Occidental Petroleum: The Uncle, The Oracle And The $40 Billion In Debt

by FluidsdocSummary

- OXY is at a critical point as asset sales have not gone as expected in the face of the pandemic.

- Specialist firm Moelis is assisting them with pushing maturities out to a point where oil prices can recover enough to cover OXY's costs.

- We think given the drivers for some of the big player's in OXY stock this has a good chance to bear fruit.

- In the higher oil price scenario we expect the stock is attractive at current levels for investors willing to take on considerable risk of a no deal-debt wall approaching over the next 5 years.

- Investors who don't subscribe to a higher oil price theory, should steer clear because in the long run only prices above $50 bbl can save OXY.

Introduction

Over the past year, Occidental Petroleum, (OXY) has been a horrible investment, for everyone but Warren Buffett that is. The Wiley old tycoon from Omaha clips an $800 mm coupon every year on his preferred stock. This quarter he's taking it in stock to preserve cash for the company. Another legendary investor, Carl Icahn, can't be happy about that as it dilutes his nearly 10% stake in the company.

Compared to Uncle Carl, Warren is sitting pretty with Preferred Shares, to Uncle Carl's common. Both rich uncles are coming to the annual meeting in late May, by proxy I suppose. Uncle Carl will have quite a chip on his shoulder. Both have a "Dog in the fight," to the tune of billions of dollars in seeing the company avoid default. And, that could be what save's OXY's bacon.

Note- the bulk of this article was published in the Daily Drilling Report in early May.

The worst deal of all time

It would be hard to imagine a deal where victory has turned to ashes faster than the OXY/Anadarko deal. (If you can think of one, please comment thusly. I'd love to know about it.) It's almost like divine intervention to "scorch the earth," in front of the victor.

There was once a guy called Murphy who, legend has it, coined a term after a series of unfortunate events that has stood the test of time. It has entered the lexicon as "Murphy's Law" and has untold corollaries. Simply stated it says that, "Anything that can go wrong, will."

With the year that's gone by one must wonder if Vicki Hollub "murphied" the Anadarko deal to any extent. Probably not, if one murphies to the extent below, nothing would ever get done.

What if oil goes to -$37 in 2020?

What if the global economy shrinks 20-30% as a result of a once in a generation virus?

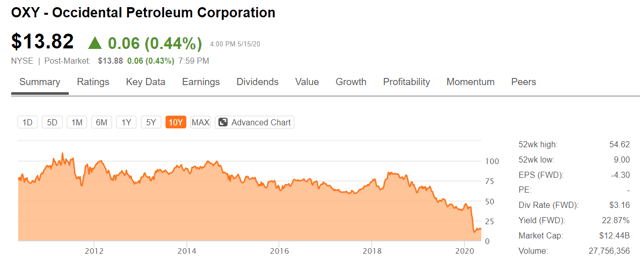

People are eager to lambaste the company for winning the contest to acquire Anadarko Petroleum last year. And, justifiably so. In hindsight, it was a horrible deal, not only because OXY paid too much, and took on too much debt to make the deal. And, of course- the timing was cataclysmically bad! Since the deal was announced the oil market has imploded, and that certainly accounts for the fall from the high $40's (already horrific) to the $10's. I can only imagine the depth of despair of those investors who bought in the $60's thinking a rebound to the $70's was coming. It may, but not for a good while yet.

I am guilty of having written several favorable articles on this deal based on the quality of the assets OXY picked up, and their ability to convert them to cash flow. My logic was sound, and in an alternate universe where the oil price and the global economy doesn't collapse over the same time period, I could very well be patting myself on the back instead of...well, never mind.

But we have to live in this universe and have to answer a question about what to do about the capital we have left in the stock, or if you've been sitting on the sidelines, is there a thesis to buy in now?

OXY looks for wiggle room

OXY has hired a boutique management company to help restructure its nearly $40 bn pile of debt. If this doesn't happen the company's future is bleak. This pile of debt was supposed to be substantially reduced in asset sales. With the degradation of asset values that has followed the market's collapse, that prospect is no longer feasible over the time frame available to the company and now OXY must act.

In any scenario likely to emerge, the company's low interest, near term debt will have to be exchanged for maturities that are pushed out significantly to give OXY some breathing room. This will come at a cost though, in the form of higher interest payments that consume more of the company's free cash flow. Hopefully, this Moelis bunch can get this done in a way that removes a near term cloud from over OXY's proverbial head.

A big part of their challenge is OXY's near term debt (the stuff they really need to push back), trades at discounts of 20-30% to face value. And, of course Moody's crushed their credit rating back in March, meaning the low interest rates of the rescheduled debt will be moving higher, which means the "vig" will be going higher as well. Hey, if it was easy they wouldn't need Moelis, would they?

