The Arrival Of The 'Unavoidable Pension Crisis'

by Lance RobertsSummary

- I wrote an article in 2017 discussing the “Unavoidable Pension Crisis.” At that time, most did not understand the risk.

- Since then, the situation has continued to worsen.

- COVID-19 pandemic has likely triggered a rolling pension collapse over the next couple of years.

In 2017, I wrote an article discussing the “Unavoidable Pension Crisis.” At that time, most did not understand the risk. However, two years later, the “Unavoidable Pension Crisis” has arrived.

To understand we are today, we need a quick review.

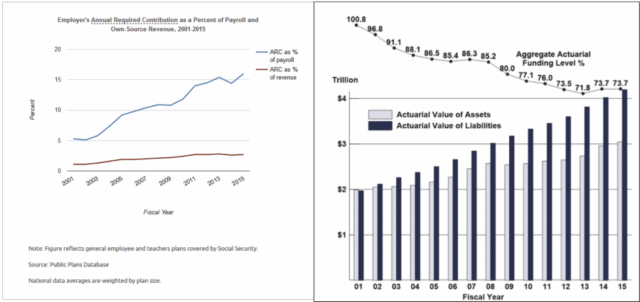

“Currently, many pension funds, like the one in Houston, are scrambling to marginally lower return rates, issue debt, raise taxes, or increase contribution limits. The hope is to fill the gaping holes of underfunded liabilities in existing plans. Such measures, combined with an ongoing bull market, and increased participant contributions, will hopefully begin a healing process. Such is not likely to be the case. This problems are not something born of the last ‘financial crisis,’ but rather the culmination of 20-plus years of financial mismanagement. An April 2016, Moody’s analysis pegged the total 75-year unfunded liability for all state and local pension plans at $3.5 trillion. That’s the amount not covered by fund assets, future contributions, and investment returns ranging from 3.7% to 4.1%. Another calculation from the American Enterprise Institute comes up with $5.2 trillion, presuming that long-term bond yields an average 2.6%. With employee contribution requirements extremely low, the need to stretch for higher rates of return have put pensions in a precarious position. The underfunded status of pensions continues to increase.”

The Crisis Is Here

Since then, the situation has continued to worsen as noted by Aaron Brown in 2018:

“Today the hard stop is five to 10 years away, within the career plans of current officials. In the next decade, and probably within five years, some large will face insolvency,

We are already there. Here was the key sentence in Brown’s commentary:

“The next phase of public pension reform will likely be touched off by a stock market decline. Such creates the real possibility of at least one state fund running out of cash within a couple of years. The math says that tax increases and spending cuts cannot do much.”

Brown was right, and the COVID-19 pandemic has likely triggered a rolling pension collapse over the next couple of years. Via the NYT:

“Now the coronavirus pandemic have it ticking faster. Already chronically underfunded, pension programs have taken huge hits to their investment portfolios over the past month as the markets collapsed. The outbreak has also triggered widespread job losses and business closures that threaten to wipe out state and local tax revenues. That one-two punch has staggered these funds, most of which are required by law to keep sending checks every month to about 11 million Americans.”

Over Promise Under Deliver

Here is the real problem:

“Moody’s investor’s service estimated that state and local pension funds had lost $1 trillion in the market sell-off that began in February. The exact damage is hard to determine, though, because pension funds do not issue quarterly reports.”

At the end of the year, we will find out the true extent of the damage. However, this is not, and has not been, a real plan to fix the underfunded problem. “Hope” for higher rates of sustained returns continues to be the only palatable option. However, targeted returns have continuously fallen short of the projected goals.

To wit:

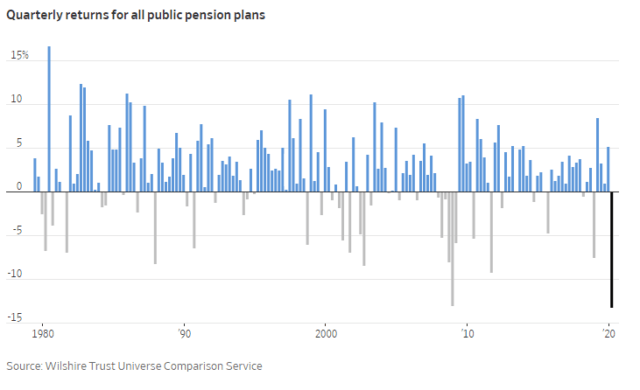

“Over the past decade, public pensions had ramped up stockholdings and other risky investments to meet aggressive return targets that average around 7%. For the 20 years ended March 31, public pension-plan returns have fallen short of that target, however, returning a median 5.2% according to Wilshire TUCS.”

