Lithium Miners News For The Month Of May 2020

by Matt BohlsenSummary

- Lithium prices were slightly lower for the month, but look to have bottomed.

- Lithium market news - Higher demand boosts China's battery material output. Posco Chemical triples capacity in cathode production to meet EV battery demand.

- Lithium company news - LG Chem & Panasonic in tight race to be #1 EV battery supplier. Albemarle expresses interest in Tianqi's stake in Greenbushes lithium mine.

Welcome to the May 2020 edition of the lithium miner news. May saw lithium prices slightly lower, and some financial results from the majors as the industry struggles along due to low lithium prices. Despite this, the medium and long term outlook continues to brighten.

Lithium spot and contract price news

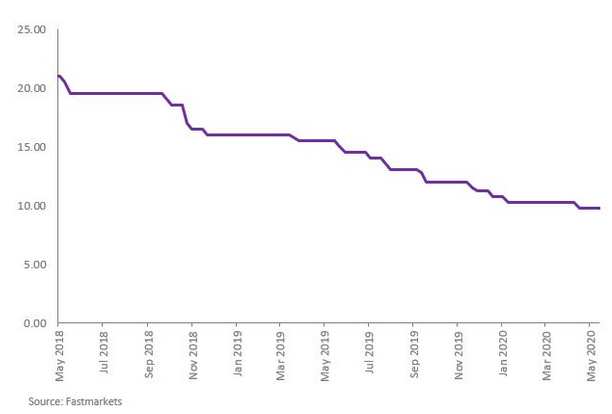

During May, 99.5% lithium carbonate China spot prices were down 4.34%. Lithium hydroxide prices were down 0.89%. Spodumene (5% min) prices were down 3.83%.

Fastmarkets (formerly Metal Bulletin) reports 99.5% lithium carbonate battery grade spot midpoint prices cif China, Japan & Korea of US$7.50/kg (US$7,500/t), and min 56.5% lithium hydroxide battery grade spot midpoint prices cif China, Japan & Korea of US$9.75/kg (US$9,750/t).

Benchmark Mineral Intelligence has April prices at US$6,582 for Li carbonate, US$9,125 for Li hydroxide, and US$420 for spodumene (6%).

Lithium hydroxide, battery grade, cif China, Japan &Korea

Lithium carbonate, battery grade, cif China, Japan & Korea

Source: Fastmarkets

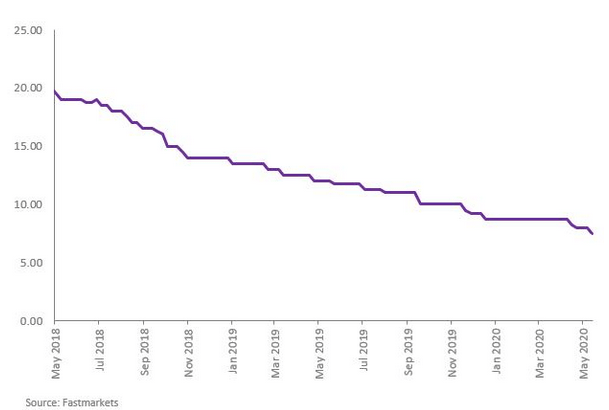

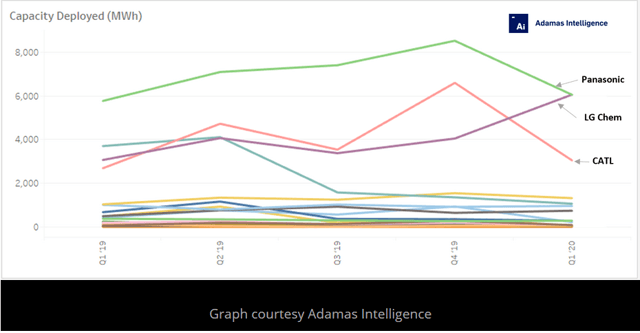

Lithium demand versus supply outlook

On May 11 Argus Media reported:

Higher demand boosts China's battery material output. China's battery materials production rose in April as demand recovered across downstream sectors after the Covid-19 outbreak eased in China. Higher demand from the consumer electronics battery sector, particularly tablet computers and body temperature testers since late March, has raised output for cobalt tetroxide and lithium cobalt oxide. The country produced 4,900t of cobalt tetroxide in April, up by 7pc from a year earlier and by 25pc from March, according to data from China's nonferrous metals industry association (CNIA). Lithium cobalt oxide output in April increased by 5pc on a yearly basis to 5,760t, up by 29pc from March. China's production of nickel-cobalt-aluminium/nickel-cobalt-manganese (NCM/NCA) ternary precursors totalled 20,000t in April, down by 16pc from a year ago, but up by 3pc from March. April's NCM/NCA battery materials output declined by 24pc from a year ago, but inched up by 0.44pc from March to 13,700t.

