Still A Lot Of Value In Corporate Bond Market

by Brian Gilmartin, CFASummary

- Readers can see that currently even AAA OAS are cheaper to Treasuries than at any point in the last 10 years.

- Ending late last week at +89 bps to Treasuries, even the AAA OAS spread is twice what it's traded at over the last four years, which was a period where high-quality credit like AAA OAS rarely traded over 50 bps.

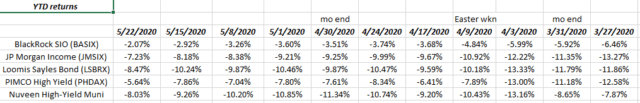

- Clients have a direct 10-15% in high-yield today via HYG and the Pimco Fund, but also have some exposure via the BlackRock's Strategic Income Opportunity, the JPMorgan Income Fund and the Loomis Sayles Fund.

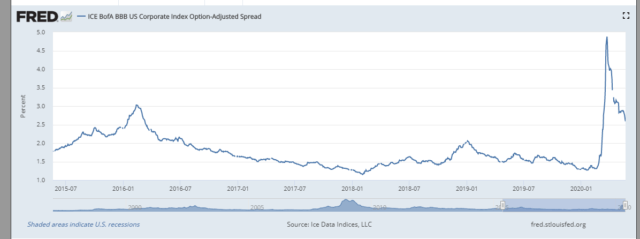

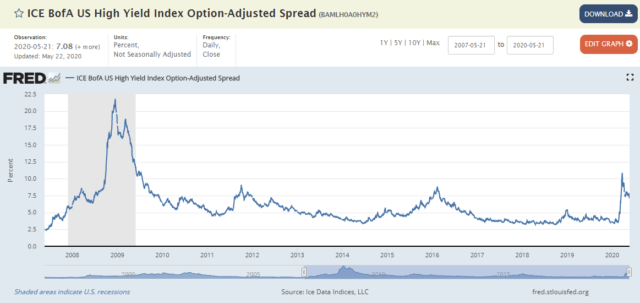

First off, a quick "hat-tip" or shout-out to Nicholas Colas and Jessica Rabe at DataTrek Research, who have been posting similar FRED (Federal Reserve Bank of St Louis) charts on the US corporate credit markets. After seeing DataTrek's credit spreads charts over the last few weeks, I went to Fed St. Louis website and took a look at them myself and felt it was time to post some thoughts on the rapidly improving corporate credit market in the US, and even the Emerging Markets (NASDAQ:EMB) as was last done in late April, 2020 here.

The bottom two charts, and particularly the last chart is what I find fascinating: Readers can see that currently even AAA OAS are cheaper to Treasuries than at any point in the last 10 years.

Using the pointer on the AAA-credit-OAS-to-Treasuries chart at FRED, the peak spread for AAAs in late March was a whopping 235 basis spread-to-Treasuries. In the initial crude oil crash, in late 2015, early 2016, the same spread never made it over 100 bps.

Ending late last week at +89 bps to Treasuries, even the AAA OAS spread is twice what it's traded at over the last four years, which was a period where high-quality credit like AAA OAS rarely traded over 50 bps.

While very few tactical changes have been made to client equity accounts or asset allocation the last few months (GM was sold in its entirety, while the two biotech ETFs were bought, i.e. XBI and IBB), a lot of client bond money was or bond allocation funds were held in Schwab's higher-yielding money markets coming into 2020, due in no small part to very tight credit spreads - and pre-pandemic anyway - the prospect of higher short-term rates as nonfarm payroll growth remained white-hot.

Since late March and early April 2020 here is where a lot of that previously-domiciled money-market cash was invested:

Check the improvement in YTD returns for these funds, and just in the last week, the bump in returns.

The Barclays Aggregate - which is 60% Treasuries - is +5.2% on the year.

Summary/conclusion: Simply looking at AAA-rated OAS, there is still some spread-tightening ahead for the corporate bond market, particularly as the Federal Reserve and Jay Powell have promised to back-stop everything:

Cut-and-pasted from Jay Powell's 60 Minutes interview:

POWELL: So the things we're doing now are substantially larger. The asset purchases that we're doing are a multiple of the programs that were done during the last crisis. And it's very different this time. In the last crisis, the problems were in the financial system. So they were providing support for the banking system. Here, really, the problems are in what we call the real economy, actual companies that make and sell goods and services. And what's happening to them is that many of them are closed or just not having any revenue.

And we're trying to do what we can to get them through this period where they're perfectly good companies that have had, you know, sound financial condition as recently as February, but now they have no business. And they have fixed costs. So we're trying to help them get through that period.

PELLEY: Are you now satisfied that the markets, the equity markets, the bond markets, are functioning properly?

POWELL: They have been. The markets have been functioning well. I would give you, as an example - there was a period during this crisis period of the first half of March when big American companies, household names, were unable to borrow. And companies tend to roll over their debt and borrow as a perfectly routine matter in today's capital markets and economy.

And so we said that we were going to start a facility to lend to companies. We also have a facility for medium size and small companies too. But this is for the large companies. So when we said that and we started to build it - and what happened is the markets began to heal.

And just the fact that we have stated a strong intention to make credit available has really calmed things down. And now, companies have had a month and a half to finance themselves. And many have done so without our help. So that's a good thing.

Clients will remain overweight corporate credit probably through year-end 2020, and the above referenced credit spreads should continue to narrow given the shock of the pandemic and Covid-19.

As a $21-$22 million advisor, this blog doesn't see the in-depth credit spread detail that most larger asset managers see from the sell-side, but simply just watching LQD (corporate bond ETF) in late March '20 (never owned for clients) fall from $134 to $104 in a period of three weeks was impetus enough for the Fed to move and move sharply.

Clients have a direct 10-15% in high-yield today via HYG (high yield ETF) and the Pimco Fund, but also have some exposure via the BlackRock's Strategic Income Opportunity (an unconstrained fund), the JPMorgan Income Fund and the Loomis Sayles Fund.

Clients who have been looking to put in new money, I'm trying to explain to them that corporate bond funds and corporate credit risk are probably the best "risk-adjusted" return through the end of 2020.

Take everything written here with deep skepticism and a heavy grain of salt. These are simply opinions for readers to consider in light of their own financial considerations.

Thanks for reading and a wonderful Memorial Day Weekend to all.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.