REITs That Will Soar

by Jussi AskolaSummary

- We invest in REITs in part because we believe that paying dividends matters.

- Yet our primary focus in on valuation, not on dividend safety.

- Indeed the present period is once again showing that there's no such thing as an absolutely safe dividend.

- We show a discounted cash flow valuation assuming a full year of lost revenue, and find that the market vastly overreacted in several REIT sectors.

- Opportunities abound.

Co-produced with R. Paul Drake for High Yield Landlord

The markets will recover. Maybe now. Maybe a year from now. What matters most is that they will recover.

An investor with cash now would do well to place that cash in areas that will soar during the recovery. It makes a lot of sense to move funds out of investments that have done OK or dropped only modestly into other investments that are highly likely to appreciate much more during the recovery.

Here we discuss our approach to REIT investments. We show how it leads us to the REIT sectors where prices will soar as the economy recovers.

Dividends Matter

We are big believers in dividend-paying stocks. One of the reasons we like REITs is that they are legally obligated to pay dividends with at least 90% of their taxable income.

Our studies have shown that dividend-paying stocks, including equity REITs, can be expected to outperform long term. This is doubly true when a retiree is withdrawing funds to support living expenses.

However, we do not select stocks on the basis of their dividend yield. We select them on the basis of valuation.

This may seem strange, as the name of our service is High Yield Landlord. It's true that we don’t favor REITs with tiny yields. But our focus is primarily on high total return.

We are followers of Benjamin Graham. We want to buy undervalued REITs. Because of the REIT dividend rules, these also have higher yields than fully-valued REITs. We don’t want to buy REITs whose high yield reflects their enduring, small prospects.

Perhaps we should have named our service High Return Landlord. But we didn’t.

Figure 1. We follow Benjamin Graham in seeking investments that are undervalued and have a margin of safety. Source.

Dividend Safety is a Mirage

Our emphasis on valuation at times places our recommendations in conflict with those of authors whose primary concern is dividend safety. These authors are attracted to SWAN (sleep well at night) stocks.

SWAN stocks very often pay comparatively low dividends, often only 2% or 3%. To compensate, they show large dividend growth rates over time.

There's an inherent tradeoff with REITs. A REIT can be fairly valued, pay a tiny dividend, and have the resources to grow rapidly. Or it can be fairly valued, pay a substantial dividend, and grow more slowly.

The low-paying SWAN stocks are a good place to be for long-term investors. Amongst fairly-valued REITs, owning these may make sense for investors far from needing to draw cash out.

Yet no dividend is absolutely safe.

Events always can develop so that any specific REIT sector becomes hard pressed. The economic pauses in response to COVID-19 has done this to some REIT sectors.

Some highly-touted SWANs have indeed cut or suspended their dividends in this present crisis. This includes mall REIT Tanger Factory Outlets (SKT) and shopping-center REIT Kimco (KIM) to date. Simon Property Group (SPG) also seems very likely to cut, when they announce their dividend next month.

Even the triple net lease sector is hard pressed. This may seem a shock, as such REITs are often seen as bond substitutes, which is reflected in their interest-rate sensitivity.

Despite this, their dividends are now threatened. Quoting an article published on Feb. 15, 2020,

“NNN currently yields 3.69%. This isn’t an enormous yield, by any means. But it's incredibly safe.”

Yet less than two months later, NNN management had this to say in their earnings call:

“By no means is our dividend untouchable”

Other net lease REITs, save for Realty Income (O), have left open the door for dividend cuts as well.

Recent events have emphasized that an investor who expects to live on current dividends is being unwise. Retired investors really do need a cash buffer.

The cash buffer may come from prior dividends normally. But everyone also needs a plan that can take them through periods like this one, which may last two years or somewhat more.

The other weakness of the SWAN approach is that retirees may sensibly want larger returns. They should avoid the sequence of returns risks created by depending primarily on security appreciation for income. Amongst fairly valued REITs, it's often preferred stocks that appeal to this group.

We Buy Undervalued REITs

In contrast to those who try to buy “safe” dividends, our goal is to buy REITs that are not fairly valued. We seek REITs that are undervalued enough to bring us Benjamin Graham’s “margin of safety” regarding the price we pay. In modern terms, we are seeking alpha.

We emphasize that the price of such securities will be volatile and that the timescale for them to be revalued may well be five to 10 years. In the meantime, since we select well-managed REITs in sectors we believe in, we expect to normally receive good dividends while we wait.

