Celsius: Hold On For The Ride

by WY CapitalSummary

- Celsius's potential TAM is massive and should support many years of strong growth.

- Even with COVID-19 substantially disrupting marketing, the company is still showing strong growth.

- With Bang signing an exclusive distribution agreement with Pepsi, Celsius should be able to sign up several great distributors.

- Overall, profitability is increasing, growth remains strong, yet the company still trades at a discount to peers.

Some stocks just have to be bought and held to get the best returns. While I originally bought Celsius Holdings (NASDAQ:CELH) because it was trading at a discount to peer Monster Beverage (MNST), over the past few months after tasting the drink and doing more research, I now believe the company would likely be a much better investment over the long term.

Massive opportunity

One of the main reasons why we decided to hold Celsius for the long term is because of its immense TAM. Even though Celsius has seen phenomenal growth over the past few quarters, there is still a substantial opportunity for further growth.

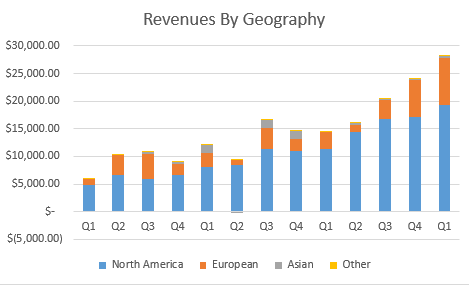

Source: WY Capital, company filings

The North American segment, for instance, still has less than $80mil in annualized sales despite 70% growth in Q1. Considering the market is $3.25bil and growing mid-single digits, there is substantial opportunity for additional growth domestically.

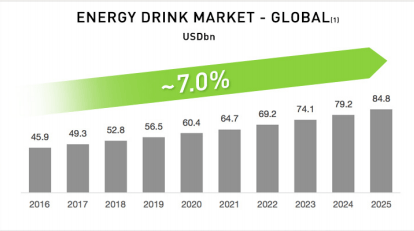

International is an even bigger opportunity for Celsius. According to its investor presentation, the global energy drink market is current $60bil and estimated to grow at a CAGR of 7%. The international market is so big that even mature brands like Monster and Red Bull have seen double-digit growth recently in international markets, while Celsius has barely tapped the international arena, with most of its international revenues coming from Europe and China.

Source: Celsius investor presentation

Currently, Celsius cannot afford to focus too heavily on the international market due to its small size, but after a few years, when its US sales are more developed, international will be a massive growth driver.

COVID-19 and other developments

Despite the massive impact of COVID-19 on businesses around the world, Celsius seems mostly unaffected, likely due to its diversified distribution network. The largest impact of COVID-19 on Celsius was causing nearly all large events to be canceled, which substantially disrupted Celsius's marketing strategy.

Up until the COVID virus pandemic, a significant component of our marketing strategy primarily consisted of live integrated programs that reached a critical mass of consumers at large gatherings. Our Live Fit Tour, for example, integrated fitness and competitive activities where we reached tens of thousands of new consumers in high energy settings. Source: Q1 2020 call

However, Celsius was able to quickly pivot to online marketing strategies, including hosting virtual workouts, signing sponsorship deals with grocery delivery services, and working with online retailers. This marketing campaign seems to have worked, as Celsius more than doubled sales and gained market share on Amazon.

And for the 13 weeks ending April 11, 2020 sales in dollars in the energy drink category within Amazon versus the same period a year ago indicated Celsius sales growth of 118.2% and it's share increased 2% within the category to 11.4, which further demonstrates the momentum we are building in the category with Celsius. Source: Q1 2020 call

Despite the marketing disruption, sales seem to be holding up well. In Q1, Celsius reported its best sales growth since 2018. While some of this was due to the Func Food acquisition in Q3 2019, organic growth was also quite strong - if you remove an estimated $3.5mil in Func Food sales in the quarter, sales growth would still be around 70%. Momentum has slowed somewhat in Q2, with growth in April slowing to around 38%, but considering the economic situation, this growth is quite impressive.

As we enter the second quarter, we are seeing growth in April orders and in North America, we have seen growth of approximately 38% over the prior year, which provides us further confidence on our ability to maintain our momentum in the category. Source: Q1 2020 call

In addition, during the quarter, Bang signed an exclusive US distribution deal with Pepsi (NASDAQ:PEP). This has disrupted the industry substantially, which has opened up many opportunities for Celsius to exploit. We believe Celsius should be able to take advantage of the current volatility to increase distribution substantially in the US, leading to strong revenue growth.

We feel we're in a good position, we're already up to 100 distributors and the ones we were talking with and had conversations ongoing and dialog, it was really a challenge because Bang had exclusivity in a lot of contracts that were in place with these distributors. But now that has opened we have discussions ongoing. We feel we're in a really good spot. Some of the distributors that are releasing Bang are very excited for the opportunity to work with Celsius. Source: Q1 2020 call

Financials

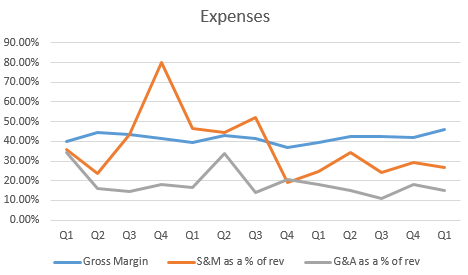

Outside of revenues, Celsius's profitability saw substantial improvement as well. Gross margins reached its highest point in the company's history - 46%, as the strong sales growth led to substantial operating leverage. Other opex like S&M and G&A also saw a decline as a % of revenue. All this led to the 2nd profitable quarter in the company's history, with an operating profit of $1.3mil.

Source: WY Capital, company filings

While we believe gross margins have reached their peak for now, we believe S&M and G&A expenses will further continue to decline as Celsius continues to grow, which should lead to substantial profitability improvements in the years ahead.

Valuation

Currently, Celsius trades at around $550mil, or around 5x estimated 2020E revenue. This is still a discount to the 8x multiple that slower-growing Monster Beverage is currently trading at, and even if you take out Func Food, the gap isn't narrowed substantially.

It doesn't make sense how Celsius is trading for such a low multiple, considering (1) profitability has been improving substantially, (2) organic sales are still seeing strong growth and (3) TAM remains as large as ever. We believe the discrepancy mainly is caused by the small market cap, meaning most institutional investors have very little knowledge of Celsius. As Celsius continues to grow, we believe this problem should be solved.

The main risk with Celsius is competition and execution. The energy drink market is quite crowded, with many players and very low barriers to entry, so a potential challenger to Celsius could arrive any day. However, with a strong brand and a unique product, we doubt it would be easy for competitors to replicate Celsius's success. As long as management continues to execute well, the current price will prove to be a bargain within a few years.

Takeaway

Overall, with a massive TAM, a differentiated product, and sizzling growth, Celsius is poised to capture a substantial share of the energy drink category over the long run, which we believe will generate substantial shareholder returns along the way. It took us half a year to realize Celsius is supposed to be a long-term investment, but now that we know this, we no longer plan to sell, even after the current run-up.

Disclosure: I am/we are long CELH. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.