Source: BNEF

Lithium market and battery news

On April 27 The Korean times reported:

LG Chem bets big on carbon nanotubes. LG Chem will invest 65 billion won ($53 million) by the first quarter of 2021 to expand production of carbon nanotubes, which are known to be among the strongest, lightest and most conductive fibers, at its plant in Korea. With the investment, the company said it will expand the annual production capacity to 1,700 tons from the current 500 tons. "By using carbon nanotubes as anode-conductive additives, we will be able to reduce the use of conductive materials by about 30 percent and increase the capacity of lithium-ion batteries," the company said.

Note: Graphene is a single thin layer 2D film, while the carbon nanotube in a thin film rolled like a 3D tube or cylinder.

On April 28 Reuters reported:

SK Innovation to start construction of second EV battery plant in U.S. South Korea’s SK Innovation Co Ltd, a supplier for Volkswagen and Ford Motors, said on Tuesday it will spend $727 million to build a second electric vehicle [EV] battery plant in the United States. It will begin construction of the factory in July and aim to start production in 2023. It will make a further investment in its second U.S. factory, bringing total spending to about $1.5 billion.

On May 4 Benchmark Mineral Intelligence reported (paywalled):

Shanshan group begin construction of lithium chemicals plant in Hunan province, target stage 1 capacity of 25,000 tpa.

On May 6 Which Car reported:

Samsung set to smash EV battery range wide open. Solid-state battery breakthrough from one of the world's leading tech companies could solve EV range issues. Samsung’s Advanced Institute of Technology (SAIT) has revealed a revolutionary solid-state battery that would enable electric vehicles to drive between Melbourne and Sydney on a single charge. That means a vehicle’s range can be effectively doubled without requiring any extra space to store the battery. While Tesla’s lithium-ion batteries, for example, have an energy density of 272 watt-hours per litre, the new solid-state battery can brag an incredible 900Wh/L. That dramatic improvement is thanks to a second significant innovation; the composition and construction of its anodes. While the current most efficient and energy-dense batteries use lithium anodes, the Samsung solution introduces a new silver-carbon coating known as Ag-C, which is just 5.0 micrometers thick.

Note: You can learn more from my recent article here - "A Look At Solid-State Batteries, The Latest Developments, And The Main Players".

On May 15 Pulse News Korea reported:

Posco Chemical triples capacity in cathode production to meet EV battery demand - Pulse by Maeil Business News Korea.....Posco has completed expansion to triple capacity in producing high-nickel cathode.....The affiliate under steelmaking giant Posco is now capable of producing 40,000 tons of cathode materials a year when including the 10,000 ton facility in Gumi in North Gyeongsang Province. The company plans to boost annual capacity of its Gwangyang plant to up to 90,000 tons in the future depending on market conditions. The capacity is enough to provide 60 kilowatt-hour high-performing batteries to 750,000 electric cars.

Note: You can read more on the Posco story here, where Benchmark discuss Poscos's expansion plans for both cathodes and anodes.

On May 20 SP Global reported:

The European Commission plans draft EU green battery rules by October ahead of EV surge. The European Commission plans to propose EU sustainable battery rules by October in a bid to challenge China's dominance of the global battery market, which is projected to grow to Eur250 billion per year ($274 billion) by 2025. The EC hopes the rules will become binding by 2022, in time for an expected surge in electric vehicle output in 2023. The rules aim to give the EU a competitive edge in battery sustainability, performance and safety, and to develop a circular economy for all batteries produced or sold in Europe. A key issue is access to raw materials.....The EU is expected to need up to 18 times more lithium and five times more cobalt by 2030 to meet demand from renewable energy, e-mobility, defense and space sectors.

