Suncor - Immediate Action Will Mean Stronger Returns

by The Value PortfolioSummary

- Suncor Energy is an incredibly well positioned Canadian oil major. The company's FFO / share is better than most oil majors.

- The company's financial health is quite good. The company has already cut costs dramatically, while continuing to focus on growth, but it can cut costs further.

- There are some risks worth paying attention to for shareholders. Specifically, the continued volatility in oil prices. However, the company is a quality long-term investment.

Suncor Energy (NYSE: SU) has a more than $25 billion market capitalization. The company's share price has dropped 50% as a result of the oil price collapse, however, the company has been one of the highest margin best positioned Canadian energy producers. As we'll see throughout this article, the company has been overly punished, however, it has strong long-term potential.

Suncor Energy - Resource World Magazine

Suncor Energy Financial Health

Suncor Energy has focused on improving and maintaining its financial health through the downturn.

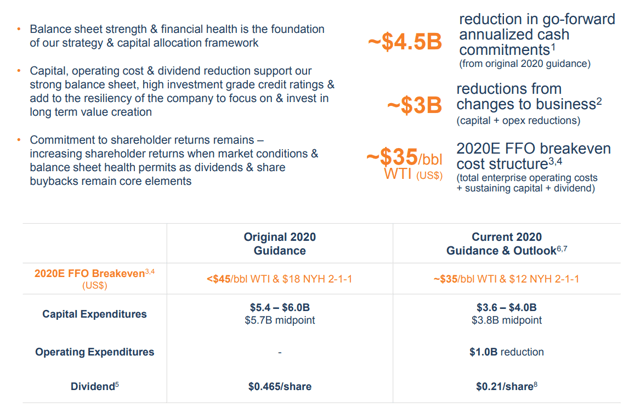

Suncor Energy Financial Health - Suncor Energy Investor Presentation

Suncor Energy has focused on maximizing its cash flow and maintaining its financial position. The company has $4.5 billion in a reduction in its cash commitments with a $3 billion reduction in capital and operating expenditures. The company has cut its dividend by more than 50% to improve its financial position.

The company has managed to get its FFO breakeven to ~$35 / barrel WTI versus $45 / barrel WTI previously. That's a prudent $10 / barrel reduction, counting sustaining capital, and puts the company much closer towards current oil prices. Of course the company isn't rolling in the cash at current prices, but with $33 WTI it's not losing much either and it'll be able to handle the worst of the crash.

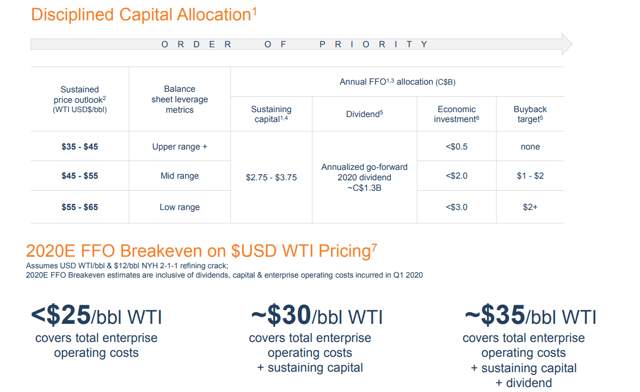

Suncor Energy Dividend Capital Allocation - Suncor Energy Investor Presentation

At the same time, Suncor Energy has the ability to significantly reduce its costs further if required. The company could cut its dividend to $0 if it wants to have a $30 / barrel WTI breakeven. Alternatively, in the immediate term, if the company is okay with production dropping, it can cut sustaining capital to $0 in the immediate term and have a <$25 / barrel WTI.

So not only does the company have the strength in the immediate term, it has the ability to lower its costs further should it choose to.

Suncor Energy Asset Base

Suncor Energy's cash flow and business are supported by the company's asset base.

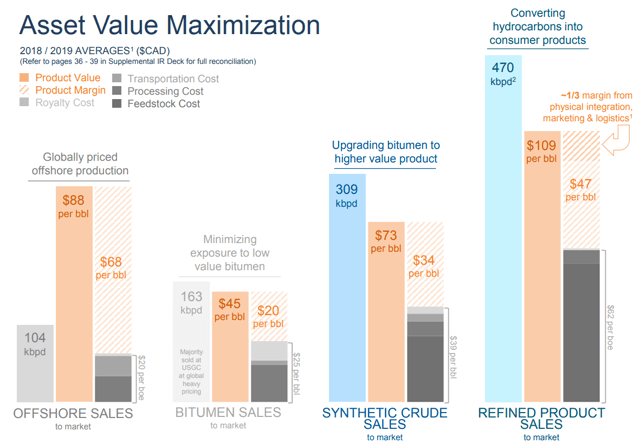

Suncor Energy Asset Value Maximization - Suncor Energy Investor Presentation

Suncor Energy's strength comes from its significant production and its ability to maximize production along the value chain. The company gathers its Bitumen and minimizes its exposure to low valued Bitumen which suffers from oil prices. The company then starts by updating a significant % to higher value production, increasing value per barrel.

Lastly, the company uses physical integration, marketing, and logistics to increase the value of the product dramatically further, again for a minimal increase in costs. The company's integrated asset base and its ability to maximize high value production means significant additional cash flow for the company.

