Preformed Line Products: Value, Growth, And Insider Buying

by Mitchell RosenthalSummary

- Fundamentals have rebounded sharply since 2016, yet valuation multiples are attractive on a historical and relative basis.

- Margins, efficiency, and growth metrics are substantially better than those of peers. Number of outstanding shares has been steadily falling.

- Some "smart money" appears interested. Jim Simons owned 1.62% of shares as of 3/31/20.

About

Preformed Line Products Company (PLPC) sells products used to build and maintain energy and communications systems. As their 10-Q explains:

Our primary products support, protect, connect, terminate, and secure cables and wires. We also provide solar hardware systems, mounting hardware for a variety of solar power applications, and fiber optic and copper splice closures.

A little over half of its Q1:20 revenues came from the U.S., 18.1% came from EMEA, 15.9% came from the Americas, and 13.09% came from the Asia-Pacific region.

Why Now?

Fundamentals have rebounded sharply since 2016, yet valuation multiples are attractive on a historical and relative basis. Additionally, insiders own more than 16% of shares and have been buying shares over the past three months for about $48/share (not far from the current price of $50). The number of common shares has been steadily falling since late 2015, down about 9% since then.

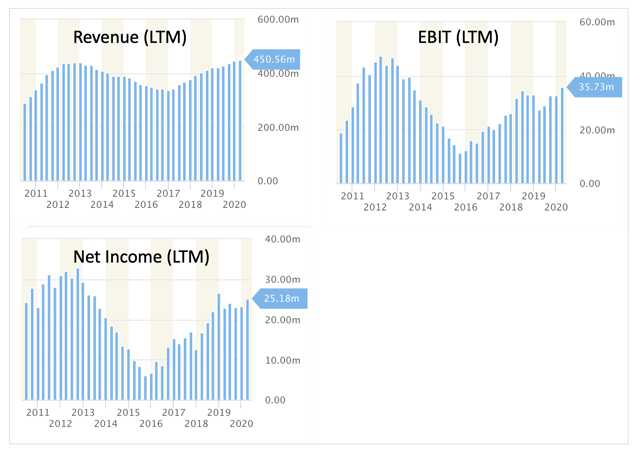

As the chart below shows, revenues, operating income, and net income (LTM) have improved considerably since 2016, according to data from StockRow. EBIT and net income have more than doubled since that time.

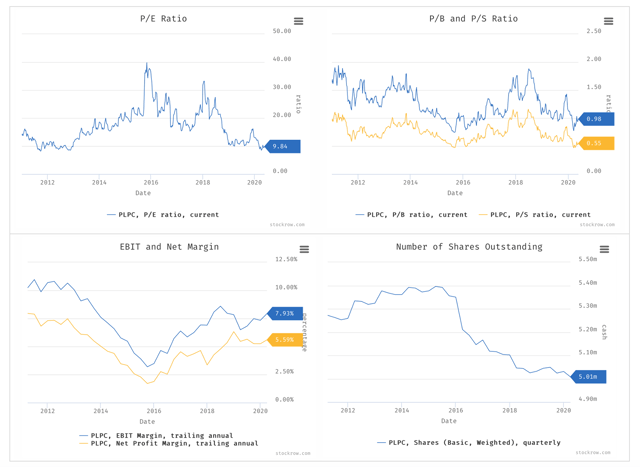

The stock's P/E is half of what it was in 2016. Its P/B and P/S multiples are essentially unchanged from 2016 and both are still less than 1. Meanwhile, EBIT and net margins have doubled since that time, and the number of shares outstanding have been in a steady decline since then (see chart below).

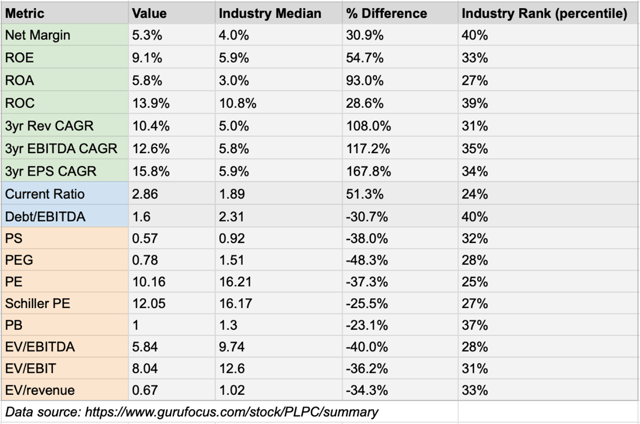

Additionally, PLPC's margins, efficiency, and growth metrics are better than most of its peers in the industrial products industry, and the company's valuation multiples are well below the industry median, according to data from GuruFocus (see below).

On the downside, the company's net debt has increased substantially, rising to $38.6mil in Q1:20 from $10.1mil in Q1:19. This is something to keep an eye on. However, the company's Altman-Z score (often used as a proxy for bankruptcy risk) stands at a healthy 3.91. And as the table above highlighted, the firm's Debt/EBITDA is still lower than the median value of its peer group.

Finally, as noted earlier, insiders have been buying over the past three months for around $48/share, fairly close to today's prices. Insiders owned more than 16% of shares as of Q1:20. Additionally, some "smart money" appears interested in the stock. Jim Simons, founder of famed hedge fund Renaissance Technologies, owned 1.62% of shares as of 3/31/20.

Bottom Line

PLPC's fundamentals have improved substantially since 2016, valuations look attractive, and insiders are buying. Though debt use has increased, it still looks fairly reasonable. Additionally, investor sentiment has been improving; shares have recovered from their March 2020 levels and have recently broken above the 50-day moving average and stayed above it. This stock will likely interest value investors looking for companies that are outperforming peers at a reasonable price, and whose stock prices are recovering after initially falling out of favor.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in PLPC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.