SeaChange Warns Of An Abysmal Q1 As Customers Continue To Delay Purchase Decisions

by Henrik AlexSummary

- Discussing recent Q1/FY2021 earnings warning.

- Customers continue to delay purchase decisions, resulting in an at least 55% sequential revenue decrease with likely substantial cash burn.

- While management remained optimistic on H2/FY2021, visibility appears to be very low at this point.

- Liquidity is running low, a secondary offering might be in the cards.

- Avoid the stock until liquidity issues have been addressed and the company gains renewed traction with customers.

Note:

I have covered SeaChange (NASDAQ:SEAC) previously, so investors should view this as an update to my earlier articles on the company.

Two months ago, fellow contributor Mike Arnold presented small-cap video solutions enabler SeaChange as "facilitator of a new social distancing reality" and Seeking Alpha editors labeled the article as a "Top Idea".

But at least for now, SeaChange is actually suffering badly from COVID-19 fallout as customers continue to delay purchase decisions as evidenced by an ugly warning for Q1/2021 issued after the close of trading on Thursday (emphasis added by author):

Similar to the majority of global industries, the video delivery technology industry has been meaningfully impacted by the effects of COVID-19. The intensifying COVID-19 crisis during March and April 2020 significantly slowed customer engagement due to customers working from home, and many customers focusing their resources on remote networking support and servicing the growing demand for bandwidth due to higher network usage caused by COVID-19 confinement. This has caused a number of SeaChange's potential customers to delay making a final decision regarding their Framework engagements. Based on the foregoing, management currently expects total revenue for the fiscal first quarter ended April 30, 2020 to be lower than the comparable period in fiscal 2020. Management believes a majority of the Company's customers have simply delayed making a final decision regarding their originally planned engagements, pending the return to a more normal operating environment.

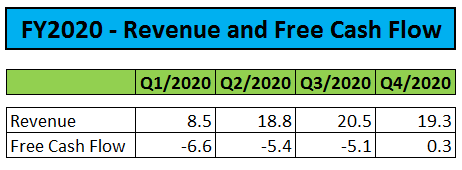

To provide some background: Q1/2020 was, by far, Seachange's weakest quarter in its entire history as a publicly-traded company with revenues of just $8.5 million and substantially negative free cash flow.

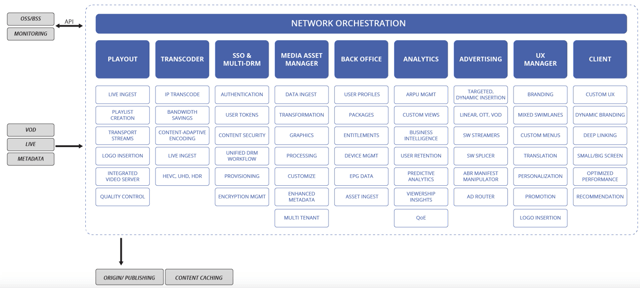

Picture: Framework Solution Overview - Source: Company Website

Remember also that Q4/FY2020 already saw substantial COVID-19 impact with a number of Framework deals delayed and SeaChange missing its projected revenue range of $70-80 million for the year. In addition, free cash flow in the quarter benefited from $2.1 million of one-time proceeds for the sale of its headquarters and the remaining purchase price for its stake in Layer 3 TV which was sold to T-Mobile (NASDAQ:TMUS) in 2018 while cash flow from operations remained firmly negative.

Source: Company's SEC-Filings

At that time, new management pointed to the transition to the company's so-called "Framework" value-based selling approach as the main reason behind the poor performance. Historically, the company had sold and licensed its products and services on a standalone basis while the new approach offers customers the ability to license all of SeaChange's products and services, including specified upgrades, for a fixed period of time at a fixed price.

While top-line performance increased considerably over the course of the year, free cash flow did not follow suit due to the required accounting treatment for the Framework deals with the company recognizing approximately two thirds of the transaction value as license revenue upfront while only the remaining one third will be recognized as service revenue ratably over the life of the deal which usually is four or five years.

But in contrast to the accounting treatment, customers are billed ratably which results in the above discussed cash flow disparity.

With Q1/2021 revenues apparently below last year's abysmal $8.5 million number, I would estimate negative free cash flow in the range of at least $6-8 million which would leave SeaChange with just $5-7 million in cash and cash equivalents.

Not surprisingly, the company has implemented additional cost savings measures as well as taking actions to improve its working capital position to build a bridge to an anticipated pick-up in business in H2/FY2021.

As a result, SeaChange has shifted its business operations to further reduce our operating expenses and to align its strategy with current market conditions. In late April and May, the Company instituted additional cost-optimization measures. These measures are in addition to the actions the Company took in fiscal 2020 that resulted in more than $12 million in annualized cost savings. In line with these measures, the Company is continuing to take actions to improve its working capital position and to ensure the business is positioned to not only mitigate the present macro risks but also to capitalize on the anticipated demand for its solutions during the second half of fiscal 2021. Management expects to see stronger demand for the Framework solution in the second half of fiscal 2021 as TV providers look to leverage SeaChange's technology to reduce operating expenses and monetize their growing unsold advertising capacity.

Personally, I turned very cautious on the company after listening to the Q4/FY2020 conference call in early April as CEO Yosef Aloni mostly tried to dance around a number of tough analyst questions and sometimes appeared more like a stock promoter than a company executive.

After being poked by analysts on the call, management admitted to anticipated further cash burn for FY2021 albeit at a reduced level when compared to FY2020. With the business now having fallen off a cliff, SeaChange will be required to raise additional capital quite soon. On the call, CFO Michael Prinn hinted to potentially monetizing the company's aggregate $26.4 million in accounts and unbilled receivable balances but I wouldn't be surprised at all to see the company coming to market with a secondary offering in the not too distant future.

At least, the company continues to have no debt.

But even with the latest round of cost cutting, SeaChange might still require quarterly revenues of $25+ million to achieve cash flow break-even which looks like an unrealistic target over the short- to medium term.

Bottom Line

At least for now, SeaChange is not a beneficiary of COVID-19 as the company's service provider customers have largely delayed purchase decisions for the company's Framework product offerings. While management remains optimistic for the second half of the fiscal year, the current issues might very well persist for another couple of quarters.

With liquidity running low, a secondary offering might be in the cards.

In my opinion, management should consider putting up the company for sale instead of implementing another round of cost cutting measures each time SeaChange is losing traction with customers.

Investors should avoid the company's shares unless liquidity concerns have been addressed and customer buying patterns normalized.

Even a short sale looks tempting ahead of an ugly Q1/FY2021 report and likely disappointing guidance as well as the potential for a secondary offering but with management potentially pursuing strategic alternatives, a short position is not without risk.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.