On May 22 Cleantechnica reported:

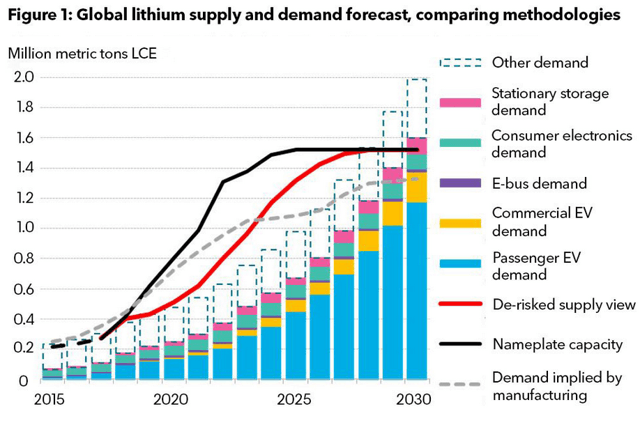

LG Chem & Panasonic in tight race to be #1 EV battery supplier, CATL Solidly #3. “By cathode chemistry, NCM 6-Series was the most used variety in the first quarter of 2020 by GWh deployed, followed closely by Tesla/Panasonic’s 3rd generation NCA and NCM 5-Series. In fourth place, high-nickel NCM 811 captured 9% of global market share by GWh deployed and an imposing 32% in China specifically.” Adamas Intelligences says that 20.5 GWh of EV batteries were deployed in Q1 2020, compared to 20.9 GWh in Q1 2019 and 26.5 GWh in Q4 2019.

Panasonic and LG Chem reportedly had 60% of the EV battery market in Q1, 2020

Source: Cleantechnica

On May 20 Investing News reported:

Q1 Lithium Results Are In — Key takeaways from from top miners. Lithium producers had already initiated a supply response to this challenging environment prior to the outbreak, but COVID-19 also brought temporary suspensions and revisions of expansion plans.

Lithium miner news

Albemarle (NYSE:ALB)

On May 6, Albemarle announced: "Albemarle reports first quarter results." Highlights include:

- "Net sales of $739 million; Net income of $107 million, or $1.01 per diluted share; Adjusted diluted EPS of $1.00.

- Adjusted EBITDA of $196 million decreased by ~13% year-over-year, but above previously communicated guidance.

- Taking action to bolster our balance sheet to enhance financial flexibility; drew $250 million on our revolver, repaid other short-term debt.

- Accelerating our $100 million cost savings initiative; we now expect to realize between $50 and $70 million of these savings in 2020.

- Implementing short-term cash management actions to save between $25 and $40 million per quarter; reducing 2020 capital spending by about $150 million from plan.

- As previously announced, J. Kent Masters was named Chairman, President and CEO of Albemarle effective April 20; separately, in March......"

On May 8 Reuters reported:

Albemarle expresses interest in Tianqi's stake in Greenbushes lithium mine. Chengdu, China-based Tianqi, which owns 51 percent of Greenbushes to Albemarle’s 49 percent, said last month it was exploring selling equity and assets, including Greenbushes, to cut debt. Albemarle has the right of first refusal over any stake sale. “We’re interested in it. We’re following it, but we’re also mindful of the current market environment,” Albemarle Chief Executive Kent Masters.....

Sociedad Quimica y Minera S.A. (NYSE:SQM)

On May 19, SQM announced:

SQM to pay interim dividend. The Board of Directors unanimously approve the following: To pay an interim dividend equal to US$0.17092 per share to be charged against 2020 retained earnings.....

On May 19, SQM announced: "SQM reports earnings for the first quarter of 2020." Highlights include:

- "SQM reported net income for the three months ended March 31, 2020 of US$45.0 million, compared to US$80.5 million in same period of 2019.

- Revenue for the three months ended March 31, 2020 were US$392.0 million.

- Adjusted EBITDA margin for the first three months of 2020 reached 33.9%.

- Earnings per share totaled US$0.17 for the three months ended March 31, 2020."

Investors can read the company's latest presentation here.

Jiangxi Ganfeng Lithium [SHE:002460] [HK: 1772], Mineral Resources [ASX:MIN], International Lithium Corp. [TSXV:ILC] (OTCPK:ILHMF)

No news for the month.

(Chengdu) Tianqi Lithium Industries Inc. [SHE:002466]

No news for the month.