Figure 2. To buy low we seek undervalued REITs. Source.

But we know that dividends are not guaranteed. If some black swan swoops in and they are stopped for awhile, this does not change our investment thesis. It would take permanent value destruction to do that.

With this perspective, we are not phased by bear markets. We are happy to hold what we own through them. And they provide buying opportunities for some REITs that more often than not are overpriced.

History Says NAV Discounts Drive Big Returns

Specifically, we emphasize buying REITs that are priced at a significant discount to their Net Asset Value (“NAV”). NAV is Total Asset Value less debt.

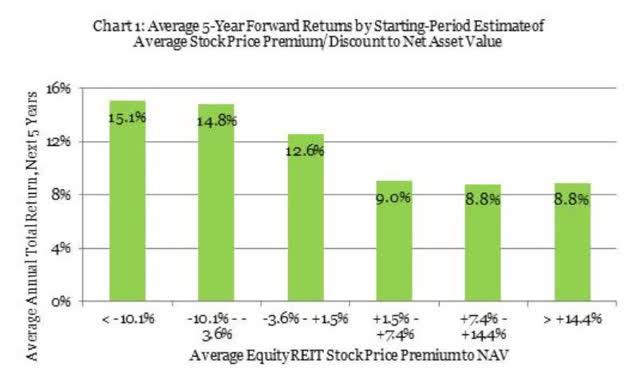

Buying REITs at a discount to NAV has historically been quite successful. In a 2017 article from Nareit, Brad Case reports that

“Since December 1990, five-year average total returns have tended to be about 11.88%% minus 18.97 times Green Street’s estimate of the average price-to-NAV premium at the beginning of the period.

He also includes Figure 3:

Figure 3. Significantly undervalued REITs have returned nearly twice as much as significantly overvalued REITs. Source.

What About NAV Destruction?

At the moment we are like kids in a candy store. But some doubters believe that the present period of temporary lost income is destroying a great deal of NAV.

What’s more, we are likely to soon see analysts evaluation of NAV come down more than makes sense. This always happens in bear markets.

Analyst values of NAV will come down more than is fundamentally justified. Analysts suffer great sociological and political pressures within their firms and communities as their valuations depart further from market prices. They always tweak their models to get the “known” result.

The shorthand path to valuation is to use “cap rates” to summarize the way the market for business properties values income. But this also is problematic at times like the present. Quoting David Simon from the latest SPG earnings call:

“Cap rates are and are not necessarily a science. We tend to look on return on equity, return on investment.”

Instead, let’s look at fundamentals for investors. The value of any business to an investor follows from the discounted sequence of cash flows that can be paid out or used to grow the business.

These cash flows are the Distributable Cash Flow (“DCF”), which is Funds From Operations (“FFO”) less maintenance capex. Here we approximate maintenance capex as 10% of pre-crisis EBITDA (2% for net lease REITs).

We looked at the annual reports filed with the SEC for 2019 for SPG, EPR Properties (EPR), Regency Centers (REG), and National Retail Properties (NNN). DCF ranged from 65% of revenue for NNN to 46% for EPR and SPG.

Based on the same documents, the combination of operating expenses, overhead, and interest ranged from 35% for NNN to 54% for REG and EPR.

Now suppose there were an entire year with zero revenue and if there was no reduction in opex. The approximate story is that these REITs would take a loss for the year of one ordinary year’s DCF. NNN would do better than that.

We then evaluated the discounted cash flows, assuming net total losses of the 2019 DCF in 2020, a return to the 2019 DCF in 2021, and potentially growth thereafter. In addition, we accounted for the interest expense on the additional debt taken on to cover the losses, which reduced DCF going forward by 4%.

One can take the sum out to all years since the additions to value are negligible after 20 or 30 years, for discount rates that investors will want. This gives simple expressions for the results.

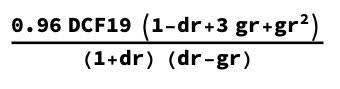

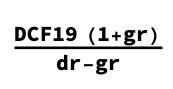

We designated the 2019 DCF as “DCF19.” We obtained this expression for the net present value of the cash flows which is...

