100 High Yielders Down Big: These 4 Are Worth Considering

by Blue HarbingerSummary

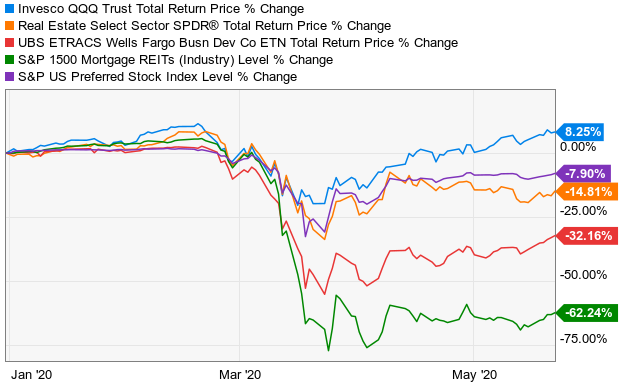

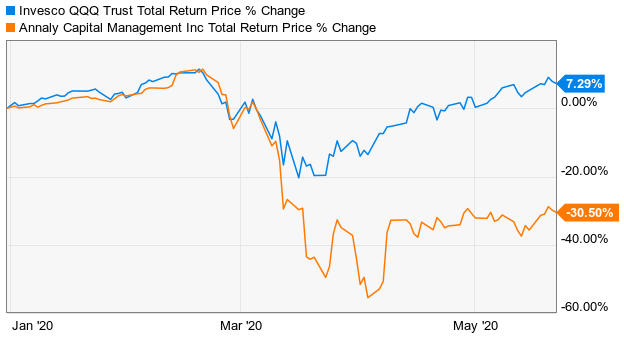

- While the tech-heavy Nasdaq 100 nears all-time highs, select big dividend stocks remain attractively priced.

- This report shares data on over 100 high yield stocks that are down big this year, including property REITs, mortgage REITs, BDCs and preferred stocks.

- We highlight four opportunities in particular that are interesting and worth considering.

As the Nasdaq 100 (QQQ) bucks the pandemic and approaches new all-time highs, value and dividend stocks are lagging the market significantly. To contrarians, this is an opportunity to sift the rubble in search of a few gems. This report shares data on 100 high dividend stocks (including BDCs, Property REITs, Mortgage REITs and Preferred shares) that are down big so far this year and also offer tempting high dividend opportunities. We also review four specific high yielders that we believe are particularly interesting and worth considering.

Why the Market is Down

Obviously, COVID shutdowns have created extraordinary challenges, and it’s really not possible to overstate the terrible impacts the virus has had on many people's lives. That said, the pandemic is impacting different businesses dramatically differently, and that’s why we’ve seen dramatically different performance among market segments. For example, a lot of technology stocks have been less impacted by social distancing (i.e., QQQ is up) and certain styles (such as small caps and value) continue to underperform dramatically. Whether these differences will revert, time will tell. But in our view, it’s a stock picker's market right now, and we share multiple attractive opportunities below.

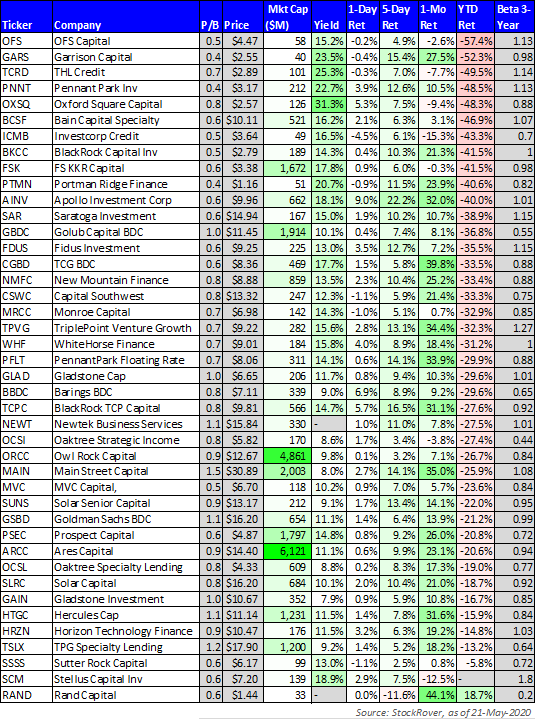

Business Development Companies (“BDCs”)

If you don’t know, BDCs generally provide financing to smaller “middle market” companies, and this is a segment of the market that has been impacted negatively and dramatically. As we saw in the chart above, the recent performance of the BDC industry (BDCs) as compared to the rest of the market - has been ugly. Further, here is a look at 25 BDCs that offer big yields, and are down dramatically so far this year.

