue than is expected or begin to see margins contract. Both of these factors would likely cause the stock's multiple to significantly contract.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.