Merger Arbitrage Analysis And Spread Performance - May 24, 2020

by Mal Spink, CFASummary

- ForeScout Technologies declines following the accusation of a MAE and subsequent legal action.

- COVID-19 forces investors to reanalyse merger arbitrage risks.

- Average merger arbitrage cash spreads marginally higher during the week.

This weekly column explains the reasons behind the movement in a selection of the largest U.S. cash merger arbitrage spreads from the past week as calculated by Merger Arbitrage Limited. We analyze the attractiveness and profitability of each spread going forward and indicate the trading position or action we have taken or intend to take based upon the analysis given.

Forescout Technologies (FSCT)

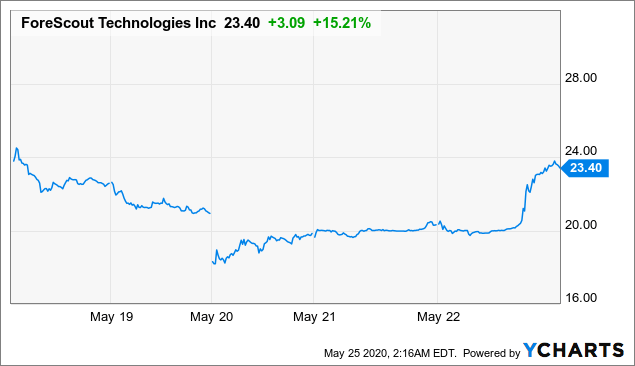

Forescout Technologies moved sharply lower on Monday as the company announced that

Advent provided notice to Forescout that it would not be proceeding to consummate the acquisition of Forescout on May 18, 2020, as scheduled

The stock continued to trade lower over the next couple of days when an update from Forescout was released stating they had filed a complaint with the Delaware Court of Chancery. The press release stated,

On May 15, 2020, Advent notified Forescout that it would not consummate the acquisition on May 18, 2020, as scheduled. Advent’s purported excuse for its wrongful conduct is that a closing condition to the transaction has not been satisfied because a “material adverse effect” has occurred at Forescout. Forescout believes that no material adverse effect has occurred, that all closing conditions are satisfied, and that Advent is obligated to close the transaction. Forescout believes that Advent has relied on meritless excuses to support its position.

And then continued,

The merger agreement explicitly allocated the risk of any impacts from COVID-19 to Advent. Since announcing the transaction, Forescout shareholders overwhelmingly approved the transaction…“We have satisfied all conditions to closing under our merger agreement, and a material adverse effect has not occurred,”

However, Forescout have not explicitly stated that the reason for the company material adverse effect claim was related to the Covid-19 pandemic. Finally, on Friday, the stock rebounded on news that a Delaware judge has set an evidentiary hearing for the company’s lawsuit against Advent for June 2-3. Unfortunately for Advent, the hearing comes before the June 6 termination date thus denying them the possibility of escape by allowing the deal to lapse.

This decline follows the revelation of potential issues surrounding the restructuring and borrowings of FSCT and whether or not they breach a loan covenant. Some analysts believe the stock may fall as low as $13 in the worst case scenario. Advent have yet to comment on the case but clearly believe they have a potential exit via a MAC clause. FSCT however feel confident they can force Advent to close the deal. Then again, FSCT clearly want the acquisition to happen so in effect they have nothing to lose. The vagueness of their commentary however does raise our suspicions.

By the close on Friday, the stock had finished down by $6.12 at $23.40, a fall of 20.73%. This gives a simple spread of 41.03% against an offer price of $33.00 from Advent International. We previously stated we are considering a short position in this stock but were unable to do so before Monday’s announcement. We would expect little information from either company until the hearing commences and as such will refrain from taking a position. Speculation on pending legal outcomes is beyond the scope of many merger arbitrageurs. During these unprecedented times this a tough decision to call even for seasoned legal observers. We strongly advise traders to reevaluate what their potential loss may be when speculating in this type of situation.

Merger Arbitrage and Market Data

The broader market powered ahead during the week as a renewed sense of investor optimism returned. Economies around the world have now begun to tentatively reopen. Meanwhile, clinical trials continue in abundance. It appears investors were happy to shrug off political tensions. This comes despite the U.S. senate introducing a bill which has the potential capability to delist Chinese stocks from U.S. exchanges. By the close on Friday, the broader market in the U.S. as defined by the S&P 500 ETF (SPY) finished up 3.20%.

The IQ ARB Merger Arbitrage ETF (MNA) declined steadily through the week and despite a brief rally on Friday finished in the red. Falls in FSCT & TECD were the reason for the decline. However, Delphi Technologies (DLPH) continues to generate positive returns benefiting from the absence of a short position in acquirer BorgWarner (BWA). (You can read our analysis of advantages and disadvantages of investing with the MNA ETF in the "Merger Arbitrage Strategy" section at the Merger Arbitrage Limited website). By the end of the week, the MNA was showing a loss of 0.86%.

Merger Arbitrage Portfolio Analysis

U.S. based cash merger arbitrage continued their negative performance run last week as the losers again triumphed over the winners by 14 to 6 with 0 non-movers. There were no cash positions last week as the index of cash merger arbitrage spreads maintains its full complement of 20 deal constituents. The top 20 largest cash merger arbitrage spreads as defined by MergerArbitrageLimited.com lost 0.69% whilst the dispersion of returns was 5.71%. The figure is remains below both the 3-month average but is now back above the long-term look back period. The negative performance of the portfolio was primarily attributable to the loss in FSCT accompanied by declines in TECD & ADSW. Positive performances from RRGB & BITA helped curtail the extent of these losses.

The index of cash merger arbitrage spreads now offers an average of 17.04%. This is marginally higher than last week's figure of 16.93% and is due to the stock price decline and extension to the expected completion date in the FSCT deal. For this coming week, the T20 portfolio has 20 deals and 0 vacant spots filled by cash which may prove to be the last full complement for some time.

For additional merger arbitrage discussion be sure to catch our exclusive interview with Seeking Alpha "SA Interview: Merger Arbitrage Investing With Mal Spink, CFA".

Merger arbitrage trading is not without risks. This strategy, although accessible to individuals as well as professionals, should be thoroughly understood BEFORE investment capital is put at risk. To assist the reader, "evergreen" content such as "how-to" & introductory guides, a reading list and much more including a list of the largest cash merger arbitrage spreads currently available can be found at the Merger Arbitrage Limited website associated with the author of this article.

Author's note: If you enjoy Merger Arbitrage Limited, please consider following us by clicking on the "Follow" button at the top of this page and hitting the "Like" button below.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.