First Solar Remains Solid Yet Unexceptional

by Simple Investment IdeasSummary

- First Solar reported mixed Q1 results in the face of the coronavirus.

- The company has the balance sheet and infrastructure to withstand near-term headwinds.

- FSLR's emphasis on manufacturing could backfire in the long-term.

First Solar (NASDAQ:FSLR) remains one of the most stable and consistent solar companies in the industry. The company has managed to maintain a strong leadership position in an industry plagued with volatility and bankruptcy. The coronavirus is once again testing First Solar's ability to operate in an uncertain environment. So far, First Solar has done a good job of mitigating the negative impacts of the pandemic.

First Solar reported somewhat mixed results in Q1. The company's quarterly GAAP EPS of $0.85 beat expectations by an impressive $0.61. However, First Solar's revenue of $532.12 million did remain flat on a Y/Y basis. This is not all that bad considering the current economic situation. While First Solar will likely be materially impacted by the coronavirus over the next few quarters, the company is well-situated to survive the pandemic.

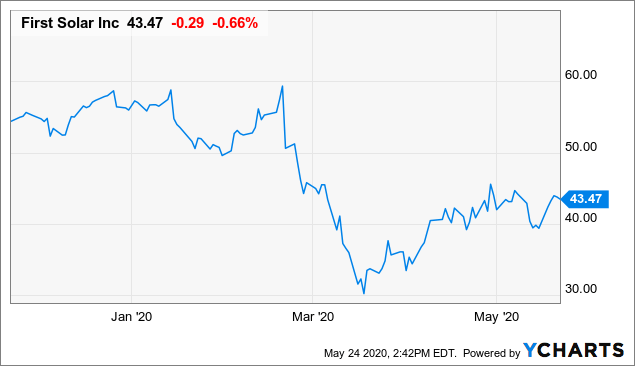

First Solar has recovered some of its coronavirus-related stock losses over the past few months.

Data by YCharts

Balance Sheet Remains Strong

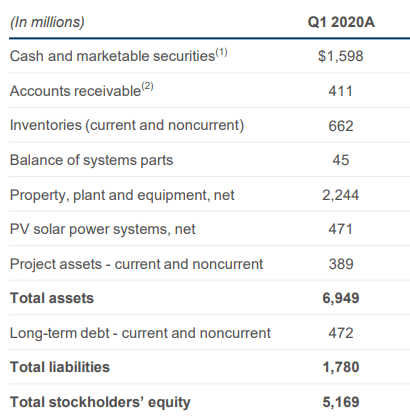

First Solar boasts one of the strongest balance sheets in the solar industry. Its strong balance sheet should prove particularly useful over the next few quarters as the coronavirus starts to take a deeper toll on the industry. At the end of Q1, First Solar had a cash, restricted cash, and marketable securities balance of $1.6 billion.

While First Solar's net cash position of $1.1 billion decreased Y/Y, this was partly the result of a $350 million payment for a class-action settlement. First Solar clearly has a large enough cushion to withstand coronavirus-related headwinds over the next few quarters. However, the negative impact of the coronavirus still cannot be underestimated given the uncertainty surrounding the ultimate economic implications of the pandemic.

First Solar's strong balance sheet should allow the company to fare far better than competitors during the pandemic. The coronavirus will likely disproportionately impact the smaller-scale solar market given the large amount of human-to-human contact necessary in that particular solar segment. Given that First Solar's business is more geared towards utility-scale solar, the company may be better protected from the economic downturn.

First Solar still possesses one of the strongest balance sheets in the industry.

Source: First Solar

Focusing on Series 6

First Solar is putting a great deal of attention on next-generation solar manufacturing. The company is focusing heavily on its Series 6 line in order to gain a competitive edge in the manufacturing space. The Series 6 module is at the cutting edge of thin-film technology and is likely to remain a focal point for First Solar in the near-term. The series 6 module offers low LCOE, higher yield, and efficiencies of around 17%.

Despite the impact of the coronavirus, demand for First Solar's Series 6 modules still remains strong. The company has a multiyear contracted backlog of ~12 GW. First Solar is even accelerating its Series 4 shutdown in order to focus more heavily on Series 6. While First Solar is making solid progress in its Series 6 transition, the transition will likely be slowed by disruptions caused by the coronavirus.

First Solar Series 6 panel will allow the company to remain cost competitive in solar manufacturing for the foreseeable future.

Source: First Solar

Solar Manufacturing Is Still Risky

First Solar's decision to focus more heavily on solar manufacturing as opposed to the project business comes with a great deal of risk. Solar manufacturing has always been an incredibly volatile and low-margin business, especially with the competition from Chinese manufacturers. Solar manufacturing has been littered with major collapses and bankruptcies over the past few decades.

While First Solar's thin-film technology is undeniably cutting-edge, the company will have to work incredibly hard to remain competitive in the long-term. Given how fast solar technology in general is advancing, solar modules become technologically obsolete far faster than technologies in other industries. As such, First Solar is taking a large risk in focusing so heavily on the manufacturing side of solar.

Conclusion

First Solar has firmly established itself as a premier solar company in an incredibly competitive industry. Unlike many other solar companies, First Solar possesses solid technology and strong financials. However, in the industry that is as competitive and fast-changing as solar, this may not be enough for First Solar to be considered a buy at its market capitalization of $4.6 billion.

Although First Solar is definitely doing far better than peers like SunPower (NASDAQ:SPWR), investors may still want to stay neutral on this company. It has proven to be incredibly hard for solar manufacturers to remain competitive over the long-term. First Solar's heavy emphasis on solar panel manufacturing could eventually backfire given the risks associated with the solar segment.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.