Suncor Energy Capital Spending and Growth

Suncor Energy is focused on maximizing the value from its asset base with capital spending and growth.

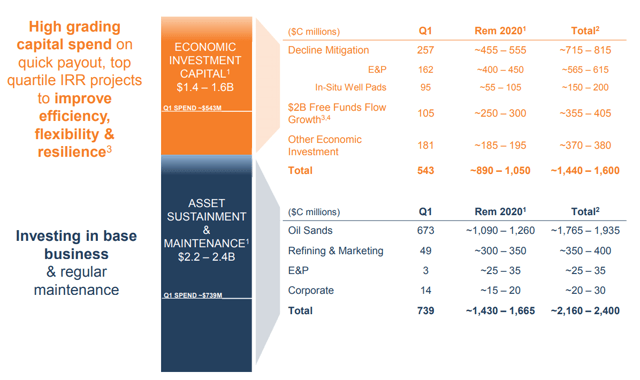

Suncor Energy Capital Spending - Suncor Energy Investor Presentation

Suncor Energy is planning to spend roughly $2.3 billion on asset sustainment and maintenance. At the same time, the company is spending another $1.5 billion on economic investment capital. That's total investment of roughly $3.8 billion Canadian $. That's a significant amount, however, the company's already spent $1.3 billion Canadian worth.

That means that for the next 3 quarters the company only has ~$800 million Canadian in quarterly obligations. That's a roughly 40% reduction off of the company's 1Q Canadian obligations, improving the company's expenditures significantly. At the same time, the company is focused on continuing growth unlike other companies.

The company's continued focus on growth in a downturn will reward shareholders when the downturn ends.

Suncor Energy Cash Flow

Going forward, Suncor Energy has significant cash flow and the ability to generate significant shareholder returns.

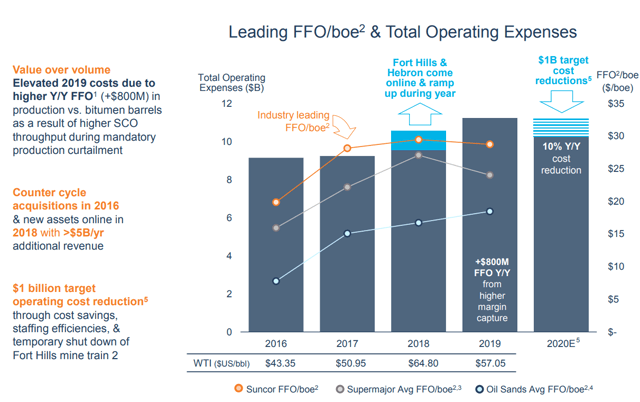

Suncor Energy FFO / Barrel - Suncor Energy Investor Presentation

Suncor Energy is focused on dramatically increasing its FFO / barrel with counter cycle acquisitions and continued cost reductions. The company has agreed to cut production by a respectable amount (100k barrels a day) as a result of the collapse in oil prices. That has also allowed the company's expenses to decrease dramatically.

The company has managed industry leading FFO / barrel. Looking at a 2018-2019 average price for roughly $60 / barrel, the company's FFO / barrel was roughly $30 / barrel. The company's daily production is roughly 760 thousand barrels / day. That means in a normal environment the company's annual FFO would be ~$8 billion USD versus a $26 billion USD market capitalization.

The company's capital expenditures, growth included, are roughly $3.8 billion annually. That leaves $4.2 billion annually, or more than 15% of the company's market capitalization for shareholder rewards.

Suncor Energy Risk

Suncor Energy has a significant amount of risk worth paying attention to as a results of the risks the company faces from oil prices.

Specifically, Suncor Energy produces a significant amount of oil, but as we discussed above, even in a best case scenario the company's breakeven would drop to $25 WTI. While that's incredibly impressive for long-term oil prices, it doesn't count moments of uncertainty such as with COVID-19. In that case, prices dropped to well below $25 WTI.

Suncor Energy is one of the best positioned oil companies for the downturn. As we saw above, the company has had better FFO / barrel than the oil majors. Still, however, in a drawn out collapse the company would struggle. The volatility of oil prices is a risk that all shareholders should keep an eye out for - or at least be willing to hold out during.

Conclusion

Suncor Energy is a quality investment with a unique opportunity to get in as a result of oil price volatility. The company has managed to cut costs dramatically, which is incredibly impressive. However, the company can cut costs much further if required. At the same time, the company's FFO / share has stayed higher than the oil majors.

The company is one of the unique companies, due to its strength, to be able to continue investing in growth. However, with that said, there is some risk from continued oil price volatility. The company has an unmatched asset portfolio, that will support future integrated growth. We recommend investing for the long-term at this time.

Create a High Yield Energy Portfolio - 2 Week Free Trial!

The Energy Forum can help you build and generate high-yield income from a portfolio of quality energy companies. Worldwide energy demand is growing quickly, and you can be a part of this exciting trend.

The Energy Forum provides:

- Managed model portfolio to generate you high-yield returns.

- Deep-dive research reports about quality investment opportunities.

- Macroeconomic overviews of the oil market.

- Technical buy and sell alerts.

Disclosure: I am/we are long SU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.