Harte Gold: Digging Into The Q1 Results

by Taylor DartSummary

- Harte Gold released its Q1 results last week, with quarterly gold production hitting a record high near 8,600 ounces.

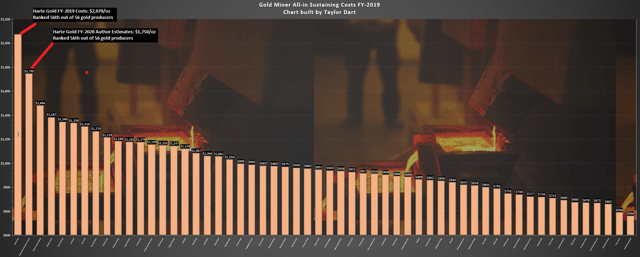

- While this is a step in the right direction operationally, the company's all-in sustaining costs continue to be the highest in the sector, averaging $1,994/oz the past two quarters.

- To make matters more difficult for Harte, the company continues to have a massive debt position and no clear path to paying it off unless costs can come down materially.

- Based on Harte's extremely high debt, reliance on $1,700/oz gold to generate a profit, and non-existent operating margins, I continue to see the stock as an Avoid.

We're now more than two-thirds of the way through the Q1 earnings season for the Gold Miners Index (GDX), and it's been a mixed start to the year given the COVID-19 related complications to operations. Harte Gold (OTCPK:HRTFF) is the most recent junior miner to report its Q1 results, and the company saw a solid quarter from a production standpoint. Unfortunately, the company's all-in sustaining costs [AISC] continue to be atrocious, at the highest levels in the sector. To make matters worse, the company's suspended operations at its Sugar Zone Mine at the end of March, while a proactive measure, certainly isn't ideal for a company with a colossal debt load. Based on Harte's nearly US$70 million in debt, non-existent margins despite a higher gold (GLD) price, and overall extremely high risk compared to other miners, I continue to see the stock as an Avoid.

(Source: Company Website)

Harte Gold released its Q1 results last week, reporting quarterly gold production of 8,600 ounces, marking the highest quarterly production since the Sugar Zone Mine went into commercial production last year. While this was a definite step in the right direction after a disastrous performance thus far relative to the mine plan, costs continue to be a significant issue for Harte, with AISC coming in at $1,951/oz for Q1. This figure is more than 150% higher than the projected costs in the Sugar Zone PEA completed in 2018, which called for AISC of just $708/oz over the expected 11-year mine life. Unfortunately, this is one of the risks of heading into production without a Feasibility Study. Rubicon Minerals (OTCQX:RBYCF) learned this the hard way after significant challenges with its Phoenix Mine. Let's take a closer look at Harte's Q1 results below:

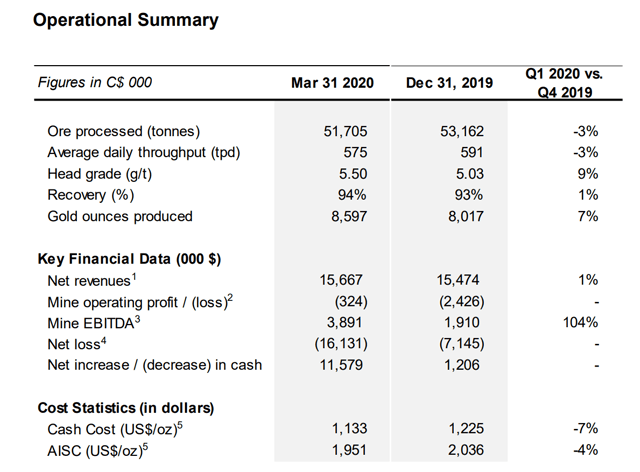

(Source: Management Discussion & Analysis)

As we can see from the chart above, Harte Gold processed 51,700 tonnes in Q1, down 3% sequentially from Q4 2019 levels, and there was likely a minor headwind here due to operations being suspended with two days left in Q1. Meanwhile, head grades were up 9% sequentially to 5.50 grams per tonne gold, a significant improvement that also drove a 100-basis point improvement in gold recoveries, up to 94% in the most recent quarter. However, while these are improved operating metrics, costs continue to be a significant issue, a function of how low the production is relative to the mine plan. The mine plan had called for 80,000 ounces of gold production per year or 20,000 ounces per quarter, and as long as the company is producing less than 10,000 ounces per quarter, it's going to be very difficult to generate much profit.