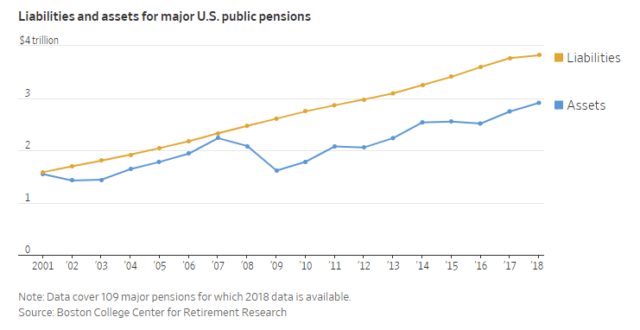

While State and Local governments all want to ignore the problem, it is isn’t going away. There is a simple reason why pensions are in such rough shape: The amount owed to retirees is accelerating faster than assets on hand to pay those future obligations. Liabilities of major U.S. public pensions are up 64% since 2007, while assets are up 30%, according to the most recent data from Boston College’s Center for Retirement Research.

More importantly, there is nothing that can, or will, change the two pre-existing problems which have plagued the economic shutdown is exacerbating pensions.

Problem #1: Demographics

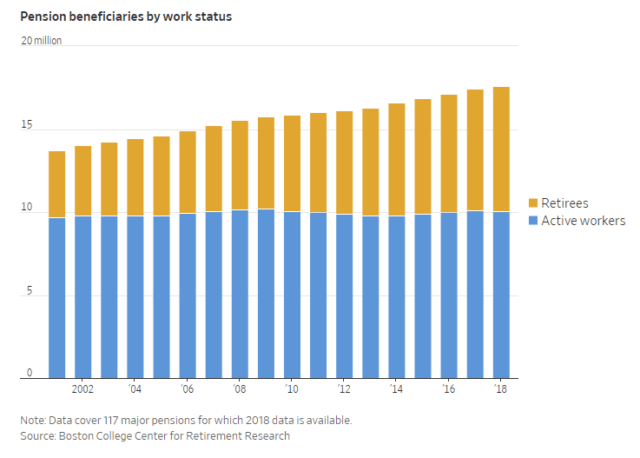

With pension funds already wrestling with largely underfunded liabilities, demographics are another problem as baby boomers age. The number of pensioners has jumped due to longer lifespans and a wave of retirees over the past decade, while the number of active workers remained relatively stable.

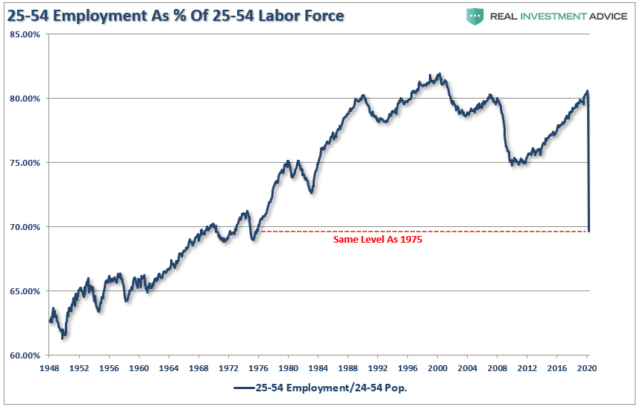

The problem compounds as the labor-force participation for the prime-age working group of 25-54 years of age declines due to the economic shutdown.

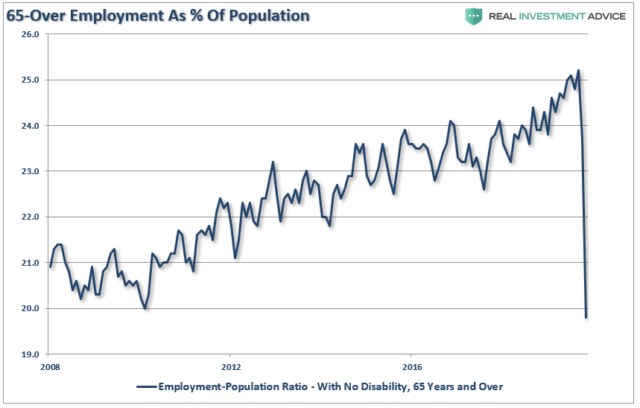

At the same time, companies are forcing the over-65 participants into retirement. These individuals are immediately able to start taking pension distributions.