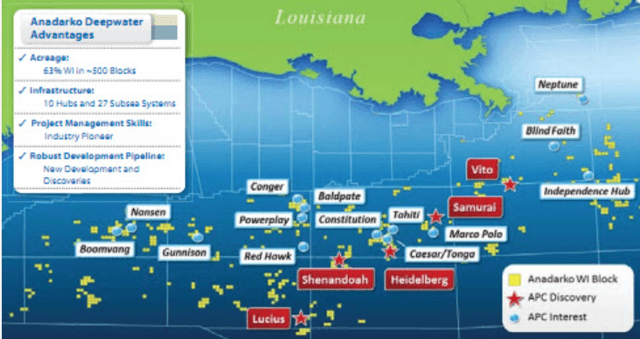

One scenario that may come into play in a debt reschedule is OXY's long cycle GoM production. Through the much maligned Anadarko deal that is admittedly a train-wreck in hindsight, come with a lot of assets. If OXY were to offer some security other than it's now tarnished, good name, it could probably get much better financing for this debt. How about it's GoM portfolio. Huge infrastructure, easy access to the best market in the world. I could sell this deal, maybe Moelis has someone as good as I was.

Source You are looking at 10's of billions of dollars worth of infrastructure and leases in the picture above. Perhaps lenders would take some of this at a discount to restructure debt along favorable terms?

This is a gambit based on the belief that higher prices will come along and rescue the company with improved cash flow in time for the new debt maturities. This will have the effect of increasing property and asset values to where their disposal will make sense.

This could be where The Oracle and Uncle Carl come in.

The Rich Uncle and the Oracle

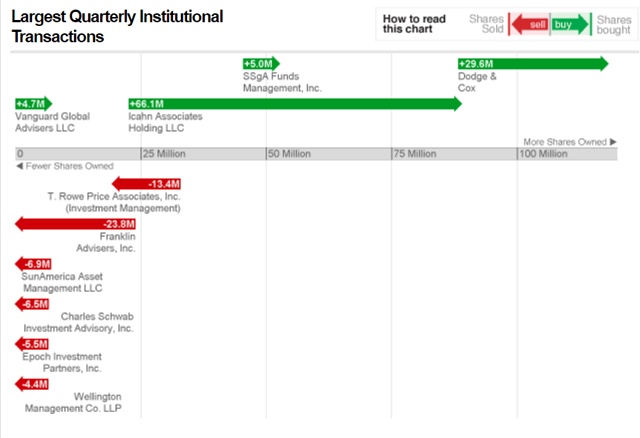

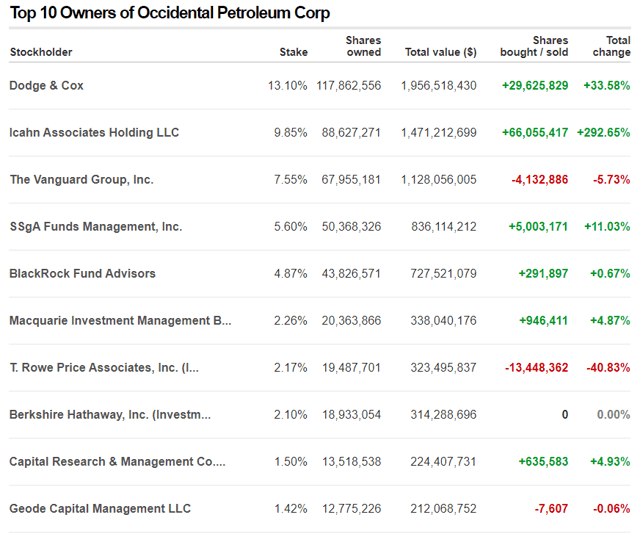

Carl Icahn owns about 10% of the company at the present. He's been a little moody about this actually. Let's track his movements in reverse order.

May 15th, 2020- buys 66 mm additional shares

March-12th, 2020- buys another 7.5% of common stock

November-8th, 2019- Icahn sells a third of his stake

May-3rd, 2019, Icahn buys small position in OXY

If you look at this chronologically, in May of 2019 he was establishing a beachhead position to influence the company at it's annual meeting. The collapse of the stock afterward led to sell probably for tax reasons, as he'd lost about half his initial stake. Then in 2020 he decided to take control of the company and reduce his average cost. He's down about $1 bn on a roughly ~$3 bn investment.

The Oracle however can be a bit more sanguine. He gets his coupon-in shares this year, and his original investment ($10 bn) is theoretically held at par in Preferred Shares. Let's face it though, were the company to fail, the bond holders would scoop up most of the assets, leaving Warren holding an empty bag. Warren wants his money back at some point.

In summary on this point. Two legendary investors are into this deal for billions, a significant amount of money to each of them. More important, given their advanced ages, there is the issue of a stain on their legacy. Both have ample reasons to dig deep to forestall a default by OXY, and facilitate a better outcome with the debt rescheduling.

It is worth noting that these two legendary investors have a lot of company from the upper reaches of the Hallowed Halls of investing. If OXY tanks, a lot of the fund manager morning chat show darlings are going to have some s'plainin' to do to their investors.

A reinvigorated Board

A couple of things have happened this year that might have encouraged Uncle Carl. One was the addition of Andrew Gould to the Board. I wrote about this earlier this year. Give it a read if you're new. Gould brings some serious chops to the table from a total industry knowledge perspective as the ex-CEO of Schlumberger.