Livent Corp. (LTHM)[GR:8LV] - Spun out from FMC Corp. (NYSE:FMC)

On May 11, Livent Corp. announced:

Livent releases first quarter 2020 results. First quarter 2020 revenue was $69 million, with a reported GAAP net loss of $2 million, or -1 cent per diluted share. Adjusted EBITDA was $9 million and adjusted earnings per share were 2 cents per diluted share. First quarter results reflected a challenging operating environment for both Livent and the lithium industry as a whole. Lower pricing continued, and volume was down due to the impact of COVID-19 in Asian markets......

Orocobre [ASX:ORE] [TSX:ORL] (OTCPK:OROCF)

On April 29, Orocobre announced:

Limited expansion activities recommence at Olaroz. Orocobre Limited advises that following approval from Argentine authorities, communities, unions and other stakeholders limited operations have recommenced on the Olaroz Stage 2 expansion.

On May 11, Orocobre announced: "2019 sustainability full report."

Upcoming catalysts include:

- H2 2020 or H1 2021 - Olaroz Stage 2 (42.5ktpa) commissioning.

- H1 2021 - Naraha lithium hydroxide plant (10ktpa) commissioning (ORE share is 75%).

You can read the latest investor presentation here, or my article "An Update On Orocobre."

Galaxy Resources [ASX:GXY] (OTCPK:GALXF)

No significant news for the month. Just the AGM results voting back in the board.

Upcoming catalysts include:

2020 - Construction progress at SDV. James Bay FS.

Investors can read my recent article "Galaxy Resources Plan To Be A 100,000tpa Lithium Producer By 2025", and my CEO interview here, and the latest company presentation here.

Pilbara Minerals [ASX:PLS] (OTC:PILBF)

On April 28, Pilbara Minerals announced: "March 2020 quarterly activities report. Moderated production strategy, improved recoveries and lower costs ensure strong cash position maintained, positioning Pilbara Minerals well for market recovery." Highlights include:

Production and Sales

- "Significant focus on health and safety initiatives in response to the COVID-19 pandemic. Health and safety performance continued to be strong for the quarter, with no reportable injuries.

- Campaign mining and processing continued in response to challenging market conditions.

- Production of 20,251 dry metric tonnes [dmt] of spodumene concentrate (December Quarter: 14,711 dmt).

- Spodumene concentrate shipments totalled 33,729 dmt (December Quarter: 33,171 dmt).

- Tantalite concentrate sales totalled 33,970lbs (December Quarter: 75,369 lbs).

- Improved lithia recovery rates continued, with recovery now largely in line with plant design specifications.

- Five-year, 75,000tpa offtake agreement signed with Yibin Tianyi (a key participant in CATL’s lithium supply chain), further diversifying Pilbara Minerals’ global customer base, with the first shipment of 20,000t of spodumene concentrate completed in March 2020."

Project Development

- "Stage 2 technical studies supporting an incremental expansion continued during the Quarter with delivery of results expected by mid-year.

- Pilbara Minerals and POSCO continue to pursue the downstream joint venture in South Korea, with POSCO currently conducting further evaluation of both the design and timing of the chemical conversion facility in light of lithium market conditions."

Lithium Market

- "Softer market conditions continued during the Quarter with spodumene concentrate pricing (SC6.0 basis) lower than achieved during the December 2019 half-year.

- Resumption of economic activity in China following the lift of COVID-19 lockdown measures and an extension of China’s EV subsidy program expected to boost the lithium-ion battery sector and improve market conditions in the medium to longer term."

CORPORATE

- "Moderated production strategy and cost reductions maintained a strong balance sheet, ensuring the Company is well placed to capitalise on the market turnaround.

- Healthy quarter-end cash balance of $108.2M (31 December 2019: $105.5M), inclusive of $7.2M of irrevocable bank letters of credit for shipments completed in late March 2020.

- Subsequent to Quarter-end, the Company has implemented a salary sacrifice scheme that invites employees and executives to sacrifice up to 25% of their salaries for share rights issued under the Company’s Employee Awards Plan as part of its ongoing strategy to manage cashflows and encourage further employee share ownership."

Upcoming catalysts:

2021 - Stage 2 commissioning timing to depend on market demand.

Investors can read my article "An Update On Pilbara Minerals", and an interview here.

Altura Mining [ASX:AJM] (OTC:ALTAF)

On April 30, Altura Mining announced: "Quarterly activities report March 2020." Highlights include:

Production and Sales

- "Quarterly production of 42,282 wet metric tonnes [WMT] of lithium concentrate.

- Calendar year to date sales of 44,648 dry metric tonnes [dmt] of lithium concentrate.

