Cathay General Bancorp: Upcoming CECL Adoption To Hurt Earnings

by Sheen Bay ResearchSummary

- CATY has deferred the adoption of CECL, the new accounting standard for loan losses, to later this year. The adoption will boost provision expense in the remainder of the year.

- Net interest margin will likely contract further in the second quarter due to the full-quarter impact of federal funds rate cuts.

- Uncertainties related to the US and China relations, economic environment, and duration of Paycheck Protection Program loans have increased the riskiness of the stock.

- The risks and uncertainties justify a discount to the target price.

Cathay General Bancorp's (NASDAQ:CATY) earnings decreased by 30% quarter-over-quarter in the first quarter, mostly due to a hike in provision expense. As CATY intends to adopt CECL, the new accounting standard for credit losses, later this year, provision expense will likely remain high for the rest of 2020. The elevated provision expense will pressure earnings this year. Additionally, further net interest margin compression will suppress earnings. On the other hand, the demand for relief loans will support the bottom line. Overall, I'm expecting earnings to decline by 31% year-over-year to $2.41 in 2020. The December 2020 target price suggests a high upside from the current market price. However, the uncertain economic environment justifies a discount to the target price; therefore, I'm adopting a neutral rating on CATY.

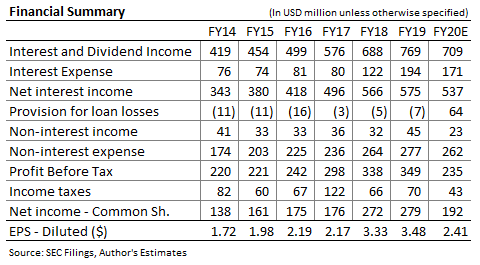

CECL Adoption to Lift Provision Expense

CATY booked a loan loss provision of $25 million in the first quarter versus a loan loss reversal of $5 million in the last quarter of 2019. The company booked provisions using the old incurred loss model as it has deferred CECL adoption to later this year. As mentioned in the first quarter's conference call, provision expense could've been higher by $5 million to $15 million if CATY had adopted CECL on January 1, 2020. I'm expecting CATY's upcoming CECL adoption to lift provision expense in the remainder of the year. Further, CATY has exposure to high-impact sectors that will drive provision expense in 2020. As mentioned in the conference call, hotels made up 1.9%, retail made up 11.3%, and restaurants made up 1.1% of total loans as of March 31, 2020. Moreover, the worsening of relations between the US and China in the wake of the spread of COVID-19 and ahead of the US presidential elections can lead to trade disputes. A large number of CATY's customers depend on trade between the two countries. On the plus side, the loan-to-value ratio of the total commercial real estate portfolio is quite low, which will limit credit losses. Considering these factors, I'm expecting CATY to book a provision expense of $64 million in 2020 as opposed to a loan loss reversal of $7 million in 2019.

Full-Quarter Impact of Rate Cuts to be Visible in the Second Quarter

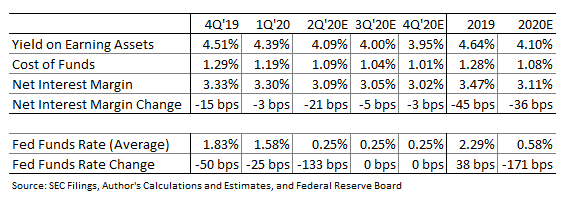

CATY's NIM declined by 3bps in the first quarter, which contributed to the earnings decline. I'm expecting NIM to decline further in the second quarter due to a full quarter's impact of the 150bps federal funds rate cuts in March. However, deposit repricing throughout the year will likely ease some of the pressure on NIM. As mentioned in the latest 10-K filing, around 91% of certificates of deposits, representing 46% of total deposits, will mature in 2020. Around $1.2 billion, or 8% of total loans, will mature in the second quarter, and $1.7 billion, or 11% of total loans, will mature in the third quarter, as mentioned in the conference call. Additionally, most variable-rate loans have hit their floors, according to the management.

