High Yields From Tax-Advantaged Debt: America First Multifamily

by Rida MorwaSummary

- COVID-19 has created a completely new environment.

- The market is still struggling with figuring out the new reality and balancing the opposing forces.

- Where there's chaos lies opportunity.

- Multi-family rent collections have remained very strong. People prioritize paying rent for obvious reasons.

- Getting in at the debt level provides a good layer of protection, and can be done at a steep discount.

Co-produced with Beyond Saving

COVID-19 has created an environment that has never been seen before. Never before have we seen the US economy nearly shut down. Never before have we seen the economy attempt to restart. It's like turning the key in your car after you realize the lights were accidentally left on all night- will it start? Or will we just hear click, click, click, click.

It's understandable that the market is full of fear and uncertainty. While we can look back at prior recessions, the 2020 COVID-19 crisis is going to have its own history books that will describe all the reasons why it was different.

This uncertainty has reached the debt markets. In March, we saw an unprecedented disruption of the debt markets as there was a rush to liquidity larger than we have ever seen. The Federal Reserve stepped in to ease liquidity fears injecting an unprecedented amount of money into the economy.

Still, any debt that reflects credit risk continues to trade at a material discount to pre COVID-19 levels. Will people pay their debt? Will companies pay their debt? On the one hand, businesses are not designed to have zero revenue for an extended period of time and that puts on a significant strain.

On the other hand, the federal government has stepped up to the plate in a big way, providing some direct support, but perhaps most importantly, the Fed has ensured that banks have ample liquidity. Unconcerned about their own liquidity, lenders have been able to make deals, give borrowers a break and provide the all-important time for them to get back on their feet without defaulting.

The fear and uncertainty has caused the share prices of anything touching debt to fall. This means that for investors willing to buy now, there will be potential for fantastic future returns.

We want to own debt that has:

- Quality underlying collateral.

- Strong underlying fundamentals.

- A positive historical track record.

- Trading at a discount to par.

- Throw in some tax exemption for good measure

Too good to be true? Not at all. These are the kinds of opportunities that only come around when the market is panicking.

America First Multifamily Investors LP (ATAX) is a limited partnership that invests primarily in mortgage revenue bonds or MRBs. Mortgage revenue bonds are issued by state and local housing authorities to provide financing for affordable multifamily and student housing and commercial properties.

While called "bonds," these are more similar to mortgages as they are secured, on a first lien basis, by the underlying properties. The intent of the program is to provide capital for low-income housing, so the properties are required to have a percentage of their units dedicated to renters who are below the poverty line.

Additionally, ATAX directly owns two multifamily properties. Plus, they own non-controlling interests in ventures that build and stabilize multi-family properties with the intent to sell them at a profit, which they refer to as "Vantage Properties."

One of the big appeals to MRBs is that the interest income from them is tax exempt. Since ATAX is a limited partnership, this benefit is passed directly along to investors. This helps us investors get a little extra juice from our yield. Last year, approximately 37% of ATAX's distribution was tax exempt.

Rental Payments

Being in a secured lending position, ATAX is not directly impacted by the daily oscillations in rental revenues. Whether a particular building is very profitable or slightly profitable does not matter much for the MRB holder. However, it's important that the borrower is doing well enough that they can service their debt.

This is why it's fantastic news that the properties in ATAX's portfolio experienced 94% rent collection in April. In the ballpark of what they would expect to collect in a normal month.

Additionally, ATAX has prepared to offer forbearance to their borrowers if needed. Most of their MRBs are through Freddie Mac. Unlike residential mortgages, multi-family borrowers are required to prove hardship in order to qualify for forbearance. The current program allows for forbearance for up to three months, and then repayment would have to be made over a 12-month time frame. However, despite this option being available, as of May 8, none of ATAX's MRBs have requested forbearance.