- Record single cargo of 22,564 dmt shipped in January to long-term offtake partner Ganfeng Lithium.

- Average quarterly operating cash cost lowered to US$345/wmt produced (FOB basis), (December quarter US$354/wmt (FOB basis)), reinforcing Altura’s position as the second lowest cost Australian Producer."

Health, Safety and Environment [HSE]

- "No Lost Time Injury [LTI] recorded for the quarter.

- Pragmatic solutions and management plans implemented to ensure safety and wellbeing of all staff and business continuity through the COVID-19 pandemic."

Corporate

- "Three-year extension of existing Loan Note Facility.

- Equity raise of $11.2 million to bolster working capital.

- $50 million standby equity funding secured."

Investors can read a company presentation here.

AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

On May 5, AMG Advanced Metallurgical Group N.V. announced: "AMG Advanced Metallurgical Group N.V. reports first quarter 2020 results." Highlights include:

Strategic Highlights

- "AMG and Shell Catalysts & Technologies received all regulatory consents necessary for the formation of the Shell and AMG Recycling B.V. joint venture, and has commenced operations.

- AMG continued basic engineering for its lithium project in Zeitz, Germany, and in Zanesville, Ohio, AMG has committed $140 million as of March 31, 2020 in construction and engineering contracts for investment in a second ferrovanadium plant.......

- In light of ongoing demand uncertainty in the global aerospace market due to the effect of COVID-19, AMG has put the IPO of AMG Technologies on hold."

Financial Highlights

- "EBITDA(2) was $22.3 million in the first quarter of 2020 as the Company’s segments provided balanced earnings.

- SG&A declined 7% in the first quarter of 2020 to $34.9 million compared to $37.4 million in the first quarter of 2019 due to lower personnel costs and initial steps on cost reduction.

- AMG Technologies’ order backlog increased 9% to $242.2 million as of March 31, 2020, compared to $222.6 million as of December 31, 2019.

- AMG’s liquidity as of March 31, 2020 was $372.2 million and the Company has maintained its final 2019 declared dividend of €0.20 to be paid in the second quarter 2020."

Upcoming catalysts:

2020 - Lithium projects in Zeitz, Germany and in Zanesville, Ohio in planning stage.

2021--> - Stage 2 production at Mibra Lithium-Tantalum mine (additional 90ktpa) planned.

Neometals (OTC:RRSSF) (Nasdaq:RDRUY) [ASX:NMT]

On April 30, Neometals announced: "Quarterly activities report for the quarter ended 31 March 2020." Highlights include:

Corporate

- Balance sheet strength underpins 2cps partially franked dividend. Strategy of delivering cash returns to shareholders continues with approximately AUD$56m returned in the past 5 financial years.

- Continued focus on commodities linked to the electric vehicle [EV] and energy storage [ESS] thematic, with a pivot towards more sustainable resource recovery and recycling projects to compliment upstream resources with collaboration deal announced (post the quarter end) to recover vanadium from high‐grade by‐products of leading Scandinavian steel producer, SSAB.

- Cash $94.9 million, receivables, and investments at $6.0 million and no debt."

Core Development Activities

Lithium‐ion Battery Recycling Project.

- "Successful completion of the Neometals lithium battery recycling pilot occurred in March with all proof‐of‐scale objectives met and technical risk significantly reduced.

- Data delivered to SMS group for it to conclude diligence on forming a 50:50 recycling joint venture, commence feasibility level studies and commence construction of the proposed demonstration plant in Europe.

- Chemical product samples from the pilot achieved high purities and positive early product evaluation feedback received from battery industry participants.

- Market evaluation activities advanced. Discussions with potential battery supply and offtake partners advanced targeting agreements for the demonstration plant trials, to as a prelude to formal agreements for the first commercial plant."

Lithium Refinery Project

- "Finalised preparations for commencement of a jointly funded Feasibility Study as part of collaboration with leading Indian power trader, Manikaran Power Limited, to evaluate the development of the first lithium refinery in India utilising Neometals offtake arrangements from Mt Marion, the second largest producer of lithium concentrate in the world.

- The project is a strategic, low‐cost option for to develop a downstream lithium chemical operation as a first‐mover into a large market where the central government is striving to develop a domestic supply chain to remove its total reliance on imports and achieve its planes for 100% electric vehicle sales."

