Tracking Glenn Greenberg's Brave Warrior Advisors Portfolio - Q1 2020 Update

by John VincentSummary

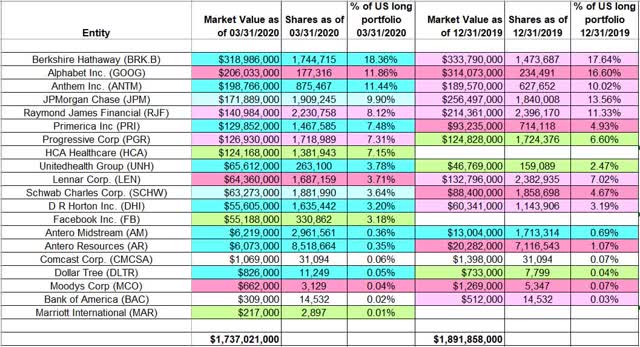

- Glenn Greenberg’s 13F portfolio value decreased from $1.89B to $1.74B this quarter.

- Brave Warrior Advisors added HCA Healthcare and increased Anthem while reducing Alphabet.

- The largest three positions are Berkshire Hathaway, Alphabet, and Anthem, and they add up to ~42% of the portfolio.

This article is part of a series that provides an ongoing analysis of the changes made to Glenn Greenberg's 13F portfolio on a quarterly basis. It is based on Greenberg's regulatory 13F Form filed on 05/15/2020. Please visit our Tracking Glenn Greenberg's Brave Warrior Advisors Portfolio series to get an idea of his investment philosophy and our previous update for the fund's moves during Q4 2019.

This quarter, Greenberg's 13F portfolio value decreased ~8% from $1.89B to $1.74B. The top three holdings represent ~42% of the portfolio while the top five is at 60%. The largest position is Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) which is at ~18% of the portfolio.

New Stakes

HCA Healthcare (HCA), Facebook Inc. (FB), and Marriott International (MAR): These are the three new positions this quarter. HCA is a large 7.15% of the portfolio position established this quarter at prices between $68 and $151 and the stock currently trades at ~$107. For investors attempting to follow, HCA is a good option to consider for further research. The ~3% FB stake was purchased at prices between $146 and $223 and it is now above that range at ~$235. MAR is a minutely small 0.01% position.

Stake Disposals

None.

Stake Increases

Berkshire Hathaway: BRK.B is currently the largest position at 18.36% of the portfolio. It was established in Q2 2019 at prices between $197 and $219. Q3 2019 saw a ~20% stake increase at prices between $196 and $215. That was followed with a similar increase this quarter at prices between $162 and $230. The stock currently trades at ~$175. For investors attempting to follow, BRK.B is a good option to consider for further research.

Anthem Inc. (ANTM): ANTM is a large (top three) ~11% of the portfolio stake established in Q3 2019 at prices between $238 and $311 and the stock currently trades at $277. This quarter saw a ~40% stake increase at prices between $175 and $306.

JPMorgan Chase & Co. (JPM): JPM is a large (top five) ~10% of the portfolio stake established in Q3 2014 and built over the next two quarters at prices between $54.50 and $63. The position has wavered. Recent activity follows: Q4 2017 and Q1 2018 had seen a combined ~25% selling at prices between $95 and $119 while the next four quarters saw a ~40% increase at around the same price range. Last three quarters had seen a combined ~11% selling at prices between $104 and $139. The stock currently trades at ~$89.50. This quarter saw a minor increase.

Primerica Inc. (PRI): PRI is a ~7.5% of the 13F portfolio position established in Q3 2011 at a cost-basis in the low-20s. H2 2016 saw a two-thirds reduction at prices between $53 and $72.50. The position has wavered since. Recent activity follows: Q3 2019 saw a ~16% stake increase at prices between $110 and $129. That was followed with a ~19% selling last quarter at prices between $118 and $137. This quarter saw a stake doubling at prices between $62 and $137. The stock currently trades at ~$108.

