Twilio: Coronavirus Accelerating Positive Trends, Downside Ahead

by MangoTree AnalysisSummary

- TWLO blew out Q1 expectations, as the coronavirus did the opposite of what people expected and accelerated its business. If you think about it, this is pretty intuitive.

- As workers migrated to a stay-at-home environment, app usage and new downloads likely increased. These trends improved TWLO's core business, and SendGrid likely improved as the enterprise world moved online.

- All the coronavirus did was accelerate the underlying trends that have made TWLO such a strong growth investment since its $15/share IPO.

- Where have I gone wrong on TWLO? In the past I have pointed out valuation, reliance on large customers, and a small business learning curve. At this point, those risks just do not seem anywhere nearly as valid.

- Reiterating rating at SELL. PT raised from $57 to $130.

The Print

Twilio (NYSE:TWLO) delivered an extremely strong Q1 print. Revenue and EPS greatly exceeded expectations. As a result, the stock ran ~40% in a single trading day. Over the course of the next few days, Twilio continued to rally, nearing $200/share. So let's take a brief look at the numbers.

- Revenue of $364.86M vs. expectations of $328.27M

- Non-GAAP EPS of $0.06 vs. expectations of -$0.11

In addition, Twilio delivered a strong guide, which factored into the rally. This print led to a flurry of price target raises and even some upgrades of the stock.

Coronavirus Accelerating Underlying Trends

Contrary to what seemed to be the popular opinion heading into the Q1 print, coronavirus actually may have aided Twilio. Most people speculated that coronavirus would negatively affect Twilio. In reality quite the opposite happened, coronavirus has accelerated the transition in the communications business that Twilio has been forcing. As stay-at-home trends continue, businesses are being forced to migrate away from doing business in a physical sense. They are moving increasingly online. Twilio is a direct beneficiary of the virtualization of business. Especially when communication between enterprises and customers is as crucial as it is in the current era, demand for Twilio's product has never been higher.

Also, consider the fact that Twilio's business model is usage based. The more usage there is on an app, the more money Twilio makes. As people have more time on their hands, they are interacting online much more, meaning Twilio's business is being propelled higher.

The use cases for CPaaS technology are vast as most applications will likely require integrated communications infrastructure at some point in the future. Twilio is the market leader in CPaaS. Twilio has locked down many large-scale applications, further validating the need for CPaaS in the future of technology. The main reason it appears that Twilio leads CPaaS is the company's focus on a usage-based pricing and a focus on simple APIs and SDKs to develop communication environments. Twilio also differentiates itself from the competition in terms of the breadth of its offerings. While competitors may try to compete with Twilio in certain niches, like SMS or voice, Twilio's offerings are far more extended. The company's technological offerings extend across video, text, voice, e-mail, and more. This makes Twilio the most versatile, and only one-stop-shop for programmable communication on the market today. In addition, Twilio's APIs do not require (in most cases) advanced knowledge of programming to get working effectively. They are mostly simple, and easy to use, another positive factor that differentiates Twilio from competitors.

The Long-Term Story

The long-term story is this: As business and communication moves online at a faster pace, the CPaaS and integrated communications market will continue to grow. Twilio is the only company on the market able to deliver a comprehensive suite of APIs aimed at all forms of communication. Whether it be e-mail, voice, video, or text, Twilio has simple tools that make it easy for developers to hit the ground running. In addition, Twilio's usage based model means that when people spend more time interacting with apps (especially in the stay-at-home era), Twilio makes more and more money. Greater usage entails greater revenue for Twilio.

In addition, Twilio Flex could be a strong growth driver long-term. As contact centers move to the cloud, Twilio Flex's suite of tools and overall simple and comprehensive user interface will be a must for modern contact centers. Flex will likely drive contact centers towards the cloud long-term.

Finally, there are likely applications that will use Twilio in the future that we have not seen yet. Communication is extremely important for any business, and I believe Twilio is driving a large disruption in the way that businesses and customers communicate. Twilio will likely have some form of functionality in almost any app at some point, meaning that the growth story for Twilio is a much longer growth story than one might ordinarily expect. This is why valuing Twilio is a so hard for me. While the company looks extremely expensive on 2020, and even 2021 numbers, the growth at Twilio is likely to continue for years to come.

Valuation

Twilio's valuation has always confused me. While the company is certainly riding the CPaaS growth wave, the valuation likely prices all of that in. If you try to value Twilio relative to the rest of the SaaS segment, it can seem like a bargain at times or fairly valued. But SaaS is one of the most (if not the most) richly valued segments of the market. This is likely justified because of the lofty growth expectations for these companies. That being said, I do not believe in relative valuation, so let's look at Twilio's valuation.

In 2020, I anticipate revenue growth of 36% Y/Y. Consensus expectations are calling for 34% Y/Y growth. I am slightly ahead of the Street on my growth expectations. I anticipate only modest decelerations in growth in the years following as the CPaaS market is likely to expand as Twilio continues to build out its business offerings and the use cases for CPaaS expand.

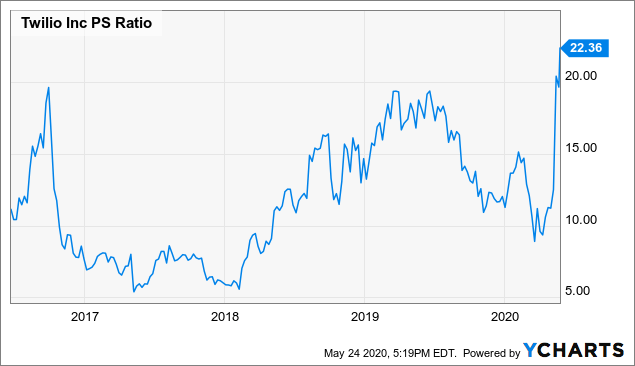

Here is the problem, look at the P/S multiple.

Data by YCharts

Not only is the P/S multiple ridiculously high in the first place, but it is also extremely high relative to its historic self. So, valuations are definitely stretched. Again, this isn't so bad when you look at other companies in the SaaS space. But consider this: You are paying ~22X revenue for a company that will likely grow revenues in the 30% area for the next few years. I am anticipating $1.537 billion in 2020 revenue, which is slightly above consensus. Assuming 12X revenue, which captures the growth profile of Twilio realistically. This brings me to a market capitalization of $18.444 billion, which on ~140 million shares values the business at ~$131.69/share. Thus my PT on Twilio is $130.

Conclusion

Twilio is a strong business with a good long-term growth trajectory. That being said, unless you want value Twilio against other extremely frothy software stocks, there is no way to get past the stock's current valuation.

(source)

TipRanks: Hold

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a short position in TWLO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not a financial advisor. This is not financial advice. Please do your own due diligence before initiating positions in any of the securities mentioned.