...where “dr” is the discount rate and “gr” is the annual growth rate. In contrast, the value if there's no reduction in revenue in 2020 is:

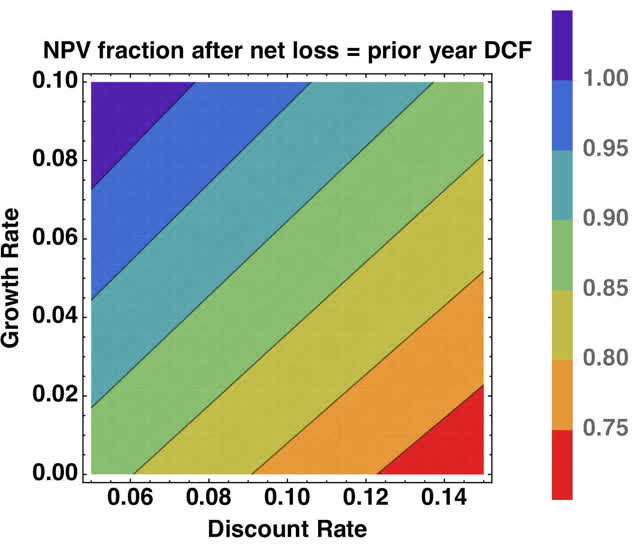

By taking the ratio of these two results, we find the value of the REIT including that year with no revenue, expressed as a fraction of the value with no lost revenue. Figure 4 shows the result.

Figure 4. Value of a REIT that has lost one year’s revenue, as a fraction of its value without any lost revenue, as a function of discount rate and growth rate. Source: author calculations.

The green band in Figure 4 shows fractions between 85% and 90%. This example shows how remarkably insensitive cash flow valuations are to even a massive disruption, if it's temporary.

In terms of numbers, the value of the cash flows is 21 times the DCF with no lost revenue and 18.4 times DCF after a full year of lost revenue. The corresponding values of price/FFO would be about the same for triple nets like NNN and roughly 10% smaller for REITs in other sectors.

This result is no surprise. It's quite close to long-term average REIT prices.

REIT Market Sectors That Will Soar

The market has vastly overreacted to the disruptions caused by COVID-19. In any sector that could've happened, suffering reduced income as a result.

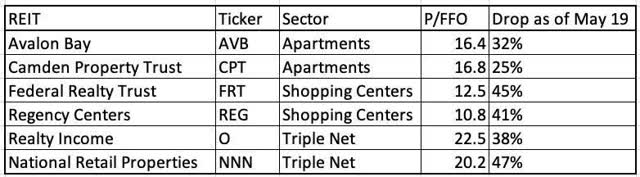

Figure 5 shows the drop from their highs of 6 REITs that are generally considered to be blue-chip REITs. The P/FFO is based on anticipated 2020 FFO before the virus hit.

Figure 5. These REITS are all ON SALE now. Source: High Yield Landlord.

We have come to learn that the apartment REITs have not suffered a significant loss in revenue, yet the best of them are still down 25% or more. They will soar as the market recovers.

The shopping center REITs have been collecting more than half their rent, but are being punished as though they will suffer massive permanent loss of income. Yet these centers emphasize businesses that are and will be needed by their neighborhoods and are resistant to e-commerce. They will soar as the market recovers.

Triple-net REITs generally are priced by the market well above NAV, because this lets them generate rapid and accretive growth. We won’t be buyers of NNN and O when they get back up there, but we cheerfully buy them now.

Conservative investors who have their money in REIT sectors that have dropped little, such as cell towers and data centers, now have an excellent opportunity. They could move some of those funds into blue-chip REITs like those shown here. Such REITs will provide better income and more appreciation over the next few years.

In all these sectors there also are very solid REITs that already were undervalued before the market dropped. These will bring even stronger returns going forward. One of our favorites in the shopping-center space is Brixmor Property Group (BRX).

There also are a quite a few REITs that have suffered from taking apocalyptic prognostications too seriously. Included in this group are SPG and EPR. We will save further discussion of these for other articles. An investor with a balanced view of human behavior will profit strongly by investing in such beaten-down opportunities now.

Historic Market Opportunity! Act Now!

The recent market crash has created exceptional opportunities. Many high-quality REITs are now offered at >10% sustainable dividend yields and have 100-200% upside potential in a recovery.

At High Yield Landlord, we are loading up on these discounted opportunities and share all our Top Ideas with our 1,600 members in real-time.

Start your 2-Week Free Trial today and get instant access to all our Top Picks, 3 Model Portfolios, Course to REIT investing, Tracking tools, and much more.

Get Started Today!

We are offering a Limited-Time 28% discount for new members!

Disclosure: I am/we are long BRX; SPG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.