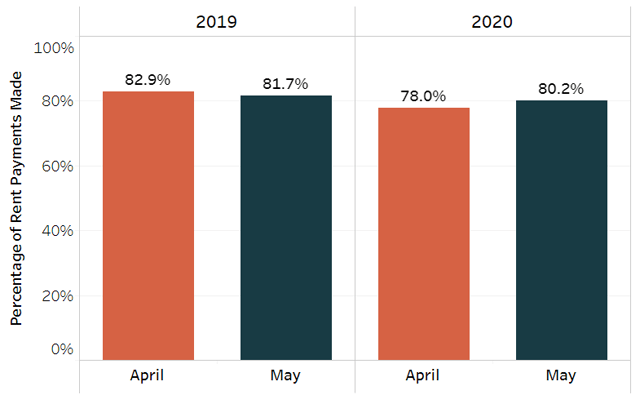

Despite the high unemployment rate, government stimulus appears to have been enough in April to ensure that most people are paying their rent. We do not yet have any numbers for May. However, aggregated statistics suggest that the first week of May payments are higher than April's and are only 1.5% lower than the were last year.

Source: NHMC

If this carries over to ATAX, then May collections could exceed the 94% they collected in April and we would expect all of their MRBs to be able to easily service their debt.

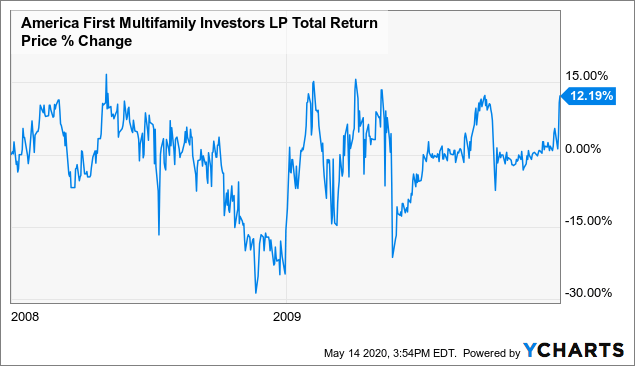

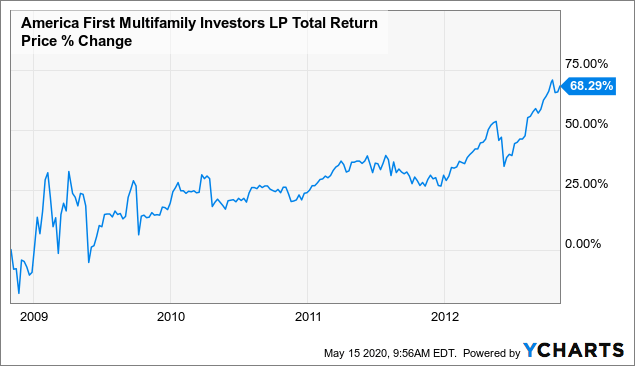

Rent is a crucial bill for most people. It's one of those bills that many might pay late, but overall, it's one that they will go to extraordinary measures to cover. We saw similar fears in late 2008, which sent ATAX's share price down nearly 30%.

However, most people paid rent throughout the recession, and apartment owners serviced their debt. ATAX did have four bonds that defaulted during this period, where they pursued foreclosure and were able to recover significant portions of the loans. One advantage of lending based on an operating property is that the collateral has material value.

While it led to pressure on cash flow and some realized losses, ATAX came out the other side and provided investors with positive returns for the period. Investors who were willing to take advantage of the panic, and buy the dip, did exceptionally well.

Balance Sheet

ATAX utilizes leverage, and they like to keep their leverage around 60% debt to assets. At the end of Q1, that's exactly where they were at. Historically, this has proven to be a debt level that provides ATAX enough cushion in troubled times, while boosting returns during the good times.

ATAX just recently made some positive changes, refinancing more than $50 million that was at 4%-4.5% interest rates into a single loan at 2.1% in April. Also, refinancing two mortgages at rates that were 25 and 40 bps lower than the prior loans. With interest rates having declined so dramatically, refinancing will provide an opportunity for ATAX to gain some incremental cash flow.

In terms of net book value per unit, ATAX is at $5.38 as of March 31, down only 4% from the end of 2019. ATAX went from trading at a 37% premium to book value, to trading at a 20% discount to book value.

