The Indian Express

Mastercard sees 200% jump in contactless payments, says it is healthiest option now

During the pandemic, Indians have started rethinking how to handle the cash, as many fear currency notes might be an easy vehicle in spreading the infectious disease.

by Anuj BhatiaWith coronavirus pandemic on top of consumer minds, contactless payments have grown by 200 per cent over the last 30 days, according to US payments giant Mastercard.

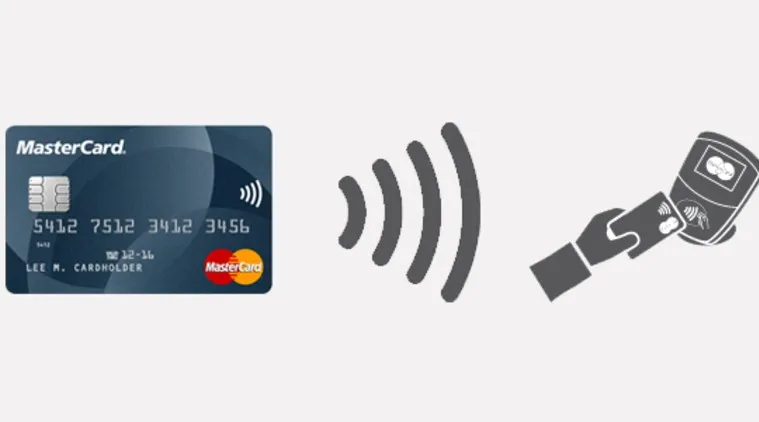

“Covid-19 has added another dimension to contactless payments,” Vikas Saraogi, VP, Head of Acceptance, Mastercard, South Asia, told Indianexpress.com over a phone call. “It has emerged as the healthiest way of making payments because all that you need to do is to just tap your card and below Rs 2000 transactions, you don’t even require a pin.”

Saraogi says contactless and digital payments have grown 15x in the country over the last 18 to 20 months. A secular trend was already there and Covid-19 has only “expedited” that trend, he said, adding: “What would have happened in the next four to five years, is now happening in the next four to five months, if not four to five weeks.”

During the pandemic, Indians have started rethinking how to handle the cash, as many fear currency notes might be an easy vehicle in spreading the infectious disease. Cashless and digital payments, in comparison, are more secure and require minimum physical contact between the seller and shopper. In fact, more shops and e-commerce platforms are refusing to take cash. Some are urging consumers to pay by tapping their cards to a point-of-sale terminal or use digital wallets like Paytm and Google Pay using smartphones.

“In groceries and supermarkets, where you will typically see a long queue or quick-service restaurants and pharmacies, contactless used to be very popular because it’s a faster way of making payment. It’s a queue busting solution,” Saraogi said. Although there is no info on how many Indians use contactless payments, it is estimated that 25 per cent of cards in circulation are contactless.

ALTBalaji CEO: Small-town India discovering OTT platforms; ‘adult’ no more a taboo word

India’s transit system will also likely benefit from the uptake of contactless and digital payments in the post-COVID-19 world. FASTags have already been made mandatory by the government which minimises the contact between drivers and toll booth operators. Meanwhile, Metro corporations in Delhi and Mumbai are expected to shun physical tokens and instead implement a contactless ticketing system using only metro cards.

“We will be seeing a new normal where people will prefer to go for contactless payments even after the threat of Covid-19 subsides, not only due to greater awareness around hygiene factors in the fight against Covid-19 but also because of the greater convenience that many of the first-time users of digital payments will experience in the coming times,” said Sanjay Gupta, Vice President & India Country Manager, NXP

Countries like India are witnessing greater acceptance for mobile payments thanks to the growth of smartphone sales in the country. “Can every smartphone with NFC be turned into a consumer and merchant device? This is what we are working on,” Saraogi said.

Samsung Pay, which is a mobile payment service that enables consumers to use their Samsung smartphones to make in-store purchases at contactless and magnetic stripe terminals using NFC and MST technology, is supported by Mastercard.

“Samsung Pay was just one of the types of a wallet making a payment… what we are now doing is democratising that across the banks.” Mastercard has worked closely with HDFC bank on its PayZapp app. “We worked with them and we’re working with other banks as well, ” Saraogi said, adding that most of the banks would be able to use the same technology to provide mobile tap and go payments to the consumers. At the same time, Mastercard is also encouraging merchants to use their NFC-enabled phones to accept payments.

Fortnite developer Epic Games: ‘Behaviour of Indian gamers yet to be discovered’

While the increase in the adoption rate of digital payment solutions is a healthy sign, cashless payments can also increase security and privacy concerns such as hacking and data breaches. Accepting that this will become the default option of the future, Ashish Kohli, Managing Director & CEO, Kreditech India, warns there is a stronger need to “tighten cybersecurity norms and evolving secured frameworks as cashless payments may also be vulnerable to cyber threats.”