A Fertility Problem

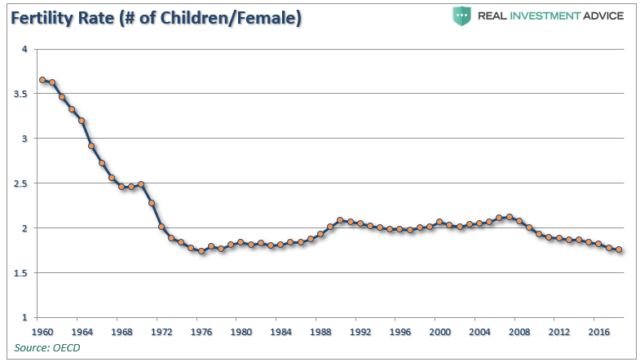

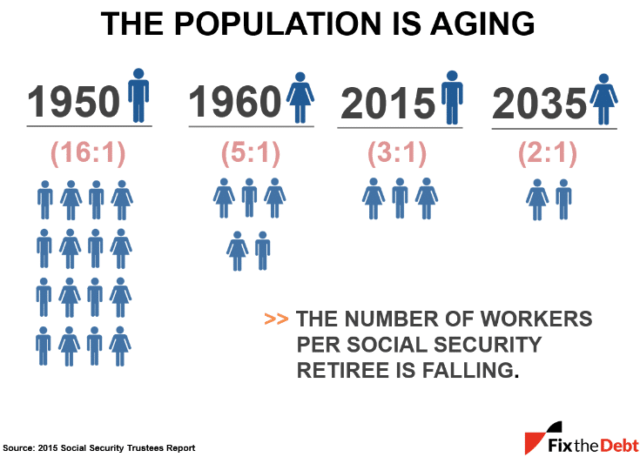

One of the primary problems continues to be the decline in the ratio of workers per retiree as retirees are living longer (increasing the relative number of retirees), and lower birth rates (corresponding number of workers.) Such is due to two demographic factors:

- An increased life expectancy coupled with a fixed retirement age; and,

- A decrease in the fertility rate.

In 1950, there were 16-workers per social security retiree. By 2015, the support ratio dropped to 3:1, and by 2035 it is projected to just 2:1.

As discussed previously, the problem is that while the “baby boom” generation may be heading towards retirement years, there was little indication they were financially prepared to retire. To wit:

“As part of its 2019 Savings Survey, First National Bank of Omaha examined Americans’ habits, behaviors, and priorities when it comes to saving, monthly spending, and retirement planning. The findings showed that nearly 80% of Americans live paycheck to paycheck.

Many have now been “asked to retire,” which means they cannot collect unemployment benefits. They are also permanently removed from the labor force.

Such is particularly problematic for pension funds because this will lead to an immediate demand for payouts at a time when pension fund assets decline. Unfortunately, the ultimate burden will fall on those next in line.

Problem #2: Markets Don’t Compound

The biggest problem is the computations performed by actuaries. The assumptions regarding current and future demographics, life expectancy, investment returns, levels of contributions or taxation, and payouts to beneficiaries, among other variables, consistently turn out wrong.

Using faulty assumptions is the linchpin to the inability to meet future obligations. By over-estimating returns, it has artificially inflated future pension values. However, high expected returns are required to reduce the required contributions to the pension plans.

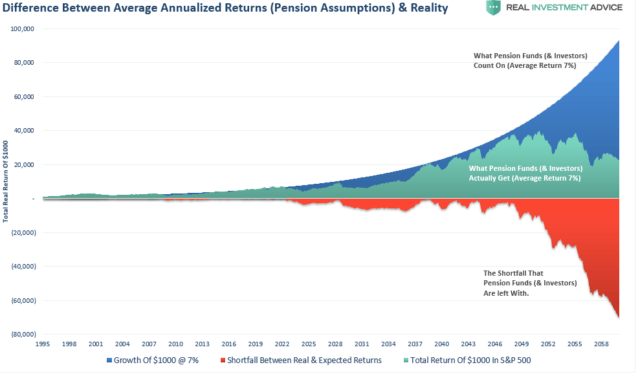

There is a significant difference between actual and compounded (7% average annual rate) returns. The market does NOT return an AVERAGE rate each year, and one negative return compounds the future shortfall. (Forward projections are a function of expected return values due to rising deficits, valuations, and demographics.)