Why The Decline?

We believe that ATAX should trade at a premium to book value. ATAX's bonds are secured by operating properties, which they have a demonstrated ability to recover value from in the event of a default. Plus, who doesn't love a little tax-free income?

They have reasonable leverage, and multi-family housing fundamentals remain strong. While other landlord types are reporting rent collection as low as 15%, multi-family rent collections have been only slightly below normal. If a 96% rent collection happened six months ago, nobody would have batted an eye of concern.

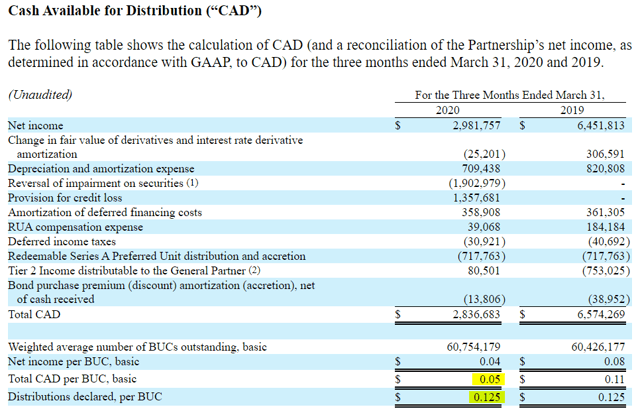

Certainly, the macro fears come into play, but we believe the main reason ATAX has failed to rebound is the "Cash Available for Distribution" or CAD metric.

Source: ATAX 8-Q May 6th

ATAX's CAD tends to be a lumpy number. However, in the long run, ATAX wants CAD to exceed the dividend. With CAD at less than half of the dividend, the market might be concerned. In fact, there was significant discussion on the earnings call regarding the dividend.

Part of the reason CAD is lumpy is that the Vantage investments rely on profiting from developing and then selling multifamily properties. This process takes about three years and dependent upon the ultimate sale. The timing of which is not predictable.

CEO Chad Daffer said,

One of them is how can we talk and we have a better picture of when the Vantage deals will be made available for sale. We've not given guidance in the past. And we're not going to do that today. But I think you can take – you can make your own assumptions and reviewing the financial data that's in our 10-Q. The greater question that I think everyone is waiting for? The answer to is and we appreciate it is, as we've discussed in the past our distributions to our BUC holders are made – determined by the ATAX general partner based on the cash available for the distribution. The general bar in working with the manager will evaluate the factors that go in to the BUC holder distributions. That is consistent with our long-term interest of the BUC holders surely. Right now we're evaluating the effects of COVID-19 on your investment portfolios and how – the negative impact to our liquidity and cash. And sometime in the next weeks, we're going to give guidance to the marketplace on what we're going to do with the distributions for 2000 – for Q2 2020 and beyond.

Source: ATAX Q1 2020 Earnings Conference Call

What we can take from this is that ATAX's outlook on CAD is going to influence their dividend decisions. It is influencing it now as they reduced their dividend to $0.06/quarter, and when the market improves and they can go back to selling properties, it will improve.

We note that Q2 CAD was impacted by a $1.9 million reversal of impairment. This is a one-time impact caused by the sale of PHC certificates and was reversing several previous adjustments made to CAD over many quarters. Backing that adjustment out, CAD was $0.08/unit. So the $0.06 seems to be sufficient to ensure that by year end their payout will match CAD for the year without needing to sell any properties at all.

Future Of The Dividend

These are trying times, and maintaining liquidity is essential. ATAX is unlikely to borrow money to cover the dividend, and they shouldn't. They made the decision to set the dividend at a level that is easily covered by cash-flow.

ATAX has hunkered down and preparing for the worst. April and May rents look strong because of the stimulus, but in June or July, things could change. We cannot guarantee that the government will pass another stimulus, or how long it will be for people to return to work. The longer people are unemployed, the more strain they will have paying their bills, the less rent is paid and the higher the risk of default.