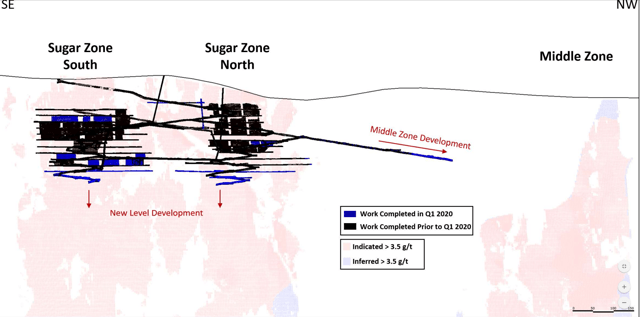

(Source: Management Discussion & Analysis)

All-in sustaining costs for Q1 were $1,951/oz, the highest costs in the sector currently, despite a slight improvement from the $2,036/oz in Q4 2019. This led to a mine operating loss of $324,000 and an operating loss of $2.6 million in Q1. It's worth noting that this was despite the gold price gaining more than 5% in Q1, and 10% at its highs from Q4 2019. It is worth noting that the company has continued with accelerated mine development in Q1 in hopes of developing new areas to mine and providing operational flexibility, and this weighed on costs. Therefore, given the high development costs and other one-time items, all-in sustaining costs looked higher than they should have in the quarter. We can take a look at a couple of these items above and get a better idea of the real all-in sustaining costs:

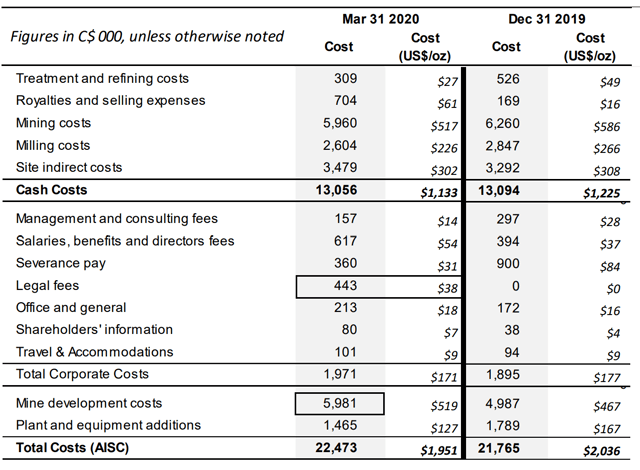

(Source: Management Discussion & Analysis)

As we can see in the above table, the company had higher legal costs in the quarter of C$0.4 million relating to ongoing legal matters, and we also saw very high development costs of C$5.98 million, compared to C$4.98 million in Q4 2019. Finally, severance pay relating to the management change was down in the quarter to just C$0.36 million but is also a one-time item that shouldn't be a further issue throughout 2020. This was a headwind of $31/oz to all-in sustaining costs. Therefore, after factoring in these three costs, the company likely saw a one-time headwind of $130/oz to $150/oz in the most recent quarter as mine development should begin to taper off over the coming quarters, and these non-recurring items won't weigh on costs. However, even after factoring in this headwind, this leaves us with all-in sustaining costs of closer to $1,775/oz to $1,800/oz. These are unacceptable costs for any mine when the industry average is $980/oz. We can get a better perspective of just how exorbitant these costs are in the chart below, and the company will remain ranked in the last sector by a wide margin even if costs do improve slightly in FY-2020 to my estimate of $1,750/oz.