Not all BDCs are created equally, as some focus on industries particularly hard hit by the virus, whereas others are more naturally tilted towards social distancing. Also very interesting to keep in mind, the government could increasingly look to BDCs to provide stimulus. For example, Senator. Pat Toomey recently suggested ‘finding other channels for lending to small and medium businesses. He said business development corporations “could be effective conduits” for the financing.’

Horizon Technology Finance (HRZN), Yield: 11.5%

Horizon Technology Finance Corp. is a business development company that pays a big monthly dividend (“MOPAY”) and offers an attractive combination of growth and income. It generates its high income by investing in a non-traditional high-income area of the market - development-stage companies. Horizon was sitting on significant attractive dry powder heading into the pandemic, and it has been opportunistically deploying increasing amounts of cash to new investments. According to Robert D. Pomeroy, Jr., Chairman and Chief Executive Officer of Horizon:

In this challenging economic environment, we are focused on continuing to manage our existing portfolio of investments, maintain a strong balance sheet and prudently originate new investments… We believe our current liquidity position and strong balance sheet provide us with the capacity to manage through this unprecedented environment."

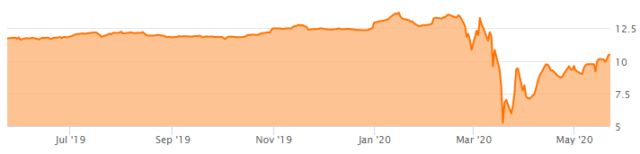

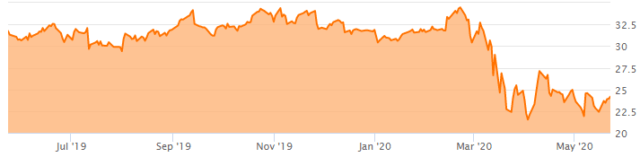

Horizon Share Price:

If you are looking for an attractive high-income portfolio-diversifier, Horizon is worth considering. You can access our previous full report on Horizon here.