ATAX's book value held up extremely well in Q1, and we expect that their book value will remain relatively resilient. This provides us 30% upside to book value, and even more upside if ATAX goes back to trading at a premium. We expect that upside will be realized in time, likely within a year. The dividend will continue to match CAD, so we would expect to see a raise when things become more clear and ATAX can resume selling properties at a profit. Likely in mid to late 2021.

Conclusion

In our experience, fear of people not paying their bills tends to be far greater than actual non-payments. Rent is at the top of most American's priorities. Nobody wants to be homeless. This means that most people will cut back on all other expenses before they default on rent.

We are all aware of those who will "game" the system, move in, not pay rent and stretch out eviction proceedings as long as possible, and then move to the next place and do the same thing. That's the exception, not the norm. Most people would be extremely stressed to get a delinquency notice for the thing that is most important to them - a roof over their family's head.

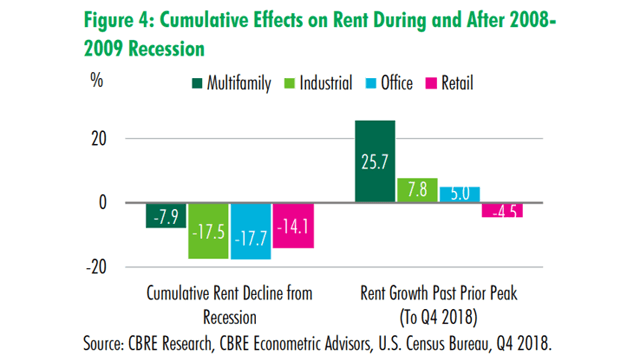

Paying rent will remain a top priority for most Americans. This is why historically, multi-family properties have had the strongest performance of any property class during recessions. It had a lower decline, a shorter trough, and it recovered much more strongly during the bull market.

Source: CBRE

In the near term, multi-family properties will have to deal with the reality that a lot of people are hurting financially. Some will struggle to pay rent, even though most will sacrifice elsewhere. ATAX is somewhat insulated in that the majority of their holdings are at the debt level, and it's the equity that will be impacted first.

While much is in fact different this time, some things have not changed. Multi-family is still a very durable asset class, for fundamental and obvious reasons. Protecting your "home" is a primal instinct that will never change.

Despite a few foreclosures in 2010, ATAX was able to remain strong thanks to the strong rebound. By the time ATAX had actually gained possession of the buildings, the market was in recovery and they were able to recover most of their capital.

There will be some near-term challenges for cash flow. ATAX might have to hold on to some of their Vantage properties longer than anticipated to wait for a better opportunity to sell. We could see a few MRBs default. All of this means that there could be some risk to the dividend in the near term.

In the long run, the multi-family market will recover as fast or faster than any other type of real estate. The Vantage properties will find buyers willing to pay a good price. Any properties that ATAX forecloses on will be sold at prices that recover a substantial portion of what is owed, and possibly even more. ATAX has the infrastructure to operate the properties for a period if necessary.

Those who bought the dip in 2008, when the extent of the sub-prime crisis was first recognized and the market was in a panic, went on to enjoy very sizable returns over the next three years, despite ATAX having a dividend reduction.

Today, ATAX is very near the same lows that they had back then. The market is giving us an opportunity to buy up bonds secured by multi-family real estate at $0.80 on the dollar. Not just any multi-family bonds, but bonds that throw off a significant level on tax-exempt cash flow.

This is a deal we are not going to pass up. High yielding, selling at a discount, strong fundamentals, and partially tax exempt. ATAX is a strong buy.

Thanks for reading! If you liked this article, please scroll up and click "Follow" next to my name to receive our future updates.

High Dividend Opportunities, #1 On Seeking Alpha

HDO is the largest and most exciting community of income investors and retirees with over +4300 members. Our Immediate Income Method generates strong returns, regardless of market volatility, making retirement investing less stressful, simple and straightforward.

Invest with the Best! Join us to get instant-access to our model portfolio targeting 9-10% yield, our preferred stock and Bond portfolio, and income tracking tools. Don't miss out on the Power of Dividends! Start your free two-week trial today!

Disclosure: I am/we are long ATAX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.