Dollar General: Hoping That Nothing Has Changed

by D.M. Martins ResearchSummary

- Dollar General is about to report earnings for the second time since the COVID-19 crisis hit the United States.

- The retailer should benefit from both the "stockpiling blitz" in February and from consumers spending their government stimulus money in April.

- My bullishness goes beyond the short-term opportunities to include a track record of producing strong results through economic prosperity and hardship.

To the best of my knowledge, Dollar General (DG) will be the first major company to deliver earnings twice since the COVID-19 crisis hit the United States. The retailer will report 1Q20 results on May 28, ahead of the opening bell.

It will be interesting to see how financial performance and expectations for the rest of the year may have changed over the past ten weeks. I am hoping that Dollar General's management team will maintain the optimism displayed in mid-March, and that the retailer will remain "an island of calm in a sea of chaos".

Credit: 10tv.com

What to expect

Analysts expect Dollar General to produce almost 12% in revenue growth this time, levels that have not been reached since the fourth quarter of 2016. The top-line increase will be aided by only modest comps of 3.8% in the year-ago quarter. However, growth may also be dragged by fewer new stores opened during the pandemic - store count nearly doubled since the Great Recession of 2008. Adjusted EPS is forecasted to land at $1.70, about 15% higher than first quarter 2019.

As a refresher, Dollar General's 1Q20 will include the full months of February through April. Therefore, the company's financial results will probably benefit from both the "stockpiling blitz" of non-perishable household items in late February and from consumers spending their government stimulus money later in the quarter.

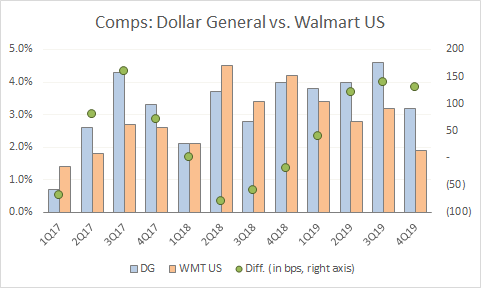

Keep in mind that Walmart's (WMT) April US comps approached 10%, and that they have been about one percentage point lower than Dollar General's in the past four quarters (see below). Dollar General will probably also stand out due to the heavier revenue mix of consumable products compared to home, seasonal and apparel: nearly 80% of total sales in 2019.

Source: DM Martins Research, using data from multiple reports

The other piece of the puzzle worth looking at are margins. So far this earnings season, most retailers have suffered from a number of variables affecting profitability. Among the ones most likely to impact Dollar General are a heavier mix of low margin e-commerce and increased personnel costs.

Regarding the latter, the retailer has already announced two waves of employee appreciation bonuses between March and May, along with the hiring of 50,000 new associates. These extra expenses are probably both indicative of top-line strength and margin pressure. Net-net, I expect the first quarter to have been a solid one for the Tennessee-based company.

On the stock

My bullishness towards DG goes beyond the short-term opportunities. Sure, I expect the company to have been one of the best-performing retailers in the first quarter of 2020. Still, shares have a place in my All-Equities Storm Resistant Growth (a.k.a. AE SRG) portfolio primarily because of Dollar General's track record of producing strong financial results through economic prosperity and hardship.

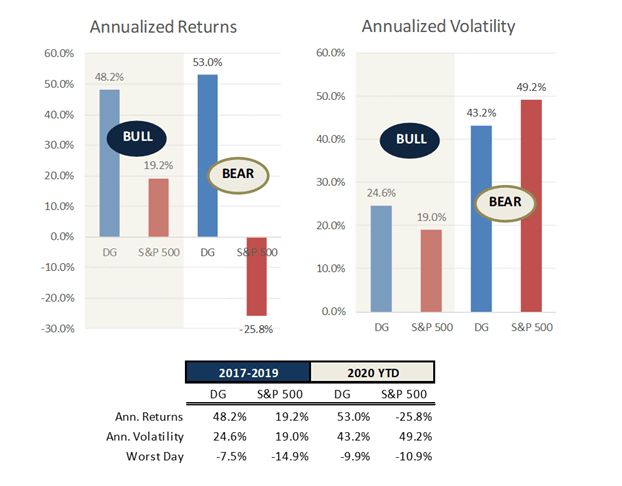

Source: DM Martins Research, using data from Yahoo Finance

As the graph above suggests, DG has been an outperformer since I added it to my portfolio during bull (2017-2019) and bear periods (2020). The combination of good management practices and a cycle-agnostic business model has resulted in outstanding investment returns over the past several years. I expect the dynamic to remain in place, even if shares might still look overpriced at a forward P/E of 23x.

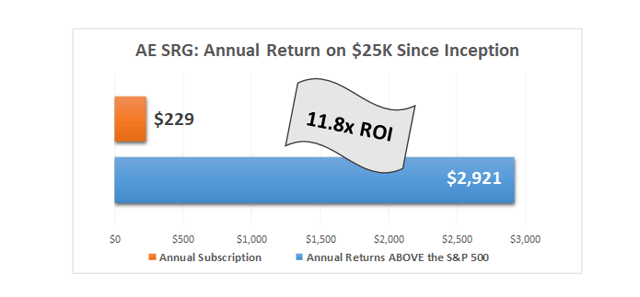

I use an approach that favors predictability of financial results and broad diversification when choosing stocks for my All-Equities Storm-Resistant Growth portfolio. So far, the small $229/year investment to become a member of the SRG community has lavishly paid off, as the chart below suggests. I invite you to click here and take advantage of the 14-day free trial today.

Disclosure: I am/we are long DG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.