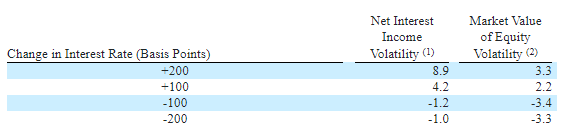

A simulation conducted by the management is a good gauge of NIM's rate-sensitivity. According to the results of the simulation disclosed in the 10-Q filing, a 100bps decline in interest rates can reduce net interest income by 1.2%, as shown below.

Considering the factors mentioned above, I'm expecting NIM to decline by 21bps in the second quarter, and by 36bps in the full year. The following table shows my estimates for yield, cost, and NIM.

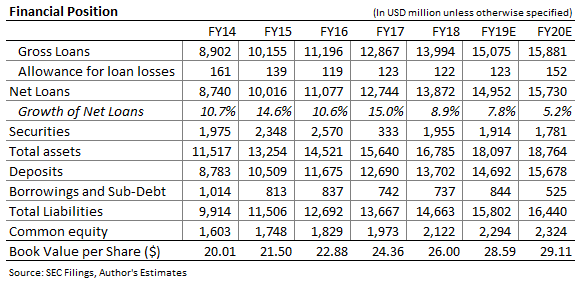

I'm expecting modest loan growth to partially offset the adverse effect of NIM compression on net interest income. CATY's participation in the Paycheck Protection Program, PPP, will increase loans by $220 million in the second quarter, as mentioned in the conference call. Moreover, CATY has launched a relief program that can drive loans in the year ahead. I'm expecting loan forgiveness under PPP to decrease the loan portfolio in the third quarter. Overall, I'm expecting CATY's loans to increase by 5.2% by the end of 2020 from the end of 2019. The following table shows my balance sheet estimates.

Earnings to Dip to $2.41 per Share

The surge in provision expense and NIM contraction will likely suppress earnings, while modest loan growth will support earnings in 2020. Overall, I'm expecting CATY's earnings to decrease by 31% year-over-year in 2020 to $2.41 per share. The following table shows my income statement estimates.

There are chances that actual results will miss estimates because of the uncertainties surrounding the depth and duration of the COVID-19 pandemic. CATY's provision expense is difficult to forecast as the company has not yet adopted CECL. Moreover, the uncertain economic environment amid the COVID-19 pandemic can lead to provision expense surpassing its estimate. Moreover, net interest income can give a surprise if the duration of the majority of PPP loans gets extended beyond 2020. Such an extension can lead CATY to book lower-than-expected PPP fees under net interest income for this year. Furthermore, the tensions between USA and China are another source of risk. Due to the uncertainties, CATY is currently at an above-normal level of risk.

I'm expecting CATY to maintain its quarterly dividend at the current level of $0.31 per share in the remainder of 2020. Despite the prospects of an earnings decline, the dividends appear secure because the earnings and dividend estimates suggest a payout ratio of 51%, which is sustainable. Additionally, there is hardly any threat of a dividend cut from regulatory pressures because CATY is well-capitalized. The company's common equity tier I capital ratio was 12.38% as of March 31, 2020, which is far above the minimum requirement of 7.0%. The dividend estimate for 2020 suggests a dividend yield of 5.0%.

A Discount to the Target Price is Warranted

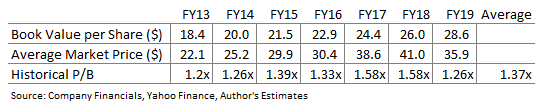

I'm using the historical average price-to-book multiple, P/B, to value CATY. The stock has traded at an average P/B ratio of 1.37 in the past, as shown below.

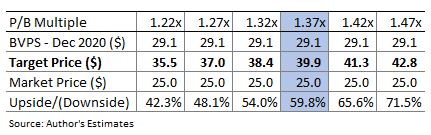

Multiplying the average P/B ratio with the forecast book value per share of $29.1 gives a target price of $39.9 for December 2020. The target price implies a 60% upside from CATY's May 22 closing price. The following table shows the sensitivity of the target price to the P/B ratio.

A discount to the target price is warranted because CATY is currently at an above-normal risk level. The uncertain economic environment, precarious relations between the US and China, and the uncertain PPP loan duration are all sources of risks. These risks and uncertainties justify a discount to the target price; therefore, I'm adopting a neutral rating on CATY.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: This article is not financial advice. Investors are expected to consider their investment objectives and constraints before investing in the stock(s) mentioned in the article.