Then there is the addition of Steve Chazen as the new Chairman, a title he's held previously. Chazen has an investment background prior to coming to OXY with Merrill Lynch. He was the architect of the deal that spun off California Resources, (CRC) with $6-bn of debt, leaving the company (OXY) in a much stronger position. He also hand-picked Vicki Hollub to be the company's CEO, so I expect that, although she deserves to be fired, she will stay on. It makes sense actually. Say what you want about her deal making prowess, or lack there of, no one knows the Permian better than she. As I've said in an alternate universe where the oil market isn't destroyed, Miss Vicki is getting double digit pay rises and is the darling of the morning chat shows.

Bottom-line here. The big distracting fight that was brewing for the annual meeting is now sidelined. Uncle Carl gets his directors, and should like the other new additions we've discussed.

This fact when combined with the credibility of Gould and Chazen should assist OXY in getting the most favorable terms for the rescheduling of their debt.

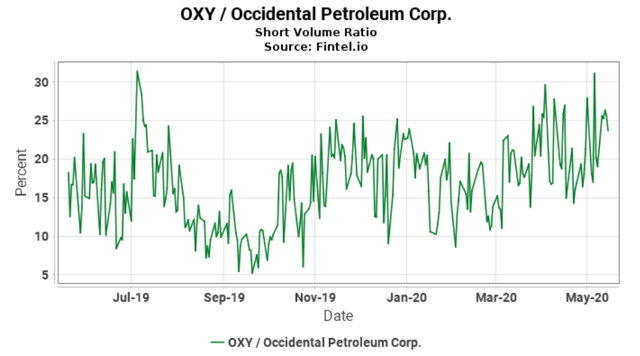

Short interest

Now with all of this said, there is considerable short interest in the company.

Why?

Well it could be the current negative valuation of it NAV to its capitalization. Or it could be that its EV-Enterprise Value ratio is way out of whack with debt comprising 75% of the total. Stuff like that puts analysts in a dour mood.

So the shorts have solid rationale for their viewpoint on the company.

Your takeaway

If you believe as I do that sustainably better pricing for WTI is coming NLT than the second half of the year then the answer to the question is hang on if you're long. If you aren't you have a chance to invest along with Uncle Carl. (Not necessarily a slam dunk as his track record in oil isn't that great. He owned Chesapeake, (CHK),which is about to file Chapter 11. Hertz' Chapter 11 filing the other day won't help his legend either. Still he's a legendary investor for a reason, meaning he's been way more right than wrong over the long haul. He's a billionaire from his investments, a statement that stands on its own.

OXY needs wiggle room to survive the coming debt wall. Given its new Board, and the involvement of the Oracle and Uncle Carl, I think the chances are pretty good they are able to do this deal.

The Caveat- If and only if prices improve substantially, (back into the middle $50's at least over the next year or so.) then this will prove to have been a winning strategy. Planned assets sales will find buyers with better prices and cash flow will return to levels that sustain growth in production. Debt will be reduced.

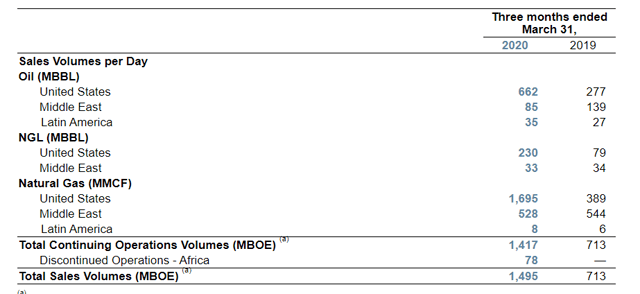

Substantially better oil prices fix a lot of what's wrong with OXY. Thanks to hedging OXY's realized prices were substantially better than the spot prices over this time period, with U.S. prices averaging $45 bbl domestically, and $57 internationally. Part of what's hurt the stock is that they will not be able to get pricing near this good in any near term hedging scenario. But, that is priced in at current levels and shouldn't provide an additional downdraft in my opinion.

Pricing in the $40's won't get it for them as you can see. That's another thing that keeps the stock in the teens. Few are predicting an increase much beyond the $40's for a good while. Notably, Shell, (RDS.A), (RDS.B), and BP, (BP). They're both a lot smarter than I am, and both were making plans around $100 oil back in 2014. We saw how that turned out. Maybe they're not any smarter than I am?

I think there is shortage case building for crude oil from under-investment, turmoil in shale ( I think declines in shale will be way more than the big agencies are forecasting), and a global economy that will turn out to be more resilient than most folks expect. This sort of strategic thinking stays behind the paywall of the Daily Drilling Report, so perhaps try a subscription if you'd like some details.

If you don't believe we are going to get better prices sustainably for WTI, then stay away or short this one as you see fit.

Disclosure: I am/we are long OXY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an accountant or CPA or CFA. This article is intended to provide information to interested parties and is in no way a recommendation to buy or sell the securities mentioned. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to do their own due diligence before investing their hard-earned cash.