Exploration Activities

- "Strong drilling results at the Armstrong deposit and Cassini‐Wannaway trend continue to enhance the projects value. The delineation and evaluation of high‐grade massive mineralisation within existing resource inventory supports development of a pipeline of short lead‐time nickel sulphide deposits for future demand from EV’s."

On May 1, Neometals announced:

Lithium‐ion battery recycling joint venture update. Project developer Neometals Ltd confirms an extension to the decision date for formation of its proposed lithium‐ion battery (“LIB”) recycling joint venture (“JV”) with German company, SMS Group GmbH (“SMS”)......The JV formation decision date of 30 April 2020 has now been extended by two months i.e. JV shareholder agreement execution scheduled on or before 30 June 2020.

On May 5, Neometals announced: "Jointly funded feasibility study for lithium refinery." Highlights include:

- "Feasibility Study commences to further evaluate Neometals/Manikaran Indian lithium refinery.

- Vendor package design teams, study managers and engineers appointed.

- Evaluation nameplate capacity doubled to 20,000tpa LiOH to include toll-treatment capability at request of market participants.

- Opportunity to drive economies of scale and optimise overall capital efficiency by removing lithium carbonate from the proposed product mix."

Lithium Americas [TSX:LAC] (LAC)

On May 8, Lithium Americas announced: "Lithium Americas reports first quarter 2020 results." Highlights include:

Caucharí-Olaroz Lithium Project (“Caucharí-Olaroz”):

- "On March 19, 2020, construction activities at Caucharí-Olaroz were temporarily suspended immediately following the declaration in Argentina of a country-wide mandatory quarantine in response to COVID-19.

- In mid-April 2020, following revisions to the scope of the government restrictions, activities at Caucharí-Olaroz resumed on a limited basis.

- The resumption of activities is occurring gradually with full caution and attention to the health and safety of returning employees, contractors and suppliers and in constant communication with the Argentine authorities, communities and all other stakeholders.

- COVID-19 health safety procedures have been implemented at site and at the Jujuy office.

- The impact of COVID-19 restrictions and safety procedures on the construction schedule is being assessed and the Company expects to provide an update by the end of Q2 2020.

- Any increase in capital costs as a result of the COVID-19 impact on the construction schedule is expected to be minimal and within the existing contingency.

- As of March 31, 2020, construction was 40% complete with $373 million (66%) of the planned capital expenditures committed including $249 million (44%) spent."

Thacker Pass Lithium Project (“Thacker Pass”):

- "Lithium Americas is abiding by all government restrictions relating to COVID-19 in Nevada, and staff are efficiently working from home.

- Permitting continues as planned, with the Mine Plan of Operations accepted by the Bureau of Land Management (“BLM”) and the Notice of Intent published on January 21, 2020 in the federal register, which started a mandated 365 day requirement for the BLM to complete the permitting process. Major permits are expected to be received by the end of Q1 2021.

- Over 10,500 kg of high-quality lithium sulphate has been produced at the process testing facility in Reno, Nevada prior to the temporary closure of the facility in response to COVID-19 safety measures.

- Third-party vendors continue to engineer and design lithium carbonate and lithium hydroxide evaporator and crystallizer as well as provide performance guarantees and product samples.

- A definitive feasibility study (“DFS”) is being completed with an initial targeted production capacity of 20,000 tonnes per annum (“tpa”) lithium hydroxide and approximately 2,000 tpa lithium carbonate (“Phase 1”); the DFS is on track to be completed by mid-2020.

- The Industrial Company, a division of Kiewit Corporation, is engaged to complete key aspects of the DFS.

- Thacker Pass permitting and DFS costs are expected to be fully funded from available cash on hand.

- The Company is exploring financing options for Phase 1 construction, including the possibility of a joint venture partner at Thacker Pass."

Corporate:

- "As at March 31, 2020, the Company had $82.1 million in cash and cash equivalents, including $36.8 million representing the Company’s 50% share of Caucharí-Olaroz cash and cash equivalents, a $20.0 million drawdown on one of the credit facilities to fund Caucharí-Olaroz and $25.3 million held by Lithium Americas and its subsidiaries.

- As at March 31, 2020, the Company had drawn $95.8 million of the $205.0 million senior credit facility and $22.2 million from its $100.0 million unsecured, limited recourse, subordinated loan facility.

