BTCMANAGER News

BTC Failed to Break $10,000 – How to Hedge Loss in Spot Trade?

by Guest PostBitcoin’s 3rd halving was expected to be a bullish event for BTC investors. However, Bitcoin tried 4 times to break above the strong resistance of $10,000, but it failed. Since May 20, the price of BTC has declined nearly 10%, and reached the lowest of $8,800 on May 21, shifting traders’ focus from breaking the $10 resistance to now holding above the key support of $9,200.

At the press of time, Bitcoin price continues to retest the support at $9,200. And the steady downtrend momentum may eventually cause the price decline below the bullish pennant. Besides, the bearish move in the past 2 days have become intense as well.

Most Indicators Point to a Downside Correction

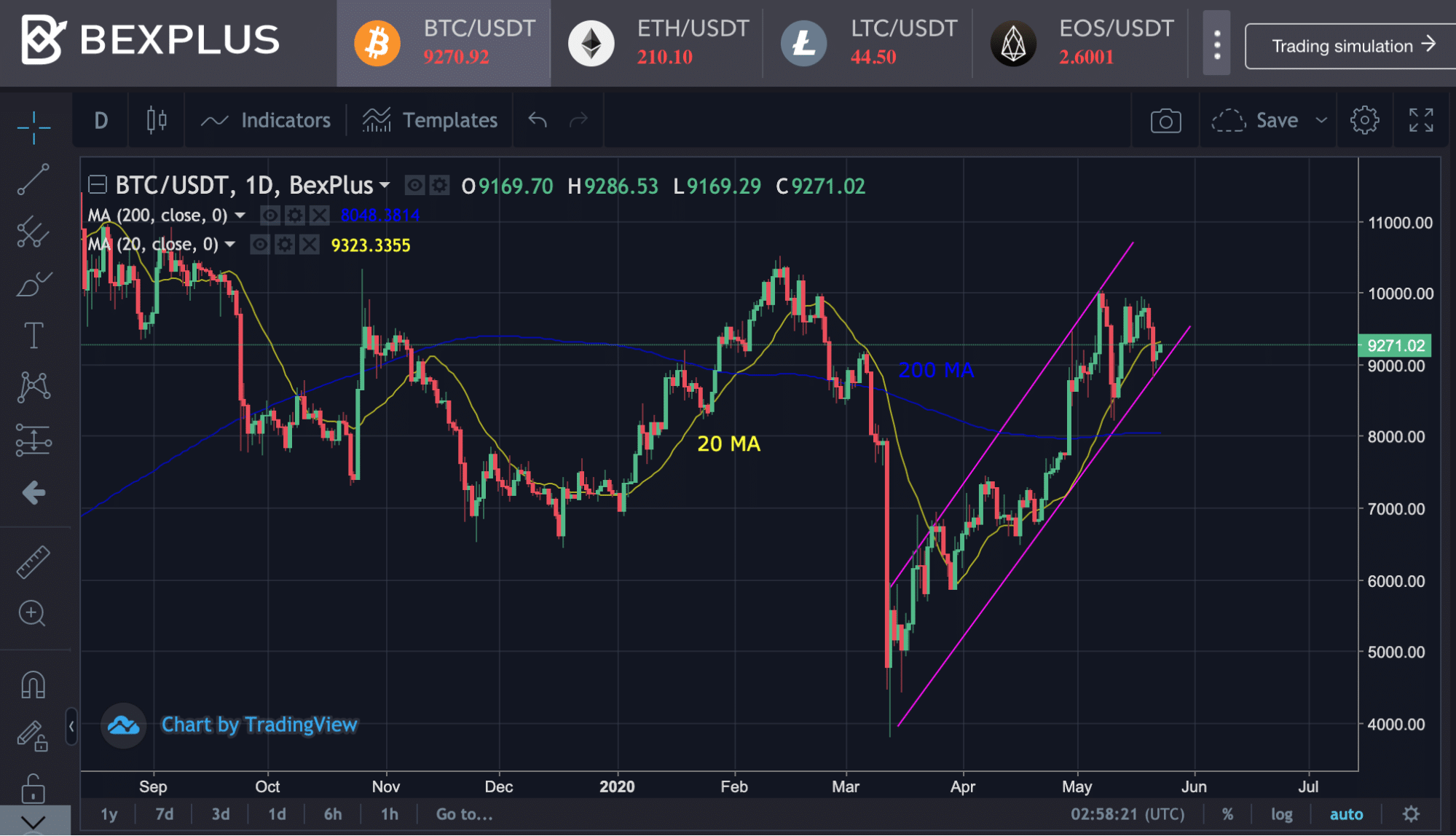

As shown in the daily chart below, we can notice that Bitcoin is still above 200-day moving average which is located near $8,000. And the price moves near the lower trendline in the ascending channel, which indicates that the power of bull is weakening. If Bitcoin drops below $9,000 again, a revisit to $8,500 – $8,000 may occur.

In addition, Bitcoin barely saw a minor pullback when it surged from $7,700 to $10,000. But, the bull power didn’t maintain and BTC failed to stand above $10,000, which also leave BTC vulnerable to a sizable decline.

How to Hedge Loss in Spot Trade & Get Bigger Gains

From the analysis above, we can make bold prediction that a large downside correction is ahead. Unless you are a Bitcoin believer, investing in bitcoin spot market may cause you more loss in the upcoming trend. Thus, we suggest you to hedge loss in spot trade by trading BTC perpetual contracts with 100x leverage.

For example, if we predict that BTC price may soon decline, we can open a short position. Step 1. Currently, BTC price is around $9,300, we can place the short order with 0.1 BTC.

*Note that with 100x leverage, with only 0.1 BTC, you can buy 10 BTC worth contracts.

Step 2. If Bitcoin decline and hit $8,500, which is the next key support as we predicted, then, you can set Take profit at the point.

Profit: 10 BTC ($9,300 – $8,500)/$8,500 = 0.94 BTC.

Only with 0.1 BTC used as margin and $800 price volatility, you can make profits of 0.94 BTC which is nearly $8,700 USDT.

Bexplus – One of the Best BTC Futures Exchanges

Bexplus is one of the world-leading futures exchanges with no spread in cryptocurrency area. It provides Bitcoin, Ethereum and Litecoin perpetual contracts and more (buy-in or sell-out anytime without expiration) with 100x leverage. Added 100x leverage, you can purchase 100 BTC contracts with only 1 BTC as margin. Furthermore, it also provides professional risks management tools like “Stop Loss” and “Take Profit” which help you lower risks and guarantee profits.

Join Bexplus in 30s with No KYC now, you can also get up to 10 BTC as the deposit bonus.