(Source: Author's Chart)

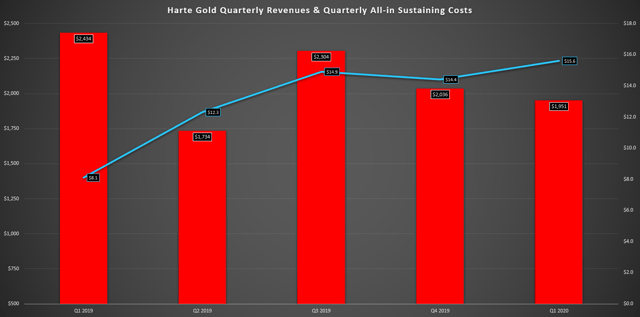

If we look at the results from a financial standpoint, the results are also quite disappointing, as the average realized gold selling price of $1,502/oz in Q1 for Harte did not rise enough to offset the company's costs. As we can see in the chart below, we can see that revenue is trending higher, a positive sign, but this only gives us one part of the picture. Simultaneously, as revenue has trended higher (blue line) to C$15.6 million in Q1, all-in sustaining costs have remained quite high, averaging $2,006/oz on a trailing-twelve-month basis. Even if accounting for the most recent gold price above $1,700/oz, this simply isn't going to cut it. Besides, even if the gold price were to rise and costs come down, we've got another issue, which is a massive interest expense for Harte Gold. This is the result of a huge debt load that the company has struggled to put a dent in since beginning production. Unfortunately, much of this debt comes at an interest rate of LIBOR plus 3.4-4.4%. Let's take a closer look below:

(Source: Author's Chart)

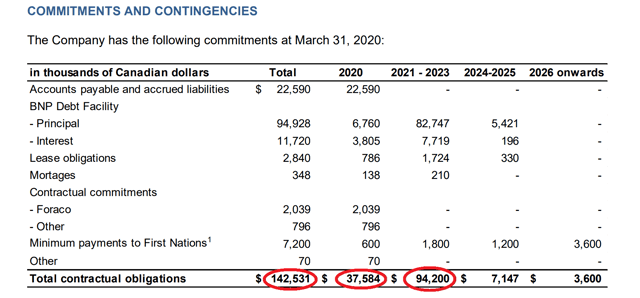

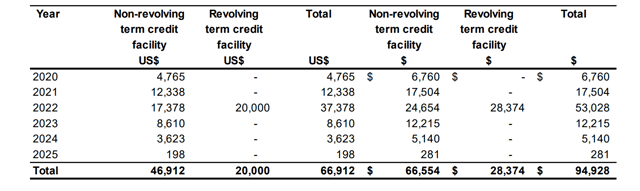

As we can see in the table below, the company's interest expense in Q1 alone was C$1.5 million, translating to nearly 10% of the C$15.6 million generated in revenue. The current debt with BNP Paribas (OTCPK:BNPZY) - which is a US$72.5 million revolving credit facility - unfortunately, increased in Q1 due to the strengthening of the US Dollar vs. the Canadian Dollar. Therefore, the current balance is C$93 million on the BNP Paribas Debt Facilities, with C$11 million classified as current. This represents a massive debt load for a company with a market cap near $100 million based on its 847 million shares outstanding, and Harte's mine being closed still certainly doesn't help matters.

(Source: Management Discussion & Analysis)

Fortunately, BNP Paribas graciously deferred payments for June 30 and September 30 and removed all covenants related to minimum mine and mill production pertaining to the credit facility. While this gives Harte some breathing room while the mine is closed, things are still quite tricky here. This is because we have no operating profits for Harte, no room left to draw on its credit facility, and outstanding debt equal to roughly 70% of the company's market capitalization at a high-interest rate. Therefore, while the company's current cash position of $13.7 million is sufficient to cover this year's debt repayments of less than C$10 million, it's likely that the company will need to dilute shareholders further by raising capital over the next twelve months. The only way to avoid further dilution is if Harte can deliver much improved operating metrics, or the company can benefit from an even higher gold price.

(Source: Management Discussion & Analysis)

In summary, while we saw some slight improvement in operating metrics for Harte Gold, it was not nearly enough to offset the risk of an investment in the company here. Given that Harte Gold continues to have non-existent margins, a massive debt load relative to its market cap, and its operations currently remain shut down, there is a massive risk here for investors. It's possible we could see the company emerge from this precarious situation, but I see no point in taking on elevated risk when 90% of the sector is flourishing. Therefore, I continue to see Harte Gold as an Avoid, as I believe there are dozens of better opportunities elsewhere in the industry.

Disclosure: I am/we are long GLD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.