- On February 7, 2020, the Company and Ganfeng Lithium Co. Ltd. (“Ganfeng”) entered into an agreement whereby Ganfeng has agreed to invest $16.0 million in Caucharí-Olaroz to increase its interest from 50% to 51%, with Lithium Americas owning the remaining 49%. In addition, Lithium Americas will receive $40.0 million in cash from the proceeds of non-interest-bearing loans from Ganfeng, which, upon closing, is expected to strengthen the Company’s balance sheet and enhance its liquidity position. The transaction is expected to be completed in Q3 2020 subject to closing conditions."

Upcoming catalysts:

- 2020 - Cauchari-Olaroz plant construction.

- Mid 2020 - Thacker Pass DFS.

- Early-Mid 2021 - Cauchari-Olaroz lithium production to commence and ramp to 40ktpa.

- 2023 - Possible lithium clay producer from Thacker Pass Nevada (full ramp by 2026). Also any possible JV announcements prior.

NB: LAC owns 49% of the Cauchari-Olaroz project and partners with Ganfeng Lithium (51%).

Investors can read my article "An Update On Lithium Americas."

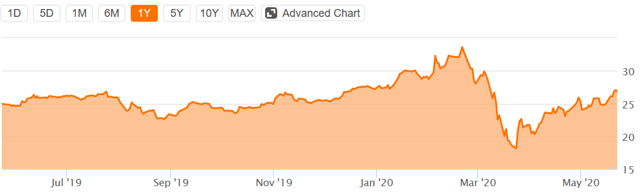

Global X Lithium & Battery Tech ETF (NYSEARCA:LIT) - Price = US$26.88.

The LIT fund moved higher in May after a heavy fall in March. The current PE is 26.76. My forecast is for lithium demand to increase 2.9 fold between 2020 and end 2025 to ~1m tpa.

Source: Seeking Alpha

Conclusion

May saw lithium prices slightly lower. It looks like a bottom has now been reached.

Highlights for the month were:

- Higher demand boosts China's battery material output.

- Samsung’s Advanced Institute of Technology (SAIT) has revealed a revolutionary solid-state battery that would enable electric vehicles to at least double range. It uses an anode with a new silver-carbon coating known as Ag-C, which is just 5.0 micrometers thick.

- LG Chem bets big on carbon nanotubes.

- SK Innovation to start construction of second EV battery plant in U.S.

- Posco Chemical triples capacity in cathode production to meet EV battery demand.

- LG Chem & Panasonic in tight race to be #1 EV battery supplier.

- Albemarle expresses interest in Tianqi's stake in Greenbushes lithium mine.

- Orocobre - Limited expansion activities recommence at Olaroz.

- Pilbara Minerals Q1 report - "Moderated production strategy, improved recoveries and lower costs ensure strong cash position maintained."

- Altura Minerals Q1 report - "Average quarterly operating cash cost lowered to US$345/wmt produced (FOB basis)...reinforcing Altura’s position as the second lowest cost Australian Producer."

- Neometals making good progress on a Lithium‐ion battery recycling JV, a 20,000tpa LiOH refinery JV in India to help meet India's EV demand, Barrambie Titanium and Vanadium Project JV, and a Vanadium recovery JV. Also strong nickel suplhide drill results at Mount Edwards (recent 60% resource upgrade).

- Lithium Americas - As of March 31, 2020, construction was 40% complete at the JV Caucharí-Olaroz Lithium Project. Thacker Pass has produced over 10,500 kg of high-quality lithium sulphate.

As usual all comments are welcome.

Trend Investing

Thanks for reading the article. If you want to sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors. You can benefit from the work I've done, especially in the electric vehicle and EV metals sector. You can learn more by reading "The Trend Investing Difference", "Subscriber Feedback On Trend Investing", or sign up here.

Latest Trend Investing articles:

- A Look At The Solar Sector And Some Top Solar Companies

- COVID-19 (Coronavirus) Plays To Benefit As Economies Reopen

Disclosure: I am/we are long GLOBAL X LITHIUM ETF (LIT), NYSE:ALB, JIANGXI GANFENG LITHIUM [SHE: 2460], JIANGXI GANFENG LITHIUM [HK: 1772], SQM (NYSE:SQM), ASX:ORE, ASX:GXY, ASX:PLS, ASX:AJM, AMS:AMG, TSX:LAC, TSXV:NLC, ASX:AVZ, ASX:CXO, ASX:NMT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information in this article is general in nature and should not be relied upon as personal financial advice.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.