NZD/CAD: Downside Pressure Likely

by Hedge InsiderSummary

- NZD/CAD is a risk-neutral pair, owing to the fact that both NZD and CAD are often considered commodity currencies.

- Since CAD is more exposed to the oil market, one would think that the recent chaos in the oil market would have been constructive for NZD/CAD.

- However, CAD has managed to hold up against NZD, perhaps owing to the Canadian economy's relative economic sophistication.

- Going forward, provided the oil market remains constructive (and maintains the progress of its recent rebound and recovery), we should expect any further upside in NZD/CAD to be limited or capped).

- Having said this, we must also monitor the bond market. Generally speaking, recent moves in oil and FX spot prices would suggest that the market believes CAD possesses redeeming qualities sufficient to avoid a full break-down versus NZD. The bond market however does not yet appear to fully lend support to CAD versus NZD.

The NZD/CAD currency pair, which expresses the value of the New Zealand dollar in terms of the Canadian dollar, is a pair that does not have a special preference with respect to its relationship with risk sentiment.

Other FX crosses such as USD/JPY and AUD/JPY are characteristically "risk-on" pairs. The common denominator for these two example pairs, the Japanese yen (or JPY), is often used as a funding currency for speculative trades. The Australian dollar is usually referred to as a commodity currency, and hence the combination of AUD and JPY presents as a fairly volatile and "pro-risk" instrument in the AUD/JPY pair (correlating positively with risk assets such as global equities).

The New Zealand dollar (or NZD) and the Canadian dollar (or CAD) are however both considered commodity currencies. Whereas AUD/JPY will often synchronize with the moves of risk assets like global equities, and even oil prices, the NZD/CAD pair is more uncorrelated; less reverent to inter-market correlations. In my previous article covering NZD/CAD, published in February 2020, I believed that the pair could break down below the 0.8300 handle but offered the potential for short-term upside.

The chart below uses daily candlesticks to illustrate NZD/CAD price action; the vertical line delineates the date on which my last article was published, and the horizontal line illustrates the 0.8300 level which NZD/CAD was indeed recently able to break (particularly through the end of March).

(Chart created by the author using TradingView. The same applies to all subsequent candlestick charts presented hereafter.)

You will notice that in fact my article's viewpoint was "on the money" in the most literal sense since we saw that the pair found the 0.8300 level within days before rallying quickly. However, the pair generated further downside volatility through March 2020, and once again bounced above the 0.8300 level through to present. The pair has not been straightforward to trade, although since late February, NZD/CAD has been ultimately bullish.

I will summarize some key points of my last article and my continuing perspective on NZD/CAD.

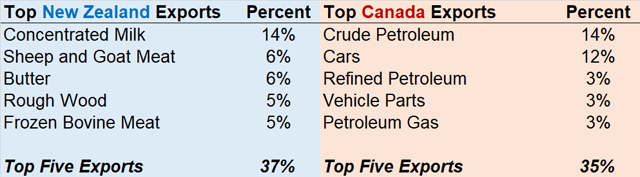

The New Zealand economy is smaller and less sophisticated than the Canadian economy. While the Canadian economy is more reliant on the oil market than New Zealand (via both domestic industry and exports), the New Zealand economy is about as concentrated (in terms of its exports, at least) as the Canadian economy, only in food products and other commodities rather than oil. Yet despite similar levels of export concentration, New Zealand is also not only smaller (about eight times smaller, if we compare by GDP) but also has a lower GDP per capita, and its overall "export portfolio" is less diverse than Canada's exports (looking beyond the top export categories).

The table below uses data from the Observatory of Economic Complexity, an organization whose website I often reference, which shows that both economies have similarly concentrated exports among top export categories. Yet the categories do differ at the top, and the recent chaos in the global oil market (which saw negative crude oil futures prices in April 2020) was decidedly bearish for CAD.

(Key export categories of New Zealand and Canada. Source: Observatory of Economic Complexity).

Yet oil products remain in demand while the COVID-19 pandemic does potentially threaten New Zealand exports more so than Canadian exports; less globalized supply chains may lead many countries to finding more local imports of food products and/or minimizing food imports. While New Zealand exports like milk, meat, butter and wood sound like staples, the world economy still largely runs on oil products, and so it would seem like New Zealand's exports are at greater risk of being substituted for other sources.

Meanwhile, New Zealand is (as mentioned above) a smaller economy, and when global uncertainties risk, it is usually the smaller (and also less sophisticated) economies' currencies that get hit harder than average.

