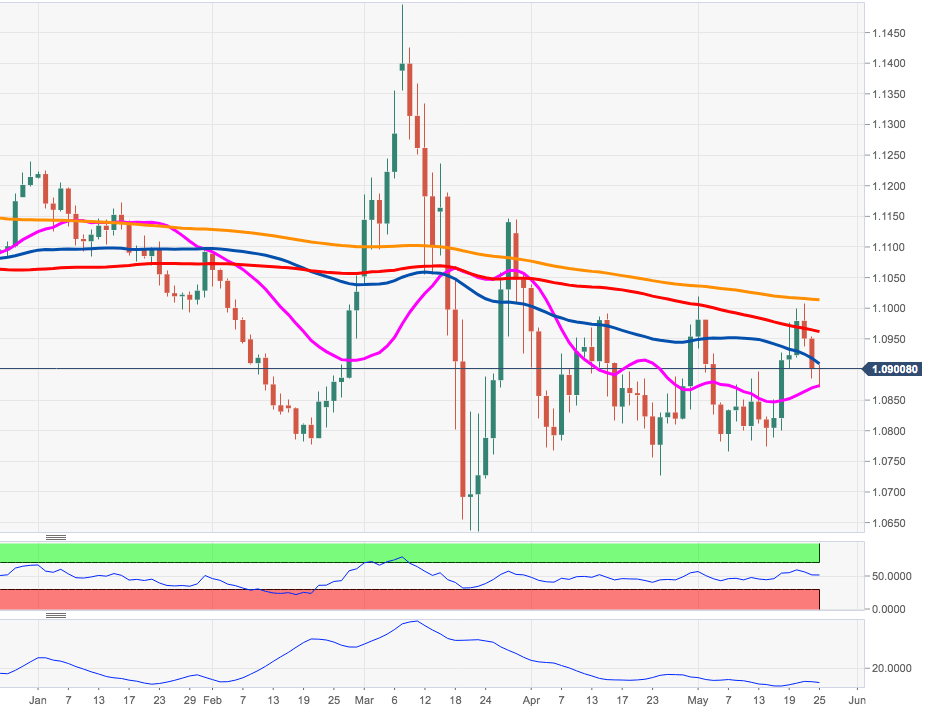

EUR/USD Price Analysis: Further consolidation remains on the cards

by Pablo Piovano- The correction lower in EUR/USD met support in the 1.0870 area.

- The pair’s upside remains limited by the 200-day SMA bove 1.1000.

The decline in EUR/USD seems to have bottomed out around Monday’s lows in the 1.0870 region for the time being.

If sellers regain the upper hand, then a potential drop to the previous consolidative pattern in the 1.0800 neighbourhood remains a palpable chance. Above the 200-day SMA, today at 1.1011, the selling pressure is expected to mitigate somewhat and allow for a probable move to late March peaks in the mid-1.1100s.

Looking at the broader picture, the rangebound theme is expected to prevail at least in the short-term horizon.

EUR/USD daily chart

EUR/USD

| Overview | |

|---|---|

| Today last price | 1.0898 |

| Today Daily Change | 38 |

| Today Daily Change % | -0.04 |

| Today daily open | 1.0902 |

| Trends | |

|---|---|

| Daily SMA20 | 1.0872 |

| Daily SMA50 | 1.0885 |

| Daily SMA100 | 1.0965 |

| Daily SMA200 | 1.1015 |

| Levels | |

|---|---|

| Previous Daily High | 1.0954 |

| Previous Daily Low | 1.0885 |

| Previous Weekly High | 1.1009 |

| Previous Weekly Low | 1.08 |

| Previous Monthly High | 1.1039 |

| Previous Monthly Low | 1.0727 |

| Daily Fibonacci 38.2% | 1.0912 |

| Daily Fibonacci 61.8% | 1.0928 |

| Daily Pivot Point S1 | 1.0874 |

| Daily Pivot Point S2 | 1.0846 |

| Daily Pivot Point S3 | 1.0806 |

| Daily Pivot Point R1 | 1.0942 |

| Daily Pivot Point R2 | 1.0982 |

| Daily Pivot Point R3 | 1.101 |