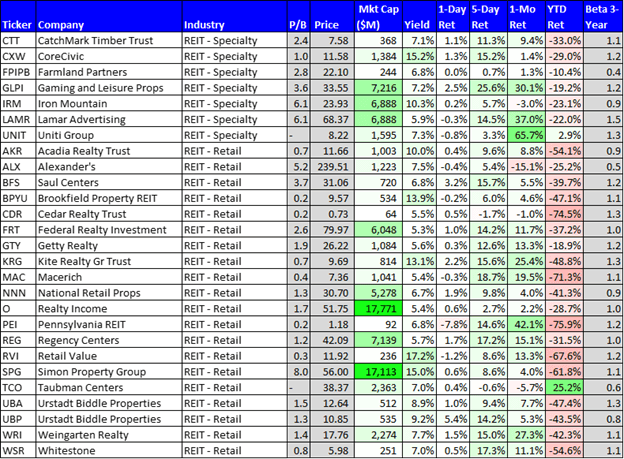

Property REITs

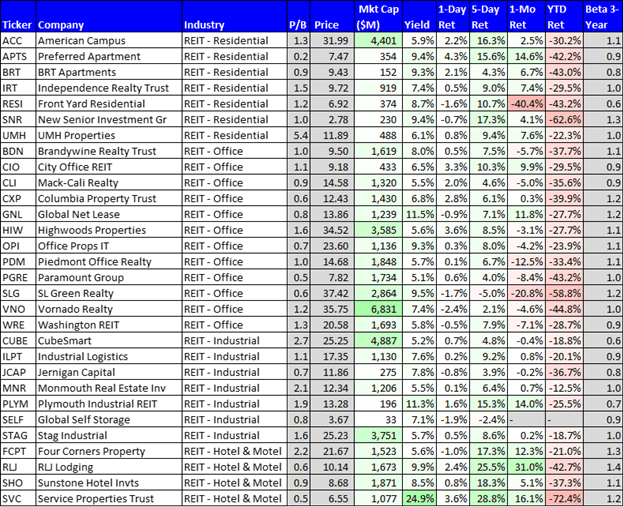

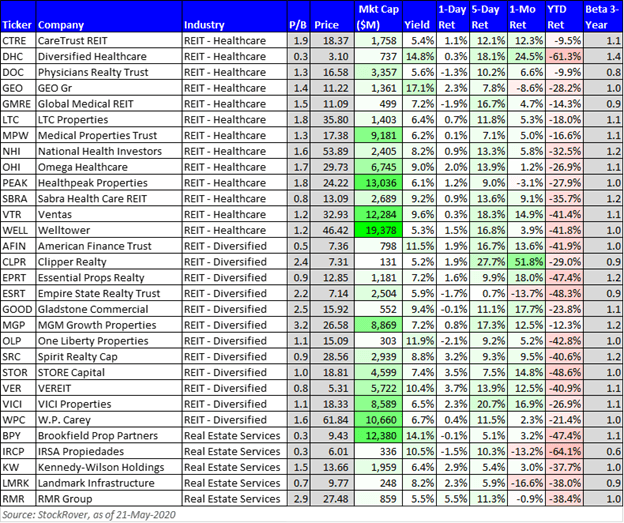

Next up are property REITs, another group that has been particularly hard hit by the pandemic, as social distancing has caused many retail stores, office buildings and restaurants to shut down completely. Further, healthcare REITs (such as senior living facilities and private prisons—which are also considered healthcare) have also been dramatically impacted, while some data center REITs have fared better. Here is a look at the performance of a variety of big dividend REITs (XLRE) that are down significantly so far this year (the list is sorted by REIT industry)

Iron Mountain (IRM), Yield: 10.2%

The recent stock market plunge has not spared physical storage REIT Iron Mountain, as its dividend yield has risen to a tempting 10.2%.

The pandemic hit at a particularly challenging time for Iron Mountain considering its slow growth in physical storage, its already stretched balance sheet and a critical business growth transition plan into digital. As of the most recent earnings announcement, the company claims to be “operating from a strong liquidity and cash position” (they have “cash on hand of $153 million and $1.1 billion available under its revolving credit facility, resulting in more than $1.2 billion in liquidity”). However they are currently in cash conservation mode. For example, Iron Mountain has:

- Eliminated nearly all temporary and contract workers;

- Introduced furloughs, mandatory vacation or sick time off, and other temporary compensation reduction measures for approximately one-third of its global workforce to align with near-term activity levels;

- Deferred certain previously planned non-essential capital investments and implemented a temporary freeze in M&A spend.

At this point, an investment in Iron Mountain is a bet on whether it can survive the pandemic without serious long-term damage (and that depends largely on the duration of the shutdowns). If IRM can weather the storm, it’s attractive, especially considering its ongoing transition to specialty data centers. You can read our previous full report on Iron Mountain here.

Mortgage REITs

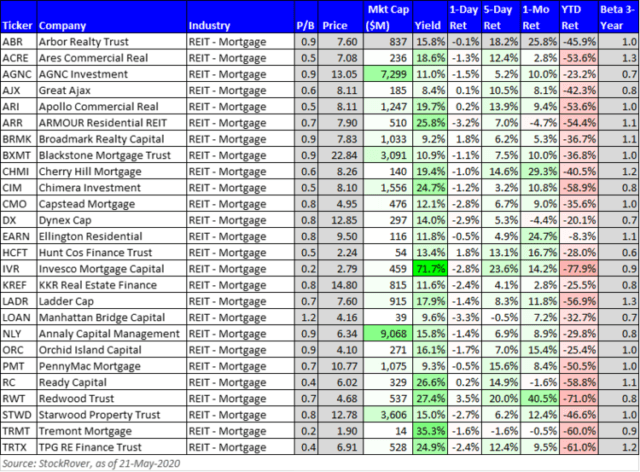

We have separated mortgage REITs (mREITs) from Property REITs because the business models (and the risks) are quite different. However, what is similar is that both property REITs and mREITs have been hit particularly hard this year. For example, here is a look at the performance of a group of big-dividend mREITs, and the year-to-date column is ugly.

