How Netgear Is More Than Just A 5G Play

by Chris LauSummary

- Netgear's revenue growth picked up at the tail-end of the first quarter.

- Paid subscribers could double.

- Mesh network, WiFi 6, and hotspots are positive drivers for revenue growth.

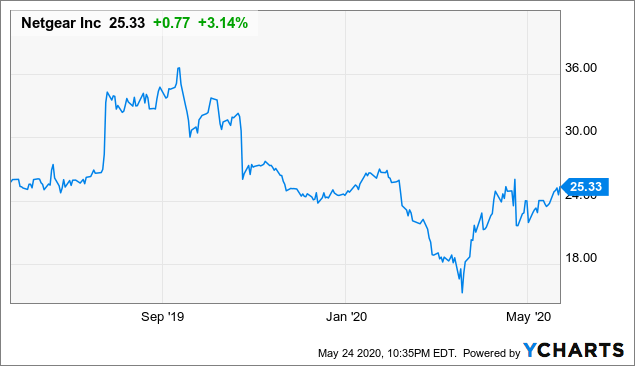

Netgear (NTGR) shares are little changed since its valuations were last reviewed in Jan. 2020. Anyone who bought NTGR stock on the massive March 18 sell-off would have done well. The stock added $10 from there and is back at the $25 level. After work from home levels surged during the lock-down, the company should have reported strong unit sales thanks to WiFi 6 router and 5G mobile hotspot. Instead, the company faced a few headwinds in the period. Should investors look at the quarterly revenue short-fall as a temporary setback? Does Netgear have positive catalysts ahead that will send the company’s valuation back to the $1 billion levels?

Stronger Second Quarter Expected

Netgear reported revenue falling 7.7% year-on-year to $229.96 million. It earned 21 cents a share (non-GAAP) but lost 14 cents on a GAAP basis. The difference is due to the exclusion of stock-based compensation of $5.6 million, litigation reserves, and amortization of intangibles.

Below: Netgear erased March's losses.

Data by YCharts

Netgear stock trended higher after the April 22 report because the company said on its conference call that market demand strengthened toward the end of the quarter. The "massive shift to work from home around the world" increased demand for WiFi 6 centric chips in its consumer market. On the small and medium business, Power-over-Ethernet demand improved.

Geographically, sales in the Americas rose 6.9% Y/Y but in EMEA, net revenue fell 26%. The latter drop is due to tougher yearly comparisons. In Q1/2019, a scheduled Brexit deadline accelerated orders. Similarly, investors may expect the increasing work from home movement will increase hardware sales in the current quarter.

Netgear ended the quarter with $209.7 million in cash. It reduced its inventory by $54.9 million. This positions it to shift its mix towards more highly profitable products like WiFi 6.

Opportunity

Increasing demand for better wireless coverage in large homes may drive WiFi 6 Mesh product sales higher. Netgear sells its Mesh products in varying sizes, with prices in the range of $229 to $699. Its two major competitors do not have a comparable product on the market. This will give the networking firm a strong lead.

Netgear said that “mobile hotspots are now being used by people working from home when they are not able to get high-speed wired Internet access.” For example, first responders relied on hotspots during the pandemic. So, after adding a record 51,000 paid subscribers for its mobile hotspot service, it ended the quarter with 228,000. The strong demand should continue throughout the year. Netgear should have no problem exceeding its goal of more than doubling its subscriber base in 2020.

The Pro AV, or Professional AV over IP, the product is another growth opportunity for the company. Announced on Nov. 5, 2019, the shift from 1080 to 4K and from 4K to 8K will drive the demand for this product line.

5G Play

Long time readers may follow the many 5G stock ideas published over the last year. Nokia (NOK), AT&T (T), and NXP Semiconductor (NXPI) are just a few companies that benefit from 5G. Similarly, Netgear’s 5G WiFi 6 mobile hotspot offers its customers double the performance of a 4G mobile hotspot. For now, chances are good that mobile hotspot solutions will lead to higher service provider revenue.

Price target and Your Takeaway

Few analysts cover Netgear but those who rank the stock as a “buy” have a price target between $30 - $38:

Data Courtesy of Tipranks

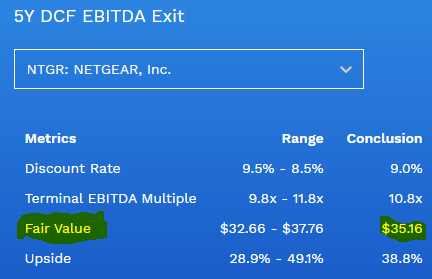

Since Netgear will likely report stronger service provider revenue in the coming quarters, the stock may offer investors another $10 in upside, or a gain of 38%. This is based on the following metrics in a 5-year DCF EBITDA Exit model:

Data courtesy of finbox (click on the link to re-calculate fair value)

After the run-up, Netgear probably has a limited upside in the near-term. My $35 price target may not play out until later this year. If it gets there, the stock will return to the billion-dollar market capitalization it lost due to selling pressure in the last year.

Please [+]Follow me and select "real-time" to get free email alerts on my publications. Get coverage on neglected, undervalued technology stocks. Previous DIY Top Idea tech alerts included Datadog, Nutanix, Fabrinet and Okta. Click on the "follow" button beside my name.

Join DIY investing today.

Disclosure: I am/we are long NOK. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.