With pensions still having annual investment return assumptions ranging between 6–7%, 2020 will likely be another year of underperformance.

As noted, pensions do not have much choice but to hope for high returns. If expected returns decline by 1–2 percentage points, the required contributions increase dramatically. For each point of reduction in the assumed return rate, pensions require a roughly 10% increase in contributions.

For many plan participants, particularly unionized workers, increases in contributions are difficult to obtain. Pension managers must maintain better-than-market return assumptions that requires them to take on more risk.

Guiding Down

But therein lies the problem.

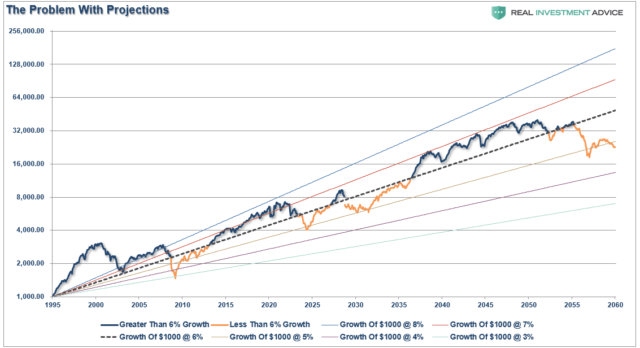

The chart below is the S&P 500 TOTAL return from 1995 to present. Projected returns use variable rates of market returns with cycling bull and bear markets, out to 2060. I have also added projections of 8%, 7%, 6%, 5%, and 4% average rates of return from 1995 out to 2060. (I have made some estimates for slightly lower forward returns due to demographic issues.)

Given real-world return assumptions, pension funds SHOULD lower their return estimates to roughly 3-4% to potentially meet future obligations and maintain some solvency.

Again, pension funds won’t, and really can’t, make such reforms because “plan participants” won’t let them. Why? Because:

- It would require a 30-40% increase in contributions by plan participants they simply can not afford.

- Given many plan participants will retire LONG before 2060 there simply isn’t enough time to solve the issues, and;

- The bear market is already further crippling plan’s abilities to meet future obligations without massive reforms immediately.

Government Bailouts

Such is why municipalities across the country have been lobbying the Democratically controlled Congress to pass another funding bill to provide financial relief. The bill, passed by House Democrats, specifically included the following:

The cornerstone of the 1,800-page bill is $875 billion for state and local governments.

Unfortunately, $875 billion is a drop in the bucket.

The real crisis comes when there is a ‘run on pensions.’ With a large number of pensioners already eligible for their pension, the next decline in the markets will likely spur the ‘fear’ that benefits will be lost entirely. The combined run on the system, which is grossly underfunded, at a time when asset prices are declining will cause a debacle of mass proportions. It will require a massive government bailout to resolve it.”

This is why the Fed is terrified of a market downturn. The pension crisis IS the “weapon of mass destruction” to the financial system, and it has started ticking.

Pension plans in the United States have a guarantee by a quasi-government agency called the Pension Benefit Guarantee Corporation (OTC:PBGC), the reality is the PBGC is nearly bust from taking over plans following the financial crisis. The PBGC will run out of money in 2025. Moreover, its balance sheet is trivial compared to the multi-trillion dollar pension problem.

We Are Out Of Time

Currently, 75.4 million Baby Boomers in America—about 26% of the U.S. population—have reached or will reach retirement age between 2011 and 2030. Many of them are public-sector employees. In a 2015 study of public-sector organizations, nearly 50% of the responding organizations stated they could lose 20% or more of their employees to retirement within the next five years.

Local governments are particularly vulnerable: a full 37% of local-government employees are at least 50-years of age in 2015.

It is now 5-years later, and the problems are worse than before.

It is no surprise that public pension funds are completely overwhelmed, but they still do not realize that markets do not compound at an annual return of 7% annually. Such has led to the continued degradation of funding levels as liabilities continue to pile up

If the numbers above are right, the unfunded obligations of approximately $5-$6 trillion, depending on the estimates, would have to be set aside today such that the principal and interest would cover the program’s shortfall between tax revenues and payouts over the next 75 years.

That isn’t going to happen.

The “unavoidable pension crisis” has arrived, and the consequences will devastate many Americans, depending on their retirement pensions.

“Demography, however, is destiny for entitlements, so arithmetic will do the meddling.” – George Will

Whatever amount you are saving for retirement is probably not enough.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.