However, in the case of mREITs (which own a lot of mortgage-related assets, such as commercial mortgage-backed securities (CMBS)), they were negatively impacted by dislocation in the fixed income markets (where CMBS are traded), especially considering mREITs tend to use a lot of leverage (borrowed money) and are particularly susceptible to wide swings in the fixed income markets (which we have experienced as part of this crisis) as potential margin calls can wreak absolute havoc on mREIT businesses and stock prices.

Annaly Capital (NLY), Yield: 14.8%

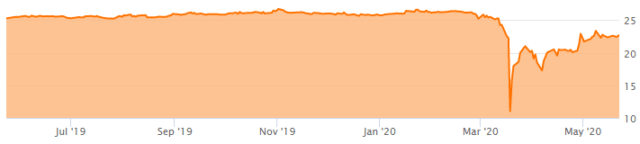

Annaly is a mortgage REIT (they own mortgage-related financial assets/securities), and Annaly shares have been hit particularly hard this year, as basically all mortgage REITs have sold off indiscriminately.

The market drama for mREITs was magnified dramatically by low-liquidity in the bond market, whereby many safe (government agency) mortgage-related securities traded at huge discounts, and mREIT investors panicked because they feared margin calls on levered mREITs would roil the industry. In some cases they were right, but in some cases they were wrong. Annaly is in much better financial shape than many mREITs, and the shares are worth considering. You can read more about our views on Annaly and mREITs in general here.

Preferred Stocks

Big dividend preferred stocks are another segment of the market that has experienced significant price declines. However, in a lot of cases, these declines were driven more by indiscriminate fear than financial realities. In some sense, preferred stocks are a lot like bonds in that they often have a “par” (or redemption) price (usually $25 per share), and preferred shares are higher than common shares in the capital structure (meaning a dividend cut for the common shares can actually be a good thing for the preferred shares because it frees up more cash flow to support the preferred share dividend payments (which are often cumulative, in the sense that even if a company misses a preferred share dividend payment, they have to make it up to investors later, so long as the company doesn’t go bankrupt)). Preferred stocks are supposed to be less volatile than common stocks, and as a group - they have been. However, preferreds are still down significantly (as you can see in the chart near the start of this report).

Gladstone Preferred (GOODM), Yield: 7.7%

Gladstone is a commercial REIT that invests in office and industrial properties. It has a highly-diversified global portfolio, and approximately 63% of its tenants have an investment-grade (or investment-grade equivalent) credit rating (this is important as it limits tenant default risk). Gladstone has collected “~98% of May cash base rent, consistent with the 98% of April rent it received.” And while Gladstone expects to receive more rent relief requests, as of May 20th, occupancy remains at 97%.

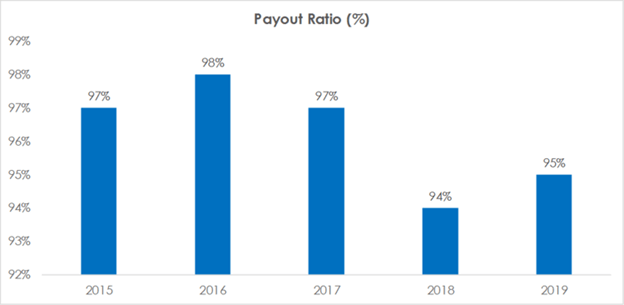

Somewhat concerning, Gladstone common shares have a relatively high dividend payout ratio as compared to FFO. For example, FFO was $0.39 in Q1 and the dividend is $0.12525 per month, which comes out to $0.375 per quarter, and that equates to a payout ratio of ~96.3%. This relatively high payout ratio is part of the reason we like the preferred shares (i.e., they’re higher in the capital structure, and would benefit from a cash flow perspective if Gladstone were to reduce the common dividend.

Source: Company data

In our view, the preferred shares are worth considering, and you can read our previous full report on Gladstone preferred shares here.

Takeaway:

The market has been ugly this year, especially for dividend and value stocks. However, if you are a contrarian investor, attractive opportunities remain. While the low-dividend Nasdaq 100 rebounds towards all-time highs, select Property REITs, Mortgage REITs, BDCs and preferred stocks continue to offer attractive investment opportunities, many of which we believe are worth considering.

We currently own shares of Annaly Capital, as well as a variety of additional REITs, BDCs and preferred stocks. You can access all of our top ideas by joining Big Dividends PLUS.* Sale End Tuesday May 26th

Try It Free for 2-Weeks, Before Prices Go Up!

Disclosure: I am/we are long NLY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.