The chart below is an updated version of the previous candlestick chart, with front-month crude oil futures prices also presented with the colored line. The recent recovery that has been staged by the oil market has naturally been more constructive for CAD, which often tends to correlate with oil fairly strongly. We would therefore expect that the collapse in oil prices would have perhaps presented an upside risk for NZD/CAD.

The steady decline in oil, which frankly began as early as the start of 2020 (and culminated in negative futures prices in April), in fact for a long time produced weakness in NZD/CAD. The fact that CAD should in theory drop harder than NZD on the back of oil market weakness, but did not, suggests that the FX market is generally far more supportive of CAD than NZD.

In spite of the sharp central bank rate cuts in 2020, which saw the Bank of Canada cut its short-term rate from +1.75% (then the highest rate among G10 nations) to just +0.25% (see an updated table here), NZD/CAD has still remained fairly subdued (now trading in a range of around 0.8300 to 0.8600).

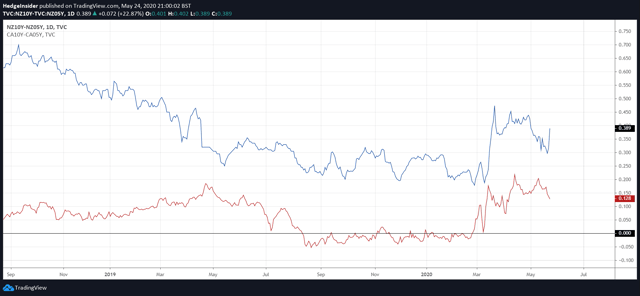

All considered, this would seem like a longer-term vote for CAD by the FX market, and a softer vote for NZD. If we use USD as a "common denominator", we can compare recent price action in the chart below; between NZD/USD (the dark blue line) and Canada (the red line). The chart reveals that on the whole, the two are trading in a fairly similar fashion; in synchrony, even.

However, I believe it is fact that the Canadian economy is a generally more diversified one that CAD is holding up versus NZD in spite of the state of the oil market. The recent recovery in the oil market does however help to cap NZD/CAD upside somewhat.

It is also worth noting that China is a key trade partner of New Zealand. Canada on the other hand is far more exposed to the United States, which perhaps helps the case for CAD, since the U.S. is likely to remain a safer partner than China going forward, as global relations between China and other countries may (continue to) sour in light of the effects of the COVID-19 pandemic.

The health and medium-term prospects of the Chinese economy are less clear at this stage, which may have the market pricing in a greater "risk premium" into NZD FX crosses until the COVID-19 pandemic is considered the past.

Provided that WTI crude oil futures prices remain roughly in the range of approximately $20.00 to $40.00 (currently $33.25 at the time of writing), and provided that the COVID-19 crisis (including its economic after-effects remain in full view), I would expect NZD/CAD to trade in the current range of 0.8300 to 0.8600 at this juncture, but with a slight preference for CAD (i.e., we should be open to NZD/CAD possibly dragging to the downside but with less fervor than seen in the recent past, such as during 2019).

I did previously note that since NZD is also correlated to oil and other "pro-risk" commodity prices in general, and since NZD is viewed as generally riskier than CAD, NZD's upside volatility can in fact exceed CAD's upside volatility when oil prices spike (leading to upside in NZD/CAD). However, this is likely to result only if the spike is driven by pro-growth demand-side factors (i.e., positive for the global economy). The reverse is not true; for instance, through mid-2008, oil prices spiked in great part due to supply-side factors; NZD/CAD did not spike but in fact fell consistently throughout this period. This also coincided with the Great Recession which began in 2007/2008.

With our slight preference for CAD, I would entertain the possibility of the pair breaking below the 0.8300 level once again in the short- to medium-term. One important metric to watch will be the steepness of these countries' yield curves, however. The chart below shows the spread between the 10-year yield and the 5-year yield of New Zealand government bonds (blue line) and the comparable spread priced into Canadian bonds (red line).

The market is offering a steeper yield curve for New Zealand, and in fact a divergence is also appearing, with the NZ yield curve building in a greater degree of steepness than the comparable Canadian spread. A steeper yield curve can be viewed as a vote of support from the bond market (i.e., that an economy has a greater chance of seeing higher rates in the longer term; "further out the curve").

Therefore, while I lean on NZD/CAD bearishness in the short- to medium-term, unless or until this bond market trend reverses, I would not rule out upside in NZD/CAD since the bond market is often very predictive of FX spot prices.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.