Surgutneftegas: Now It Looks A Bit Less Crazy In This Crazy Market

by Danil KolyakoSummary

- Unlike many other Russian O&G companies, Surgutneftegas decided to cut its dividends.

- Earlier, the company's earnings for 2019 crashed by 8 times. From this perspective, the cut is somewhat justified.

- However, Surgutneftegas still can serve as a hedge that may yield more than 15% in dividends.

Photo source: RBC

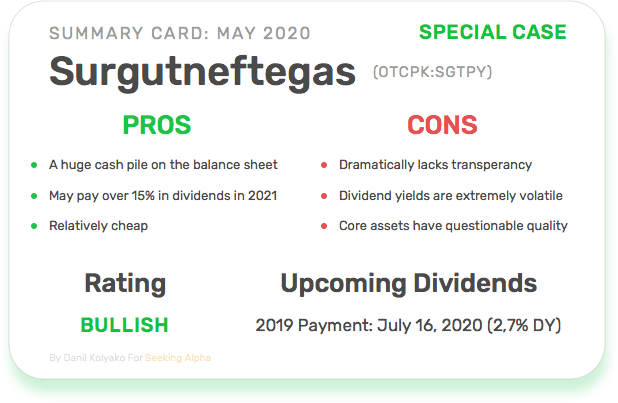

While the markets are valued unjustifiably high for the severely damaged global economy, Surgutneftegas (OTCPK:SGTPY) has suddenly become a more relevant investment idea than ever before. The stock is still cheap and may please investors with a 15-20% dividend yield in 2021 when no other O&G company is capable of delivering comparable yields. In this article, I'll discuss this investment case and a unique set of risks you need to tolerate if you want to invest in Surgut.

The Cash Anomaly

Why am I now bullish on Surgutneftegas?

- Surgut's financials benefit a lot from weaker rouble. The company has over 3 trillion roubles ($47 bn) of cash on its balance which gets revaluated every year depending on the USD/RUB currency rate. Due to the deteriorating economic situation in Russia and low oil prices (that are still almost twice as lower compared to 2019), I expect the currency rate to be closer to 80 roubles per dollar rather than 70. The USD/RUB rate of 80 and Brent at around $30 is a sweet spot for Surgut where it can show a dividend yield up to 20%.

- At normal times, Russian O&G majors like Lukoil, Tatneft, and Gazprom Neft paid decent dividends and were relatively more attractive due to substantially more transparent corporate governance and flexible dividend policies. With Brent under $40, these companies won't be able to show decent yields. This doesn't mean that all three aforementioned companies are bad long-term investments, but they are not interesting buys at current prices either.

- As the market still doesn't reflect horrible fundamentals in the global economy (even adjusted on QE-liquidity), I think it's still a bit early to load up with high-quality stocks. Therefore, buying Surgut prefs, which look pretty cheap relative to the expected dividend yield, becomes a reasonable way to stay in a waiting stance until the market offers something better to buy.

Risks

When viewing companies, I pay a lot of attention to risks. Considering the long history of Neutral ratings in my articles about Surgut, I warn you that this investment idea is more speculative rather than conservative. Even though nothing points to the fact that Surgut is going to change its prefs-oriented dividend policy or do anything with its cash reserves, the degree of unpredictability amid near-zero interest rates should not be underestimated. There's a risk that Surgutneftegas may redistribute its cash pile in a way that won't be beneficial for minority investors. Due to the extremely closed ownership structure of the company, I can't exclude such a scenario.

If you decide to place a bet on Surgut, the most important thing you should track is the USD/RUB rate on December 31, 2020 - on this day, the company's cash deposits will be recalculated and used as a base for paying dividends in 2021. Although the average dollar exchange rate last year was 2.7% higher than the year before, the rate on the last day of the year was 10.9% lower, which negatively affected the final financial result.

Dividends

For 2019, the company will pay 0.97 rouble per share to the holders of preferred shares. A year earlier, payments for this type of shares amounted to 7.62 roubles/share. The company's dividends on ordinary shares will remain at the level of 0.65 rouble, as in 2018. With the announced payments, the dividend yield for Surgutneftegas will be 1.6% and 2.6% for ordinary and preferred shares, respectively. The strengthening of the rouble in 2019 led to a fall in the company's profit as a result of a negative revaluation of foreign currency deposits on the balance sheet and a consequent decrease in dividends.

In turn, Lukoil (OTCPK:LUKFY), Rosneft (OTCPK:RNFTF), and Gazprom Neft (OTC:GZPMF) decided to behave differently during the crisis. For example, Rosneft's Board of Directors recommended paying a record dividend for 2019 of 354.1 billion roubles, or exactly half of the company's net profit. The same did Gazprom Neft, which will pay dividends of 37.96 roubles per share for 2019, which is 26.6% higher than in 2018.

The Bottom Line

The undervaluation of the company due to lack of transparency of the capital structure, lack of communication with the outside world, as well as lack of any investment strategy makes Surgutneftegas an unusual investment idea. However, crazy times require crazy solutions, and Surgut may serve this purpose well.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.