UnitedHealth Group (UNH): The 2.47% UNH position was purchased last quarter at prices between $215 and $296 and increased by roughly two-thirds this quarter at prices between $195 and $305. It is now at ~$290.

Charles Schwab Corporation (SCHW): The 3.64% SCHW stake was first purchased in Q3 2012 at prices between $12.50 and $14.50. Through 2015, the position had seen incremental purchases at higher prices. The nine quarters through Q1 2018 saw a combined ~38% selling at prices between $23 and $58. Last year saw another ~70% selling at prices between $35.50 and $50. The stock is now at $32.83. There was a marginal increase this quarter.

D.R. Horton (DHI): The medium-sized 3.20% DHI position was purchased in H2 2018 at prices between $39.50 and $46.50 and increased by ~43% next quarter at prices between $33 and $43. This quarter also saw a ~45% stake increase at prices between $28.75 and $62. The stock currently trades at ~$54.

Antero Resources (AR): AR is a ~1% of the portfolio position established in Q2 2015 at prices between $34 and $45.50 and increased by ~85% the following quarter at prices between $20 and $34.50. Q1 2016 saw another ~20% increase at prices between $19.50 and $28. The following quarter saw a whopping ~120% further increase at prices between $24.50 and $30. The stock currently trades well below those ranges at $3.22. Last quarter saw a ~40% selling at prices between $1.94 and $2.95. Brave Warrior realized losses from this position. This quarter saw a ~20% stake increase.

Antero Midstream (AM): The very small 0.36% portfolio position in AM saw a ~600% stake increase in Q1 2019 at prices between $11 and $14.50. There was a ~30% selling in Q3 2019 at prices between $6.65 and $12.10 while last quarter there was a ~270% stake increase at prices between $4.40 and $7.60. This quarter also saw a ~75% stake increase at prices between $2 and $7.60. The stock is now at $4.30.

Dollar Tree (DLTR): DLTR is a minutely small 0.05% of the portfolio stake established last quarter. The position saw a ~45% stake increase this quarter.

Stake Decreases

Alphabet Inc. (GOOG): GOOG is the second largest position at ~12% of the portfolio. It was established in Q4 2017 at prices between $952 and $1,077 and increased by ~12% next quarter at prices between $1,001 and $1,176. Q2 2018 also saw a ~14% increase at prices between $1,005 and $1,175. The five quarters through Q3 2019 had seen only minor adjustments while last quarter saw a ~20% selling at prices between $1,177 and $1,360. This quarter saw another ~25% selling at prices between $1,057 and $1,527. The stock currently trades at ~$1,410.

Raymond James Financial (RJF): RJF is a large (top five) ~8% portfolio stake established in Q3 2018 at prices between $88 and $97 and increased by ~20% over the next two quarters at prices between $69 and $94. The stock currently trades at $65.21. Last two quarters have seen a ~15% trimming.

Progressive Corp. (PGR): PGR is a fairly large 7.31% of the portfolio stake established last quarter at prices between $68.50 and $77 and the stock currently trades at $74.72. This quarter saw marginal trimming.

Lennar Corp (LEN): LEN is a ~4% portfolio stake established in Q3 2018 at prices between $46.50 and $55.50 and increased by ~55% next quarter at prices between $38 and $47. There was a ~25% reduction in Q3 2019 at prices between $46 and $56. This quarter saw another ~30% selling at prices between $29.35 and $71. It is now at ~$60.

Moody's Corp (MCO): The minutely small 0.04% MCO stake was further reduced this quarter.

Kept Steady

Bank of America (BAC) and Comcast Corporation (CMCSA): These two minutely small (less than 0.1% of the portfolio each) stakes were kept steady during the quarter.

The spreadsheet below highlights changes to Greenberg's 13F stock holdings in Q1 2020:

Disclosure: I am/we are long BAC, BRK.B, GOOGL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.